The biggest difference between retail and institutional investors?

Retail: “Should I buy now?”

Institution: “Does this pass our checklist?”

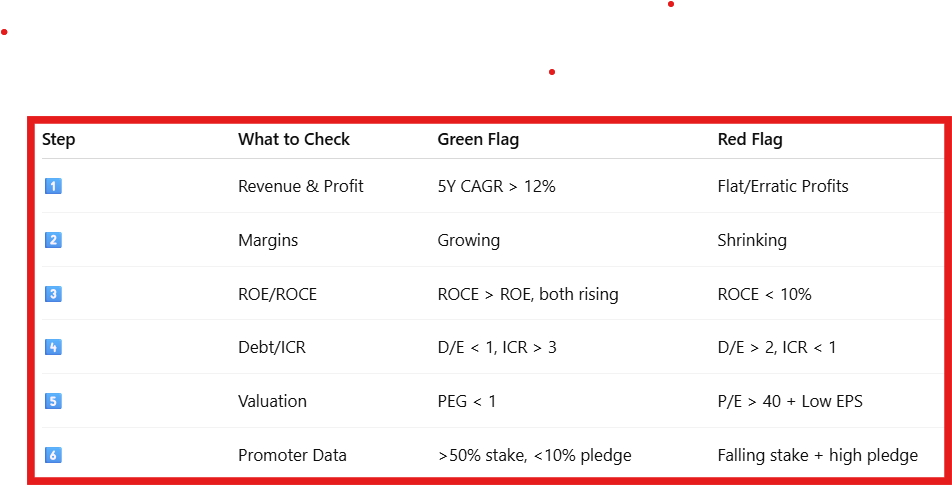

Here’s that exact 6-step checklist.

Use this before your next buy. Or risk regret.

🧵 Let’s break it down:

Retail: “Should I buy now?”

Institution: “Does this pass our checklist?”

Here’s that exact 6-step checklist.

Use this before your next buy. Or risk regret.

🧵 Let’s break it down:

🔍 What You’ll Learn In This Thread:

✅ How to spot if a stock is actually worth it

✅ The 6 exact steps I run every stock through

✅ Real examples (Zee, Kingfisher, Tata Elxsi)

✅ Where to find the data for FREE

✅ My biggest mistakes (so you don’t repeat them)

✅ How to spot if a stock is actually worth it

✅ The 6 exact steps I run every stock through

✅ Real examples (Zee, Kingfisher, Tata Elxsi)

✅ Where to find the data for FREE

✅ My biggest mistakes (so you don’t repeat them)

📢 Before we begin…

We just launched our official Telegram channel for serious investors:

→ Stock screeners every week

→ Breakout alerts

→ Cheat sheets from iconic investors

→ Real-time market filters

📲 Join now →

Let’s Grow together. 📈telegram.me/Stockizenoffic…

We just launched our official Telegram channel for serious investors:

→ Stock screeners every week

→ Breakout alerts

→ Cheat sheets from iconic investors

→ Real-time market filters

📲 Join now →

Let’s Grow together. 📈telegram.me/Stockizenoffic…

🧠 Truth Bomb: Most People Start With Price. Big Mistake.

Stock tips are like junk food.

→ Tasty.

→ Addictive.

→ And in the long run? Dangerous.

The real game starts with this checklist:

📌 Revenue

📌 Margins

📌 ROCE

📌 Debt

📌 Valuation

📌 Promoters

Stock tips are like junk food.

→ Tasty.

→ Addictive.

→ And in the long run? Dangerous.

The real game starts with this checklist:

📌 Revenue

📌 Margins

📌 ROCE

📌 Debt

📌 Valuation

📌 Promoters

📈 STEP 1: Revenue & Profit Growth - The Pulse of a Business

Ignore this, and you're gambling.

✅ 5-year Revenue CAGR > 12%

✅ Profit CAGR > Revenue CAGR? Even better.

📊 Example: Tata Elxsi (2018–2023)

→ Revenue: ₹1,386 Cr → ₹3,154 Cr

→ Net Profit: ₹250 Cr → ₹755 Cr

→ Profit CAGR: 24.4%

→ Revenue CAGR: 18.2%

Verdict? 👑 Elite growth stock.

Ignore this, and you're gambling.

✅ 5-year Revenue CAGR > 12%

✅ Profit CAGR > Revenue CAGR? Even better.

📊 Example: Tata Elxsi (2018–2023)

→ Revenue: ₹1,386 Cr → ₹3,154 Cr

→ Net Profit: ₹250 Cr → ₹755 Cr

→ Profit CAGR: 24.4%

→ Revenue CAGR: 18.2%

Verdict? 👑 Elite growth stock.

🚩 Red Flags to Watch:

→ Revenue up, profits flat = margin bleed

→ Sudden one-time profit spikes? Check “Other Income”

→ Inconsistent YoY growth = weak demand or poor management

📊 Where to check: > Financials TabScreener.in

→ Revenue up, profits flat = margin bleed

→ Sudden one-time profit spikes? Check “Other Income”

→ Inconsistent YoY growth = weak demand or poor management

📊 Where to check: > Financials TabScreener.in

What’s the first thing you check before buying a stock?

💰 STEP 2: Margins - The Hidden Truth About Efficiency

Two companies with ₹100 Cr revenue:

→ One makes ₹25 Cr profit

→ Other makes ₹6 Cr

Same sales. Completely different businesses.

✅ Operating Margin > 18%

✅ Net Margin > 10%

✅ Rising trend over 3–5 years = pricing power

Two companies with ₹100 Cr revenue:

→ One makes ₹25 Cr profit

→ Other makes ₹6 Cr

Same sales. Completely different businesses.

✅ Operating Margin > 18%

✅ Net Margin > 10%

✅ Rising trend over 3–5 years = pricing power

📉 Personal Story:

I bought a midcap infra stock in 2020.

→ Revenue growth looked solid

→ But margins fell from 18% → 8% in 2 years

Didn’t notice.

→ Contracts delayed

→ Costs ballooned

→ Net profit vanished

→ Stock fell 43%

Lesson? Margins whisper what revenue hides.

I bought a midcap infra stock in 2020.

→ Revenue growth looked solid

→ But margins fell from 18% → 8% in 2 years

Didn’t notice.

→ Contracts delayed

→ Costs ballooned

→ Net profit vanished

→ Stock fell 43%

Lesson? Margins whisper what revenue hides.

📌 Where to check margin data:

→ > P&L & Ratios

→ Annual Reports > Financial Highlights

→ Compare with sector peersScreener.in

→ > P&L & Ratios

→ Annual Reports > Financial Highlights

→ Compare with sector peersScreener.in

🧠 STEP 3: ROE & ROCE - The ‘Smart Money’ Test

These show how well the company uses YOUR capital.

→ ROE = Profit on shareholder equity

→ ROCE = Profit on total capital (equity + debt)

✅ ROE > 15%

✅ ROCE > 12–15%

✅ ROCE > ROE = low debt, high efficiency

These show how well the company uses YOUR capital.

→ ROE = Profit on shareholder equity

→ ROCE = Profit on total capital (equity + debt)

✅ ROE > 15%

✅ ROCE > 12–15%

✅ ROCE > ROE = low debt, high efficiency

🚩 My Mistake in 2021:

Bought a pharma midcap:

→ ROE: 17.5%

→ ROCE: 6.8%

→ Debt: ₹3,200 Cr 😳

ROE was boosted by leverage.

Once debt hit cash flow… stock tanked 28% in 2 weeks.

Check ROCE. Every time.

Bought a pharma midcap:

→ ROE: 17.5%

→ ROCE: 6.8%

→ Debt: ₹3,200 Cr 😳

ROE was boosted by leverage.

Once debt hit cash flow… stock tanked 28% in 2 weeks.

Check ROCE. Every time.

📉 STEP 4: Financial Health - D/E and Interest Coverage

You don’t want to buy a debt bomb.

→ D/E < 1 = safe

→ ICR > 3 = healthy

→ ICR < 1 = default risk

📊 Example: Kingfisher Airlines

→ D/E: 3.6

→ ICR: 0.7

→ Cash Flow: Negative

→ Stock: Wiped out

Even glamour dies when debt explodes.

You don’t want to buy a debt bomb.

→ D/E < 1 = safe

→ ICR > 3 = healthy

→ ICR < 1 = default risk

📊 Example: Kingfisher Airlines

→ D/E: 3.6

→ ICR: 0.7

→ Cash Flow: Negative

→ Stock: Wiped out

Even glamour dies when debt explodes.

🔍 Where to check debt data:

→ > Balance Sheet

→ Moneycontrol > Financial Ratios

→ Annual Reports > Notes to AccountsScreener.in

→ > Balance Sheet

→ Moneycontrol > Financial Ratios

→ Annual Reports > Notes to AccountsScreener.in

💸 STEP 5: Valuation - Don’t Overpay For Quality

Great business + bad price = bad investment.

✅ P/E < sector average

✅ PEG < 1

✅ P/B < 1 (for asset-heavy companies)

✅ EPS growing YoY

📊 Example:

→ Stock A: P/E 18, Growth 25% = PEG 0.72 ✅

→ Stock B: P/E 34, Growth 9% = PEG 3.7 ❌

Great business + bad price = bad investment.

✅ P/E < sector average

✅ PEG < 1

✅ P/B < 1 (for asset-heavy companies)

✅ EPS growing YoY

📊 Example:

→ Stock A: P/E 18, Growth 25% = PEG 0.72 ✅

→ Stock B: P/E 34, Growth 9% = PEG 3.7 ❌

📉 Painful Truth:

I once bought a “buzzing” tech stock at P/E 82.

→ PEG: 3.9

→ Earnings slowed

→ Stock crashed 17% in 9 months

Even Warren Buffett said:

“Price is what you pay. Value is what you get.”

I once bought a “buzzing” tech stock at P/E 82.

→ PEG: 3.9

→ Earnings slowed

→ Stock crashed 17% in 9 months

Even Warren Buffett said:

“Price is what you pay. Value is what you get.”

🕵️ STEP 6: Promoter Holding & Pledging - The Insider Confidence Check

✅ Promoter holding > 50%

✅ Pledged shares < 10%

❌ Red flag: promoter stake falling + pledging rising

📊 Zee Entertainment (2020):

→ Promoter stake: 35%

→ 90% of it pledged

→ Lenders dumped shares

→ Stock collapsed

✅ Promoter holding > 50%

✅ Pledged shares < 10%

❌ Red flag: promoter stake falling + pledging rising

📊 Zee Entertainment (2020):

→ Promoter stake: 35%

→ 90% of it pledged

→ Lenders dumped shares

→ Stock collapsed

📌 Where to check promoter data:

→ NSE India > Shareholding Pattern

→ > “Shareholding” tab

→ Trendlyne > Pledge alertsScreener.in

→ NSE India > Shareholding Pattern

→ > “Shareholding” tab

→ Trendlyne > Pledge alertsScreener.in

Have you ever checked if promoters are pledging their shares?

💬 Want More Like This?

We built 2 elite communities for serious investors:

🚀 MomentumX → Swing traders & breakout setups

💰 WealthX → Long-term compounders only

📲 DM our team now → wa.me/+918799167391

We built 2 elite communities for serious investors:

🚀 MomentumX → Swing traders & breakout setups

💰 WealthX → Long-term compounders only

📲 DM our team now → wa.me/+918799167391

🙏 Thank you for checking out the thread.

If you found this helpful, please repost the first tweet and follow for more educational content.

🧠 Follow: @CaVivekkhatri❤️

🔁 Repost the first tweet below 👇

If you found this helpful, please repost the first tweet and follow for more educational content.

🧠 Follow: @CaVivekkhatri❤️

🔁 Repost the first tweet below 👇

https://x.com/CaVivekkhatri/status/1948261226389320150

• • •

Missing some Tweet in this thread? You can try to

force a refresh