1) U.S.-China negotiation continues, but what agenda emerge on the table of Stockholm talk might be quite different from previous London talk, and of course vary from Geneva talk in May.

First, recap of London talk (June 11): China want lift of export control (EDA, H20, Jet engine, Ethane), and U.S. wants lift of REE controls—both things are on track as various news and data points suggest.

First, recap of London talk (June 11): China want lift of export control (EDA, H20, Jet engine, Ethane), and U.S. wants lift of REE controls—both things are on track as various news and data points suggest.

2) It is also later reported that two countries have "reach the deal" while did not disclose any details.

Clearly, in my view, two thing have been well conducting over the past two months: 1) Removing various negotiation barrier and ones undermining further talk. 2) Rebuilding diplomatic momentum for upcoming leadership dialogue by pushing U.S.-China interaction at various levels and across agencies (e.g.Rubio-Wang Yi on the "sideline" in Malaysia.)

Clearly, in my view, two thing have been well conducting over the past two months: 1) Removing various negotiation barrier and ones undermining further talk. 2) Rebuilding diplomatic momentum for upcoming leadership dialogue by pushing U.S.-China interaction at various levels and across agencies (e.g.Rubio-Wang Yi on the "sideline" in Malaysia.)

3) As #1 and #2 development is quite clear and previous "deal" is on track, the goal of Stockholm talk could be quite different as two countries move toward another stage of negotiation.

Of course, both U.S. and China hope to get a "deal" to "manage" the tariffs rate, which US imposed about 40-50% tariffs rate (depends on your calculation of Trump 1.0&2.0+ Biden tariffs) on China, and China imposed about 10-20% on U.S. but there is an "exemptions" tho.

Of course, both U.S. and China hope to get a "deal" to "manage" the tariffs rate, which US imposed about 40-50% tariffs rate (depends on your calculation of Trump 1.0&2.0+ Biden tariffs) on China, and China imposed about 10-20% on U.S. but there is an "exemptions" tho.

4) From U.S. perspective, Trump administration probably have couple strategic goals on the table:

a. Ask more Chinese purchases of U.S. goods (agriculture, energy, etc) to hopefully reduce trade deficit and maybe Chinese investment (which will be tricky regulatory)

b. Ask China to adjust its economic model (which will be very difficult), ranging from overcapacity, export-driven economy, and more domestic consumption

c. The administration might also ask more fair, open, and regulatory favorable Chinese market access for U.S. companies, which has been a thing complaint for years

d. Perhaps more importantly, is to lay out framework of deal to discuss and hopefully acheive in coming months that could potentially pave way for future Trump-Xi summit. Leaders summit, essentially, is about what deal get DONE right?

Of course, the deal is required complex details and negotiation process, no one know whether two side can pull this off, but this will be key to watch.

If Trump and Xi want to meet, there are several occurrence (without order)

1) Trump's visit to Beijing in Sep/Oct

2) Sideline of APEC Summit in South Korea (10/31-11/1).

3) Sideline of G20 Summit in South Africa (11/22-11/23)

a. Ask more Chinese purchases of U.S. goods (agriculture, energy, etc) to hopefully reduce trade deficit and maybe Chinese investment (which will be tricky regulatory)

b. Ask China to adjust its economic model (which will be very difficult), ranging from overcapacity, export-driven economy, and more domestic consumption

c. The administration might also ask more fair, open, and regulatory favorable Chinese market access for U.S. companies, which has been a thing complaint for years

d. Perhaps more importantly, is to lay out framework of deal to discuss and hopefully acheive in coming months that could potentially pave way for future Trump-Xi summit. Leaders summit, essentially, is about what deal get DONE right?

Of course, the deal is required complex details and negotiation process, no one know whether two side can pull this off, but this will be key to watch.

If Trump and Xi want to meet, there are several occurrence (without order)

1) Trump's visit to Beijing in Sep/Oct

2) Sideline of APEC Summit in South Korea (10/31-11/1).

3) Sideline of G20 Summit in South Africa (11/22-11/23)

5) From China's view, the goals is clearly different.

a. Reducing U.S. tariffs rate on China. Of course, China has been quite tough toward U.S. sky-high tariffs since April 2, but there is little doubt that it does have impact to its economy. This should still be a priority to address.

b. Given export control on H20 has been lifted, it is not unlikely that Chinese counterparts asking more, which I personally think will be difficult given the compromises U.S. side have made.

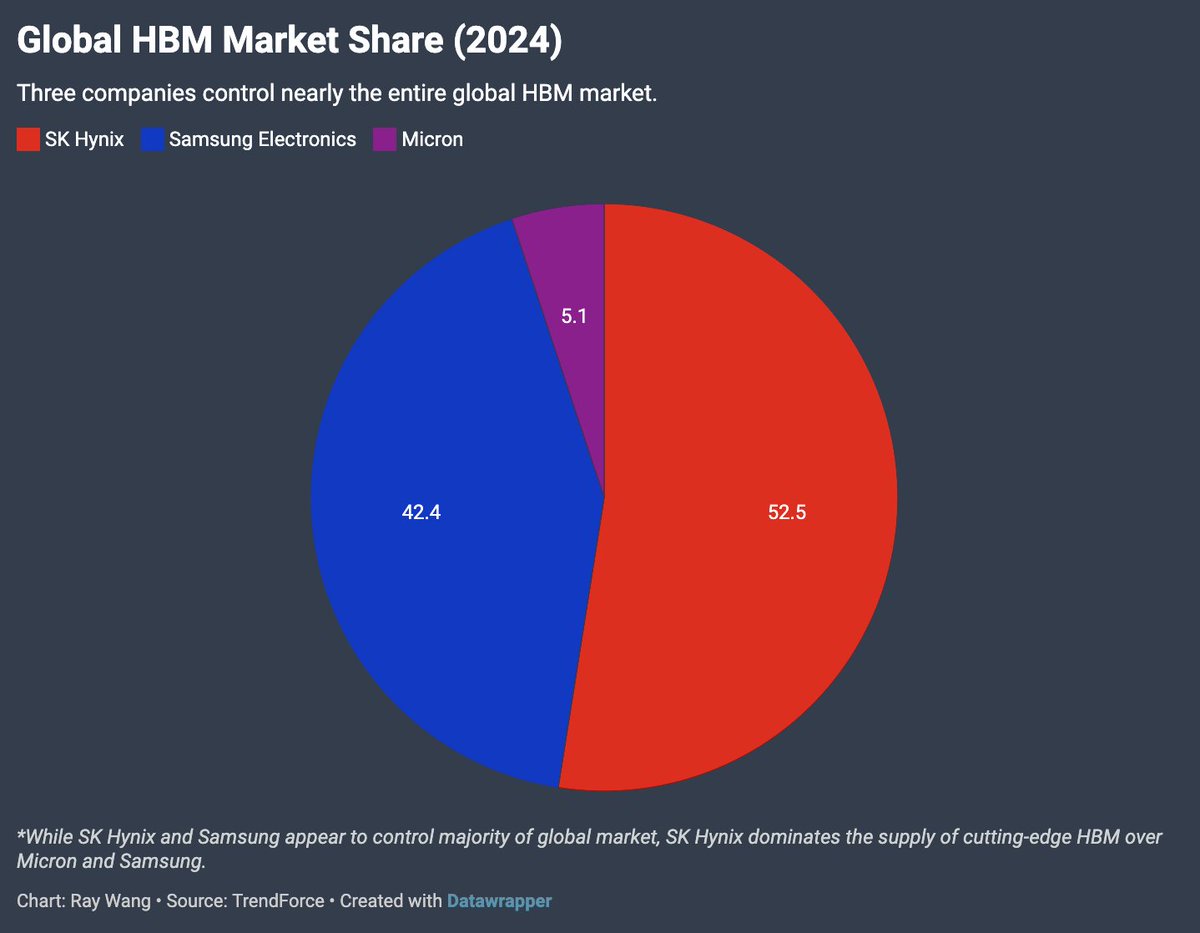

c. Section 232 semiconductor tariffs (this will likely announced in late July if not early August) are another key development to watch. Given that many consumer electronics and final assembly of AI servers are manufactured in China, higher Section 232 tariffs on Chinese imports would likely weigh on Chinese exporters and exert broader pressure on the Chinese economy.

d. Of course, similar to U.S., China certainly will welcome the visit of Trump in China or meeting with President Xi. But under what conditions will be key.

It is unclear what "deal" President Xi would like to achieve with Trump. But it is likely the lower tariffs will a key things to negotiate.

I might miss something here, but I will make some update in the future. Happy Friday.

*the graph below might not be the best one to show the presence of mentioned product, but I can address that later ~

a. Reducing U.S. tariffs rate on China. Of course, China has been quite tough toward U.S. sky-high tariffs since April 2, but there is little doubt that it does have impact to its economy. This should still be a priority to address.

b. Given export control on H20 has been lifted, it is not unlikely that Chinese counterparts asking more, which I personally think will be difficult given the compromises U.S. side have made.

c. Section 232 semiconductor tariffs (this will likely announced in late July if not early August) are another key development to watch. Given that many consumer electronics and final assembly of AI servers are manufactured in China, higher Section 232 tariffs on Chinese imports would likely weigh on Chinese exporters and exert broader pressure on the Chinese economy.

d. Of course, similar to U.S., China certainly will welcome the visit of Trump in China or meeting with President Xi. But under what conditions will be key.

It is unclear what "deal" President Xi would like to achieve with Trump. But it is likely the lower tariffs will a key things to negotiate.

I might miss something here, but I will make some update in the future. Happy Friday.

*the graph below might not be the best one to show the presence of mentioned product, but I can address that later ~

WSJ story: wsj.com/economy/trade/…

@UnrollHelper

• • •

Missing some Tweet in this thread? You can try to

force a refresh