Follower of Christ & Former USMC Sergeant. Championing crypto & hard truths. Founder and head designer at https://t.co/alKdnxYhem

2 subscribers

How to get URL link on X (Twitter) App

Why @CurveFinance?

Why @CurveFinance?

2\ Is the $LINK Token Really Needed? Let’s Take a Fair Look

2\ Is the $LINK Token Really Needed? Let’s Take a Fair Look

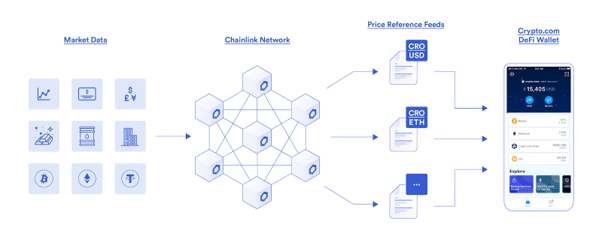

2/14 - Who and what is @chainlink ?

2/14 - Who and what is @chainlink ?

What the hell, I will be even more specific.

What the hell, I will be even more specific.

2\

2\https://twitter.com/LinkSemper/status/1479503654558134280?s=20

2\

2\

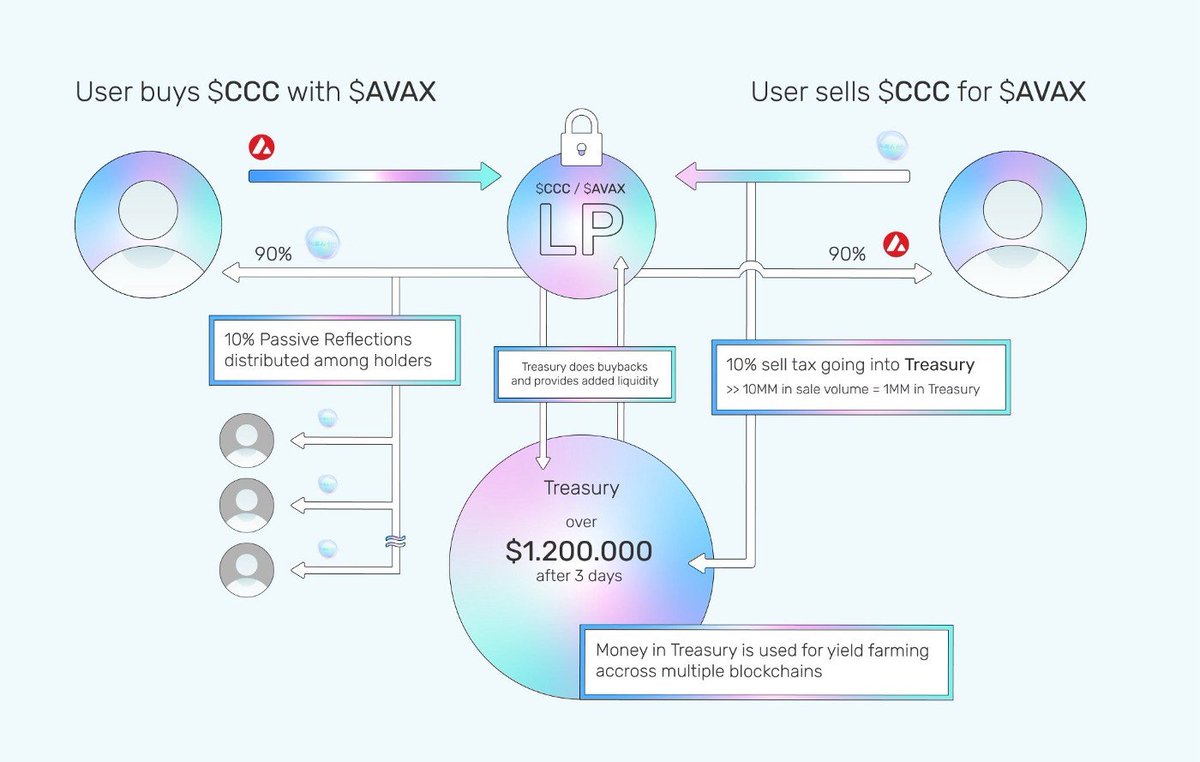

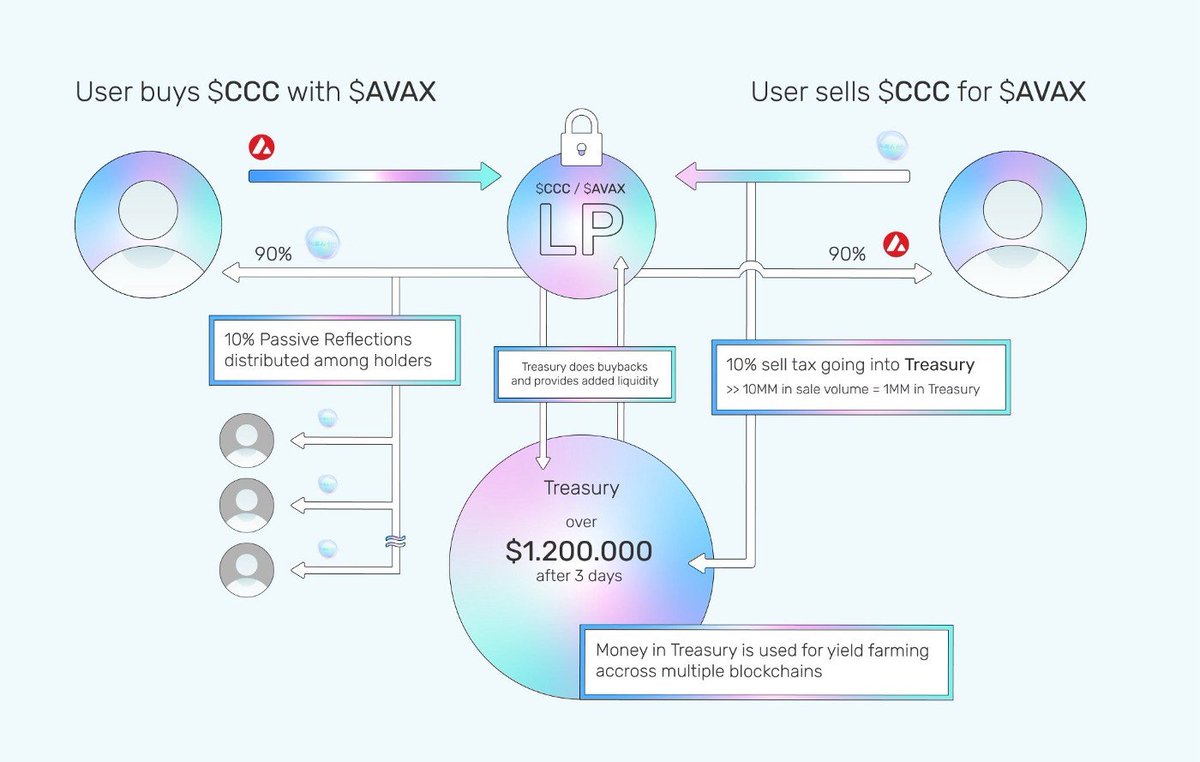

One of their major farming focuses is in the P2E arena and metaverse. This is a very strong market that requires a specific skillset to navigate and truly identify great projects. Being that I am not a gamer, but completely respect that most of the world is, this sets $CCC apart

One of their major farming focuses is in the P2E arena and metaverse. This is a very strong market that requires a specific skillset to navigate and truly identify great projects. Being that I am not a gamer, but completely respect that most of the world is, this sets $CCC apart

https://twitter.com/ReimaginedFi/status/1479106759348293640It's real easy to measure rewards with $ReFi because they pay them in ETH and have to be claimed. So you can just divide your claim by your held balance value and get a % earned over whatever period of time. I am showing 2% rewards per week currently.

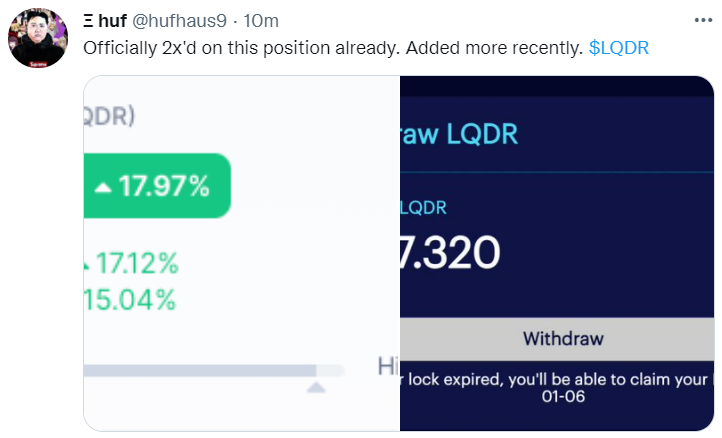

There are very intelligent people that literally live in this space, follow TA and have a great pulse on when to move and when not to. Here is an example of a de-risking situation...which most in this space are HORRIBLE at doing. $REFI

There are very intelligent people that literally live in this space, follow TA and have a great pulse on when to move and when not to. Here is an example of a de-risking situation...which most in this space are HORRIBLE at doing. $REFI

2/

2/

One of the hardest things to do in crypto is pick projects. The most common question I get from people that I speak to about crypto and want to get in is "Can I just give you the money and let invest for me?". Add to this people want yield, and you get FaaS projects.

One of the hardest things to do in crypto is pick projects. The most common question I get from people that I speak to about crypto and want to get in is "Can I just give you the money and let invest for me?". Add to this people want yield, and you get FaaS projects.

Let me first start by saying that I believe $Link is the most significant project in crypto and offers the greatest financial opportunity because of the endless use case it provides and demand it will generate as it becomes the standard for truth and trust throughout the world.…

Let me first start by saying that I believe $Link is the most significant project in crypto and offers the greatest financial opportunity because of the endless use case it provides and demand it will generate as it becomes the standard for truth and trust throughout the world.…

2/ First , $Link is a more like a complete "Toolbox" of services that tremendously improve other blockchains by offering standard and scalable services all blockchains need. $Link is a catalyst for other projects to focus & developer faster with more security & integrity.

2/ First , $Link is a more like a complete "Toolbox" of services that tremendously improve other blockchains by offering standard and scalable services all blockchains need. $Link is a catalyst for other projects to focus & developer faster with more security & integrity.

First...what is Vortex? In short, when you stake your $BNT into a pool, you are given back $vBNT. This is a 1:1 exchange for you to return later and unstake your $BNT. $vBNT carries a value which Vortex allows you to then swap your $vBNT for another crypto asset of your choice.

First...what is Vortex? In short, when you stake your $BNT into a pool, you are given back $vBNT. This is a 1:1 exchange for you to return later and unstake your $BNT. $vBNT carries a value which Vortex allows you to then swap your $vBNT for another crypto asset of your choice.