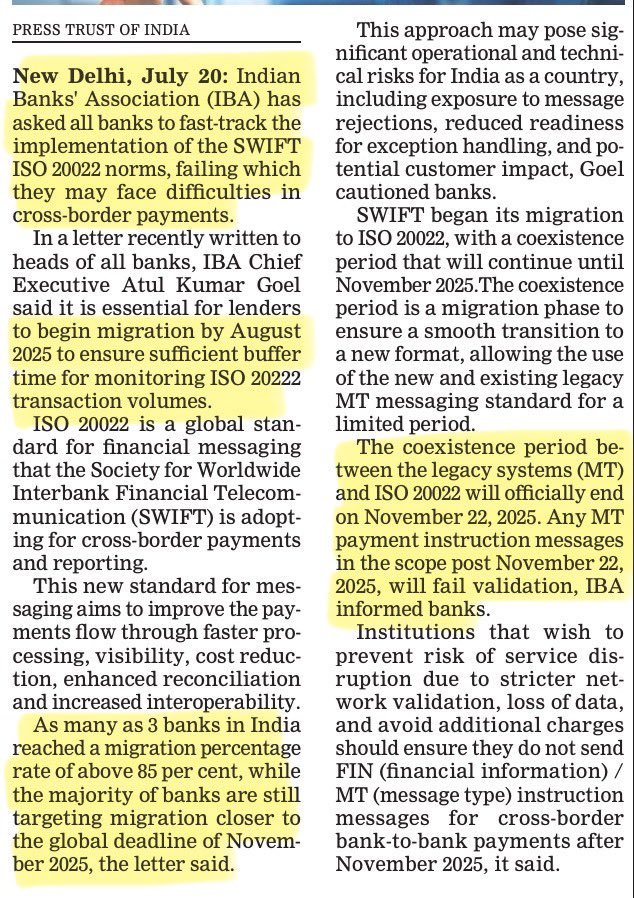

‼️ BREAKING: India’s top banking syndicate is urging all banks to fast-track ISO 20022 migration starting next month — way ahead of the November 2025 deadline.

Let’s break down this global reset acceleration. 👇🧵

Let’s break down this global reset acceleration. 👇🧵

2/🧵

Why the sudden rush?

Because ISO 20022 isn’t a format — it’s the key to the new financial grid.

Once live, Ripple corridors, XRPL, and other ISO-aligned chains (like XLM & XDC) become the invisible backbones of cross-border value.

India knows this.

The race has begun.

Why the sudden rush?

Because ISO 20022 isn’t a format — it’s the key to the new financial grid.

Once live, Ripple corridors, XRPL, and other ISO-aligned chains (like XLM & XDC) become the invisible backbones of cross-border value.

India knows this.

The race has begun.

3/🧵

India isn’t acting alone.

BRICS nations (Brazil, Russia, China, South Africa) are coordinating behind the scenes to build a multi-polar payment system — one that cuts SWIFT out of the equation.

Guess which protocols are already aligned with ISO 20022?

XRP. XLM. XDC.

India isn’t acting alone.

BRICS nations (Brazil, Russia, China, South Africa) are coordinating behind the scenes to build a multi-polar payment system — one that cuts SWIFT out of the equation.

Guess which protocols are already aligned with ISO 20022?

XRP. XLM. XDC.

4/🧵

The conspiracy they won’t tell you:

ISO 20022 is not just about “data standards.”

It’s the Trojan Horse to deploy CBDCs, tokenized assets, and bio-data verification rails (think XDNA) on the same network.

When India fast-tracks, millions of transactions will silently ride RippleNet.

The conspiracy they won’t tell you:

ISO 20022 is not just about “data standards.”

It’s the Trojan Horse to deploy CBDCs, tokenized assets, and bio-data verification rails (think XDNA) on the same network.

When India fast-tracks, millions of transactions will silently ride RippleNet.

5/🧵

India is the world’s remittance kingpin — $125B+ annually.

Once ISO 20022 flips, that tsunami of liquidity will flow through XRP corridors in real time.

You think $10 XRP is far-fetched?

Watch what happens when the largest diaspora payments bypass SWIFT.

India is the world’s remittance kingpin — $125B+ annually.

Once ISO 20022 flips, that tsunami of liquidity will flow through XRP corridors in real time.

You think $10 XRP is far-fetched?

Watch what happens when the largest diaspora payments bypass SWIFT.

6/🧵

November 2025 isn’t the start.

It’s the deadline.

The game starts next month when India accelerates the migration.

⚔️ Follow my war logs: t.me/alexanderthewh…

November 2025 isn’t the start.

It’s the deadline.

The game starts next month when India accelerates the migration.

⚔️ Follow my war logs: t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh