The private equity bubble has popped, & Trump is delivering the bailout they’ve been begging for!

Mega Thread 1/12

Trump is planning an executive order to open $12.2 TRILLION in 401(k)s to private equity. This isn’t about “opportunity.”

It’s a bailout for billionaires sitting on toxic assets they can’t sell. Here’s what they’re not telling you -

Mega Thread 1/12

Trump is planning an executive order to open $12.2 TRILLION in 401(k)s to private equity. This isn’t about “opportunity.”

It’s a bailout for billionaires sitting on toxic assets they can’t sell. Here’s what they’re not telling you -

Private equity is collapsing.

•$3 TRILLION in overleveraged, unsellable assets

•14–21% interest from floating-rate debt

•Harvard & Yale can’t unload $8B in PE stakes

•No institutional buyers left

Their solution?

Take your retirement. 2/12

•$3 TRILLION in overleveraged, unsellable assets

•14–21% interest from floating-rate debt

•Harvard & Yale can’t unload $8B in PE stakes

•No institutional buyers left

Their solution?

Take your retirement. 2/12

They’re selling this as a deal of a lifetime.

“1,000% windfalls,” they say.

But if that were true,

Harvard & Yale wouldn’t be dumping their private equity.

They’d be hoarding it.

It’s not a deal.

It’s a toxic handoff—and you’re the sucker. 3/12

“1,000% windfalls,” they say.

But if that were true,

Harvard & Yale wouldn’t be dumping their private equity.

They’d be hoarding it.

It’s not a deal.

It’s a toxic handoff—and you’re the sucker. 3/12

They’ve already begun lobbying.

Trump’s team is drafting the executive order.

This is a workaround bailout—because a public bailout would spark outrage.

So instead, they’re going after your 401(k)s.

No headlines. No votes. Just signatures. 4/12

Trump’s team is drafting the executive order.

This is a workaround bailout—because a public bailout would spark outrage.

So instead, they’re going after your 401(k)s.

No headlines. No votes. Just signatures. 4/12

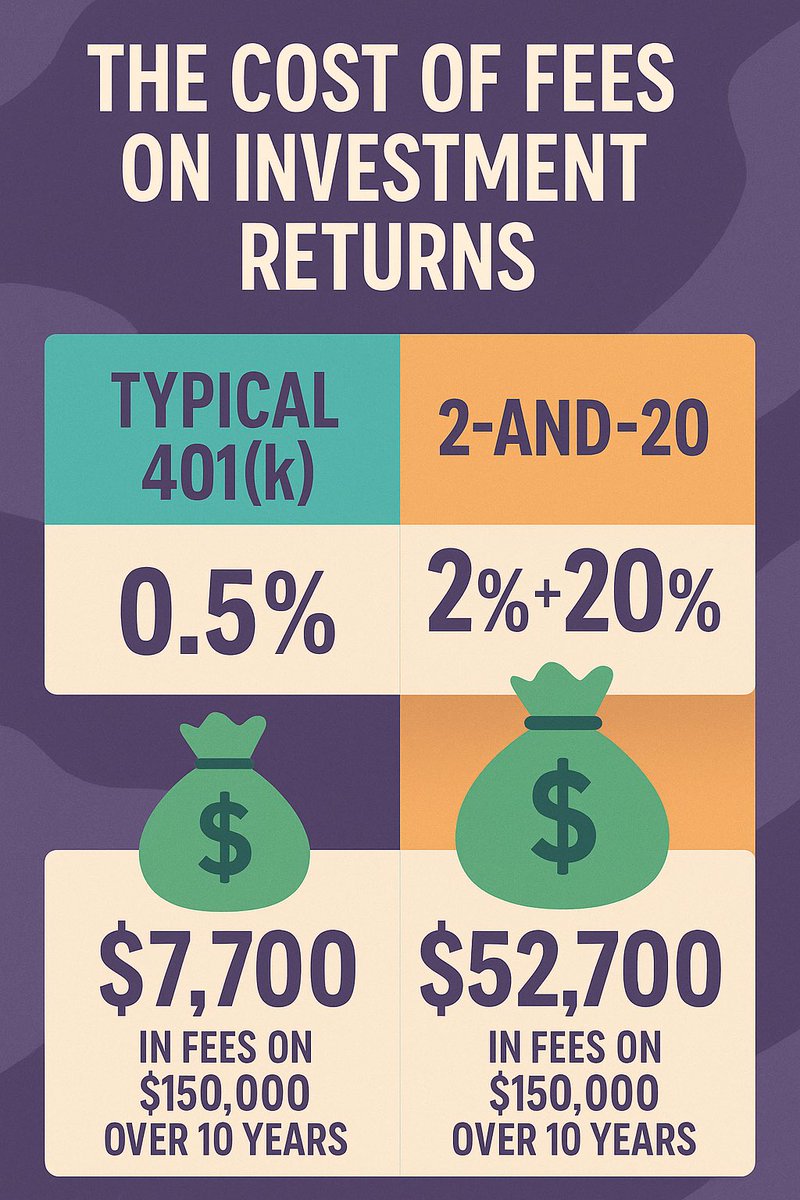

Here’s how the scam works:

🔻 You pay 0.5% to manage a normal 401(k)

🔺 In private equity, you pay 2% + 20% of gains

That means:

$150,000 in gains =

📈 $7.7K in normal fees

💸 $52,700 in PE fees

💰 That’s 60% of your return—gone

5/12

🔻 You pay 0.5% to manage a normal 401(k)

🔺 In private equity, you pay 2% + 20% of gains

That means:

$150,000 in gains =

📈 $7.7K in normal fees

💸 $52,700 in PE fees

💰 That’s 60% of your return—gone

5/12

Even Yale and Harvard are drowning in fees:

•Yale: $1.23B/year in fees on private equity

•Harvard: $1.48B/year

•Returns? 5–7%

•S&P 500 in same time: 95%

The smartest investors in America can’t make this work.

But they want you to buy it? 6/12

•Yale: $1.23B/year in fees on private equity

•Harvard: $1.48B/year

•Returns? 5–7%

•S&P 500 in same time: 95%

The smartest investors in America can’t make this work.

But they want you to buy it? 6/12

They’ve run out of billionaires.

They’ve run out of institutions.

The only untapped capital left?

Your 401(k).

Your nest egg.

Your future.

They’re counting on you not noticing.

Until it’s too late. 7/12

They’ve run out of institutions.

The only untapped capital left?

Your 401(k).

Your nest egg.

Your future.

They’re counting on you not noticing.

Until it’s too late. 7/12

They’ll call it “democratizing investing.”

But you were locked out of private equity during the boom years.

Now that it’s failing, suddenly they want you “in”?

It’s not democratization.

It’s socializing billionaire losses.

8/12

But you were locked out of private equity during the boom years.

Now that it’s failing, suddenly they want you “in”?

It’s not democratization.

It’s socializing billionaire losses.

8/12

Ask yourself:

🧠 Why is private equity lobbying for access to your 401(k)?

📉 Why aren’t your 401(k) managers asking for it?

💣 Why are they promising huge returns—on garbage no one else will buy?

Because it’s a setup. 9/12

🧠 Why is private equity lobbying for access to your 401(k)?

📉 Why aren’t your 401(k) managers asking for it?

💣 Why are they promising huge returns—on garbage no one else will buy?

Because it’s a setup. 9/12

We’ve seen this movie before:

2008: They made reckless bets

🛑 We bailed them out

💰 They got richer

😡 We lost homes, jobs, savings

Now it’s happening again—quietly.

Only this time, they’re using your retirement to save themselves.

10/12

2008: They made reckless bets

🛑 We bailed them out

💰 They got richer

😡 We lost homes, jobs, savings

Now it’s happening again—quietly.

Only this time, they’re using your retirement to save themselves.

10/12

Don’t let it happen again.

📣 Call Trump.

📣 Call your reps.

📣 Demand protection for 401(k)s.

And if your 401(k) manager allows this?

There are law firms ready to sue.

💥 We don’t have to go quietly. 11/12

📣 Call Trump.

📣 Call your reps.

📣 Demand protection for 401(k)s.

And if your 401(k) manager allows this?

There are law firms ready to sue.

💥 We don’t have to go quietly. 11/12

They broke the system.

Now they want your retirement to fix it.

We need to protect working Americans—not bail out the ultra-wealthy again.

📲 Take action.

Share this.

Speak up.

#StopThe401kHeist

12/12

Now they want your retirement to fix it.

We need to protect working Americans—not bail out the ultra-wealthy again.

📲 Take action.

Share this.

Speak up.

#StopThe401kHeist

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh