How to get URL link on X (Twitter) App

Everyone’s framing this as gold vs Bitcoin.

Everyone’s framing this as gold vs Bitcoin.

Every cycle-trained Bitcoiner is asking the same question:

Every cycle-trained Bitcoiner is asking the same question:

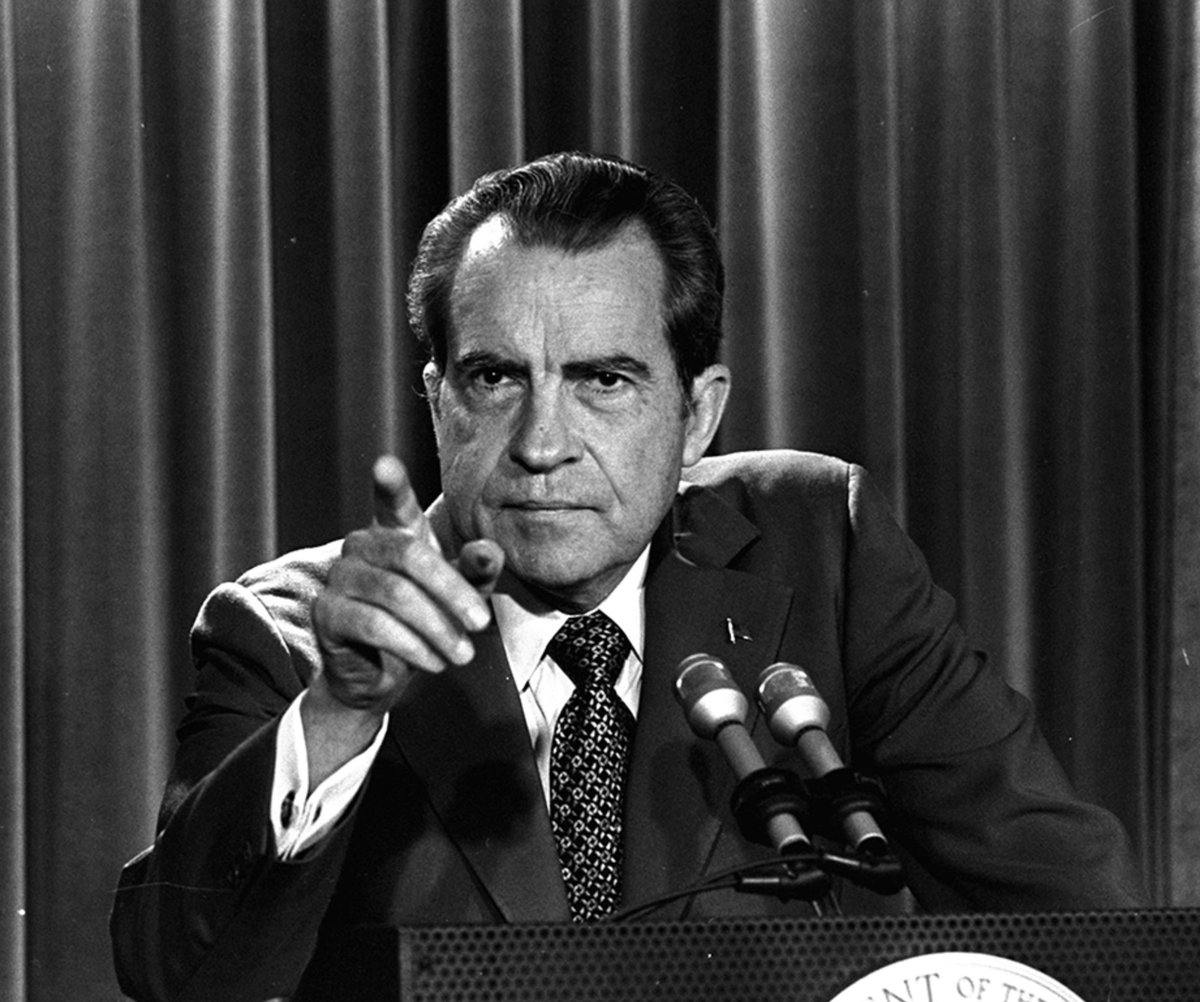

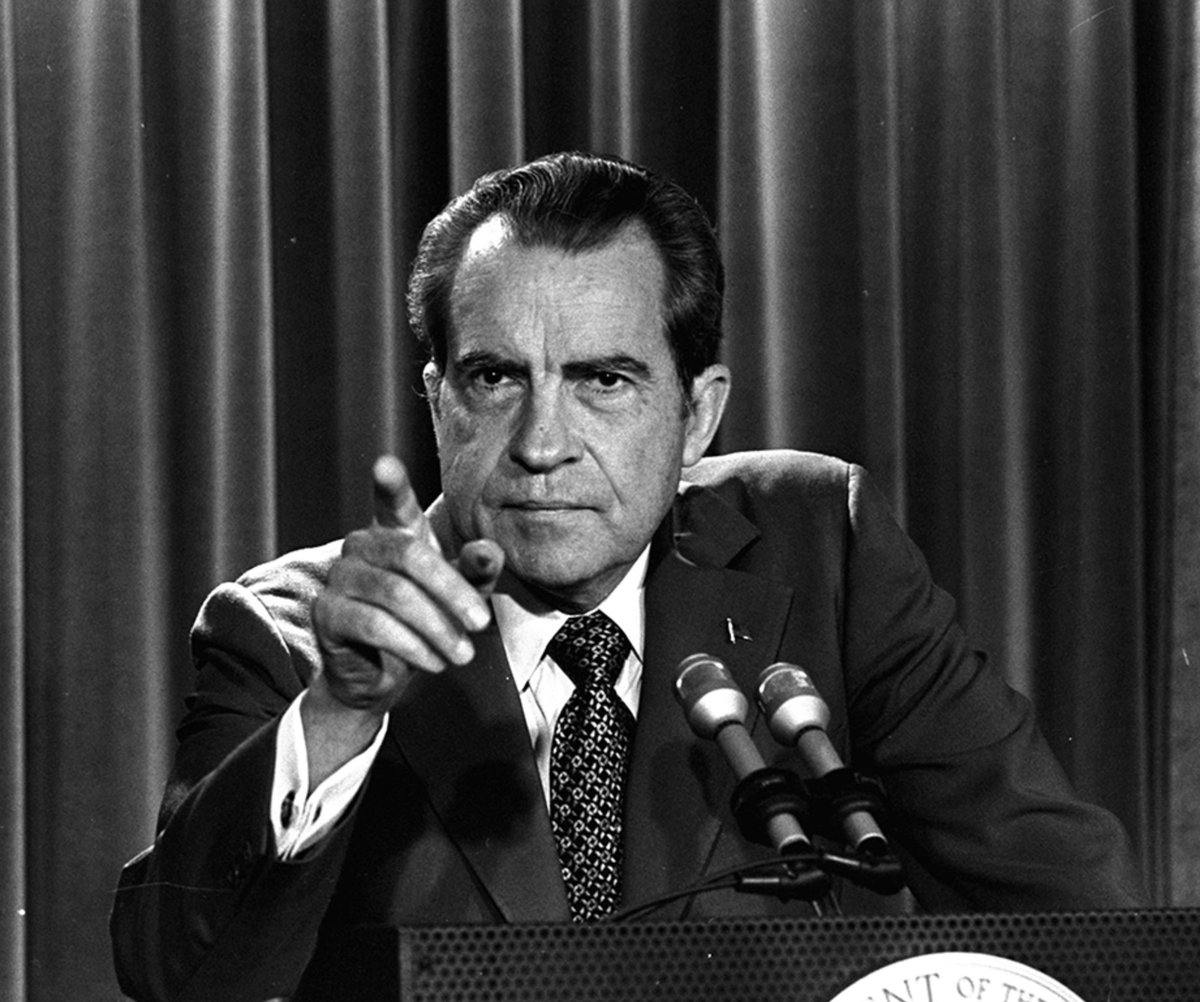

This wasn’t about removing a dictator.

This wasn’t about removing a dictator.

Start at the beginning:

Start at the beginning:

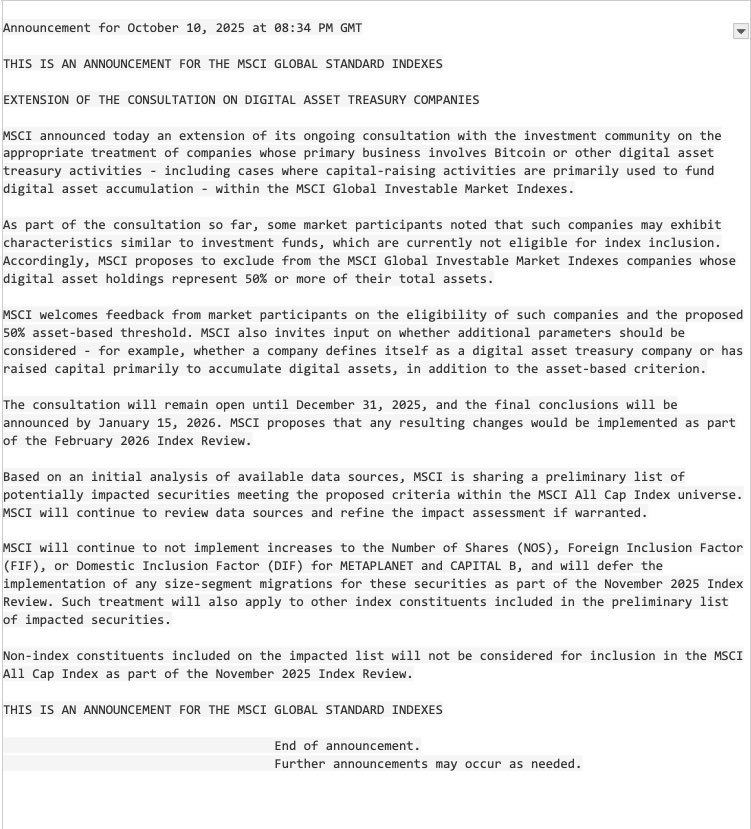

Start with MSCI.

Start with MSCI.

Nothing in the underlying thesis is breaking.

Nothing in the underlying thesis is breaking.

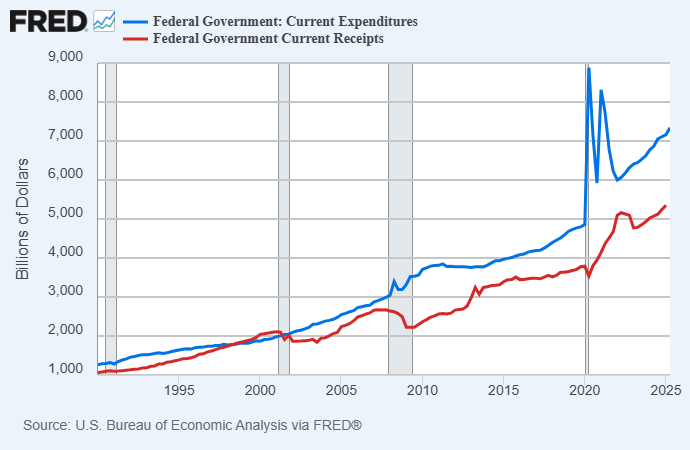

The U.S. is cornered:

The U.S. is cornered:

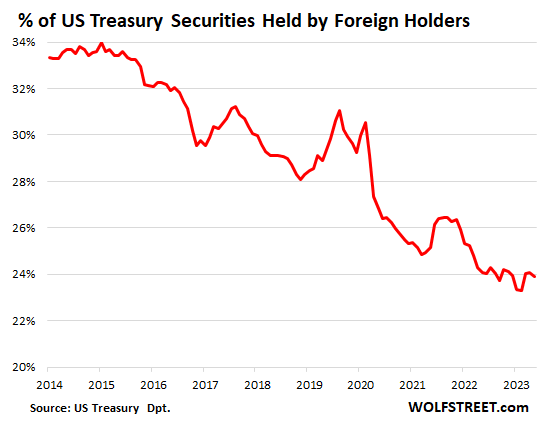

When you buy Treasuries, you’re lending to the U.S. government.

When you buy Treasuries, you’re lending to the U.S. government.

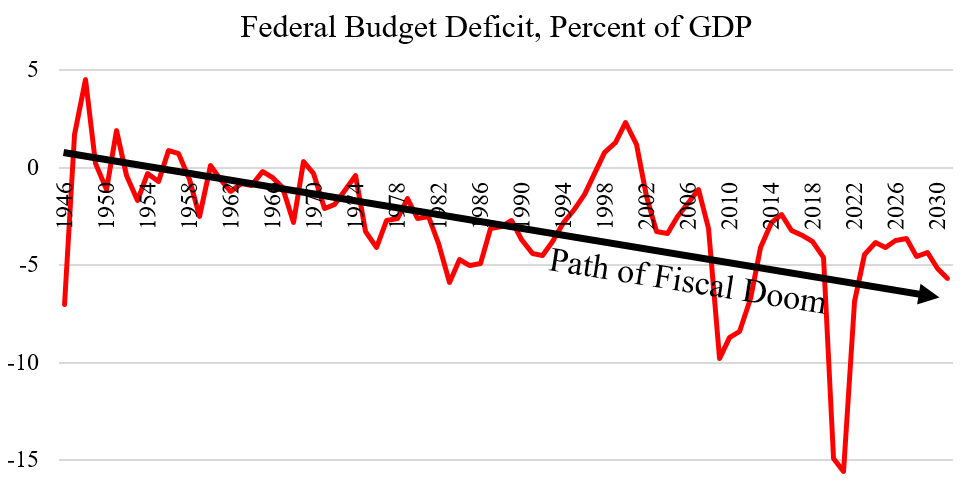

1. Fiscal Dominance: The Train With No Brakes

1. Fiscal Dominance: The Train With No Brakes

Under Bretton Woods (1944), the dollar was pegged to gold at $35/oz, and other currencies pegged to the dollar.

Under Bretton Woods (1944), the dollar was pegged to gold at $35/oz, and other currencies pegged to the dollar.

The Diagnostic Snapshot: Understanding the Affordability Crisis

The Diagnostic Snapshot: Understanding the Affordability Crisis

Officially, the Fed has a “dual mandate”:

Officially, the Fed has a “dual mandate”:

Why DCA into Bitcoin?

Why DCA into Bitcoin?

1/12 — The Maturity Wall

1/12 — The Maturity Wall

Austrian econ 101. Your time preference is how much you discount the future relative to today. Hard money that holds value rewards patience, planning, and craftsmanship. Soft money that erodes nudges people to spend first, borrow often, and hope policy bails out the gap. Change the money, change behavior, change families, change feedback loops across the whole culture.

Austrian econ 101. Your time preference is how much you discount the future relative to today. Hard money that holds value rewards patience, planning, and craftsmanship. Soft money that erodes nudges people to spend first, borrow often, and hope policy bails out the gap. Change the money, change behavior, change families, change feedback loops across the whole culture.

During Trump’s first term, tariffs doubled from ~$40B to ~$80B annually. Manageable.

During Trump’s first term, tariffs doubled from ~$40B to ~$80B annually. Manageable.

Collum’s claim is simple: governments will never allow Bitcoin to take over. He thinks it’s all a setup to get us ready for central bank digital currencies.

Collum’s claim is simple: governments will never allow Bitcoin to take over. He thinks it’s all a setup to get us ready for central bank digital currencies.

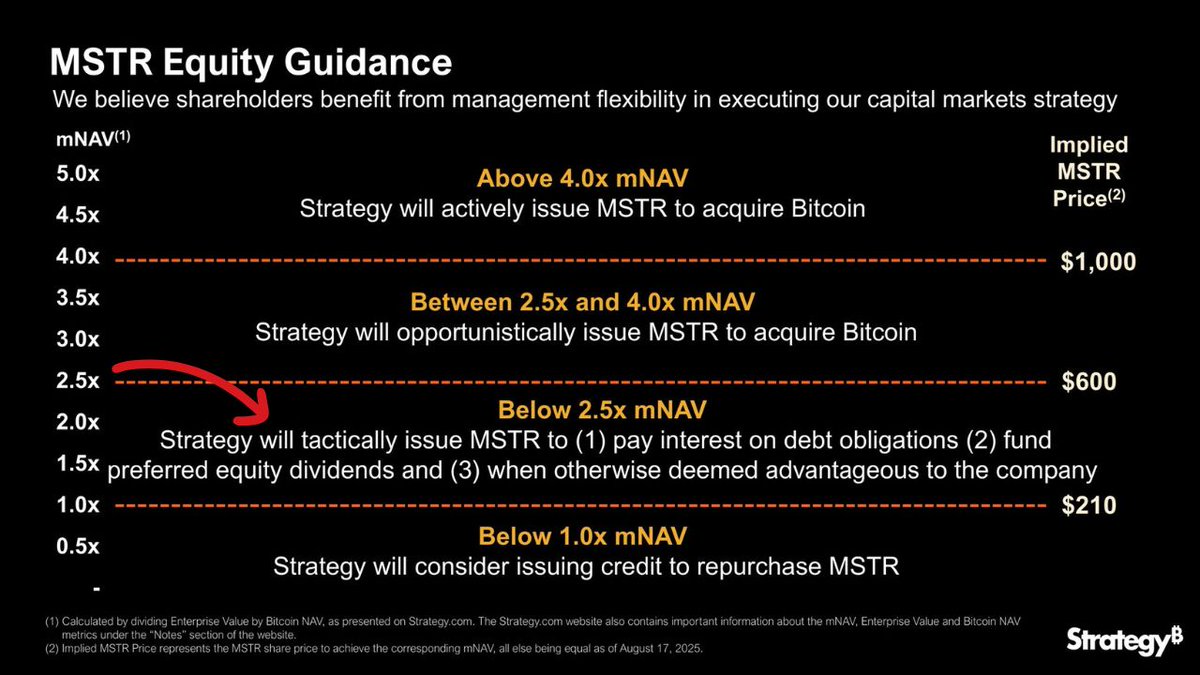

The update was announced publicly by Saylor.

The update was announced publicly by Saylor.