Being a real estate investor is one of the best ways to save on taxes.

With the OBBBA, bonus depreciation is now back to 100% in 2025.

Here’s how smart investors are leveraging this to cut their tax bills:

With the OBBBA, bonus depreciation is now back to 100% in 2025.

Here’s how smart investors are leveraging this to cut their tax bills:

The new tax bill increases bonus depreciation from 40% to 100% for assets that are “placed in service” on or after Jan 19, 2025.

This means that investors can significantly reduce their tax bill by doing a cost segregation study.

Let me explain...

This means that investors can significantly reduce their tax bill by doing a cost segregation study.

Let me explain...

Real estate buildings can be depreciated over 27.5 or 39 years for tax purposes.

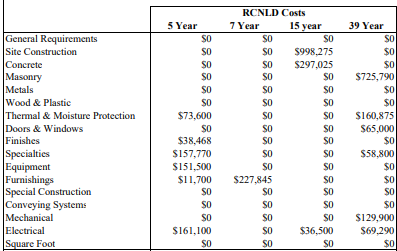

A cost segregation study (IRS Pub 5653), done by CPAs and engineers, allows you to reclassify some of the building costs into 5, 7, and 15-year property for tax purposes:

A cost segregation study (IRS Pub 5653), done by CPAs and engineers, allows you to reclassify some of the building costs into 5, 7, and 15-year property for tax purposes:

This allows you to get 100% depreciation for things like:

- carpets

- specialized wiring

- cooling systems

- ornamental millwork

- and much more

- carpets

- specialized wiring

- cooling systems

- ornamental millwork

- and much more

Say you purchase a rental for $400k.

~80% of the price is allocated to the building and ~20% to land (depends on location), so about $320k is eligible for depreciation.

Cost segregation study reclassifies ~20-30% of the building basis, or ~$80k into 5, 7, or 15 year property.

~80% of the price is allocated to the building and ~20% to land (depends on location), so about $320k is eligible for depreciation.

Cost segregation study reclassifies ~20-30% of the building basis, or ~$80k into 5, 7, or 15 year property.

Prior to the bill:

You could only take 40% in Year 1, or $32,000 of immediate depreciation.

New tax bill:

You can take the entire $80,000 as depreciation in Year 1.

With building depreciation, mortgage interest, or renovations, you could have a $90,000-$100,000 loss in Y1.

You could only take 40% in Year 1, or $32,000 of immediate depreciation.

New tax bill:

You can take the entire $80,000 as depreciation in Year 1.

With building depreciation, mortgage interest, or renovations, you could have a $90,000-$100,000 loss in Y1.

If you're in a 37% marginal tax bracket, that's about $37,000 of federal tax savings you can reinvest elsewhere. BUT:

Real estate is considered a passive activity.

You generally can't deduct this loss against your active income (like wages or business income).

Real estate is considered a passive activity.

You generally can't deduct this loss against your active income (like wages or business income).

If the average stay is less than 7 days, your rental property is excluded from the definition of a rental activity (§1.469-1T(e)(3)(ii)).

OR your stay at home spouse could qualify for real estate professional status (750 hours and >50% of time spent in real estate activities).

OR your stay at home spouse could qualify for real estate professional status (750 hours and >50% of time spent in real estate activities).

In addition, you must materially participate in your rental.

You need to meet one of the following tests:

→ Participate more than 500 hours, OR

→ Participate for at least 100 hours and at least as much as any other individual.

You need to meet one of the following tests:

→ Participate more than 500 hours, OR

→ Participate for at least 100 hours and at least as much as any other individual.

When you sell the rental, you will be subject to depreciation recapture.

You can:

• Use a like-kind exchange to defer the gains (IRC Section 1031).

• Pass it down to your heirs, so they receive a step-up in basis.

• Opportunity zones (avoid capital gains)

You can:

• Use a like-kind exchange to defer the gains (IRC Section 1031).

• Pass it down to your heirs, so they receive a step-up in basis.

• Opportunity zones (avoid capital gains)

BUT it might not make sense to take such a large loss in Y1.

If you expect your income to increase, it could make sense to postpone the cost segregation study.

It's also beneficial if you have a high income now but expect to be in a lower tax bracket when you sell.

If you expect your income to increase, it could make sense to postpone the cost segregation study.

It's also beneficial if you have a high income now but expect to be in a lower tax bracket when you sell.

If you enjoy these breakdowns, please:

1. follow me @money_cruncher

2. repost the first post so others can learn

1. follow me @money_cruncher

2. repost the first post so others can learn

• • •

Missing some Tweet in this thread? You can try to

force a refresh