🚨BREAKING: A new Python library for algorithmic trading.

Introducing TensorTrade: An open-source Python framework for trading using Reinforcement Learning (AI)

Introducing TensorTrade: An open-source Python framework for trading using Reinforcement Learning (AI)

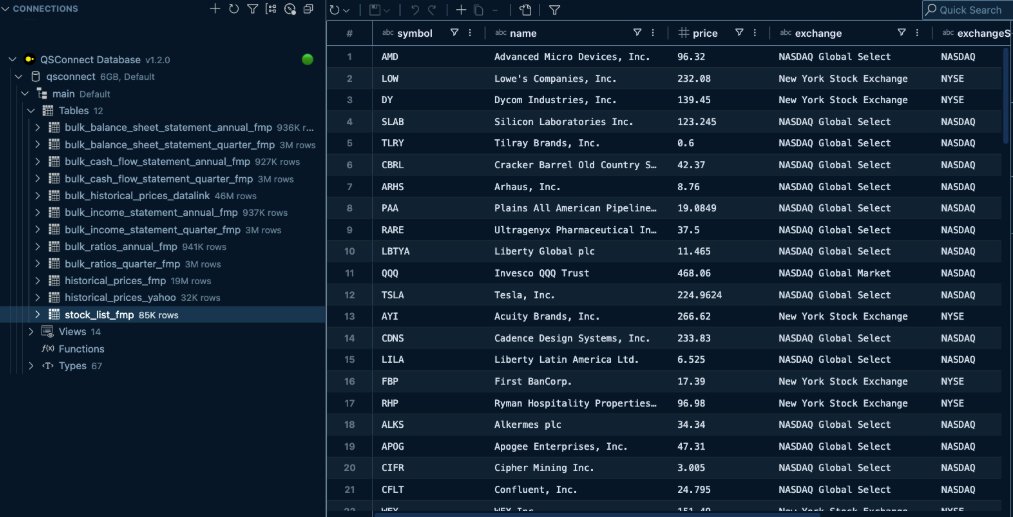

TensorTrade is an open source Python framework for building, training, evaluating, and deploying robust trading algorithms using reinforcement learning leveraging:

- numpy

- pandas

- gym

- keras

- tensorflow

- numpy

- pandas

- gym

- keras

- tensorflow

Example: Using TensorTrade to Train and Evaluate with Reinforcement Learning

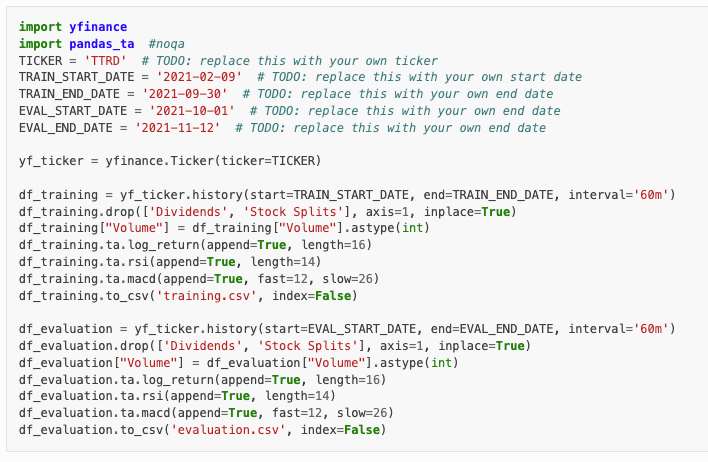

Step 1: Create training and evaluation sets

We'll start by creating a training and evaluation set as CSV files.

Step 1: Create training and evaluation sets

We'll start by creating a training and evaluation set as CSV files.

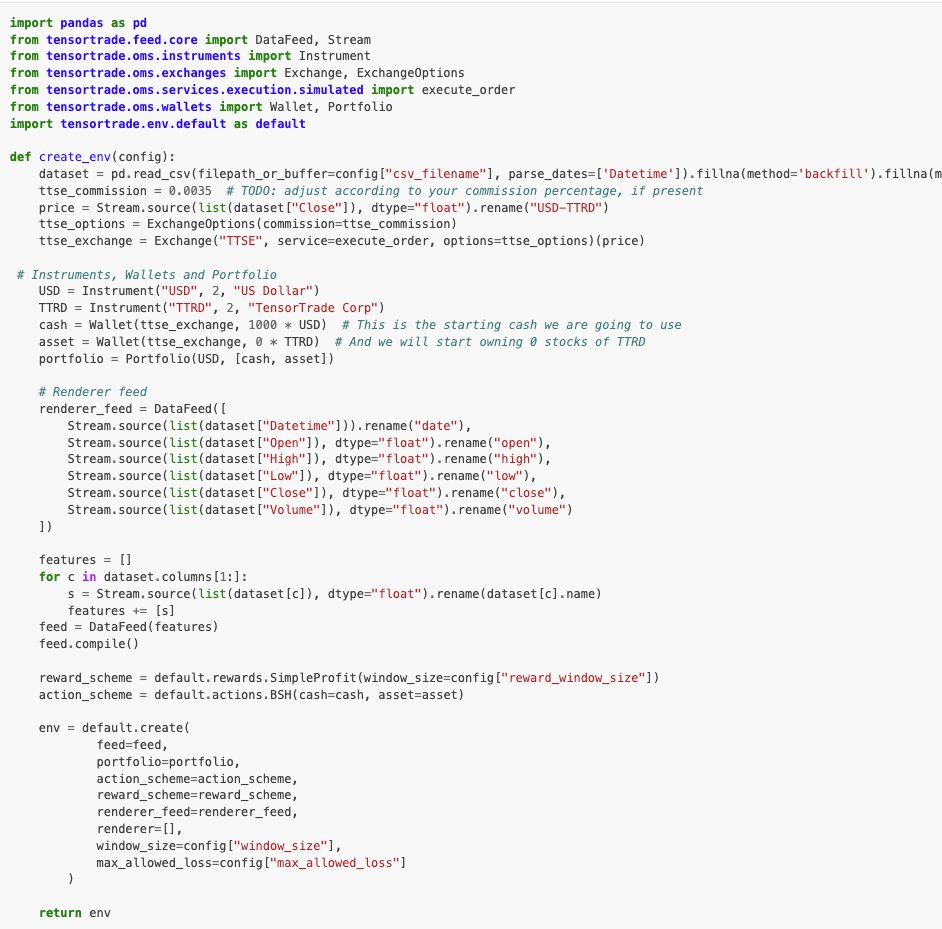

Step 2: Create a Configuration

Here we are using the config dictionary to store the CSV filename that we need to read.

Here we are using the config dictionary to store the CSV filename that we need to read.

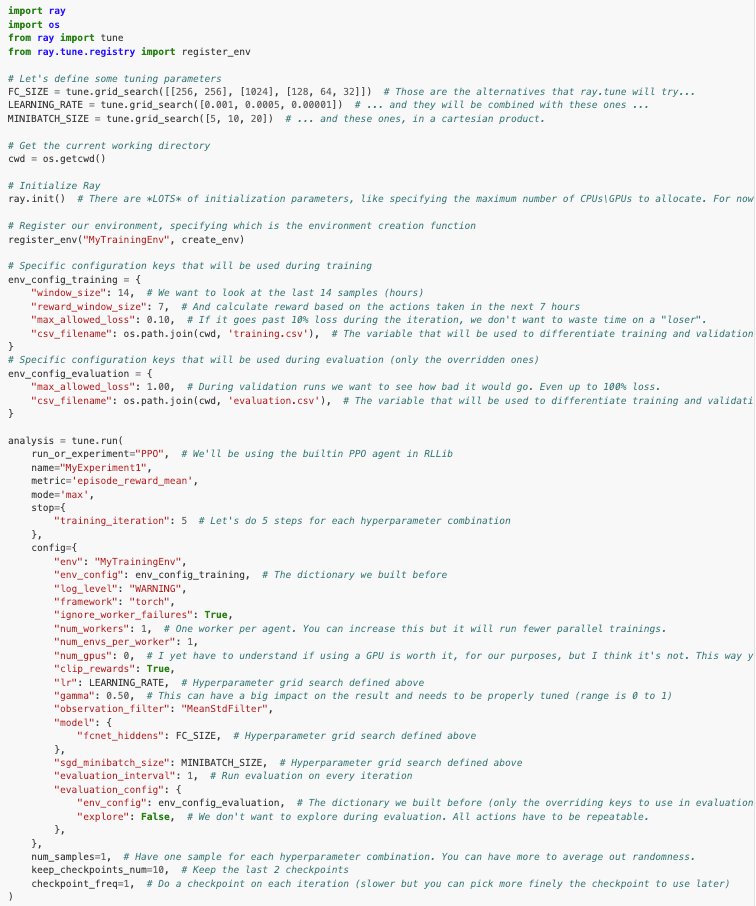

Step 3: Initialize and run with Ray

Now it’s time to initialize and run Ray, passing all the parameters necessary, including the name of the environment creator function (create_env defined above).

Now it’s time to initialize and run Ray, passing all the parameters necessary, including the name of the environment creator function (create_env defined above).

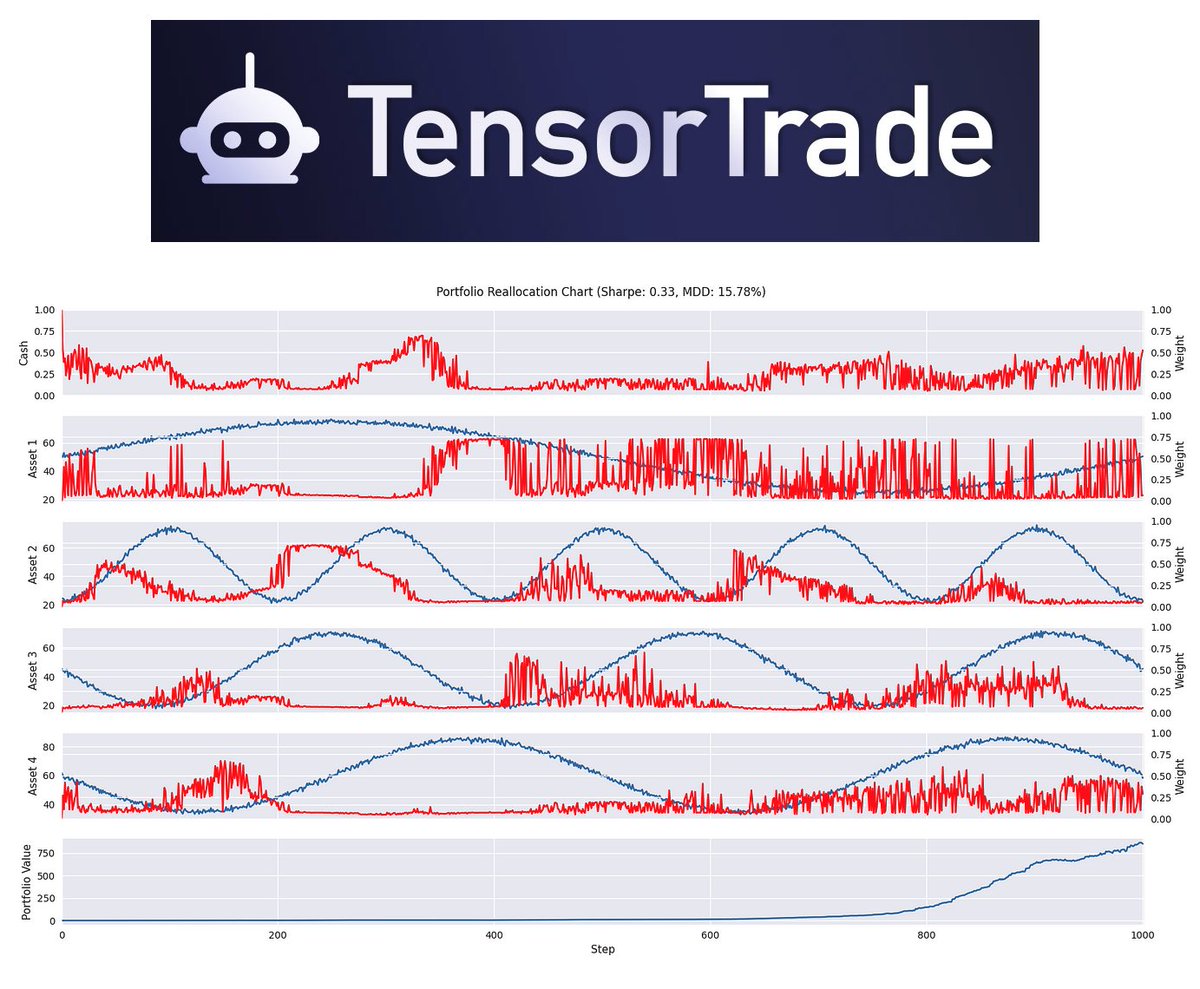

Next Steps: Reward Agents

Reward Agents (AI) bring a new capability to allow Reinforcement Learning to integrate a reward system that allows the Agent to optimize the strategy to a reward (e.g. profit).

Reward Agents (AI) bring a new capability to allow Reinforcement Learning to integrate a reward system that allows the Agent to optimize the strategy to a reward (e.g. profit).

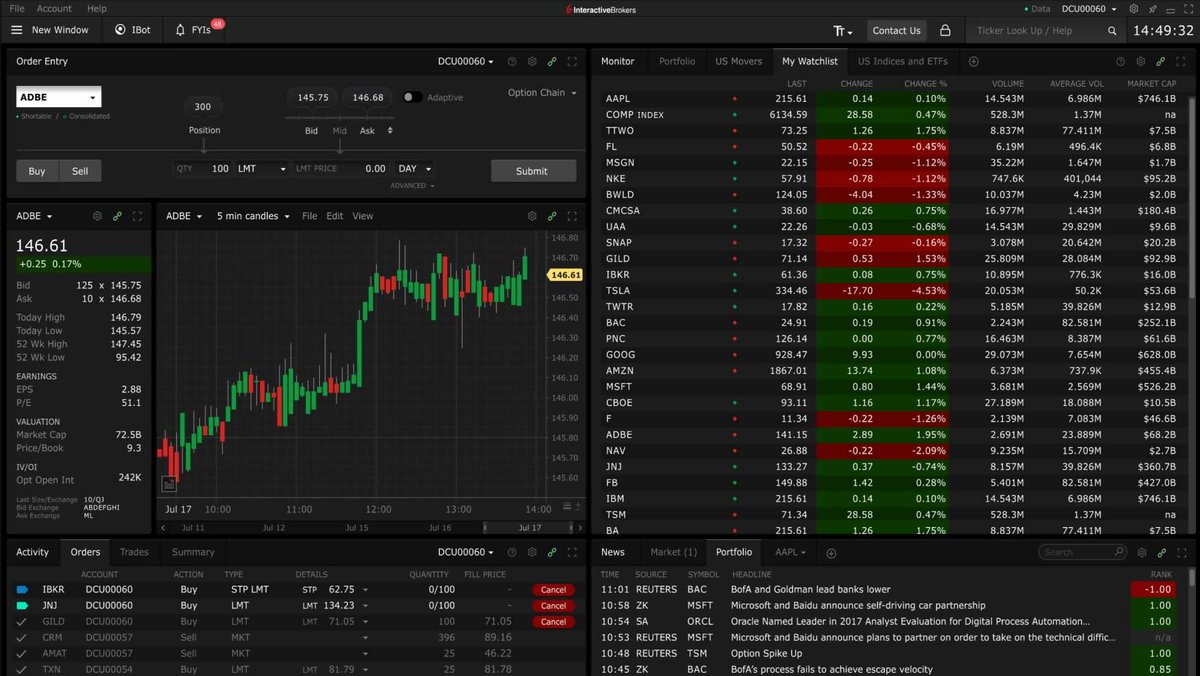

🚨 NEW WORKSHOP: How I built an automated algorithmic trading system with Python.

Hedge funds have better tools & faster execution.

That ends on August 7th.

👉 Register here to learn how to compete in an unfair game with Python (500 seats): learn.quantscience.io/become-a-pro-q…

Hedge funds have better tools & faster execution.

That ends on August 7th.

👉 Register here to learn how to compete in an unfair game with Python (500 seats): learn.quantscience.io/become-a-pro-q…

That's a wrap!

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

If you enjoyed this thread:

1. Follow me @quantscience_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/1683526993059430411/status/1948718734471782437

• • •

Missing some Tweet in this thread? You can try to

force a refresh