The Ethereum Demand Shock

A thread on why ETH's price is rising and why it will continue to rise in the months ahead.

🧵

A thread on why ETH's price is rising and why it will continue to rise in the months ahead.

🧵

2/ ETH is on a tear. After trading steadily downward for the first four months of the year, it has rebounded strongly. It's up 50%+ in the past month and more than 150% since its lows in April.

The reason? Overwhelming demand from ETPs and Corporate Treasuries.

The reason? Overwhelming demand from ETPs and Corporate Treasuries.

3/ Some context:

For the past 18 months, bitcoin's price has been driven ever-upwards up by a simple fact: ETPs and Corporate Treasuries have been buying more than 100% of all the new bitcoin being produced.

For the past 18 months, bitcoin's price has been driven ever-upwards up by a simple fact: ETPs and Corporate Treasuries have been buying more than 100% of all the new bitcoin being produced.

4/ To put some numbers on it: ETPs and Corporate Treasuries have bought 1.5 million BTC since the bitcoin ETPs debuted in January 2024, while the network has produced just 300k.

5x more demand than supply. Sometimes, it really is that easy.

5x more demand than supply. Sometimes, it really is that easy.

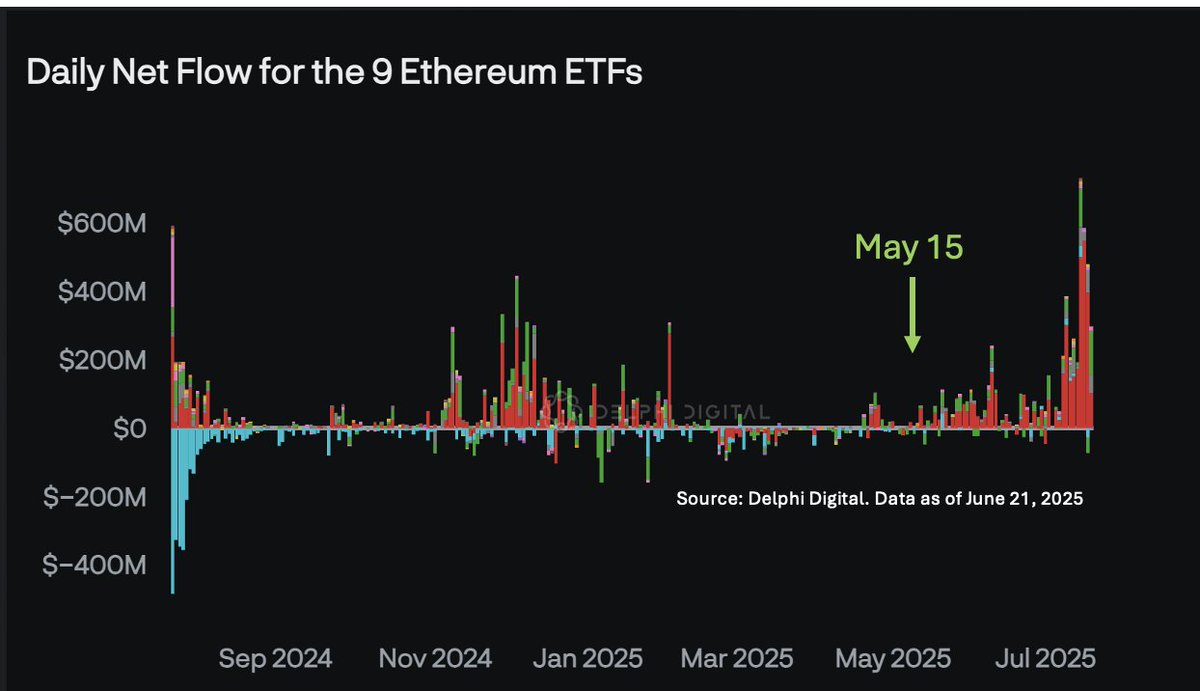

5/ Until recently, Ethereum hasn’t benefited from the same trend. ETH ETPs launched in July 2024, but the initial response was tepid. Through May 15, 2025, Ethereum ETPs had purchased just 660K ETH (on ~$2.5 billion in inflows).

Meanwhile, there were no major Ethereum Treasury Companies to speak of.

Meanwhile, there were no major Ethereum Treasury Companies to speak of.

6/ The Ethereum network produced a net 543K new ETH over this time period, basically matching demand No wonder ETH's price drifted sideways (and down!).

7/ But something changed in mid-May. Since May 15, spot Ethereum ETPs have been on a tear, pulling in more than $5 billion. Corporations have also gotten into the game, with firms like Bitmine and SharpLink announcing Ethereum treasury strategies.

8/ By our estimates, ETPs and Corporate Treasuries have combined to buy 2.83 million ETH since May 15—more than $10 billion at today’s prices. That's 32x net new supply over the same time period.

No wonder the price of ETH has soared!

No wonder the price of ETH has soared!

9/ The right question to ask is: Will this persist? I think the answer is "yes."

10/ ETP Investors remain significantly underweight Ethereum vs. Bitcoin: Although ETH’s market cap is about 19% the size of BTC, Ethereum ETPs have amassed less than 12% of the assets of Bitcoin ETPs.

11/ With surging interest in stablecoins and tokenization, we expect strong ETH ETP inflows for a long time to come.

12/ Meanwhile, all signs suggest the “ETH treasury company” trend will accelerate. The key is whether Treasury stocks trade at a premium to the value of the crypto assets they hold, and right now, that’s true for ETH treasury companies. Full steam ahead.

13/ Looking out, I can imagine ETPs and Treasury Companies buying $20 billion of ETH in the next year, or 5.33 million ETH at today’s prices.

Meanwhile, the network is expected to produce roughly 0.80 million ETH over the same period. That’s ~7x more demand than supply.

Meanwhile, the network is expected to produce roughly 0.80 million ETH over the same period. That’s ~7x more demand than supply.

14/ ETH is of course different from BTC. It's price is not set purely by supply and demand, and it doesn’t share BTC’s capped long-term issuance. But right now, that doesn't matter.

15/ In the short term, the price of everything is set by supply and demand. And for the time being, there is significantly more demand for ETH than there is new supply.

I suspect we go higher.

I suspect we go higher.

16/ To read my original analysis of ETH's supply and demand outlook, sign up to receive the Bitwise CIO Memo at www.bitwiseinvestments/ciomemo.

• • •

Missing some Tweet in this thread? You can try to

force a refresh