Mastercard's CFO called India's payment system "incredibly painful."

Translation: India just murdered a $500B industry. With FREE payments.

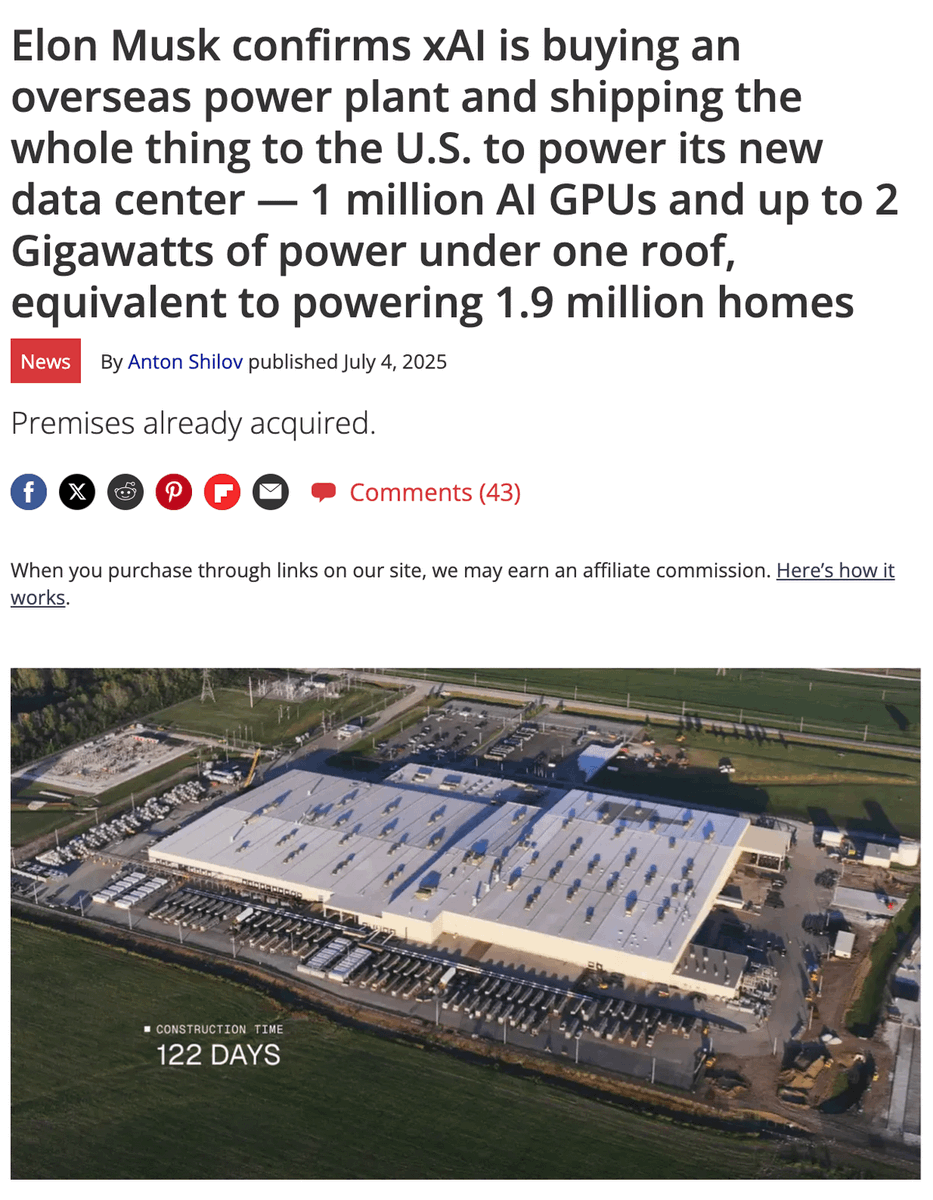

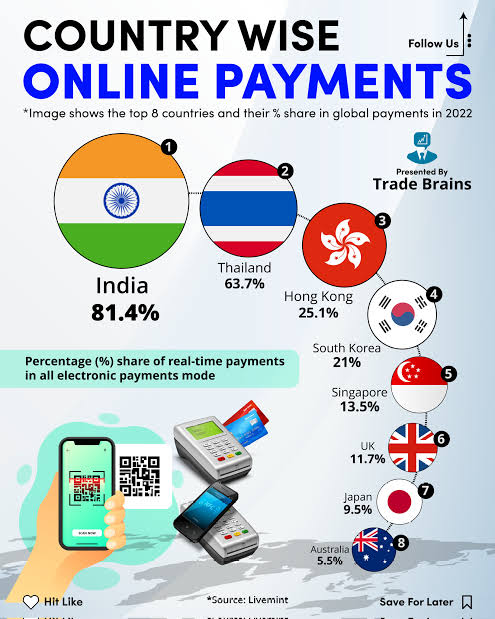

51.4 billion transactions. Zero fees. 49% of global real-time payments.

Here's how a "developing country" made Visa & Mastercard beg for mercy 🧵

Translation: India just murdered a $500B industry. With FREE payments.

51.4 billion transactions. Zero fees. 49% of global real-time payments.

Here's how a "developing country" made Visa & Mastercard beg for mercy 🧵

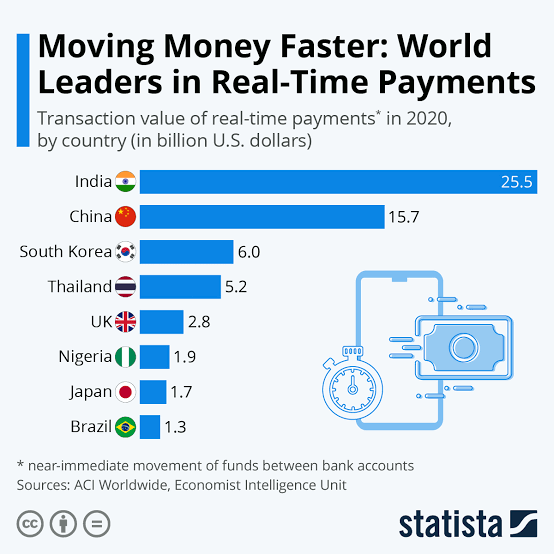

The numbers are staggering: UPI now handles 49% of ALL real-time payments globally.

One country. One system. Half the world's instant transactions.

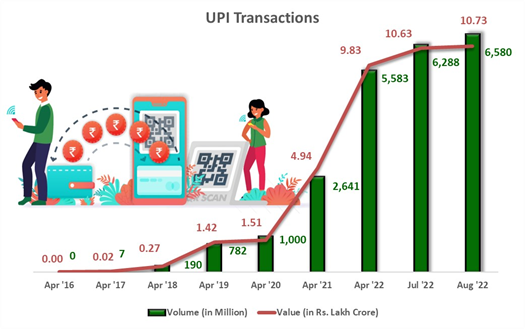

We're not talking about gradual growth.

We're talking about complete market domination in just 9 years.

One country. One system. Half the world's instant transactions.

We're not talking about gradual growth.

We're talking about complete market domination in just 9 years.

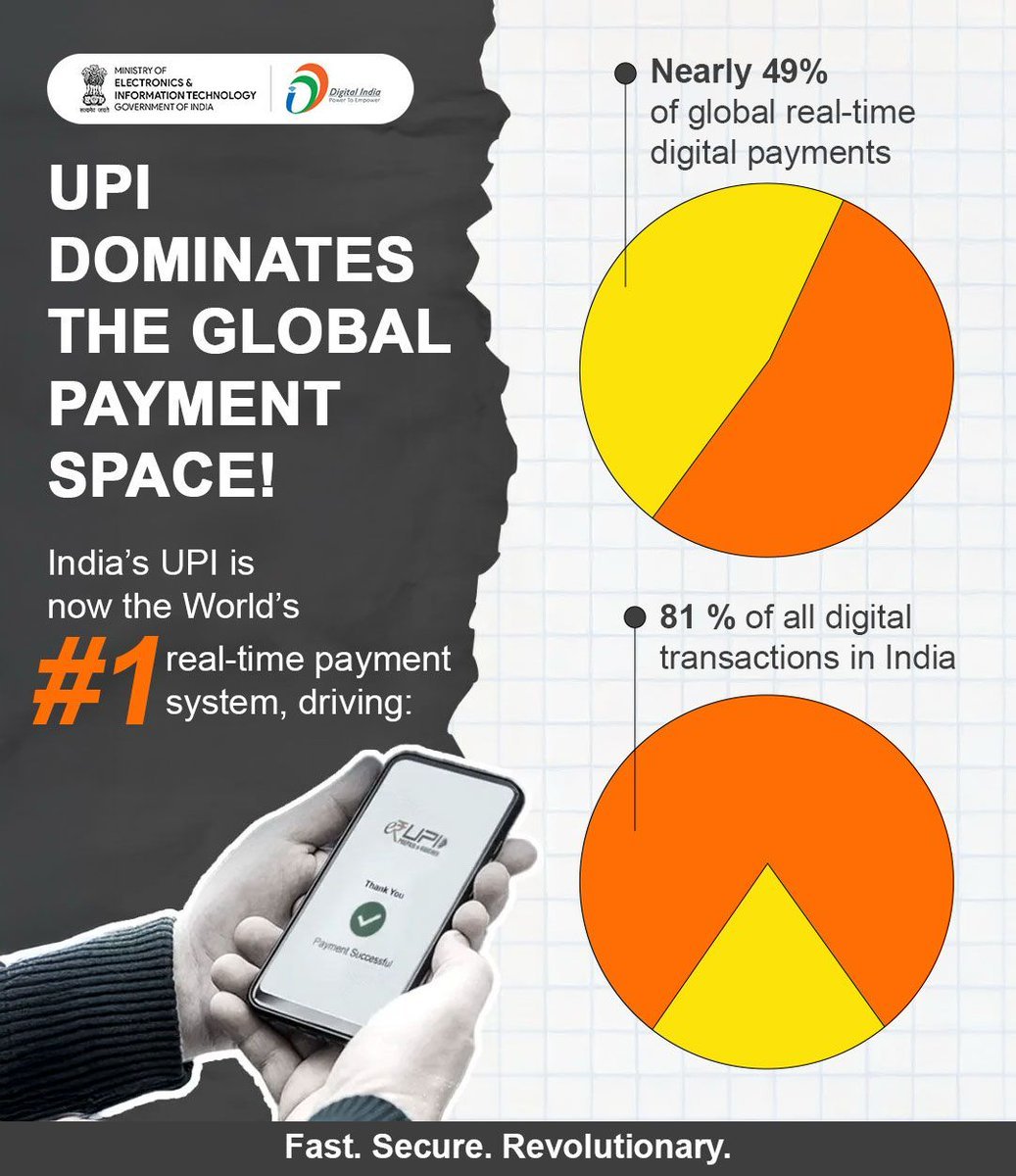

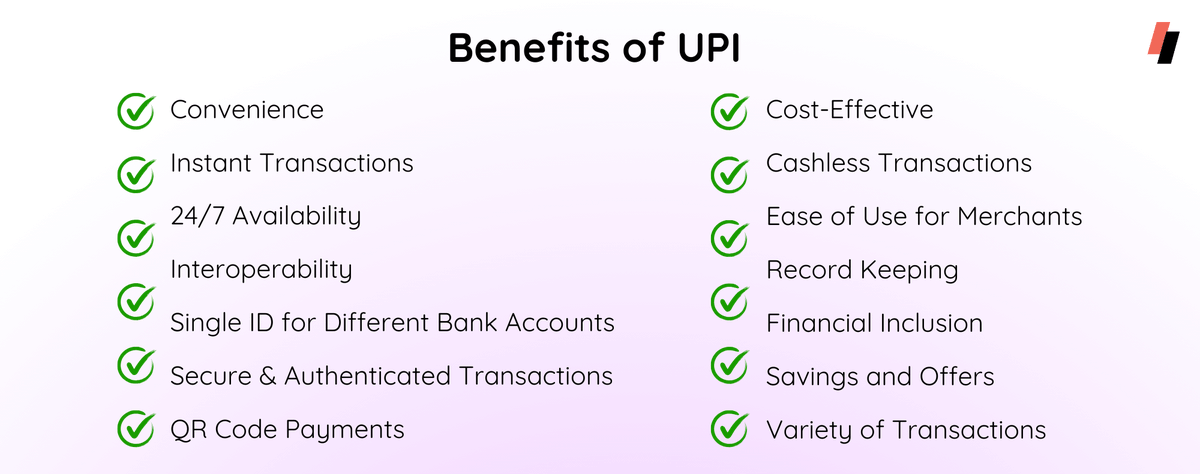

Here's what happened: India launched UPI in 2016 with 21 banks and a radical idea.

Zero fees for merchants. Instant transfers. No plastic cards needed.

Just QR codes and mobile phones.

By 2025: 673 banks. The payment giants laughed.

They're not laughing anymore.

Zero fees for merchants. Instant transfers. No plastic cards needed.

Just QR codes and mobile phones.

By 2025: 673 banks. The payment giants laughed.

They're not laughing anymore.

The domination leaderboard tells the whole story:

• UPI Q1 2025: 51.4 billion transactions

• Mastercard Q1 2025: 40.1 billion transactions

• UPI daily volume: 535 million transactions

• UPI monthly value: ₹25,14,297 crores ($294.21 billion)

• Expected by 2027: 1 billion daily transactions

India didn't just compete. They obliterated the competition.

• UPI Q1 2025: 51.4 billion transactions

• Mastercard Q1 2025: 40.1 billion transactions

• UPI daily volume: 535 million transactions

• UPI monthly value: ₹25,14,297 crores ($294.21 billion)

• Expected by 2027: 1 billion daily transactions

India didn't just compete. They obliterated the competition.

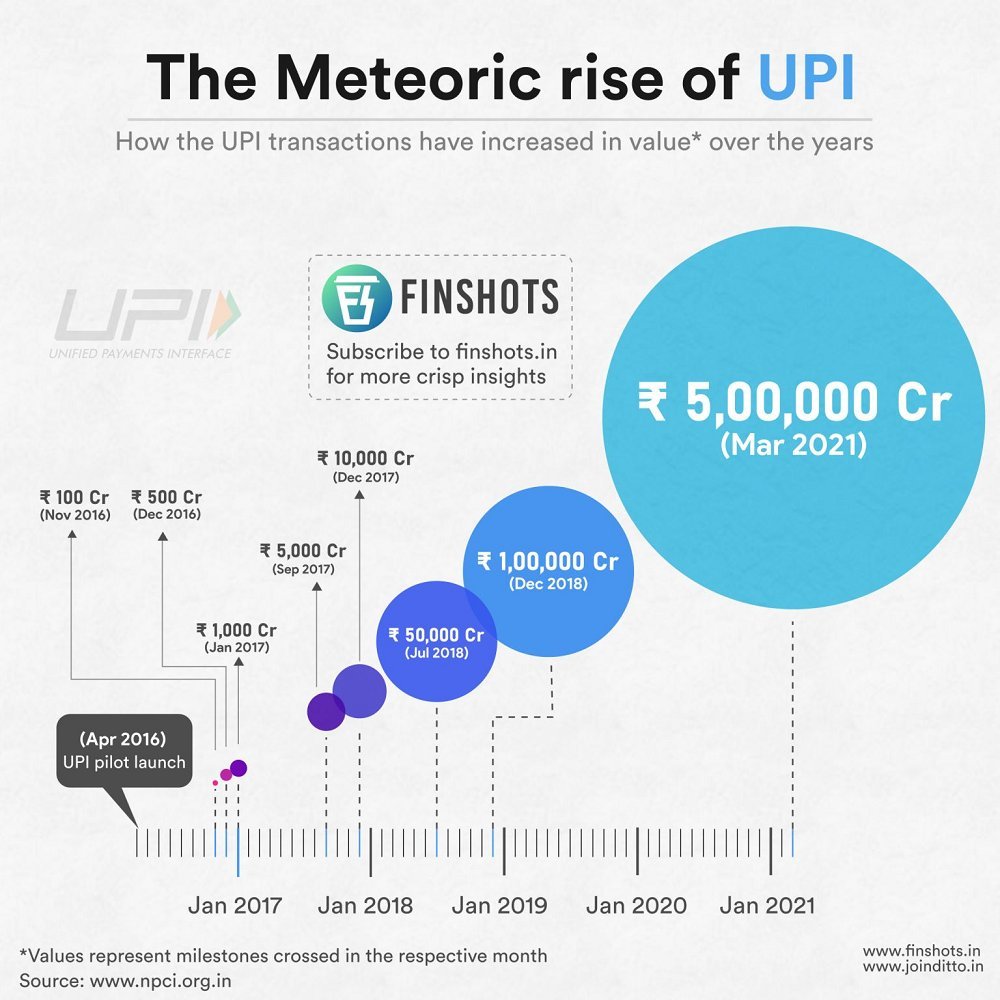

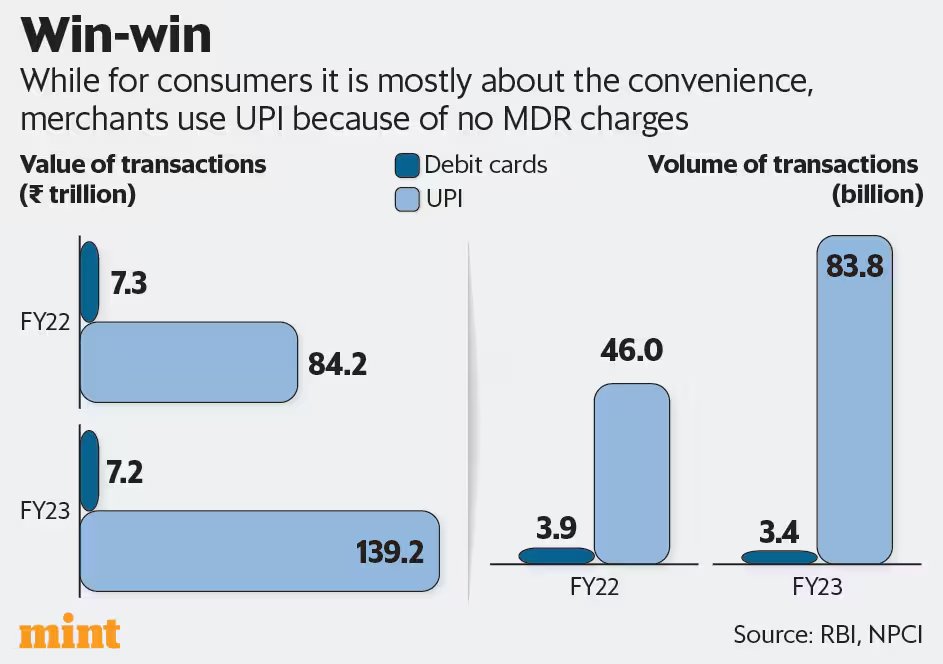

But here's the kicker: This isn't just about volume.

UPI charges 0% merchant fees.

Visa charges 0.9% on debit, 2-3% on credit.

For a ₹1000 transaction: UPI = ₹0 fee, Visa = ₹9-30 fee.

Mastercard's CFO literally called UPI an "incredibly painful experience."

Pure revenue destruction.

UPI charges 0% merchant fees.

Visa charges 0.9% on debit, 2-3% on credit.

For a ₹1000 transaction: UPI = ₹0 fee, Visa = ₹9-30 fee.

Mastercard's CFO literally called UPI an "incredibly painful experience."

Pure revenue destruction.

The scale is mind-bending:

• 2024 UPI value: ₹260.56 trillion (vs ₹131.14 trillion in 2023)

• That's 99% growth in one year

• July 2024 alone: ₹20.64 trillion processed

• 45% annual growth rate sustained

Every traditional payment metric is being shattered.

• 2024 UPI value: ₹260.56 trillion (vs ₹131.14 trillion in 2023)

• That's 99% growth in one year

• July 2024 alone: ₹20.64 trillion processed

• 45% annual growth rate sustained

Every traditional payment metric is being shattered.

The merchant adoption story is brutal for card networks:

- Small tea stall in Mumbai: Accepts UPI via printed QR code.

- Premium mall in Delhi: UPI preferred over cards.

- Street vendors: UPI QR codes stuck on handcarts.

- No POS terminals. No merchant fees. No international dependency.

- Small tea stall in Mumbai: Accepts UPI via printed QR code.

- Premium mall in Delhi: UPI preferred over cards.

- Street vendors: UPI QR codes stuck on handcarts.

- No POS terminals. No merchant fees. No international dependency.

The RBI calls it "digital payment revolution" - when free, instant payments make traditional card networks irrelevant.

Translation: Give merchants zero-cost transactions and watch billion-dollar fee structures collapse overnight.

The economics are impossible to compete against.

Translation: Give merchants zero-cost transactions and watch billion-dollar fee structures collapse overnight.

The economics are impossible to compete against.

The experimental setup was deliberately simple:

• Mobile phone + bank account = payment system

• QR codes replace expensive card terminals ($200-500 each)

• Interbank transfers with zero merchant cost

• 673 banks integrated vs fragmented card acceptance

• No international processing fees

Removed the middleman entirely.

• Mobile phone + bank account = payment system

• QR codes replace expensive card terminals ($200-500 each)

• Interbank transfers with zero merchant cost

• 673 banks integrated vs fragmented card acceptance

• No international processing fees

Removed the middleman entirely.

Critics say India subsidized this growth through government backing.

Payment experts say this reveals the future of fintech.

Mastercard admits "commercial viability concerns" about competing with free.

But here's the real question:

When 670+ banks adopt a system that eliminates traditional revenue streams, what does that tell you about market evolution?

Payment experts say this reveals the future of fintech.

Mastercard admits "commercial viability concerns" about competing with free.

But here's the real question:

When 670+ banks adopt a system that eliminates traditional revenue streams, what does that tell you about market evolution?

The technology disruption is complete:

• Cards require: Plastic manufacturing, POS terminals, international networks, complex settlement

• UPI requires: Smartphone app, QR code, domestic banking rails

• Result: 99.9% cost reduction in payment infrastructure

No wonder traditional players are struggling.

• Cards require: Plastic manufacturing, POS terminals, international networks, complex settlement

• UPI requires: Smartphone app, QR code, domestic banking rails

• Result: 99.9% cost reduction in payment infrastructure

No wonder traditional players are struggling.

The global implications are staggering:

"India is offering a template for other nations seeking to reduce dependence on Western payment networks."

Brazil studying UPI model. Singapore exploring adoption.

Nigeria, Philippines asking for technology transfer.

The blueprint for payment sovereignty is spreading.

"India is offering a template for other nations seeking to reduce dependence on Western payment networks."

Brazil studying UPI model. Singapore exploring adoption.

Nigeria, Philippines asking for technology transfer.

The blueprint for payment sovereignty is spreading.

This isn't theoretical anymore:

• UPI value: ₹260.56 trillion in 2025

• Expected growth: $4,317 billion by 2029

• CAGR: 271.9% (vs 15% for traditional cards)

• P2M transactions: 50% surge in micro-payments

• Daily micro-transactions now dominate vs large card purchases

The money is already moving away from Western networks.

• UPI value: ₹260.56 trillion in 2025

• Expected growth: $4,317 billion by 2029

• CAGR: 271.9% (vs 15% for traditional cards)

• P2M transactions: 50% surge in micro-payments

• Daily micro-transactions now dominate vs large card purchases

The money is already moving away from Western networks.

The competitive response has been desperate:

"Mastercard takes on UPI with new biometric payment passkey in India"

Translation: Can't beat them, join them.

"Linking to the UPI would let them bulk up their presence"

Even Visa/Mastercard admit they need UPI integration to survive in India.

"Mastercard takes on UPI with new biometric payment passkey in India"

Translation: Can't beat them, join them.

"Linking to the UPI would let them bulk up their presence"

Even Visa/Mastercard admit they need UPI integration to survive in India.

The timing couldn't be worse for card networks.

As nations seek payment independence, India proves domestic systems can outperform global giants.

Current international frameworks weren't designed for zero-fee payment networks.

Geopolitical tensions accelerating the shift to domestic systems.

As nations seek payment independence, India proves domestic systems can outperform global giants.

Current international frameworks weren't designed for zero-fee payment networks.

Geopolitical tensions accelerating the shift to domestic systems.

Three scenarios ahead:

1. Card networks adapt to zero-fee models globally (destroys their business model)

2. More countries launch UPI-style domestic systems (fragments their market)

3. Visa/Mastercard retreat to high-value transaction niches (loses volume game)

Market dynamics suggest option 2 is most likely.

1. Card networks adapt to zero-fee models globally (destroys their business model)

2. More countries launch UPI-style domestic systems (fragments their market)

3. Visa/Mastercard retreat to high-value transaction niches (loses volume game)

Market dynamics suggest option 2 is most likely.

The merchant economics are irresistible:

Restaurant bill ₹1000:

• Card payment: ₹970-990 received (after fees)

• UPI payment: ₹1000 received (zero fees)

• Multiply by millions of daily transactions

• Result: Billions in saved fees flowing back to businesses

No CFO can ignore this math.

Restaurant bill ₹1000:

• Card payment: ₹970-990 received (after fees)

• UPI payment: ₹1000 received (zero fees)

• Multiply by millions of daily transactions

• Result: Billions in saved fees flowing back to businesses

No CFO can ignore this math.

The consumer behavior shift is permanent:

• UPI used for ₹5 tea to ₹50,000 electronics

• No wallet loading, no card carrying

• Instant refunds, instant transfers

• Works offline in rural areas

• Available 24/7/365 unlike card networks with downtime

User experience superiority + zero cost = unstoppable adoption.

• UPI used for ₹5 tea to ₹50,000 electronics

• No wallet loading, no card carrying

• Instant refunds, instant transfers

• Works offline in rural areas

• Available 24/7/365 unlike card networks with downtime

User experience superiority + zero cost = unstoppable adoption.

The irony is perfect: We assumed payment innovation would come from Silicon Valley giants.

Instead, it came from India prioritizing financial inclusion over profit maximization.

More access ≠ less efficiency. It created the opposite.

1.4 billion people + zero fees = the world's largest payment laboratory.

Instead, it came from India prioritizing financial inclusion over profit maximization.

More access ≠ less efficiency. It created the opposite.

1.4 billion people + zero fees = the world's largest payment laboratory.

The data doesn't lie about global impact:

"Visa and Mastercard are no longer the dominant players in the card market, which also is losing its dominance to UPI in the Digital Payments space"

From financial reports, not marketing fluff.

The disruption is real, measured, and accelerating.

"Visa and Mastercard are no longer the dominant players in the card market, which also is losing its dominance to UPI in the Digital Payments space"

From financial reports, not marketing fluff.

The disruption is real, measured, and accelerating.

The global payment revolution isn't coming.

It's here. It's Indian. And it's free.

While Visa and Mastercard optimized for shareholders, UPI optimized for users.

The market has spoken with 51.4 billion transactions.

The question isn't IF other countries will follow.

It's how fast they can build their own UPI.

It's here. It's Indian. And it's free.

While Visa and Mastercard optimized for shareholders, UPI optimized for users.

The market has spoken with 51.4 billion transactions.

The question isn't IF other countries will follow.

It's how fast they can build their own UPI.

Bottom line: UPI didn't disrupt payments.

It eliminated the need for traditional payment networks entirely.

16.6 billion monthly transactions.

₹260.56 trillion annual value.

49% of global real-time payments.

The revolution is complete. The era of payment fees is ending.

And it all started with a simple idea: What if payments were actually free?

It eliminated the need for traditional payment networks entirely.

16.6 billion monthly transactions.

₹260.56 trillion annual value.

49% of global real-time payments.

The revolution is complete. The era of payment fees is ending.

And it all started with a simple idea: What if payments were actually free?

I’m Shawn, a Generative AI Consultant passionate about building AI-driven solutions.

I write about AI, startups, and the future of work.

I write about AI, startups, and the future of work.

If you found these insights valuable: Sign up for my free AI newsletter!

the-unbound-ai.beehiiv.com/subscribe

the-unbound-ai.beehiiv.com/subscribe

I hope you've found this thread helpful.

Follow me @shawnchauhan1 for more.

Like/Repost the quote below if you can:

Follow me @shawnchauhan1 for more.

Like/Repost the quote below if you can:

https://twitter.com/813034080044392448/status/1948027902022619256

• • •

Missing some Tweet in this thread? You can try to

force a refresh