If you live in South India, you probably have Milky Mist in your fridge. They're planning a ₹2000 crore IPO, giving us a perfect chance to understand how dairy companies actually work and what makes this business so challenging.🧵👇

Here's how your milk journey begins: Every litre starts on farms with 2 cows or thousands of buffaloes. Roughly 65% still flows through "informal" channels of local collectors and sweet-shops. The rest goes to organised co-ops like Amul and private dairies.

Both local milkmen and big companies want milk from the same farmers, creating bidding wars. Farmer prices change based on three things: cow fodder costs, monsoons (good rains = cheaper grass), and festivals like Diwali when sweet demand shoots up.

Here's the brutal reality: while farmers' prices keep changing, shop prices stay almost the same. Why? Price revisions are politically sensitive. Even small milk price hikes anger millions of voters, so state governments cap increases just before elections.

This creates a nightmare for dairy companies already running on razor-thin margins. You pay farmers more when cow food is costly, but can't charge customers more because government won't allow it. Your profit gets crunched from both sides.

So saving just ₹1 by using cheaper trucks or closer cold storage is as valuable as selling extra milk worth ₹1. That's precisely where milk companies try to build their advantage - in the supply chain efficiency game.

Raw milk goes bad incredibly fast - just 3 hours outside the fridge and it turns sour. Companies need entire cold chain systems: networks of village cooling centers, refrigerated trucks working like moving fridges, and testing labs at every step.

The whole cold chain system has to work perfectly. If a truck is late picking up milk from a village, that entire evening's collection spoils and becomes worthless. This is the first economic moat dairy companies try to build - collection, chilling, and transport.

Milky Mist found a smart solution to reduce costs: they use refrigerated trucks to carry finished products on return journeys instead of running empty. This smart planning makes a huge difference in their transportation efficiency.

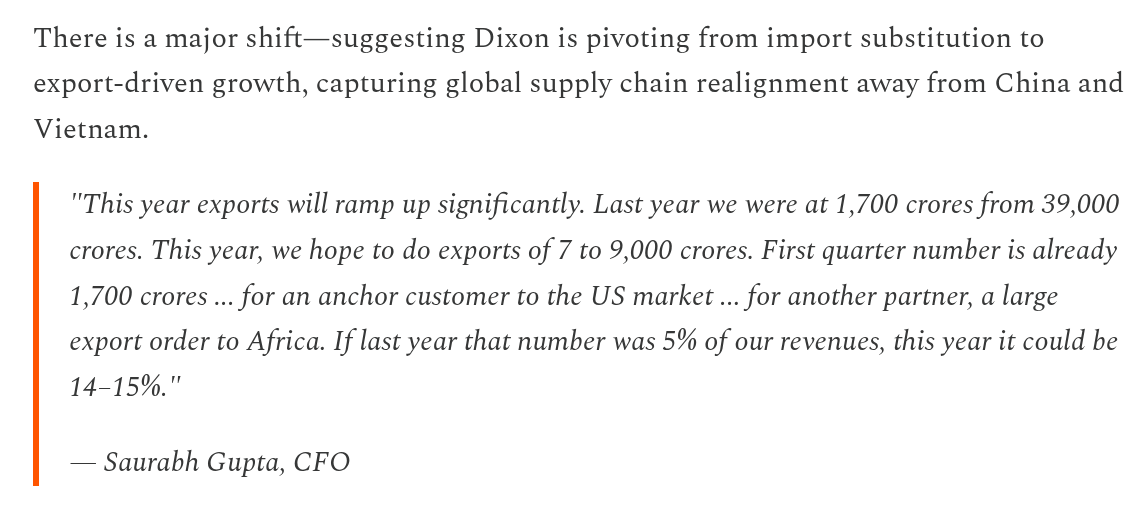

This planning gave them one of the lowest transportation costs in the industry in 2025, meaning extra money to pay farmers better prices. Small efficiency gains create massive competitive advantages in this margin-squeezed business.

Processing transforms perishability into shelf-life and margin. Factories pasteurize (kill germs), centrifuge (separate cream), then standardize (mix back in exact proportions). Result: every batch tastes identical whether you buy paneer today or next month.

This processed milk gets batched for two uses: regular milk pouches and value-added products like butter, yogurt, paneer, whey protein powder and desserts. The real money is in value-addition where margins are much higher.

A liter of milk yields ₹1 profit, but convert that same liter to cheese and it yields ₹3. Cheese and paneer demand more machines and money upfront, but earn much higher profits - exactly what Milky Mist focuses on most.

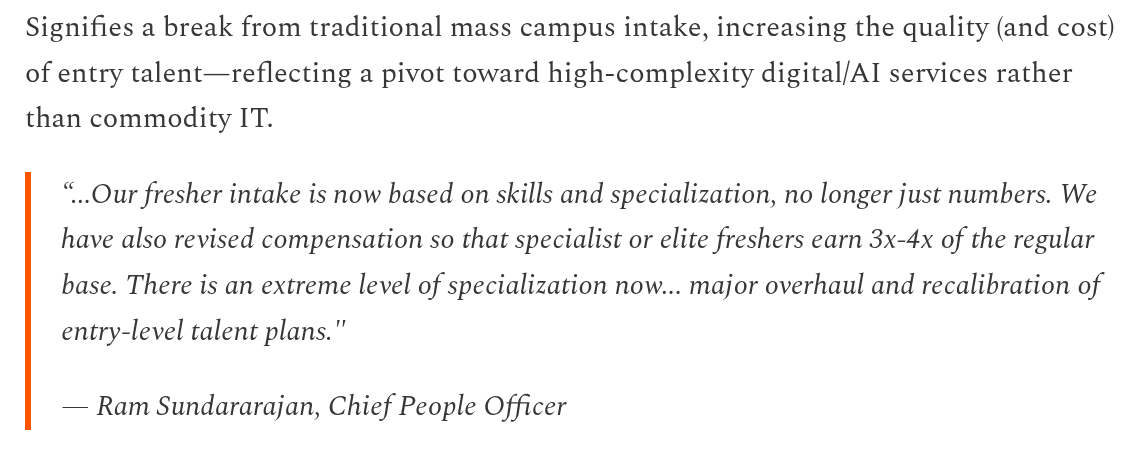

Milky Mist started in Tamil Nadu 30 years ago with laser focus on value-addition. Instead of regular packaged milk, they made paneer, cheese, and curd their main money-makers. Today they buy 30+ crore liters annually, mostly directly from farmers.

Since they buy directly from farmers, they know exactly what quality of milk they're getting - how creamy and fresh it is. This higher milk quality translates to better premiums on their value-added products as well.

Their growth is remarkable: ₹1,390 crores in 2023, ₹1,820 crores in 2024, ₹2,350 crores in 2025. But profits tell a different story: ₹27.2 crores (2023) dropped to ₹19.4 crores (2024), then shot up to ₹46.1 crores (2025) - more than 2x.

That 2024 profit drop wasn't random. Their cheese-making machines depreciated 30% in value, loans to buy these machines increased finance costs by 25%. This ate into their extra sales for that year, showing how capital-intensive this business is.

Impressively, Milky Mist owns just two factories: Perundurai (Tamil Nadu) for paneer/cheese, Bengaluru for ready-to-eat foods like parottas and chapatis. Their paneer machines ran at 110% capacity in 2025 - impressive but worrying if something breaks.

Within products, capacity varies: yogurt and cheese at 70-90%, Bengaluru plant at 80-94%, but ice-cream only at 20%. This low ice-cream utilization isn't necessarily bad - demand is seasonal, and they have room to grow during summers.

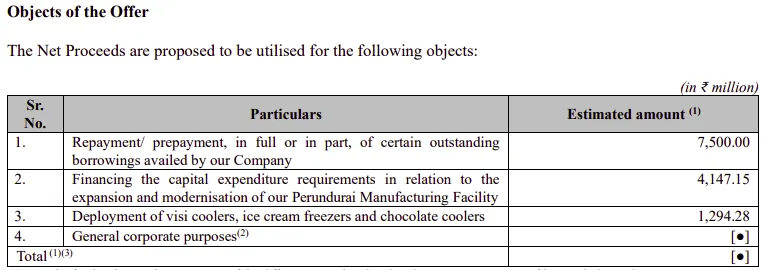

IPO funds (mix of fresh issue and offer-for-sale) will go to four areas: paying off loans, expanding production lines with modern tech, buying thousands of branded glass-door fridges for kirana stores, and operational needs.

Their expansion is clever: turning paneer waste (whey) into expensive whey protein and lactose. They'll make 10 tons whey protein and 44 tons lactose daily. Plus a yogurt line filling 21,600 cups hourly - that's 6 cups every second! Also adding premium cheeses like feta and gouda.

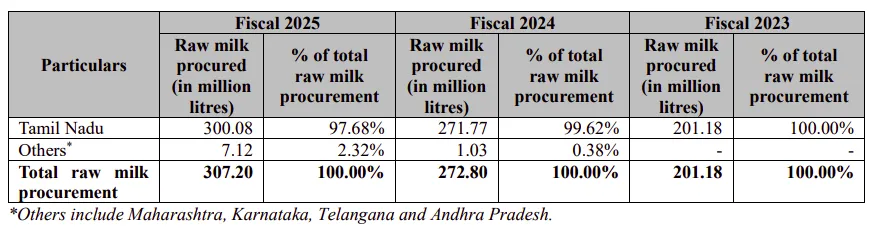

But major risks exist. First: 98% milk procurement from just Tamil Nadu. What if floods hit or truck drivers strike? Business stops overnight. Second: quality control issues as 15% milk now comes from middlemen vs 99% directly from farmers in 2023.

Final risks: single factory dependence (Perundurai handles most production - fire/flood/environmental shutdown = no backup), and disloyal distributors who pay upfront, maintain coolers, share data. If Amul offers better margins, they switch immediately. Rebuilding would be incredibly difficult.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/milky-mist-i…

All links here:thedailybrief.zerodha.com/p/milky-mist-i…

• • •

Missing some Tweet in this thread? You can try to

force a refresh