99% of traders focus on entries...

Yet the majority are exiting trades wrong.

Here’s the exact exit strategy I used to make $500k+ from trading:

Yet the majority are exiting trades wrong.

Here’s the exact exit strategy I used to make $500k+ from trading:

Everyone teaches entries.

- Breakouts

- Retests

- Sniper setups

But that’s not what makes you profitable.

Exits are.

If you don’t have a system for exits, your strategy will fail no matter how clean your entries are.

- Breakouts

- Retests

- Sniper setups

But that’s not what makes you profitable.

Exits are.

If you don’t have a system for exits, your strategy will fail no matter how clean your entries are.

Let’s break down the 3 main ways to exit a trendline trade:

1. Higher timeframe trendlines

2. Support & resistance

3. Trailing stop-loss using a “Safety Line”

Here’s how they work, and how I combine them:

1. Higher timeframe trendlines

2. Support & resistance

3. Trailing stop-loss using a “Safety Line”

Here’s how they work, and how I combine them:

Exit #1: Higher Timeframe Trendlines

Once price breaks your trendline, exit when it reaches a major HTF line.

In this platinum trade, there were two HTF trendlines that signaled exits.

One move. Two clean profit targets.

Once price breaks your trendline, exit when it reaches a major HTF line.

In this platinum trade, there were two HTF trendlines that signaled exits.

One move. Two clean profit targets.

Exit #2: Support & Resistance

Another natural exit point is key resistance zones.

In the same platinum trade, price hit 1078, a clear S/R level.

Perfect place to close before a reversal.

Another natural exit point is key resistance zones.

In the same platinum trade, price hit 1078, a clear S/R level.

Perfect place to close before a reversal.

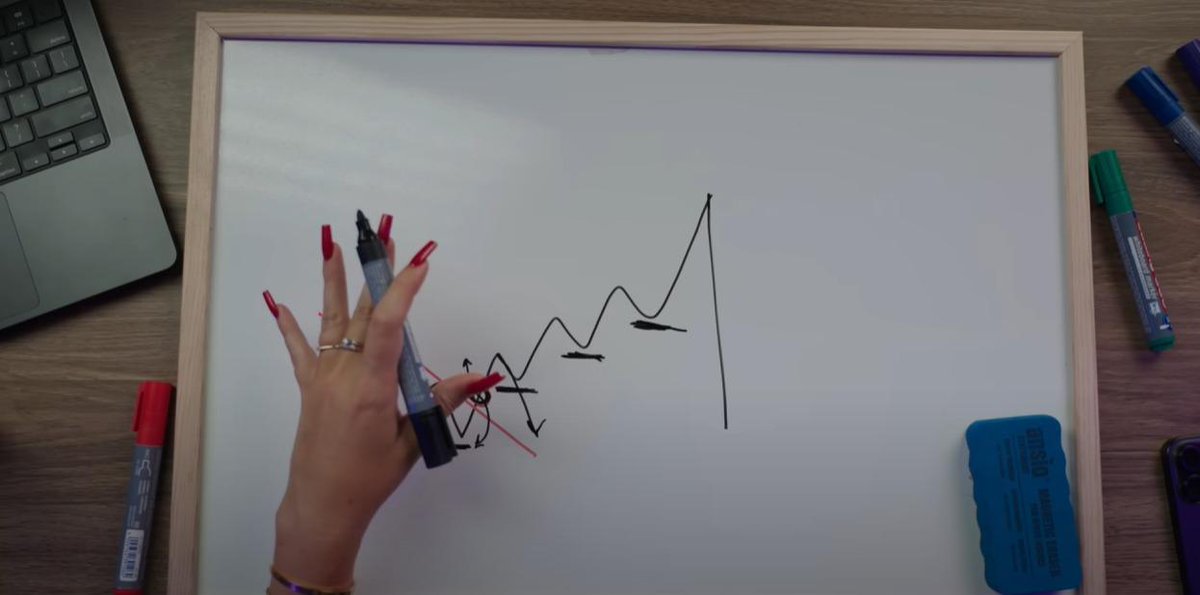

Exit #3: Trailing Stop using a Safety Line

This is what I use most often.

As price moves in your favor, trail your stop using a custom-drawn trendline on the opposite side.

If price crosses it, you exit… with profit.

This is what I use most often.

As price moves in your favor, trail your stop using a custom-drawn trendline on the opposite side.

If price crosses it, you exit… with profit.

Here’s how to draw a Safety Line:

Find the lowest visible point on the chart (Point A).

Connect to the most recent high without price intersecting (Point B).

This creates a structure for stop-loss placement.

Find the lowest visible point on the chart (Point A).

Connect to the most recent high without price intersecting (Point B).

This creates a structure for stop-loss placement.

As price trends up, create new steeper trendlines using recent pullbacks as new A/B points.

Then drag your stop behind them.

Now your worst case? Break-even or locked-in profit.

No more guessing, just reacting to structure.

Then drag your stop behind them.

Now your worst case? Break-even or locked-in profit.

No more guessing, just reacting to structure.

You don’t need one “perfect” exit method.

Use multiple exit signals in confluence.

- HTF lines

- S/R zones

- Safety Line breaks.

Let price action tell you what’s most relevant in the moment.

That’s how real traders exit with confidence.

Use multiple exit signals in confluence.

- HTF lines

- S/R zones

- Safety Line breaks.

Let price action tell you what’s most relevant in the moment.

That’s how real traders exit with confidence.

Thanks for reading!

If you’re tired of giving back profits…

And you want to exit trades with more clarity and confidence:

Follow @toritrades for more high-level breakdowns like this.

If you’re tired of giving back profits…

And you want to exit trades with more clarity and confidence:

Follow @toritrades for more high-level breakdowns like this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh