1/15 REGRESSIVE TAXATION AND THE VASTER PROBLEM THEY REVEAL:

INABILITY TO TAX THE “AMERICASTOCRACY”

- PART 1

Kenneth Rogoff and Carmen Reinhart , in the book This Time is Different 👇

INABILITY TO TAX THE “AMERICASTOCRACY”

- PART 1

Kenneth Rogoff and Carmen Reinhart , in the book This Time is Different 👇

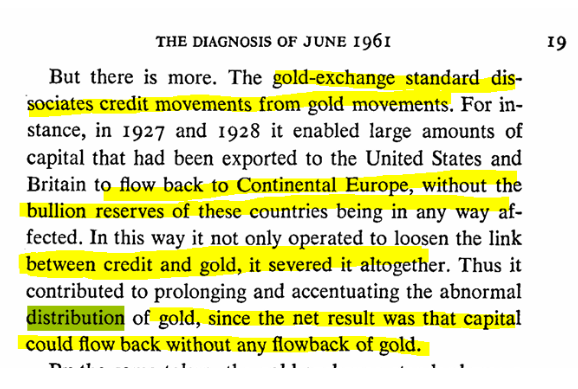

2/15 In their book Eight Centuries of Financial Folly (and gov debt defaults, repudiation and inflate away), the authors explain the problem of taxation.

3/15 In the chapter on defaults on domestic debt, the authors note that in many historical episodes, governments found it politically easier to default or inflate away their debt than to raise taxes—especially on the wealthy.

4/15 The Authors do touch upon the issue of taxation—particularly the limits of taxing elites and the aristocracy—as part of the broader discussion on fiscal fragility and sovereign default

5/15 While the book does not focus extensively on the aristocracy specifically, it does acknowledge that one recurrent historical problem in fiscal collapses has been the inability or unwillingness of states to tax their wealthy elites, including aristocrats, landlords, or politically connected groups.

6/15 This issue is presented in the context of:

Pre-modern and early modern defaults (e.g., France, Spain, various European monarchies).

The difficulty sovereigns had in raising adequate revenue, especially in wartime or crisis periods.

Pre-modern and early modern defaults (e.g., France, Spain, various European monarchies).

The difficulty sovereigns had in raising adequate revenue, especially in wartime or crisis periods.

7/15 Political economy constraints, where elites resisted or blocked tax reforms that would affect their wealth or income.

Key Examples from the Book:

French defaults before the Revolution were, in part, due to the crown’s inability to impose taxes on the nobility and clergy, who were largely exempt.

Key Examples from the Book:

French defaults before the Revolution were, in part, due to the crown’s inability to impose taxes on the nobility and clergy, who were largely exempt.

8/15 In pre-19th century Spain, similar issues arose where the monarchy relied on borrowing and struggled with tax collection due to noble privileges and administrative inefficiency.

9/15 They emphasize the repetition of political obstacles to taxation as a recurring feature in long-term sovereign debt cycles.

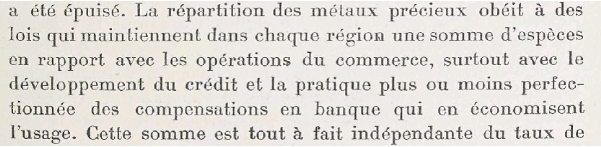

-- Necker Cite the Problem before the French revolution

-- Necker Cite the Problem before the French revolution

10/15 In his book the Great Wave Mr. Hackett mentions the problem of the inability of taxing the aristocracy as a source of fiscal failure.

Next post we will demonstrate the regressive nature of tariffs.

Next post we will demonstrate the regressive nature of tariffs.

11/15 Then we will show striking similarity France's situation and the Necker’s prescription unfollowed by France before the revolution.

12/15 Then we will go into the details of Necker’s prescription the problem of taxing the privileged, the problem of too many regressive taxes he wanted to remove while taxing more the “untaxable”

13/15 Finally need for a healthy population with an increase in budget on hospitals with a focus on better lower cost while providing better service.

14/15 Then we will go into the details of the Americastocracy’s exemption from taxes (carried interest, inheritance tax exemptions, share buybacks)

15/15 And we will finish with the institutionalization of an increasing GINI index showcasing various provision that make the “Big Beautiful Bill” a regressive/ insatiable system.

• • •

Missing some Tweet in this thread? You can try to

force a refresh