Post 1: The Realities of $XRP vs. $LINK — A Factual Comparison for Investors

This thread isn’t meant to be biased or anti-XRP for the sake of it.

My goal is simply to lay out a clear, fact-based comparison between what XRP has long been believed to deliver — and what has actually happened in the market — especially when compared to Chainlink’s progress in the same areas.

If you read this thread all the way through, you may arrive at the same conclusion I have. And even if you don’t, I hope the research here helps you think more critically about where and why you invest.

Disclaimer: This thread is comprehensive — but when you're considering putting real capital into a project for the long term, thorough research like this is not just helpful... it's necessary.

Here’s what my research and close following of industry news, announcements, and adoption data has led me to.

That XRP is not what it was promised to be — and Chainlink is doing many of the things XRP once claimed it would do.

The goal of this thread is to walk through the key claims surrounding XRP — especially the idea that it would become the infrastructure for global banking — and compare them to what has actually been delivered in the market.

At the same time, we’ll look at Chainlink’s progress, especially in the areas where it has succeeded in building real infrastructure that aligns with many of XRP’s original ambitions.

This thread is not for traders looking to scalp price action. It’s for long-term holders who have been led to believe that XRP is “inevitable,” “partnered with all the banks,” or “replacing SWIFT.” If you hold XRP based on those beliefs, this thread is for you.

Every post will present:

What the original claim was

Why it would be significant if true

What has been delivered

Whether Chainlink has achieved it instead

Verified public sources that actually support the point being made

I am not a Chainlink maxi. I am a researcher and builder in the crypto space. I’ve followed XRP and Chainlink closely for years. My only goal is to present the truth, backed by data — and hopefully help some people preserve the capital they’ve invested in this space before reality catches up to the hype.

Let’s begin.

This thread isn’t meant to be biased or anti-XRP for the sake of it.

My goal is simply to lay out a clear, fact-based comparison between what XRP has long been believed to deliver — and what has actually happened in the market — especially when compared to Chainlink’s progress in the same areas.

If you read this thread all the way through, you may arrive at the same conclusion I have. And even if you don’t, I hope the research here helps you think more critically about where and why you invest.

Disclaimer: This thread is comprehensive — but when you're considering putting real capital into a project for the long term, thorough research like this is not just helpful... it's necessary.

Here’s what my research and close following of industry news, announcements, and adoption data has led me to.

That XRP is not what it was promised to be — and Chainlink is doing many of the things XRP once claimed it would do.

The goal of this thread is to walk through the key claims surrounding XRP — especially the idea that it would become the infrastructure for global banking — and compare them to what has actually been delivered in the market.

At the same time, we’ll look at Chainlink’s progress, especially in the areas where it has succeeded in building real infrastructure that aligns with many of XRP’s original ambitions.

This thread is not for traders looking to scalp price action. It’s for long-term holders who have been led to believe that XRP is “inevitable,” “partnered with all the banks,” or “replacing SWIFT.” If you hold XRP based on those beliefs, this thread is for you.

Every post will present:

What the original claim was

Why it would be significant if true

What has been delivered

Whether Chainlink has achieved it instead

Verified public sources that actually support the point being made

I am not a Chainlink maxi. I am a researcher and builder in the crypto space. I’ve followed XRP and Chainlink closely for years. My only goal is to present the truth, backed by data — and hopefully help some people preserve the capital they’ve invested in this space before reality catches up to the hype.

Let’s begin.

Post 2: The SWIFT Claim — Is $XRP Really Replacing It

What you have probably heard is that XRP is going to replace SWIFT, that banks will soon settle payments using XRP, or that XRP will handle trillions in global transfers.

This claim sounds powerful, but it is important to understand what it actually means. SWIFT is the global network banks use to send payment instructions safely around the world. It does not move money itself, it just delivers the instructions. If XRP were replacing SWIFT, hundreds of big banks would be sending messages and funding transactions using XRP.

In reality, that is not happening. Ripple, the company behind XRP, created RippleNet, which offers messaging and payment services. Some small banks and payment providers test XRP through the On Demand Liquidity service, but almost no major banks are using it. XRP usage on RippleNet is optional and most partners skip it entirely.

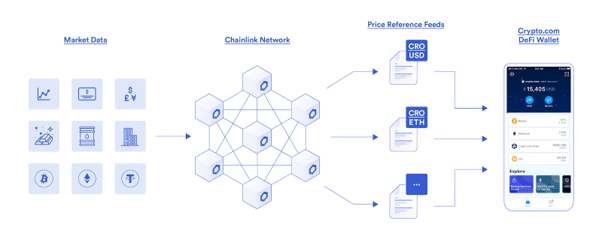

By contrast, in 2023, SWIFT publicly announced pilots using @chainlink's Cross Chain Interoperability Protocol to transfer tokenized assets across various blockchains. Participants included Citi, BNY Mellon, BNP Paribas, ANZ, UBS, Clearstream, Euroclear, and others. These were real tests of messaging and transfers using Chainlink infrastructure, not claims.

Sources:

SWIFT press release on Chainlink pilot which included 6 major banks SWIFT confirms pilot with Chainlink and tokenized asset transfer infrastructure swift.com/news-events/pr…

Finextra article summarizing the results finextra.com/newsarticle/42…

Bottom line, XRP promised to replace SWIFT but did not. Chainlink is working with SWIFT to upgrade messaging and settlement using real technology pilots. $Link

What you have probably heard is that XRP is going to replace SWIFT, that banks will soon settle payments using XRP, or that XRP will handle trillions in global transfers.

This claim sounds powerful, but it is important to understand what it actually means. SWIFT is the global network banks use to send payment instructions safely around the world. It does not move money itself, it just delivers the instructions. If XRP were replacing SWIFT, hundreds of big banks would be sending messages and funding transactions using XRP.

In reality, that is not happening. Ripple, the company behind XRP, created RippleNet, which offers messaging and payment services. Some small banks and payment providers test XRP through the On Demand Liquidity service, but almost no major banks are using it. XRP usage on RippleNet is optional and most partners skip it entirely.

By contrast, in 2023, SWIFT publicly announced pilots using @chainlink's Cross Chain Interoperability Protocol to transfer tokenized assets across various blockchains. Participants included Citi, BNY Mellon, BNP Paribas, ANZ, UBS, Clearstream, Euroclear, and others. These were real tests of messaging and transfers using Chainlink infrastructure, not claims.

Sources:

SWIFT press release on Chainlink pilot which included 6 major banks SWIFT confirms pilot with Chainlink and tokenized asset transfer infrastructure swift.com/news-events/pr…

Finextra article summarizing the results finextra.com/newsarticle/42…

Bottom line, XRP promised to replace SWIFT but did not. Chainlink is working with SWIFT to upgrade messaging and settlement using real technology pilots. $Link

Post 3: Real-World Usage — $XRP Versus $LINK

You often hear that banks and financial institutions are already using XRP behind the scenes, that adoption is happening quietly, and that the next move could multiply the price tenfold.

Here is what real-world usage means in this context. For a token to be genuinely adopted, actual companies must be using it regularly, integrating it into their systems, generating transaction volume or fees, and relying on it for services.

That is not happening with XRP. RippleNet has partnerships and signed clients, but almost none of them use XRP in production. For example, Santander has openly confirmed it is not using XRP. MoneyGram ended its partnership with Ripple in 2020. The XRP ledger is not actively used by banks for settlement at scale.

XRP did rally in mid-2023 after a partial court decision from the SEC on institutional sales, and it reached levels near its 2021 highs. However, that price rise was based on speculation and hope, not on new adoption or real usage. Meanwhile, Chainlink has seen growing adoption — it supports price feeds used by hundreds of DeFi apps; it powers Proof of Reserve for stablecoin backups; it is integrated into CCIP pilots by SWIFT and other institutions.

Sources:

Santander confirms it did not use XRP in its One Pay FX app cryptobriefing.com/santander-xrp-…

MoneyGram suspended Ripple partnership in 2020 fintechfutures.com/partnerships/m…

RippleNet On Demand Liquidity exists but usage is optional ripple.com/ripplenet/on-d…

Chainlink ecosystem tracker (live integrations) chainlinkecosystem.com/ecosystem

Electric Capital developer report for 2023 shows Chainlink leadership developerreport.com/ecosystems/cha…

Bottom line, XRP’s usage remains very limited. Chainlink is embedded in live systems that generate demand, fees, and infrastructure adoption.

You often hear that banks and financial institutions are already using XRP behind the scenes, that adoption is happening quietly, and that the next move could multiply the price tenfold.

Here is what real-world usage means in this context. For a token to be genuinely adopted, actual companies must be using it regularly, integrating it into their systems, generating transaction volume or fees, and relying on it for services.

That is not happening with XRP. RippleNet has partnerships and signed clients, but almost none of them use XRP in production. For example, Santander has openly confirmed it is not using XRP. MoneyGram ended its partnership with Ripple in 2020. The XRP ledger is not actively used by banks for settlement at scale.

XRP did rally in mid-2023 after a partial court decision from the SEC on institutional sales, and it reached levels near its 2021 highs. However, that price rise was based on speculation and hope, not on new adoption or real usage. Meanwhile, Chainlink has seen growing adoption — it supports price feeds used by hundreds of DeFi apps; it powers Proof of Reserve for stablecoin backups; it is integrated into CCIP pilots by SWIFT and other institutions.

Sources:

Santander confirms it did not use XRP in its One Pay FX app cryptobriefing.com/santander-xrp-…

MoneyGram suspended Ripple partnership in 2020 fintechfutures.com/partnerships/m…

RippleNet On Demand Liquidity exists but usage is optional ripple.com/ripplenet/on-d…

Chainlink ecosystem tracker (live integrations) chainlinkecosystem.com/ecosystem

Electric Capital developer report for 2023 shows Chainlink leadership developerreport.com/ecosystems/cha…

Bottom line, XRP’s usage remains very limited. Chainlink is embedded in live systems that generate demand, fees, and infrastructure adoption.

Post 4: Tokenomics — Who Benefits from $XRP Versus $LINK

The narrative says XRP is undervalued and well structured for long term holders based on supply and demand and the idea that banks need to use it for liquidity.

But the truth looks different. Most XRP is held by Ripple Labs and its founders, with around 40 billion held in escrow and released monthly. Usage of XRP is optional for banks, so token demand is mostly driven by speculators. Ripple’s escrow releases and founder holdings create the risk of dumps when insiders cash out.

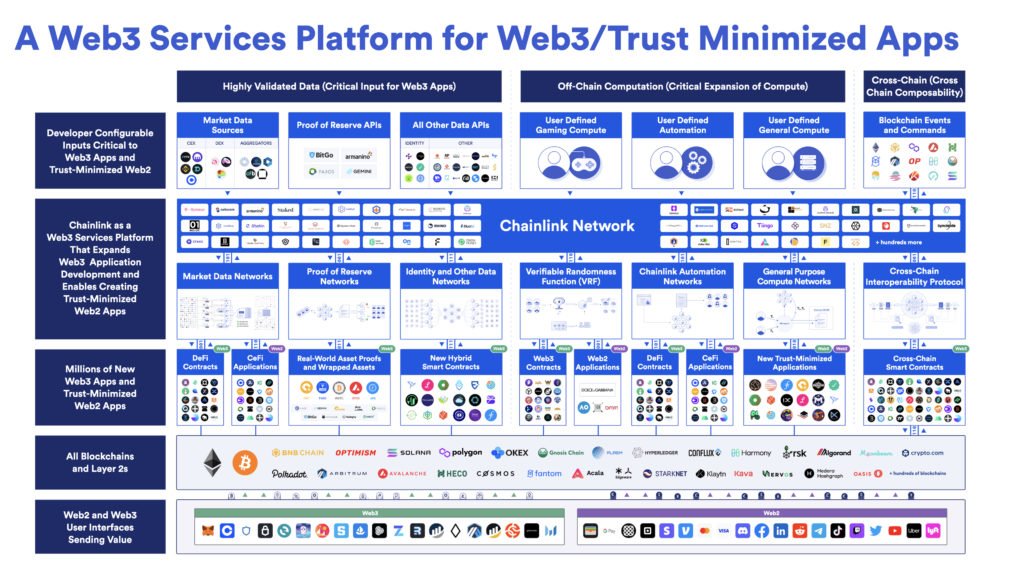

Chainlink’s model is different. The LINK token is required to run Chainlink services such as price feeds, Proof of Reserve, cross-chain communication, random values and automation. Node operators are paid in LINK, developers pay in LINK, and everything is transparent and pre-planned. There is no secret stash, and tokens are being used to build value, not to fund an inner circle.

Sources:

XRP token distribution by Messari messari.io/asset/xrp/prof…

Chainlink tokenomics 2.0 overview from Chainlink chain.link/economics

Chainlink staking and release plan chain.link/economics/stak…

Bottom line, XRP tokenomics benefit speculators and insiders. LINK tokenomics drive utility and reward infrastructure participants.

The narrative says XRP is undervalued and well structured for long term holders based on supply and demand and the idea that banks need to use it for liquidity.

But the truth looks different. Most XRP is held by Ripple Labs and its founders, with around 40 billion held in escrow and released monthly. Usage of XRP is optional for banks, so token demand is mostly driven by speculators. Ripple’s escrow releases and founder holdings create the risk of dumps when insiders cash out.

Chainlink’s model is different. The LINK token is required to run Chainlink services such as price feeds, Proof of Reserve, cross-chain communication, random values and automation. Node operators are paid in LINK, developers pay in LINK, and everything is transparent and pre-planned. There is no secret stash, and tokens are being used to build value, not to fund an inner circle.

Sources:

XRP token distribution by Messari messari.io/asset/xrp/prof…

Chainlink tokenomics 2.0 overview from Chainlink chain.link/economics

Chainlink staking and release plan chain.link/economics/stak…

Bottom line, XRP tokenomics benefit speculators and insiders. LINK tokenomics drive utility and reward infrastructure participants.

Post 5: Regulatory Clarity — Who's Really Aligned with Compliance and the Law?

A major pillar of the XRP narrative has always been this:

“XRP is regulatory-compliant, and the lawsuit is behind them.”

It’s an argument that draws in investors who believe that legal clarity equals market dominance — and it’s often repeated as if the case is already resolved.

But here’s the truth, as of July 2025:

Where Things Stand Legally

Yes, Ripple has made progress in its long-running battle with the SEC, but the case is not officially over. The details matter:

Ripple paid the $125 million penalty in cash, not XRP — signaling that even under settlement terms, the token was not used or accepted as a medium of value.

Ripple announced it would drop its cross-appeal. The SEC is also expected to drop its appeal.

However, both sides jointly requested a delay until August 15, 2025, to finalize all appeal withdrawals. Until then, the case is not legally closed.

Judge Torres denied Ripple’s request for further penalty reduction or changes to the injunction.

So while $XRP advocates may claim that “regulatory clarity” has been achieved, the actual legal closure remains pending, and no formal final judgment has yet been entered.

Sources:

reuters.com/legal/governme…

coincentral.com/xrp-lawsuit-co…

Why This Matters

Regulatory compliance isn't about winning Twitter polls — it’s about building trust with institutional stakeholders and regulators. And here’s the key:

Ripple’s approach has been adversarial. It has spent years fighting regulators, and to this day, XRP’s classification remains in limbo.

Compare that with Chainlink’s approach.

Chainlink Labs has taken the proactive route — working directly with governments, regulatory bodies, and major financial institutions to build legally-compliant, neutral infrastructure. This is not just positioning; it’s confirmed through public-sector integrations and participation in global financial sandbox initiatives.

Example: Chainlink Labs was selected by the U.S. Depository Trust & Clearing Corporation (DTCC) for a blockchain interoperability pilot in 2023 — a collaboration that’s at the heart of U.S. market infrastructure, not in opposition to it.

Conclusion

While XRP holders may believe the token has achieved regulatory clarity, the facts say otherwise:

The legal case is not yet fully resolved,

Ripple settled in USD, not XRP,

No U.S. regulatory body has made an affirmative statement that XRP is “compliant,” and

No framework exists yet that guarantees XRP’s future regulatory position.

$LINK, meanwhile, is not fighting the rules — it’s helping write them.

This difference in approach is not just strategic — it’s existential. Infrastructure must be trusted. And trust starts with alignment, not opposition.

A major pillar of the XRP narrative has always been this:

“XRP is regulatory-compliant, and the lawsuit is behind them.”

It’s an argument that draws in investors who believe that legal clarity equals market dominance — and it’s often repeated as if the case is already resolved.

But here’s the truth, as of July 2025:

Where Things Stand Legally

Yes, Ripple has made progress in its long-running battle with the SEC, but the case is not officially over. The details matter:

Ripple paid the $125 million penalty in cash, not XRP — signaling that even under settlement terms, the token was not used or accepted as a medium of value.

Ripple announced it would drop its cross-appeal. The SEC is also expected to drop its appeal.

However, both sides jointly requested a delay until August 15, 2025, to finalize all appeal withdrawals. Until then, the case is not legally closed.

Judge Torres denied Ripple’s request for further penalty reduction or changes to the injunction.

So while $XRP advocates may claim that “regulatory clarity” has been achieved, the actual legal closure remains pending, and no formal final judgment has yet been entered.

Sources:

reuters.com/legal/governme…

coincentral.com/xrp-lawsuit-co…

Why This Matters

Regulatory compliance isn't about winning Twitter polls — it’s about building trust with institutional stakeholders and regulators. And here’s the key:

Ripple’s approach has been adversarial. It has spent years fighting regulators, and to this day, XRP’s classification remains in limbo.

Compare that with Chainlink’s approach.

Chainlink Labs has taken the proactive route — working directly with governments, regulatory bodies, and major financial institutions to build legally-compliant, neutral infrastructure. This is not just positioning; it’s confirmed through public-sector integrations and participation in global financial sandbox initiatives.

Example: Chainlink Labs was selected by the U.S. Depository Trust & Clearing Corporation (DTCC) for a blockchain interoperability pilot in 2023 — a collaboration that’s at the heart of U.S. market infrastructure, not in opposition to it.

Conclusion

While XRP holders may believe the token has achieved regulatory clarity, the facts say otherwise:

The legal case is not yet fully resolved,

Ripple settled in USD, not XRP,

No U.S. regulatory body has made an affirmative statement that XRP is “compliant,” and

No framework exists yet that guarantees XRP’s future regulatory position.

$LINK, meanwhile, is not fighting the rules — it’s helping write them.

This difference in approach is not just strategic — it’s existential. Infrastructure must be trusted. And trust starts with alignment, not opposition.

Post 6: Bank Adoption — Is XRP Really Powering Global Finance?

One of the most widely believed claims in the XRP community is that XRP is “being adopted by banks,” or that it is already used “by hundreds of banks worldwide.”

This belief has been central to XRP’s market hype since its earliest days. But is it true? And if not, who is actually working with the banks?

The Claim: $XRP is Already in Use by Global Banks

Since around 2017, Ripple has heavily marketed its software to financial institutions. They’ve showcased RippleNet and On-Demand Liquidity (ODL) as fast, cheap, cross-border alternatives to SWIFT. Many XRP investors took this to mean that banks are using XRP directly for transfers.

The claim matters because if XRP were actually being used as a liquidity bridge by major banks, it would create real demand for the token — and could justify large-scale token value growth.

The Reality: Very Few Banks Use XRP — And Even Ripple Distances Itself

Here’s what’s verifiably true today:

Ripple has partnered with some financial institutions, but in most cases, these institutions use RippleNet software — not XRP itself.

The vast majority of Ripple’s financial clients do not participate in ODL (the only Ripple product that actually uses XRP).

Ripple’s most notable banking client, Santander, publicly stated in 2021 that it does not use XRP because of regulatory uncertainty and limited reach in required corridors.

Ripple itself has admitted that XRP usage is limited to select payment firms, not banks.

Even the 2023 Ripple Swell event, where headlines about “bank adoption” circulated, involved payment providers and fintechs, not traditional tier-1 banks adopting XRP.

Sources:

ecency.com/news/@cryptogl…

crowdfundinsider.com/2023/11/215697…

What About Chainlink?

While XRP tried to insert itself as a bridge currency, $LINK is being embedded as infrastructure.

Instead of trying to replace banks’ systems, Chainlink is integrating with them — providing the tools they need to securely connect legacy systems with blockchains via oracle networks.

Here’s what that looks like in action:

SWIFT’s 2022 and 2023 blockchain interoperability pilots were built using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), not XRP.

Participants in those pilots included BNP Paribas, Citi, BNY Mellon, DTCC, ANZ, and more — actual systemically important financial institutions.

These integrations are about enabling tokenized asset transfers and messaging across chains — exactly what Ripple’s ODL and RippleNet hoped to do, but with far broader reach and protocol neutrality.

Sources:

swift.com/news-events/ne…

Conclusion

While Ripple marketed heavily to banks, it hasn’t won them over at scale, and banks remain hesitant to rely on volatile assets like XRP for settlement.

Chainlink, on the other hand, is being embedded into the very fabric of how banks plan to connect to blockchain ecosystems, without needing to issue or rely on its native token for every use.

The lesson here?

Real adoption doesn’t mean tweeting “we’re replacing SWIFT.”

It means building infrastructure banks can actually use — and are already testing.

One of the most widely believed claims in the XRP community is that XRP is “being adopted by banks,” or that it is already used “by hundreds of banks worldwide.”

This belief has been central to XRP’s market hype since its earliest days. But is it true? And if not, who is actually working with the banks?

The Claim: $XRP is Already in Use by Global Banks

Since around 2017, Ripple has heavily marketed its software to financial institutions. They’ve showcased RippleNet and On-Demand Liquidity (ODL) as fast, cheap, cross-border alternatives to SWIFT. Many XRP investors took this to mean that banks are using XRP directly for transfers.

The claim matters because if XRP were actually being used as a liquidity bridge by major banks, it would create real demand for the token — and could justify large-scale token value growth.

The Reality: Very Few Banks Use XRP — And Even Ripple Distances Itself

Here’s what’s verifiably true today:

Ripple has partnered with some financial institutions, but in most cases, these institutions use RippleNet software — not XRP itself.

The vast majority of Ripple’s financial clients do not participate in ODL (the only Ripple product that actually uses XRP).

Ripple’s most notable banking client, Santander, publicly stated in 2021 that it does not use XRP because of regulatory uncertainty and limited reach in required corridors.

Ripple itself has admitted that XRP usage is limited to select payment firms, not banks.

Even the 2023 Ripple Swell event, where headlines about “bank adoption” circulated, involved payment providers and fintechs, not traditional tier-1 banks adopting XRP.

Sources:

ecency.com/news/@cryptogl…

crowdfundinsider.com/2023/11/215697…

What About Chainlink?

While XRP tried to insert itself as a bridge currency, $LINK is being embedded as infrastructure.

Instead of trying to replace banks’ systems, Chainlink is integrating with them — providing the tools they need to securely connect legacy systems with blockchains via oracle networks.

Here’s what that looks like in action:

SWIFT’s 2022 and 2023 blockchain interoperability pilots were built using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), not XRP.

Participants in those pilots included BNP Paribas, Citi, BNY Mellon, DTCC, ANZ, and more — actual systemically important financial institutions.

These integrations are about enabling tokenized asset transfers and messaging across chains — exactly what Ripple’s ODL and RippleNet hoped to do, but with far broader reach and protocol neutrality.

Sources:

swift.com/news-events/ne…

Conclusion

While Ripple marketed heavily to banks, it hasn’t won them over at scale, and banks remain hesitant to rely on volatile assets like XRP for settlement.

Chainlink, on the other hand, is being embedded into the very fabric of how banks plan to connect to blockchain ecosystems, without needing to issue or rely on its native token for every use.

The lesson here?

Real adoption doesn’t mean tweeting “we’re replacing SWIFT.”

It means building infrastructure banks can actually use — and are already testing.

Post 7: Real Utility at Scale — Is XRP Truly Used by Institutions?

Many XRP believers talk about banks using XRP for transfers and say its widespread use is just around the corner. But what does actual use look like? That means production systems where institutions buy XRP, settle with it, and use it in real transactions—every day.

XRP’s Promise: A Global Payment Token

Ripple presented XRP as a tool banks could use to move money fast and cheaply across borders. The idea was that banks would hold XRP, use it to settle transactions, and rely on it continuously in their payment systems.

Reality Check: Usage Remains Very Limited

Here’s what data and statements say:

Many banks use RippleNet—but almost none of them use XRP. They rely on Ripple’s messaging tools, not the token.

Major banks like Santander use xCurrent (Ripple’s messaging software), not XRP, in live services.

Source: Multiple independent tech and banking reports confirm xCurrent use without XRP.

See analysis: “Are Banks Using XRP? The Truth Behind Ripple’s Banking Partnerships” (June 2025):

digitaloneagency.com.au/are-banks-usin…

Ripple’s On-Demand Liquidity (ODL), which does use XRP, remains small-scale and corridor-bound—mostly for remittances between smaller markets (e.g., Philippines–Mexico), not major global banks.

Ripple has not released a single public case showing a major bank in a top financial corridor using XRP.

This shows that XRP has not yet moved from pilot to production at scale, even where RippleNet is used.

Chainlink’s Utility: Infrastructure in Use Today

Chainlink provides infrastructure, not token-based payments. Its services are used in real-world systems:

SWIFT’s CCIP pilots in 2022–2023 used Chainlink technology for transferring tokenized assets across banks like Citi, BNY Mellon, BNP Paribas, ANZ, Clearstream, Euroclear, and the DTCC.

Source: Official SWIFT press release:

swift.com/news-events/pr…

Chainlink powers actual operations—from DeFi protocols to proof-of-reserve for stablecoins and orchestration in smart contracts. Everything depends on usage, not speculation.

This confirms that Chainlink’s work is used today, in real institutions and production systems.

Summary

$XRP’s token adoption has not yet taken off in major banks.

$LINK is already embedded in live financial infrastructure, supporting institutional use cases.

Real utility means actual deployment, demand, and proof, not marketing hype.

Many XRP believers talk about banks using XRP for transfers and say its widespread use is just around the corner. But what does actual use look like? That means production systems where institutions buy XRP, settle with it, and use it in real transactions—every day.

XRP’s Promise: A Global Payment Token

Ripple presented XRP as a tool banks could use to move money fast and cheaply across borders. The idea was that banks would hold XRP, use it to settle transactions, and rely on it continuously in their payment systems.

Reality Check: Usage Remains Very Limited

Here’s what data and statements say:

Many banks use RippleNet—but almost none of them use XRP. They rely on Ripple’s messaging tools, not the token.

Major banks like Santander use xCurrent (Ripple’s messaging software), not XRP, in live services.

Source: Multiple independent tech and banking reports confirm xCurrent use without XRP.

See analysis: “Are Banks Using XRP? The Truth Behind Ripple’s Banking Partnerships” (June 2025):

digitaloneagency.com.au/are-banks-usin…

Ripple’s On-Demand Liquidity (ODL), which does use XRP, remains small-scale and corridor-bound—mostly for remittances between smaller markets (e.g., Philippines–Mexico), not major global banks.

Ripple has not released a single public case showing a major bank in a top financial corridor using XRP.

This shows that XRP has not yet moved from pilot to production at scale, even where RippleNet is used.

Chainlink’s Utility: Infrastructure in Use Today

Chainlink provides infrastructure, not token-based payments. Its services are used in real-world systems:

SWIFT’s CCIP pilots in 2022–2023 used Chainlink technology for transferring tokenized assets across banks like Citi, BNY Mellon, BNP Paribas, ANZ, Clearstream, Euroclear, and the DTCC.

Source: Official SWIFT press release:

swift.com/news-events/pr…

Chainlink powers actual operations—from DeFi protocols to proof-of-reserve for stablecoins and orchestration in smart contracts. Everything depends on usage, not speculation.

This confirms that Chainlink’s work is used today, in real institutions and production systems.

Summary

$XRP’s token adoption has not yet taken off in major banks.

$LINK is already embedded in live financial infrastructure, supporting institutional use cases.

Real utility means actual deployment, demand, and proof, not marketing hype.

Post 8: Ecosystem Development — Who’s Actually Building?

It’s easy to get swept up in price hype or big announcements. But if you want lasting value, a project needs a strong developer ecosystem—people actually building tools and apps that people use.

Why Developer Activity Is Important

If developers are building real applications—like payment processors, DeFi platforms, NFT games, or blockchain tools—then the token behind it is being used, not just traded.

XRP’s Developer Ecosystem

XRP does have some activity, but it isn’t very deep or diverse:

Public data shows very limited developer interest in the XRP Ledger (XRPL). Recent reports on XRPL development highlight fewer than 100 active developers per month, mostly working on Ripple-controlled updates or simple ledger maintenance.

Source: Bankless summary of Electric Capital’s 2024 report indicating crypto developers focus on Ethereum, Solana, etc., but not XRP.

bankless.com/read/top-crypt…

There are very few notable DeFi, NFT, or gaming projects built on the XRP Ledger. Development remains mostly confined to internal protocols, bridges, and minor use cases.

Ripple Labs still directs most innovation on XRPL rather than a community-driven, decentralized approach.

Chainlink’s Developer Engagement

By contrast, Chainlink is widely used and growing as a core utility layer:

Chainlink powers over 1,600 projects—including DeFi, NFT, gaming, insurance—with real usage in activities like randomness generation, price feeds, and Proof-of-Reserve.

Source: Chainlink’s own 2022 network summary, showing scale and variety of integrations.

blog.chain.link/the-chainlink-…

GitHub and hackathons show strong developer involvement: 18,000+ repositories reference Chainlink, and the network now supports cross-chain interoperability (CCIP), which was unheard of for XRP.

Enterprise and TradFi integration: Banks and institutions working with Chainlink on real-world pilots—not simple proofs of concept.

✅ Summary

XRPL has modest developer activity—mostly internal, not building apps that people use.

Chainlink has become a foundational tool for thousands of applications, used by both crypto and traditional finance.

If you’re holding a token hoping it becomes a long-term infrastructure play, you want more than price hype; you need real builders and real usage—and Chainlink fits that bill more closely than $XRP. $LINK

It’s easy to get swept up in price hype or big announcements. But if you want lasting value, a project needs a strong developer ecosystem—people actually building tools and apps that people use.

Why Developer Activity Is Important

If developers are building real applications—like payment processors, DeFi platforms, NFT games, or blockchain tools—then the token behind it is being used, not just traded.

XRP’s Developer Ecosystem

XRP does have some activity, but it isn’t very deep or diverse:

Public data shows very limited developer interest in the XRP Ledger (XRPL). Recent reports on XRPL development highlight fewer than 100 active developers per month, mostly working on Ripple-controlled updates or simple ledger maintenance.

Source: Bankless summary of Electric Capital’s 2024 report indicating crypto developers focus on Ethereum, Solana, etc., but not XRP.

bankless.com/read/top-crypt…

There are very few notable DeFi, NFT, or gaming projects built on the XRP Ledger. Development remains mostly confined to internal protocols, bridges, and minor use cases.

Ripple Labs still directs most innovation on XRPL rather than a community-driven, decentralized approach.

Chainlink’s Developer Engagement

By contrast, Chainlink is widely used and growing as a core utility layer:

Chainlink powers over 1,600 projects—including DeFi, NFT, gaming, insurance—with real usage in activities like randomness generation, price feeds, and Proof-of-Reserve.

Source: Chainlink’s own 2022 network summary, showing scale and variety of integrations.

blog.chain.link/the-chainlink-…

GitHub and hackathons show strong developer involvement: 18,000+ repositories reference Chainlink, and the network now supports cross-chain interoperability (CCIP), which was unheard of for XRP.

Enterprise and TradFi integration: Banks and institutions working with Chainlink on real-world pilots—not simple proofs of concept.

✅ Summary

XRPL has modest developer activity—mostly internal, not building apps that people use.

Chainlink has become a foundational tool for thousands of applications, used by both crypto and traditional finance.

If you’re holding a token hoping it becomes a long-term infrastructure play, you want more than price hype; you need real builders and real usage—and Chainlink fits that bill more closely than $XRP. $LINK

Post 9: Token Distribution and Incentives — Who Actually Benefits from Growth?

If you're holding a crypto asset for the long term, you need to understand how tokens are distributed, who controls them, and how token releases affect supply and price.

Investing isn’t just about a great idea—it’s about who wins and who pays as the token grows.

XRP: Central Control and Insider Advantage

80% of XRP (80 billion of the total 100 billion) was allocated to Ripple Labs at launch.

Ripple still holds ~40 billion XRP in escrow, releasing 1 billion tokens per month.

Source: Ripple Q2 2024 XRP Markets Report

ripple.com/insights/q2-20…

Co-founder Jed McCaleb was allocated 9.5 billion XRP and is under a sales agreement. He sold over $400 million worth of XRP in 2020 alone, an example of how insiders can sell large amounts over time.

Source: Cointelegraph “Ripple co‑founder Jed McCaleb sold $400 million worth of XRP in 2020”

cointelegraph.com/news/ripple-co…

Additional founders and Ripple insiders continue to benefit from token releases, while retail holders bear the impact of increased supply.

This structure has led many to view XRP as a token where insiders capture most upside while retail holds risk.

Chainlink: Emissions Designed for Ecosystem Growth

LINK tokens are stored in a transparent treasury, used for:

Developer grants

Paying node operators

Funding ecosystem projects

Distributions are published regularly, tied to real infrastructure work—not sold to exit.

Source: Chainlink Economics 2.0

chain.link/economics

These emissions have helped scale key services like price feeds, Proof-of-Reserve, CCIP development, and more.

Chainlink’s model aligns token use with active growth and development, not short-term token value extraction.

Why This Matters

With XRP, insiders hold most supply and dictate release timing—leaving retail holders vulnerable to dilution.

With Chainlink, tokens are disbursed to those building and securing the network, reinforcing alignment with value creation.

✅ Summary

$XRP is influenced heavily by centralized control and periodic insider sales.

$LINK distributes tokens transparently to power ecosystem expansion, with clear alignment between token release and development.

One model is built for internal profit. The other funds ongoing creation.

If you're holding a crypto asset for the long term, you need to understand how tokens are distributed, who controls them, and how token releases affect supply and price.

Investing isn’t just about a great idea—it’s about who wins and who pays as the token grows.

XRP: Central Control and Insider Advantage

80% of XRP (80 billion of the total 100 billion) was allocated to Ripple Labs at launch.

Ripple still holds ~40 billion XRP in escrow, releasing 1 billion tokens per month.

Source: Ripple Q2 2024 XRP Markets Report

ripple.com/insights/q2-20…

Co-founder Jed McCaleb was allocated 9.5 billion XRP and is under a sales agreement. He sold over $400 million worth of XRP in 2020 alone, an example of how insiders can sell large amounts over time.

Source: Cointelegraph “Ripple co‑founder Jed McCaleb sold $400 million worth of XRP in 2020”

cointelegraph.com/news/ripple-co…

Additional founders and Ripple insiders continue to benefit from token releases, while retail holders bear the impact of increased supply.

This structure has led many to view XRP as a token where insiders capture most upside while retail holds risk.

Chainlink: Emissions Designed for Ecosystem Growth

LINK tokens are stored in a transparent treasury, used for:

Developer grants

Paying node operators

Funding ecosystem projects

Distributions are published regularly, tied to real infrastructure work—not sold to exit.

Source: Chainlink Economics 2.0

chain.link/economics

These emissions have helped scale key services like price feeds, Proof-of-Reserve, CCIP development, and more.

Chainlink’s model aligns token use with active growth and development, not short-term token value extraction.

Why This Matters

With XRP, insiders hold most supply and dictate release timing—leaving retail holders vulnerable to dilution.

With Chainlink, tokens are disbursed to those building and securing the network, reinforcing alignment with value creation.

✅ Summary

$XRP is influenced heavily by centralized control and periodic insider sales.

$LINK distributes tokens transparently to power ecosystem expansion, with clear alignment between token release and development.

One model is built for internal profit. The other funds ongoing creation.

Post 10: Beyond the Comparison — $LINK Services $XRP Never Built

Throughout this thread, we’ve focused on comparing XRP’s claims with Chainlink’s real-world accomplishments. But what’s even more striking is what Chainlink is building outside of XRP’s scope entirely.

These are not just nice-to-haves, they’re foundational infrastructure powering the next phase of crypto, DeFi, gaming, and tokenized assets.

1. Proof of Reserve (PoR) — Real-Time On-Chain Auditability

What it is: Chainlink PoR lets protocols prove they actually hold the assets they claim—live, on-chain.

Why it matters: After collapses like FTX, trust depends on verifiable reserves. This service has become standard practice for top stablecoins, wrapped assets, and institutions offering tokenized funds.

Who uses it:

BitGo wBTC

Aave

Paxos (tokenized gold)

Binance (BUSD PoR prior to phase-out)

🔗 Verified source:

blog.chain.link/proof-of-reser…

2. Verifiable Randomness (VRF) — On-Chain Gaming & NFTs

What it is: A cryptographic service that generates random numbers provably not tampered with.

Why it matters: On-chain games, loot boxes, raffles, and fair NFT drops require randomness—but until VRF, there was no secure, decentralized way to do it.

Who uses it:

Axie Infinity

PoolTogether

Dozens of NFT projects and on-chain casinos

🔗 Verified source:

chain.link/vrf

3. Chainlink Automation (Keepers) — Event-Driven Smart Contract Execution

What it is: A decentralized system that triggers smart contracts automatically based on conditions (like time, price, thresholds).

Why it matters: Many smart contracts can’t monitor themselves. Without automation, DeFi requires constant manual updates—Chainlink eliminates that risk.

Who uses it:

Aave

Synthetix

Bancor

GMX

🔗 Verified source:

chain.link/automation

✅ Summary

Chainlink isn’t just matching XRP’s promises—it’s building an entire ecosystem of services that XRP never attempted.

These tools:

Add measurable value to crypto projects

Drive adoption

Create ongoing utility and demand for the LINK token

Chainlink’s infrastructure plays a foundational role in dozens of sectors, while XRP is still trying to establish the relevance of a single use case.

Throughout this thread, we’ve focused on comparing XRP’s claims with Chainlink’s real-world accomplishments. But what’s even more striking is what Chainlink is building outside of XRP’s scope entirely.

These are not just nice-to-haves, they’re foundational infrastructure powering the next phase of crypto, DeFi, gaming, and tokenized assets.

1. Proof of Reserve (PoR) — Real-Time On-Chain Auditability

What it is: Chainlink PoR lets protocols prove they actually hold the assets they claim—live, on-chain.

Why it matters: After collapses like FTX, trust depends on verifiable reserves. This service has become standard practice for top stablecoins, wrapped assets, and institutions offering tokenized funds.

Who uses it:

BitGo wBTC

Aave

Paxos (tokenized gold)

Binance (BUSD PoR prior to phase-out)

🔗 Verified source:

blog.chain.link/proof-of-reser…

2. Verifiable Randomness (VRF) — On-Chain Gaming & NFTs

What it is: A cryptographic service that generates random numbers provably not tampered with.

Why it matters: On-chain games, loot boxes, raffles, and fair NFT drops require randomness—but until VRF, there was no secure, decentralized way to do it.

Who uses it:

Axie Infinity

PoolTogether

Dozens of NFT projects and on-chain casinos

🔗 Verified source:

chain.link/vrf

3. Chainlink Automation (Keepers) — Event-Driven Smart Contract Execution

What it is: A decentralized system that triggers smart contracts automatically based on conditions (like time, price, thresholds).

Why it matters: Many smart contracts can’t monitor themselves. Without automation, DeFi requires constant manual updates—Chainlink eliminates that risk.

Who uses it:

Aave

Synthetix

Bancor

GMX

🔗 Verified source:

chain.link/automation

✅ Summary

Chainlink isn’t just matching XRP’s promises—it’s building an entire ecosystem of services that XRP never attempted.

These tools:

Add measurable value to crypto projects

Drive adoption

Create ongoing utility and demand for the LINK token

Chainlink’s infrastructure plays a foundational role in dozens of sectors, while XRP is still trying to establish the relevance of a single use case.

Post 11: Final Thoughts – The Realities of XRP vs. Chainlink

Again, the intent behind this thread is not to take sides or stir tribalism between communities.

It’s to offer a non-biased, data-driven comparison of two highly-discussed crypto projects:

One that’s widely believed to be powering the future of global finance (XRP), and another that is quietly building the infrastructure that institutions are actually starting to use (Chainlink).

Everything here is based on publicly available partnerships, documentation, usage metrics, and technical roadmaps — not price hype or influencer narratives.

📌 Why This Thread Exists

XRP has long been promoted as the future of cross-border payments, the next SWIFT, the bridge between banks and crypto.

That belief has fueled strong community loyalty and a market cap near all-time highs.

And to be fair — XRP has played an important role in the broader crypto space, particularly as a pioneer in legal battles with the SEC.

In that sense, it’s earned respect as a tip of the spear — helping define regulatory boundaries that benefit the entire crypto ecosystem.

But respect for the fight is different than validation of the product.

No matter how historic the legal journey, we still need to assess every project by its actual fundamentals:

Has it been adopted at scale?

Is it powering real-world transactions?

Are its claims materializing?

Can it generate measurable yield or value?

When we apply that filter, the gap between XRP's promises and its actual market penetration becomes harder to ignore.

✅ Chainlink by Contrast

While XRP’s story has often been driven by expectation and legal narrative, Chainlink has taken a slower, more technical path:

Building modular services (oracles, CCIP, automation) for real-world integration

Powering protocols that already secure hundreds of billions of dollars in smart contracts

Partnering with institutions like SWIFT, ANZ, and DTCC (not in theory — in actual pilot programs and testing)

It hasn’t always made headlines — but Chainlink’s progress is verifiable, transparent, and aligned with enterprise-grade use cases.

🧠 A Message for the Reader

If you're just trading XRP like any other risk asset — then technical analysis may be your best friend.

But if you're investing long-term, you owe it to yourself to dig deeper than the community narrative.

This thread wasn’t written to promote one token or trash another.

It was written to spotlight the gap between belief and delivery.

Because when a token is priced as if its grand vision is already being executed — but that execution isn’t there — then retail investors are taking on disproportionate risk, often without realizing it.

And when another project quietly executes the very vision XRP promised — but doesn’t receive the same attention — it deserves to be recognized.

🔎 Final Thought

Every investor has the right to place capital where they see opportunity.

But I hope what I’ve laid out here offers something rare in crypto: a measured, well-researched perspective that helps you think beyond hype — and into actual adoption, infrastructure, and utility.

XRP may still evolve into something great. But based on where we are right now…

Chainlink is already doing what XRP was supposed to do. And more.

That’s worth understanding before placing your next bet.

Again, the intent behind this thread is not to take sides or stir tribalism between communities.

It’s to offer a non-biased, data-driven comparison of two highly-discussed crypto projects:

One that’s widely believed to be powering the future of global finance (XRP), and another that is quietly building the infrastructure that institutions are actually starting to use (Chainlink).

Everything here is based on publicly available partnerships, documentation, usage metrics, and technical roadmaps — not price hype or influencer narratives.

📌 Why This Thread Exists

XRP has long been promoted as the future of cross-border payments, the next SWIFT, the bridge between banks and crypto.

That belief has fueled strong community loyalty and a market cap near all-time highs.

And to be fair — XRP has played an important role in the broader crypto space, particularly as a pioneer in legal battles with the SEC.

In that sense, it’s earned respect as a tip of the spear — helping define regulatory boundaries that benefit the entire crypto ecosystem.

But respect for the fight is different than validation of the product.

No matter how historic the legal journey, we still need to assess every project by its actual fundamentals:

Has it been adopted at scale?

Is it powering real-world transactions?

Are its claims materializing?

Can it generate measurable yield or value?

When we apply that filter, the gap between XRP's promises and its actual market penetration becomes harder to ignore.

✅ Chainlink by Contrast

While XRP’s story has often been driven by expectation and legal narrative, Chainlink has taken a slower, more technical path:

Building modular services (oracles, CCIP, automation) for real-world integration

Powering protocols that already secure hundreds of billions of dollars in smart contracts

Partnering with institutions like SWIFT, ANZ, and DTCC (not in theory — in actual pilot programs and testing)

It hasn’t always made headlines — but Chainlink’s progress is verifiable, transparent, and aligned with enterprise-grade use cases.

🧠 A Message for the Reader

If you're just trading XRP like any other risk asset — then technical analysis may be your best friend.

But if you're investing long-term, you owe it to yourself to dig deeper than the community narrative.

This thread wasn’t written to promote one token or trash another.

It was written to spotlight the gap between belief and delivery.

Because when a token is priced as if its grand vision is already being executed — but that execution isn’t there — then retail investors are taking on disproportionate risk, often without realizing it.

And when another project quietly executes the very vision XRP promised — but doesn’t receive the same attention — it deserves to be recognized.

🔎 Final Thought

Every investor has the right to place capital where they see opportunity.

But I hope what I’ve laid out here offers something rare in crypto: a measured, well-researched perspective that helps you think beyond hype — and into actual adoption, infrastructure, and utility.

XRP may still evolve into something great. But based on where we are right now…

Chainlink is already doing what XRP was supposed to do. And more.

That’s worth understanding before placing your next bet.

• • •

Missing some Tweet in this thread? You can try to

force a refresh