How to get URL link on X (Twitter) App

2/

2/

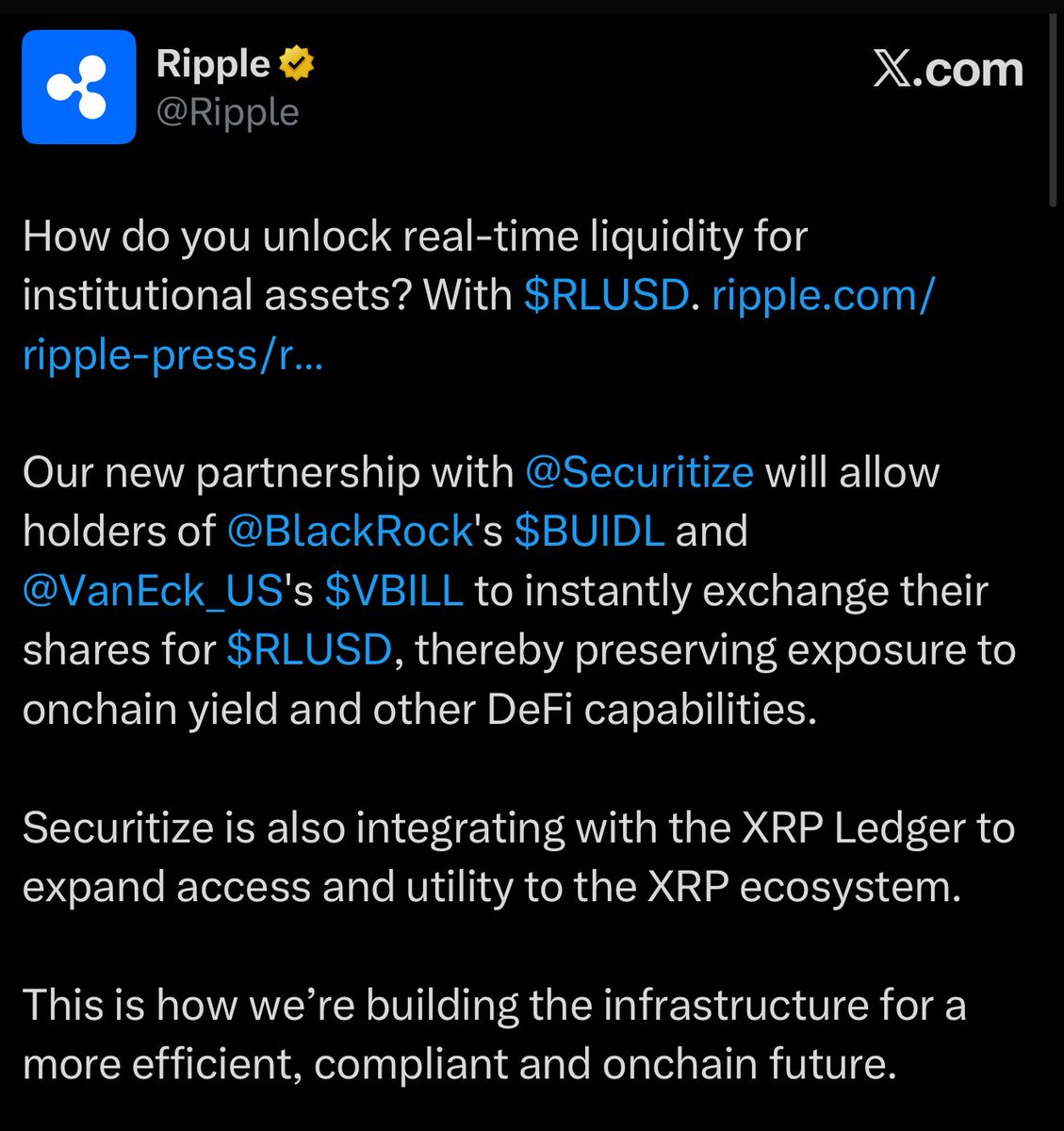

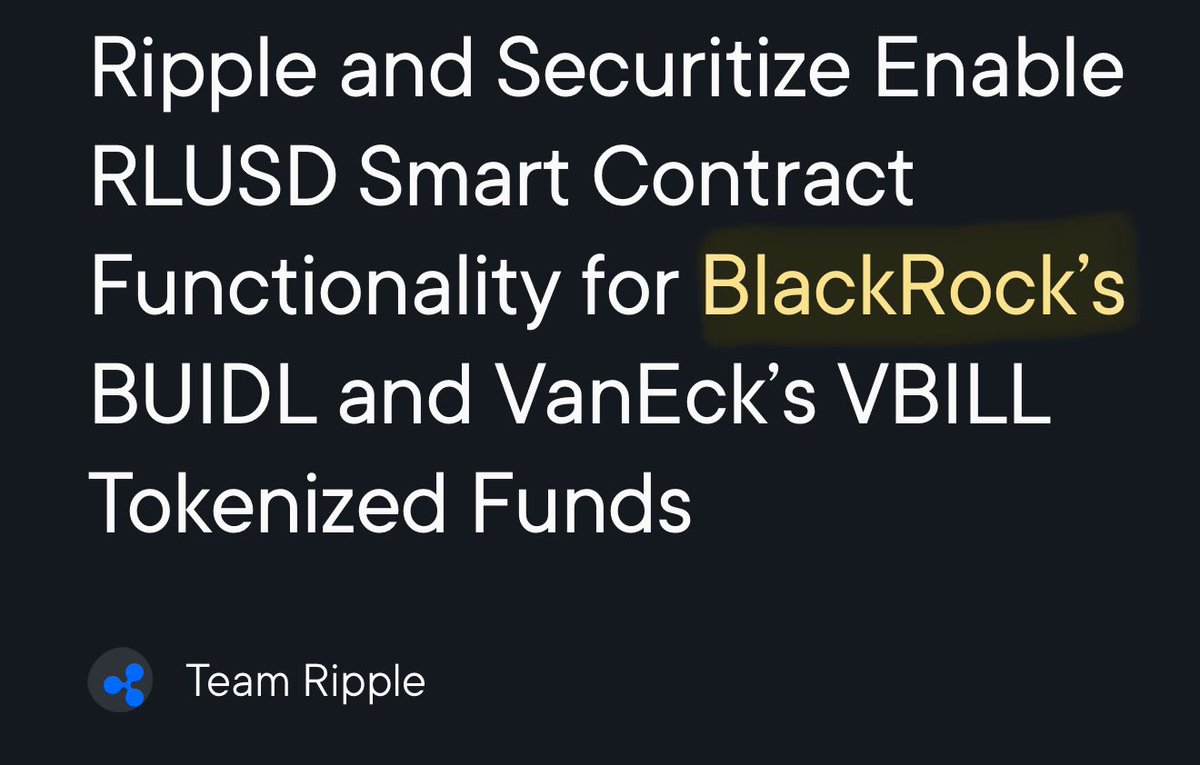

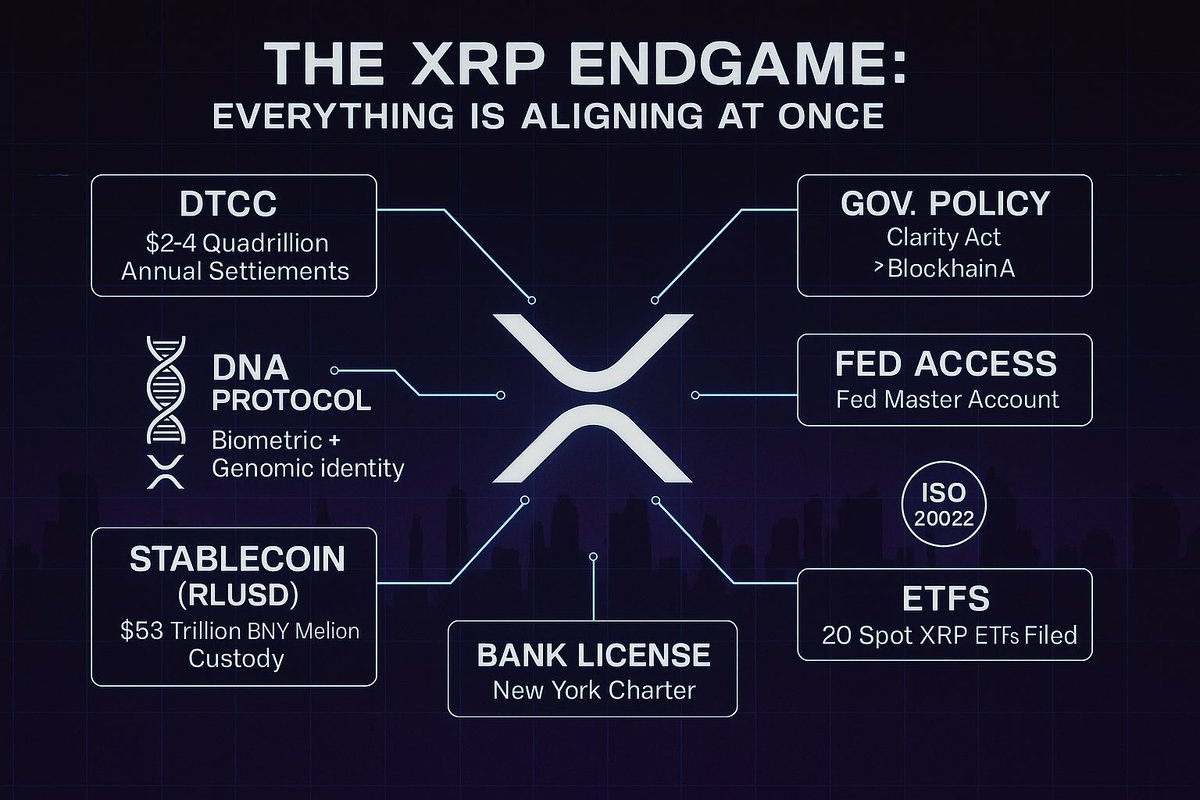

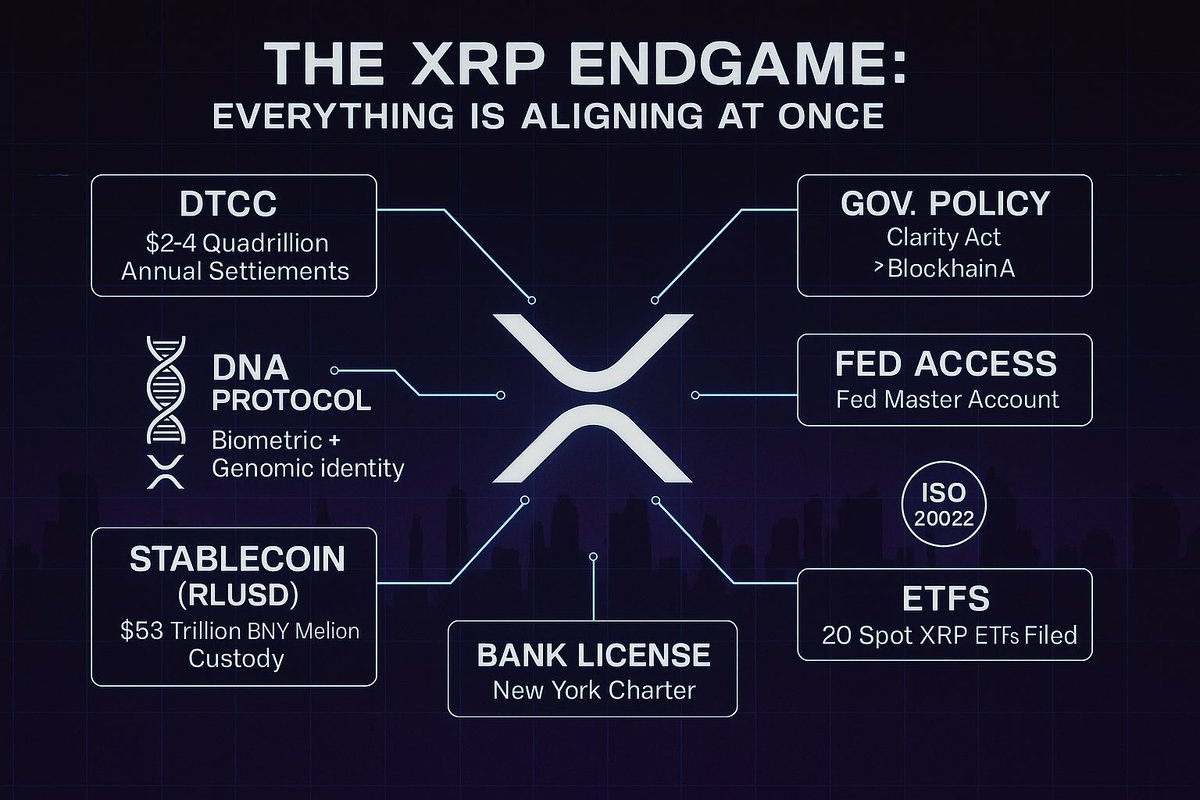

2/🧵 The idea of an XRP treasury is simple: it is a dedicated institutional entity that accumulates, manages, and strategically deploys XRP as a reserve asset. Not for trading. Not for speculation. For infrastructure.

2/🧵 The idea of an XRP treasury is simple: it is a dedicated institutional entity that accumulates, manages, and strategically deploys XRP as a reserve asset. Not for trading. Not for speculation. For infrastructure.

2/🧵 Let’s connect the dots.

2/🧵 Let’s connect the dots.

2/🧵 This is the culmination of a decade-long alliance between SBI & Ripple, two names quietly engineering global liquidity rails.

2/🧵 This is the culmination of a decade-long alliance between SBI & Ripple, two names quietly engineering global liquidity rails.

🔍 Key Facts

🔍 Key Facts

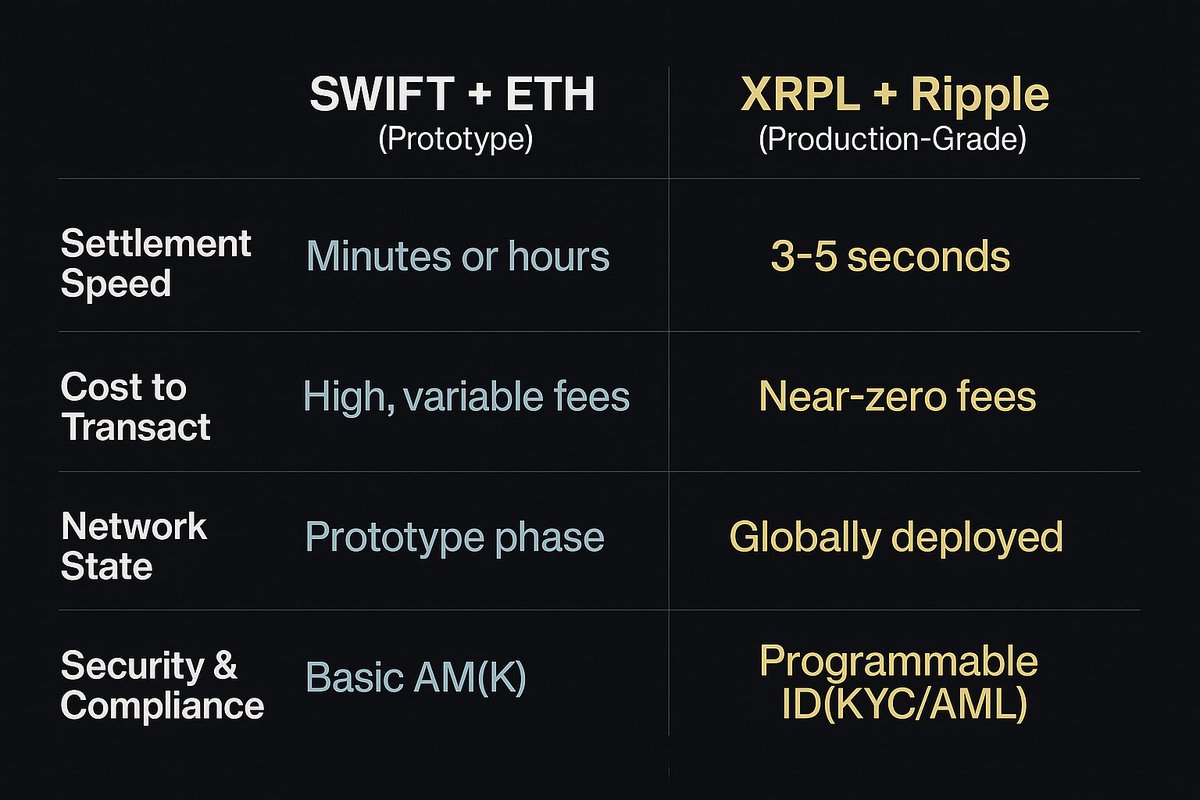

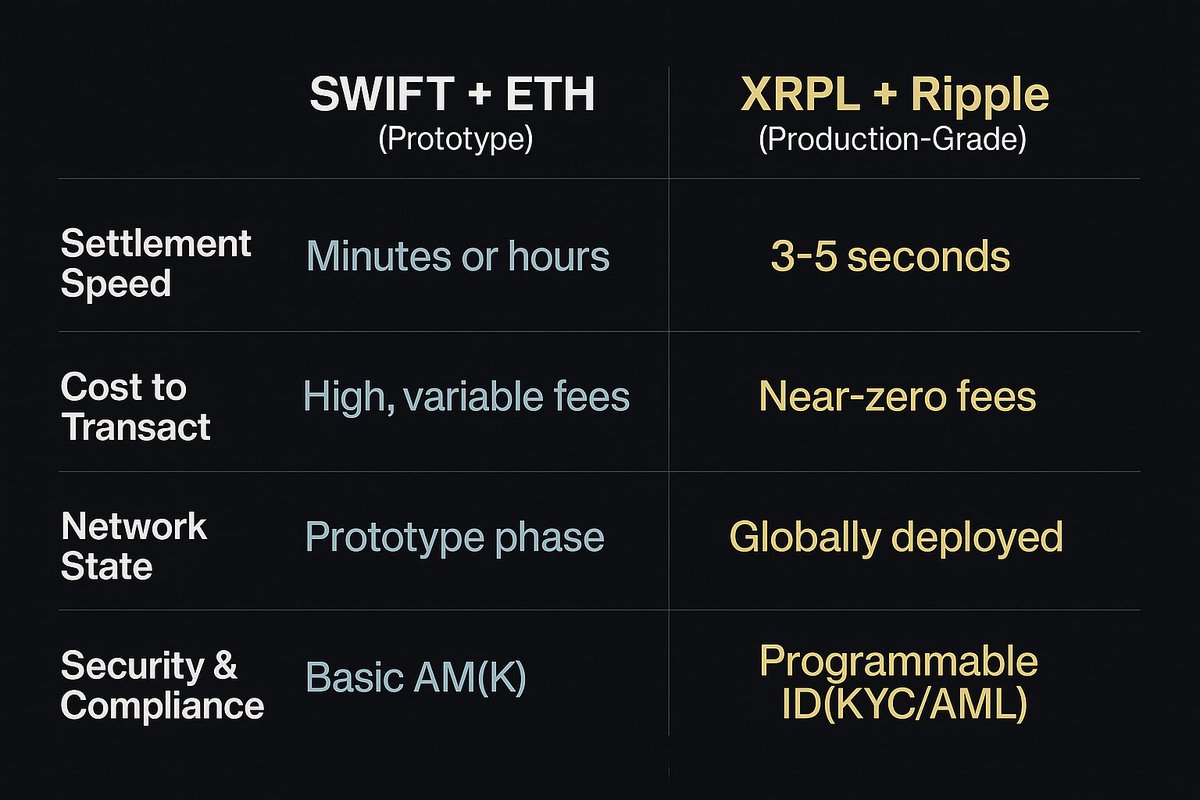

2/ 🧵 SWIFT + Consensys = Band-Aid Fix

2/ 🧵 SWIFT + Consensys = Band-Aid Fix

2/🧵 The playbook is old:

2/🧵 The playbook is old:

1/🧵

1/🧵

2/

2/

2/

2/

2/🧵

2/🧵

1/🧵

1/🧵

1/ The Lawsuit is Over. The Rails Are Open.

1/ The Lawsuit is Over. The Rails Are Open.

1/🧵

1/🧵

1/ 🏛️ DTCC Patent

1/ 🏛️ DTCC Patent

1/🧵

1/🧵

1/

1/

1/🧵

1/🧵

1/🧵

1/🧵

1/🧵

1/🧵