Fibonacci Retracement – The Most Misused but Powerful Tool in Trading 🧵

You’ve seen the golden levels:

📍 0.618

📍 0.5

📍 0.382

But do you really know how Smart Money uses Fibonacci?

In this thread:

✅ Fibonacci basics

✅ Secret levels

✅ Entry + SL + Target rules

✅ Swing & Intraday trades

✅ With Order Blocks, OBs & VWAP

👇

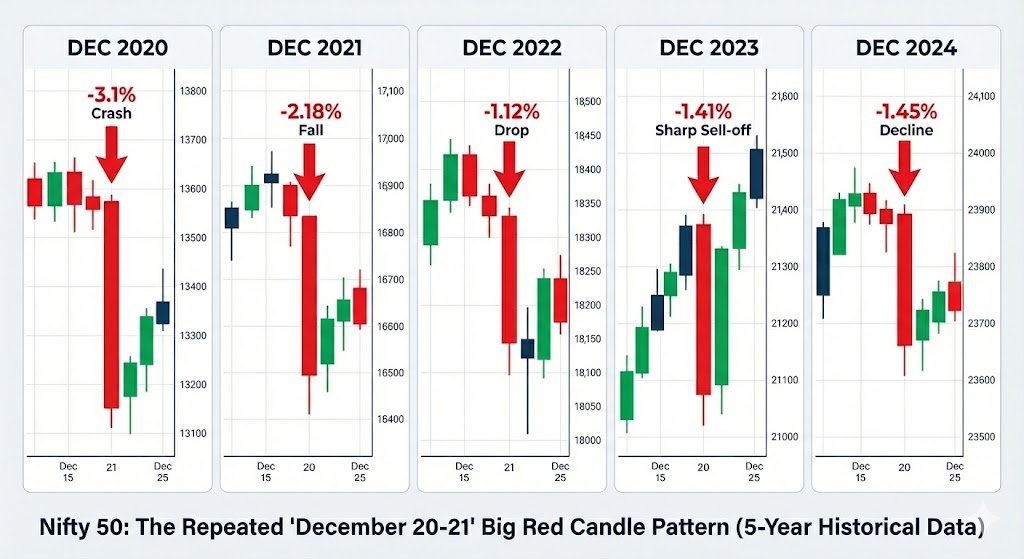

#niftycrash

You’ve seen the golden levels:

📍 0.618

📍 0.5

📍 0.382

But do you really know how Smart Money uses Fibonacci?

In this thread:

✅ Fibonacci basics

✅ Secret levels

✅ Entry + SL + Target rules

✅ Swing & Intraday trades

✅ With Order Blocks, OBs & VWAP

👇

#niftycrash

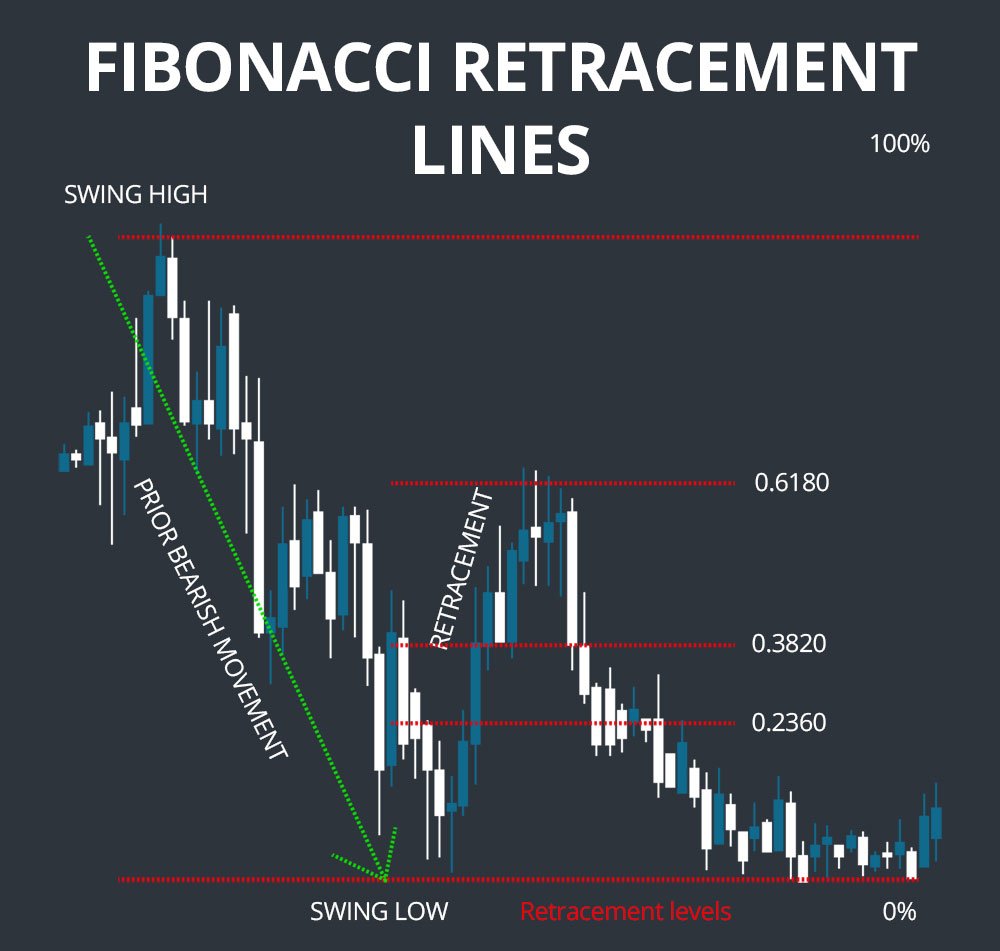

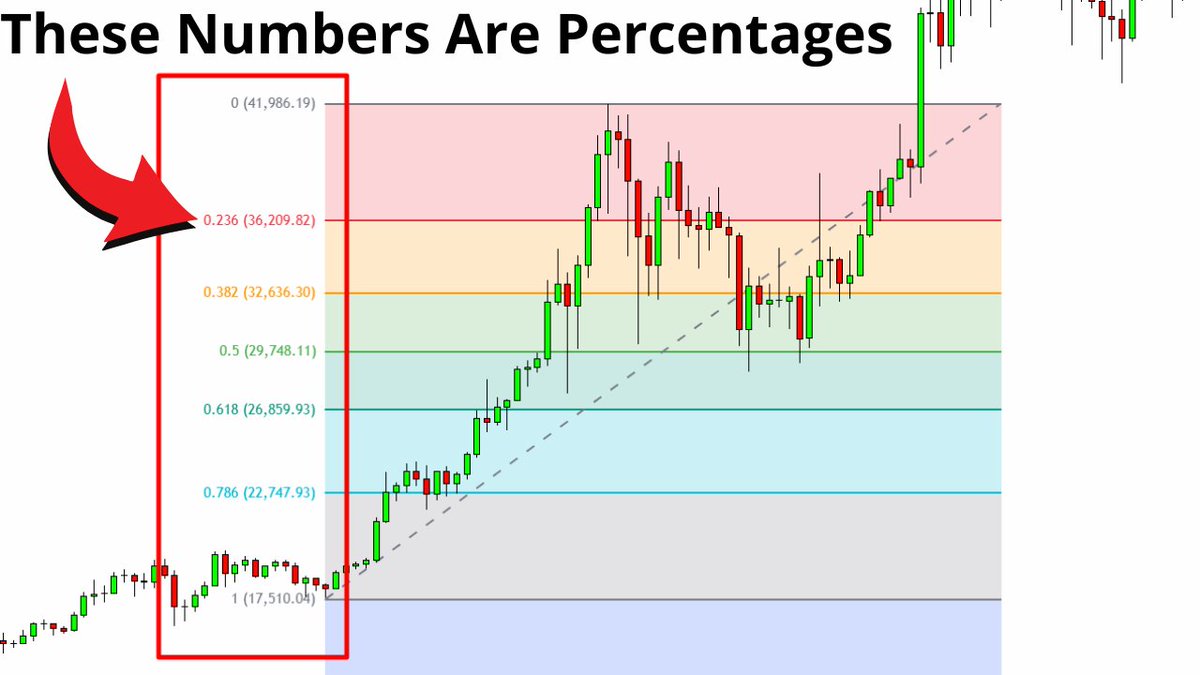

1) What is Fibonacci Retracement?

Fibonacci is based on natural ratios (like 0.618) found everywhere — plants, galaxies, and the markets.

In trading:

We use it to find potential pullback zones within a move.

📌 Key Levels:

0.236 → Weak pullback

0.382 → First bounce

0.5 → Neutral zone (not a true Fib level, but used)

0.618 → Golden retracement

0.786 → Deep retracement (Smart Money favorite)

Fibonacci is based on natural ratios (like 0.618) found everywhere — plants, galaxies, and the markets.

In trading:

We use it to find potential pullback zones within a move.

📌 Key Levels:

0.236 → Weak pullback

0.382 → First bounce

0.5 → Neutral zone (not a true Fib level, but used)

0.618 → Golden retracement

0.786 → Deep retracement (Smart Money favorite)

2) How to Plot Fibonacci (Correctly)

❌ Most plot it from random highs/lows.

✅ Here’s the correct way:

📍 Identify an impulsive move (clear trend leg)

📍 Plot Fib from swing low to swing high (in uptrend)

📍 Or swing high to swing low (in downtrend)

💥 Plot from body-to-body for Smart Money accuracy (not wick)

❌ Most plot it from random highs/lows.

✅ Here’s the correct way:

📍 Identify an impulsive move (clear trend leg)

📍 Plot Fib from swing low to swing high (in uptrend)

📍 Or swing high to swing low (in downtrend)

💥 Plot from body-to-body for Smart Money accuracy (not wick)

3) How Smart Money Uses Fibonacci

Institutions don’t enter at 0.236 or 0.382.

They wait for:

✅ 0.618–0.786 retracement

✅ OB or FVG near that zone

✅ Liquidity sweep below structure

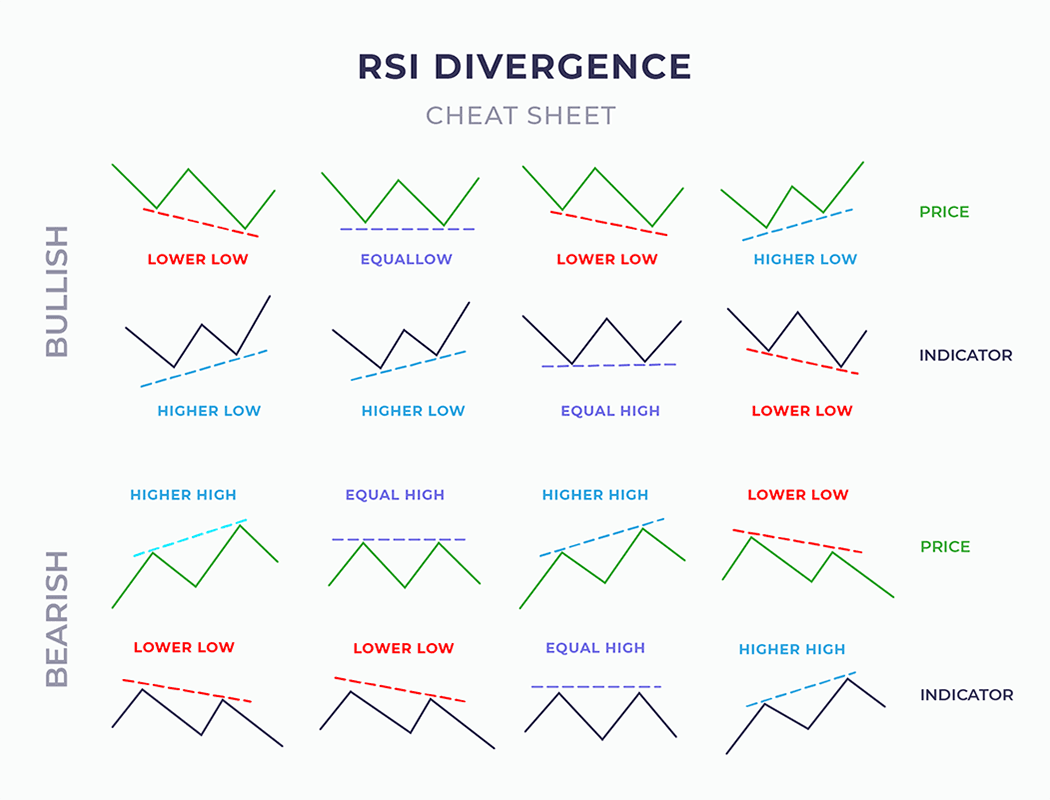

✅ RSI/Volume divergence

✅ Engulfing or trap candle

📍 Then they enter → ride it to new highs/lows.

Institutions don’t enter at 0.236 or 0.382.

They wait for:

✅ 0.618–0.786 retracement

✅ OB or FVG near that zone

✅ Liquidity sweep below structure

✅ RSI/Volume divergence

✅ Engulfing or trap candle

📍 Then they enter → ride it to new highs/lows.

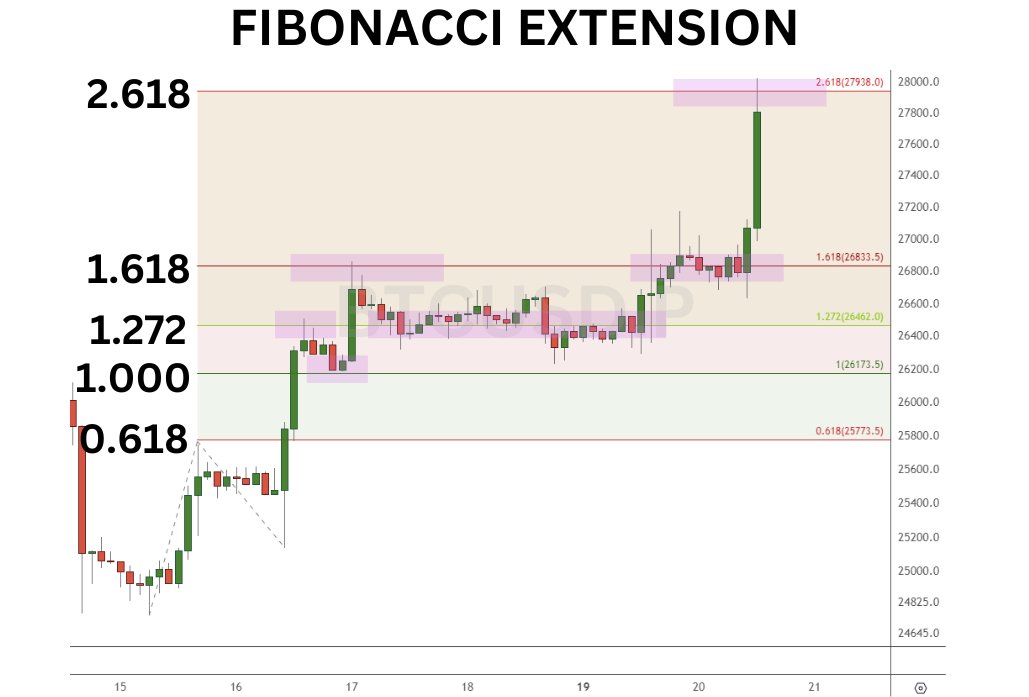

4) Entry Strategy 1: The Golden Entry

📌 Price pulls back to 0.618–0.786 Fib zone

📌 OB or FVG aligns with it

📌 Forms bullish engulfing or rejection wick

🎯 Entry: After confirmation candle

❌ SL: Below 0.786 or trap wick

🎯 Target: 0.0 Fib (swing high) → then Fib extension 1.272, 1.618

💥 Works beautifully for swing trades

📌 Price pulls back to 0.618–0.786 Fib zone

📌 OB or FVG aligns with it

📌 Forms bullish engulfing or rejection wick

🎯 Entry: After confirmation candle

❌ SL: Below 0.786 or trap wick

🎯 Target: 0.0 Fib (swing high) → then Fib extension 1.272, 1.618

💥 Works beautifully for swing trades

5) Entry Strategy 2: Fib + OB Combo (Intraday)

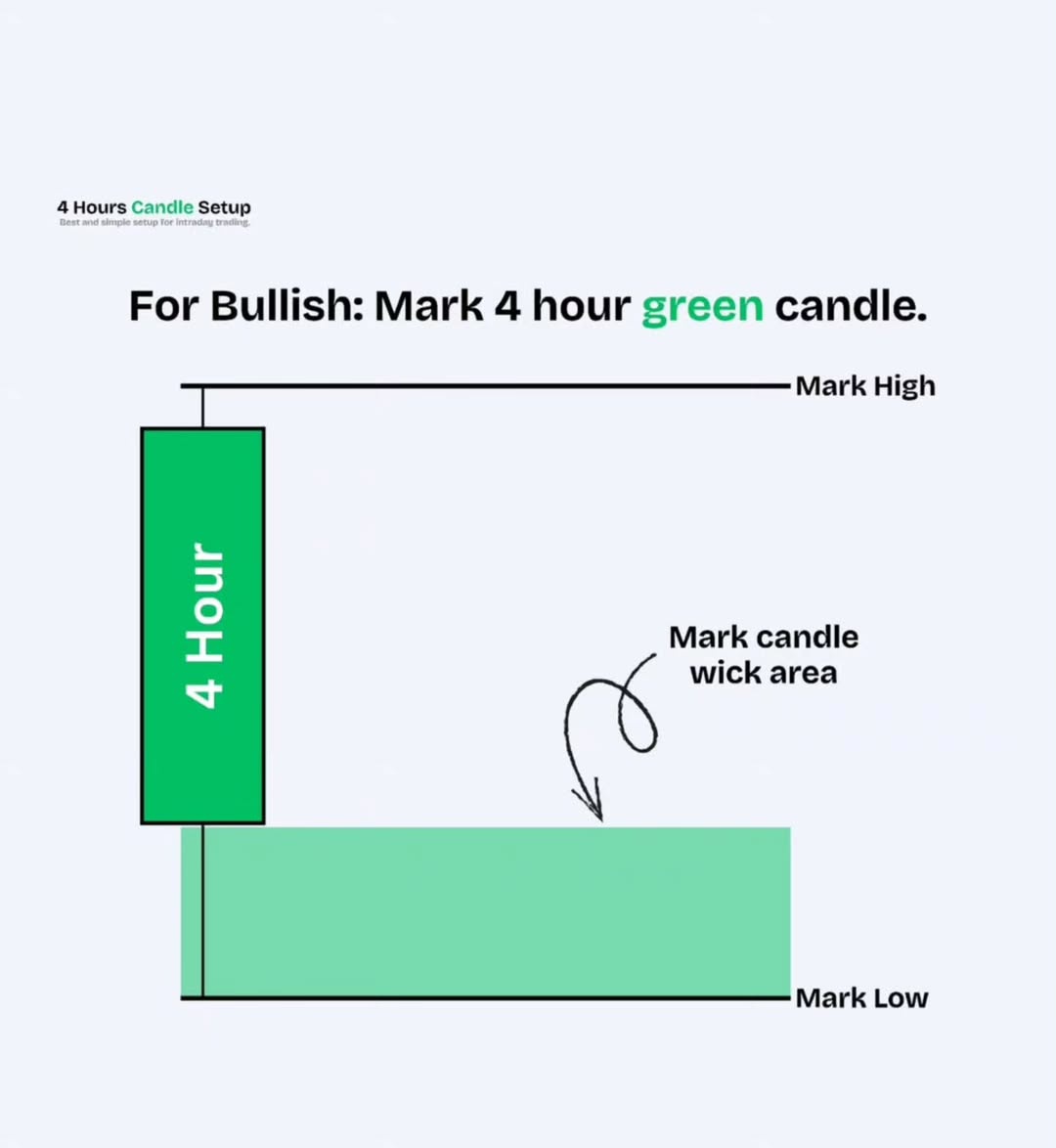

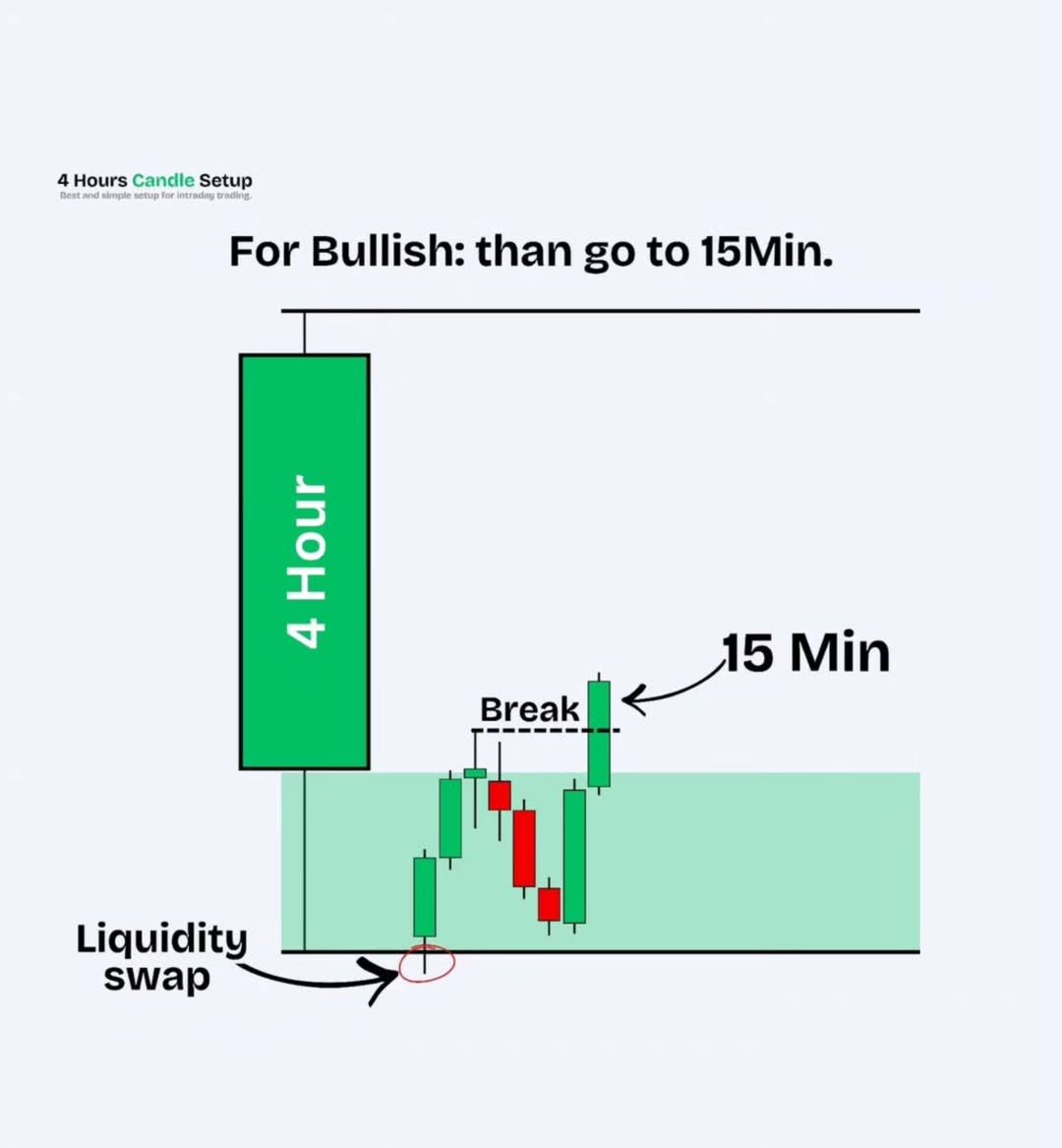

✅ Mark 15m impulsive leg

✅ Plot Fib on that leg

✅ Drop to 5m or 3m

✅ Look for OB inside 0.618–0.786

✅ Wait for rejection wick or CHoCH

🎯 Buy CE or long futures

❌ SL: Below OB

🎯 Target: Back to swing high → then extension

💡 Great for BankNifty intraday plays

✅ Mark 15m impulsive leg

✅ Plot Fib on that leg

✅ Drop to 5m or 3m

✅ Look for OB inside 0.618–0.786

✅ Wait for rejection wick or CHoCH

🎯 Buy CE or long futures

❌ SL: Below OB

🎯 Target: Back to swing high → then extension

💡 Great for BankNifty intraday plays

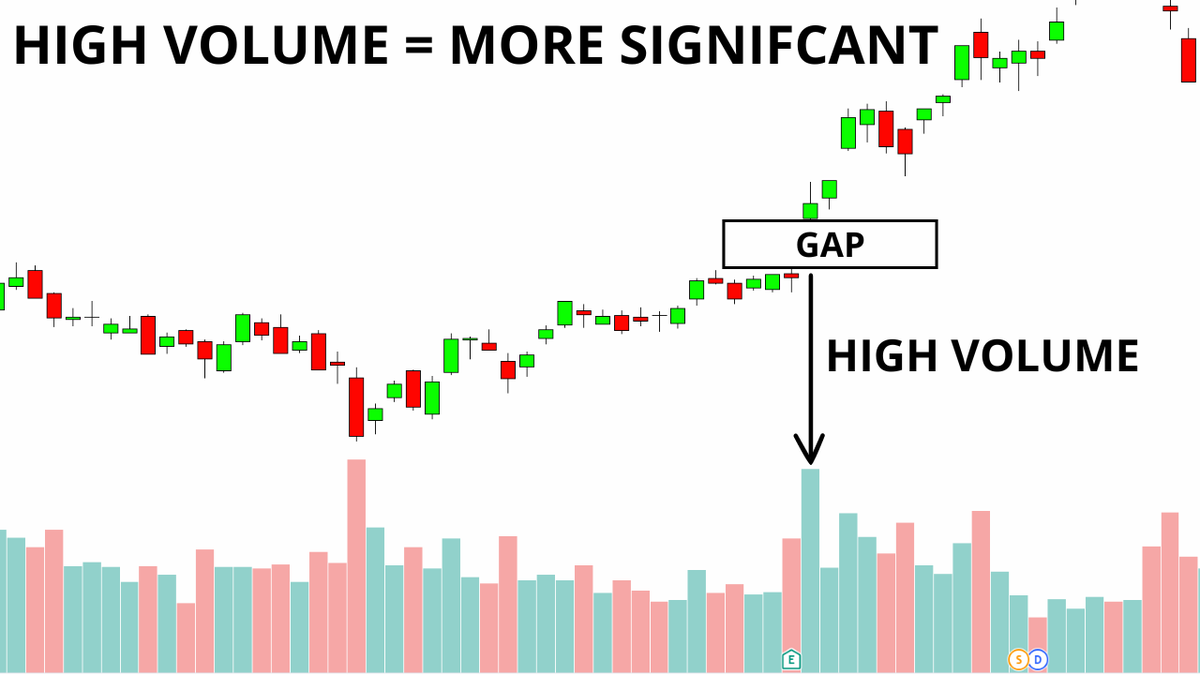

6) Entry Strategy 3: Fib + VWAP + Volume

📌 Price retraces to 0.618

📌 VWAP support nearby

📌 Volume spike on green candle

📌 RSI crosses 40–50 zone

🎯 Buy CE option

❌ SL: Below VWAP

🎯 Target: Fib 0.0 + 1.272

⚠️ Avoid entry if volume is weak or VWAP is broken

📌 Price retraces to 0.618

📌 VWAP support nearby

📌 Volume spike on green candle

📌 RSI crosses 40–50 zone

🎯 Buy CE option

❌ SL: Below VWAP

🎯 Target: Fib 0.0 + 1.272

⚠️ Avoid entry if volume is weak or VWAP is broken

7) Targets Using Fibonacci Extensions

Once price moves past previous high/low (0.0 level), use:

📍 1.272 → conservative target

📍 1.618 → golden target

📍 2.0 → max extension (rare but explosive)

💡 Use these levels for exit planning in options or futures.

Once price moves past previous high/low (0.0 level), use:

📍 1.272 → conservative target

📍 1.618 → golden target

📍 2.0 → max extension (rare but explosive)

💡 Use these levels for exit planning in options or futures.

8) Example – BankNifty 15m Chart

Impulsive rally: 49,500 to 50,100

Pullback to 49,650 (Fib 0.618)

OB + bullish engulfing + VWAP hold

Buy 49,800 CE @ ₹120

Target hit at 50,100 (0.0) → then 1.272 at 50,300 ✅

RR: 1:3+ in < 1.5 hours 🔥

Impulsive rally: 49,500 to 50,100

Pullback to 49,650 (Fib 0.618)

OB + bullish engulfing + VWAP hold

Buy 49,800 CE @ ₹120

Target hit at 50,100 (0.0) → then 1.272 at 50,300 ✅

RR: 1:3+ in < 1.5 hours 🔥

9) Pro Tips for Using Fibonacci

✅ Align Fib levels with:

Order Blocks

Fair Value Gaps

VWAP

CPR

RSI Divergence

✅ Don’t enter blindly at Fib zones

→ Wait for confirmation

✅ Plot Fib on HTF (15m, 1H) and enter on LTF (5m, 3m)

✅ Align Fib levels with:

Order Blocks

Fair Value Gaps

VWAP

CPR

RSI Divergence

✅ Don’t enter blindly at Fib zones

→ Wait for confirmation

✅ Plot Fib on HTF (15m, 1H) and enter on LTF (5m, 3m)

10) Secret Level Most Traders Ignore: 0.705

📌 Hidden institutional level between 0.618 & 0.786

📌 Price often reacts better at 0.705 than 0.618

📌 Smart Money enters here when OB sits exactly at 70.5%

🎯 Try it in your charts — sniper entries await 😎

📌 Hidden institutional level between 0.618 & 0.786

📌 Price often reacts better at 0.705 than 0.618

📌 Smart Money enters here when OB sits exactly at 70.5%

🎯 Try it in your charts — sniper entries await 😎

• • •

Missing some Tweet in this thread? You can try to

force a refresh