Nvidia's CEO is now the 7h richest person in the world worth $148 BILLION.

And he's legally avoided paying over $5.5 BILLION in taxes using strategies 99% of people have never heard of.

Here's how he's doing it:

And he's legally avoided paying over $5.5 BILLION in taxes using strategies 99% of people have never heard of.

Here's how he's doing it:

When a rich person passes away, they have to pay an estate tax.

It's basically a tax on transferring property, cash, stocks, etc to their heirs.

But with smart tax planning, you can minimize or even avoid it.

It's basically a tax on transferring property, cash, stocks, etc to their heirs.

But with smart tax planning, you can minimize or even avoid it.

The new tax bill increased the estate tax exemption to $15M in 2026.

But beyond that, you pay a federal tax of up to 40% on the value (billions in a wealthy person's case).

But let's look at how Jensen is avoiding it.

But beyond that, you pay a federal tax of up to 40% on the value (billions in a wealthy person's case).

But let's look at how Jensen is avoiding it.

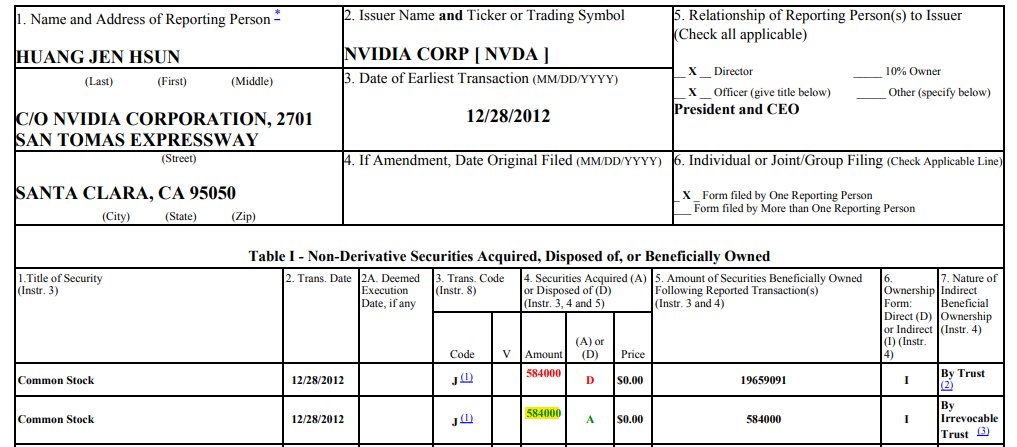

In 2012, Jensen created an "irrevocable trust" for the benefit of his children.

The main advantage of such a trust is that you are removing assets you personally own into a trust, which removes them from being subject to potential estate tax.

The main advantage of such a trust is that you are removing assets you personally own into a trust, which removes them from being subject to potential estate tax.

On December 28, 2012, Jensen transferred 584,000 Nvidia shares to the trust.

At that time, these shares were worth only $2 million.

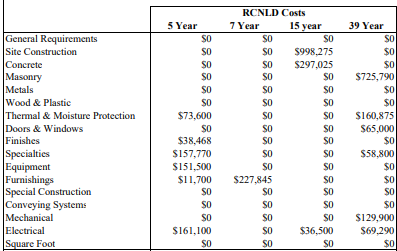

He was able to use his gift and estate tax exemption ($5M in 2012) to avoid any gift taxes:

At that time, these shares were worth only $2 million.

He was able to use his gift and estate tax exemption ($5M in 2012) to avoid any gift taxes:

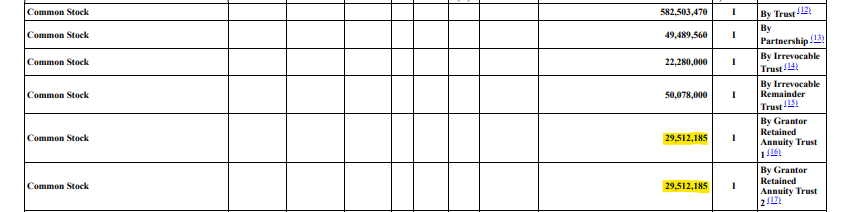

Based on the most recent SEC filing, the irrevocable trust owns 22,280,000 shares due to stock splits.

With the current price of $170, that’s worth $3.79B:

With the current price of $170, that’s worth $3.79B:

If he had not made the irrevocable trust tax play, he would have paid roughly $1.5B in estate taxes if he passed away.

That's $1.5B of wealth his heirs would've been able to retain.

But he didn't just stop there...

That's $1.5B of wealth his heirs would've been able to retain.

But he didn't just stop there...

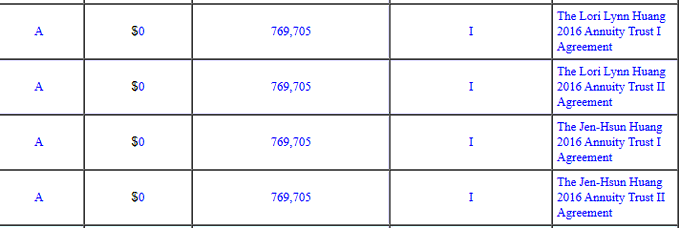

He also diversified his tax and gift strategy by creating a Grantor Retained Annuity Trust (GRAT).

Jensen and Lori both transferred 3,078,820 shares into that trust in 2016 (see screenshot)

This transfer likely had a small gift tax impact.

Jensen and Lori both transferred 3,078,820 shares into that trust in 2016 (see screenshot)

This transfer likely had a small gift tax impact.

Currently, these trusts also own 59,024,370 shares (29,512,185 each) due to stock splits inside the GRAT, and are worth around $10B (see SEC filing).

So, what's the main benefit of GRATs, and how is he avoiding estate taxes?

So, what's the main benefit of GRATs, and how is he avoiding estate taxes?

GRAT freezes a portion of an estate's value today while shifting the appreciation free of estate tax.

So, he contributed stocks into the GRAT when the share price was low and rode the wave.

This helped him avoid $4B in estate taxes.

So, he contributed stocks into the GRAT when the share price was low and rode the wave.

This helped him avoid $4B in estate taxes.

Now, this is just what we see based on the filings.

He could also be using sophisticated strategies to lower his taxes, like borrowing against trust assets (with a personal guarantee) and reducing his income taxes.

He could also be using sophisticated strategies to lower his taxes, like borrowing against trust assets (with a personal guarantee) and reducing his income taxes.

Is this legal?

Yes.

There have been proposals and court cases to crack down on estate tax and the use of irrevocable trusts (Walton v Commissioner) but none came to fruition.

Yes.

There have been proposals and court cases to crack down on estate tax and the use of irrevocable trusts (Walton v Commissioner) but none came to fruition.

If you enjoyed this thread, make sure to:

1. send it to your friend

2. follow me @money_cruncher for more CPA and personal finance content!

1. send it to your friend

2. follow me @money_cruncher for more CPA and personal finance content!

• • •

Missing some Tweet in this thread? You can try to

force a refresh