The Genius Act just became law.

Trump calls it a “financial revolution,” unleashing dollar-backed stablecoins to cement U.S. dominance in crypto.

But is this really about innovation—or a stealth move toward a programmable, surveilled dollar?

Here’s what’s really happening 🧵👇

Trump calls it a “financial revolution,” unleashing dollar-backed stablecoins to cement U.S. dominance in crypto.

But is this really about innovation—or a stealth move toward a programmable, surveilled dollar?

Here’s what’s really happening 🧵👇

The bill promises to “modernize payments” and make the U.S. the “crypto capital of the world.”

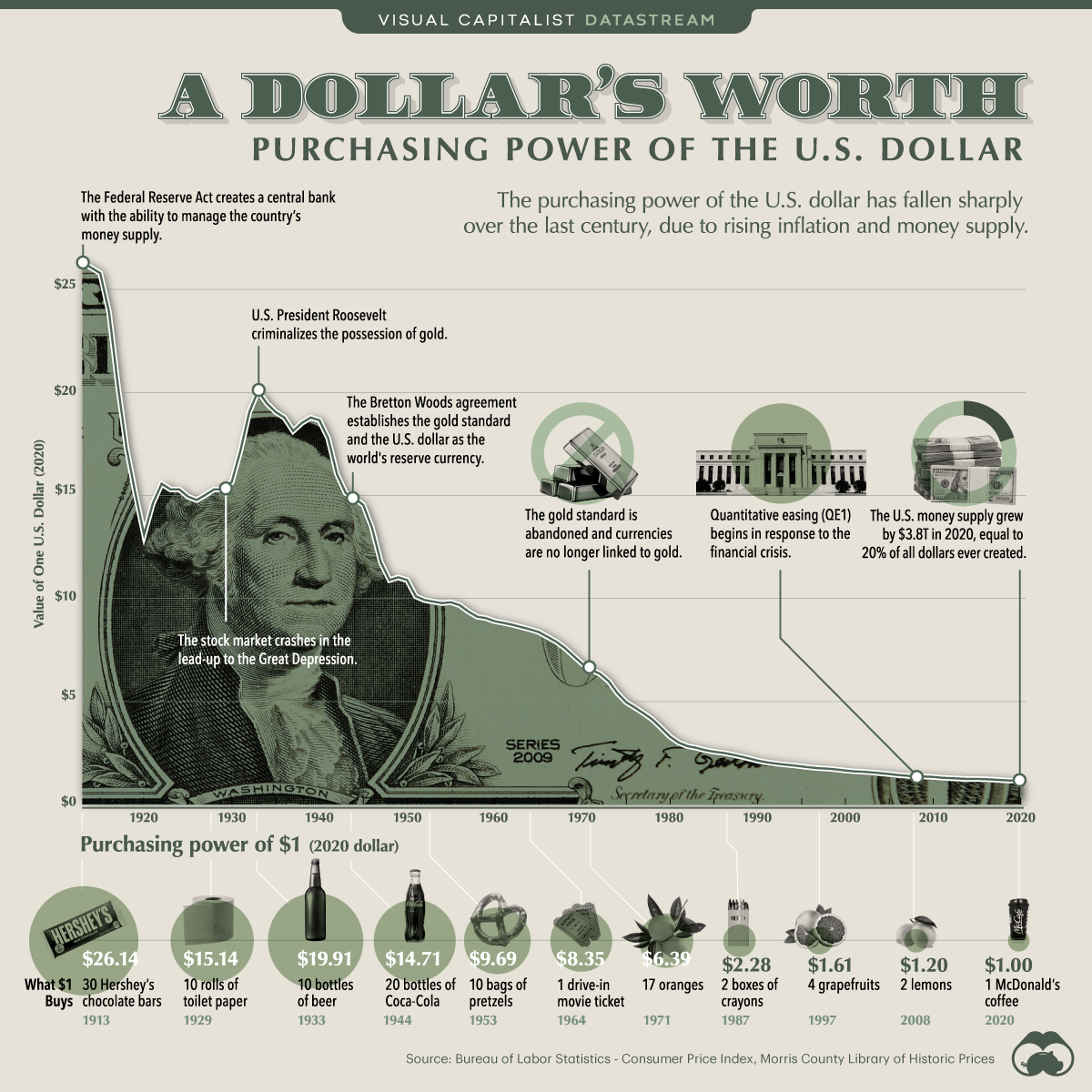

But stablecoins don’t fix fiat—they just digitize it.

They’re still tied 1:1 to the same dollar that’s lost 98% of its value since 1913.

But stablecoins don’t fix fiat—they just digitize it.

They’re still tied 1:1 to the same dollar that’s lost 98% of its value since 1913.

Trump banned a retail CBDC to “protect Americans from surveillance.”

But many argue regulated, bank-like stablecoins can easily become CBDC-lite:

• Fully auditable

• Heavily regulated

• Programmable in practice

Different issuer, similar outcome.

But many argue regulated, bank-like stablecoins can easily become CBDC-lite:

• Fully auditable

• Heavily regulated

• Programmable in practice

Different issuer, similar outcome.

Look deeper at the incentives:

Stablecoins = trillions in new demand for U.S. Treasuries.

Stablecoins = extending dollar hegemony.

Stablecoins = propping up a decaying system with shinier tech.

This isn’t monetary freedom. It’s digital fiat.

Stablecoins = trillions in new demand for U.S. Treasuries.

Stablecoins = extending dollar hegemony.

Stablecoins = propping up a decaying system with shinier tech.

This isn’t monetary freedom. It’s digital fiat.

Bitcoiners see the trap.

Stablecoins make fiat faster.

CBDCs make it programmable.

But neither solve the root problem:

Money controlled by politics, endlessly debased.

Bitcoin is the alternative—finite, incorruptible, outside state control.

Stablecoins make fiat faster.

CBDCs make it programmable.

But neither solve the root problem:

Money controlled by politics, endlessly debased.

Bitcoin is the alternative—finite, incorruptible, outside state control.

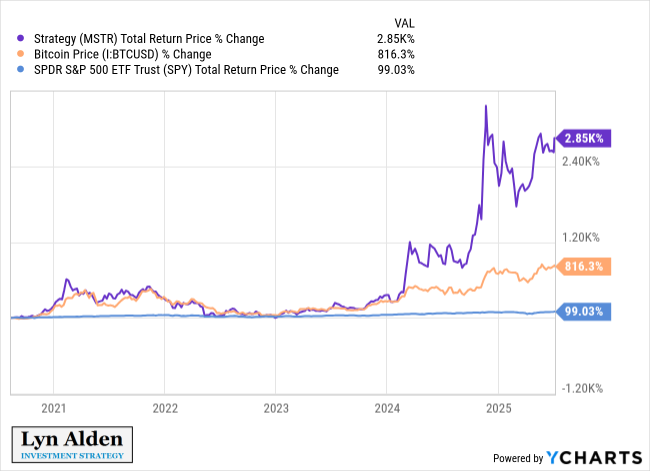

And while Washington digitizes the dollar, corporations are making their bet.

Trump Media just put two-thirds of its liquid treasury into Bitcoin.

hundreds of public companies are moving rapidly to the only money that can’t be inflated.

They’re choosing the fastest horse.

Trump Media just put two-thirds of its liquid treasury into Bitcoin.

hundreds of public companies are moving rapidly to the only money that can’t be inflated.

They’re choosing the fastest horse.

So the choice is clear:

Do you settle for a shinier, more surveilled dollar?

Or do you opt out entirely into a monetary network no government can co-opt?

The Genius Act is an attempt to save the old system.

Bitcoin builds the new one.

Do you settle for a shinier, more surveilled dollar?

Or do you opt out entirely into a monetary network no government can co-opt?

The Genius Act is an attempt to save the old system.

Bitcoin builds the new one.

Want to hear from people shaping the future of money?

Join lawmakers, asset managers, builders & sovereign leaders at BTC in DC this September.

Not just another conference—it’s where Bitcoin policy, capital & innovation meet.

🎟 | Code: SWAN for 10% off btcindc.com

Join lawmakers, asset managers, builders & sovereign leaders at BTC in DC this September.

Not just another conference—it’s where Bitcoin policy, capital & innovation meet.

🎟 | Code: SWAN for 10% off btcindc.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh