How to get URL link on X (Twitter) App

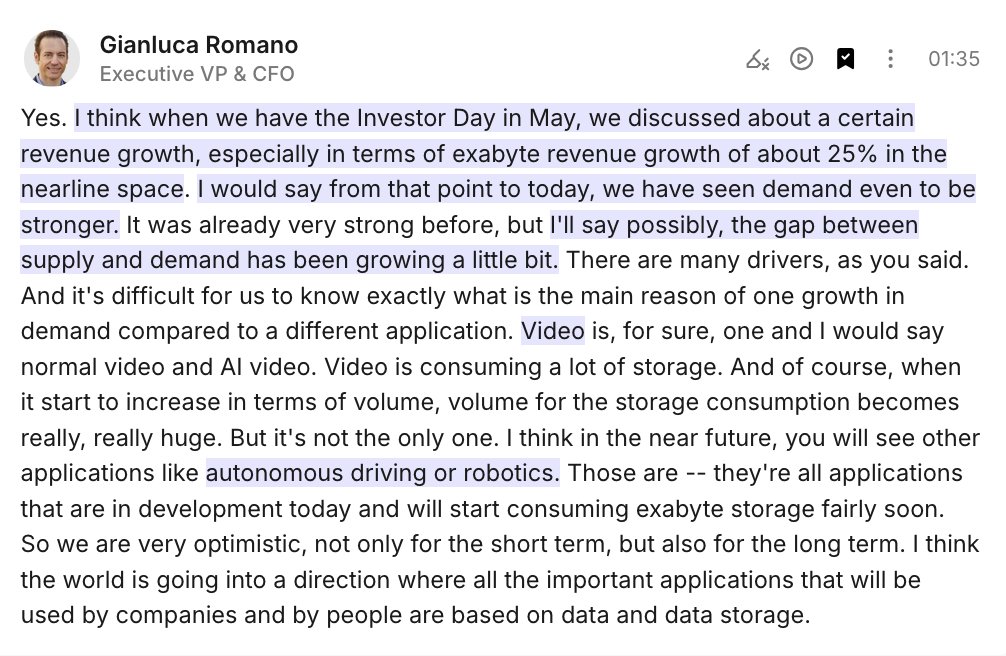

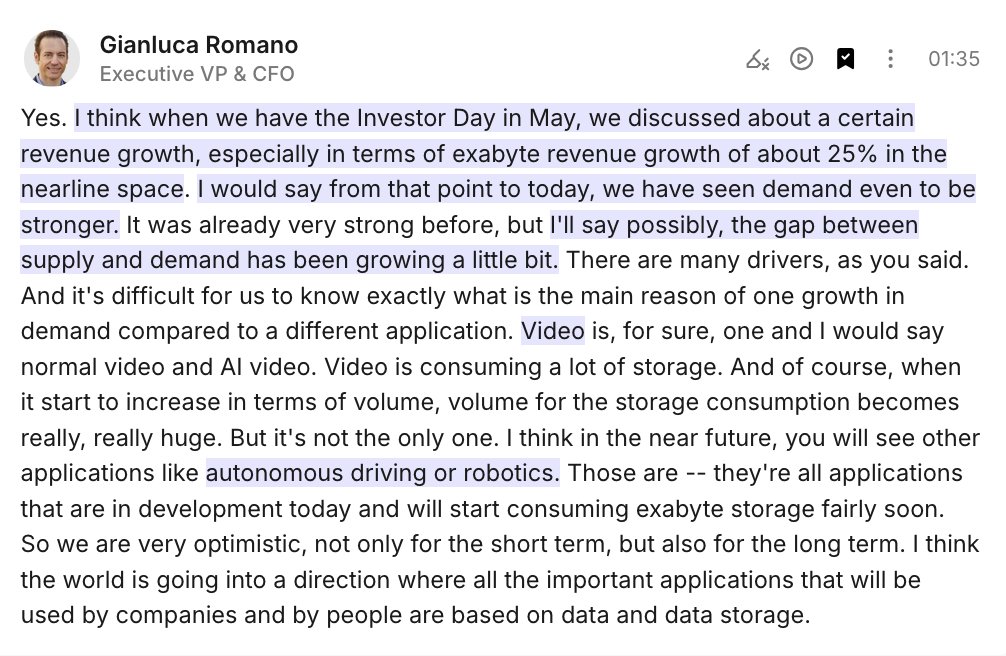

2) On capacity expansion, $STX does not see any reasons to do it, citing "the industry will generate enough exabyte capacity without increasing the unit to serve the short-term need of the data center."

2) On capacity expansion, $STX does not see any reasons to do it, citing "the industry will generate enough exabyte capacity without increasing the unit to serve the short-term need of the data center."

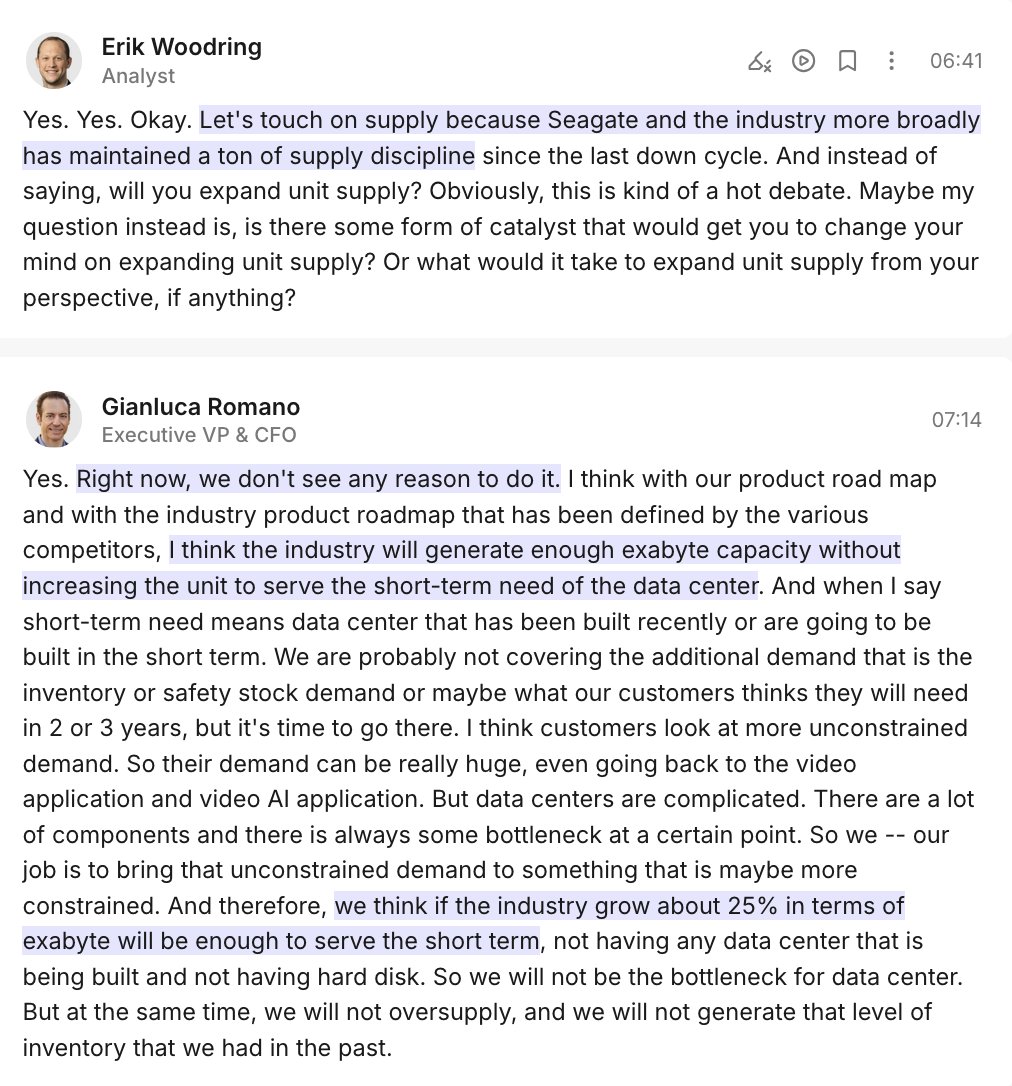

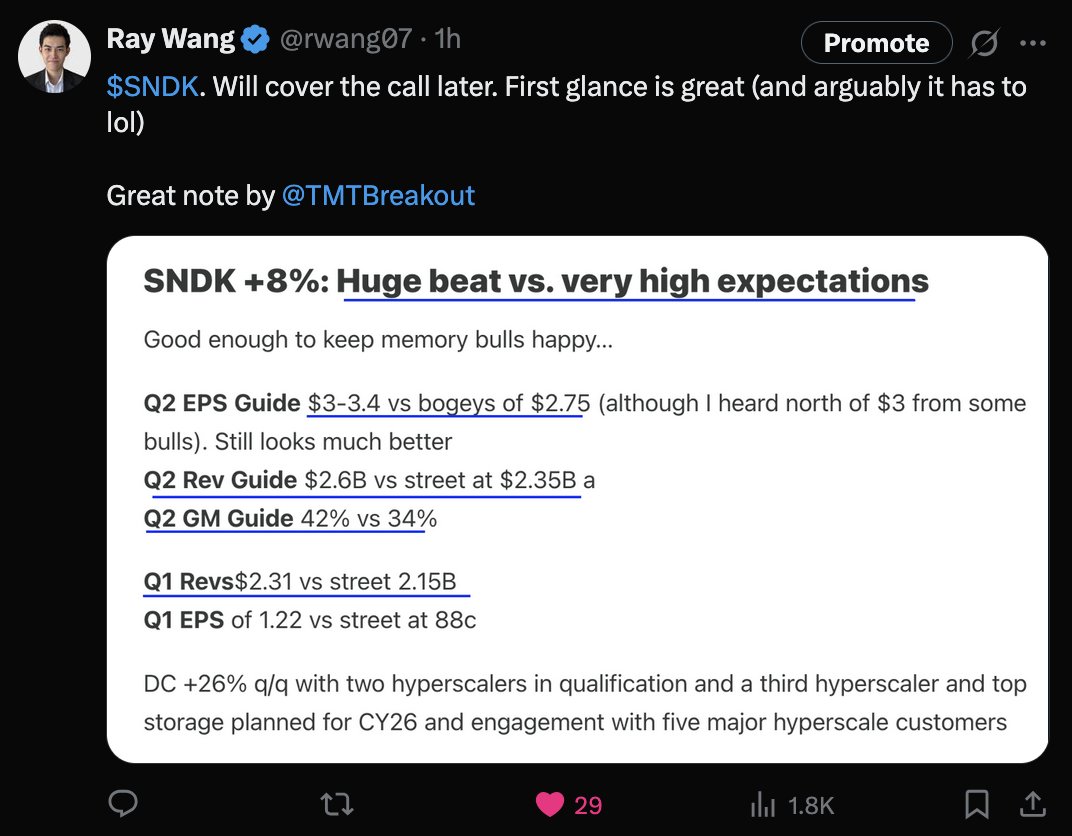

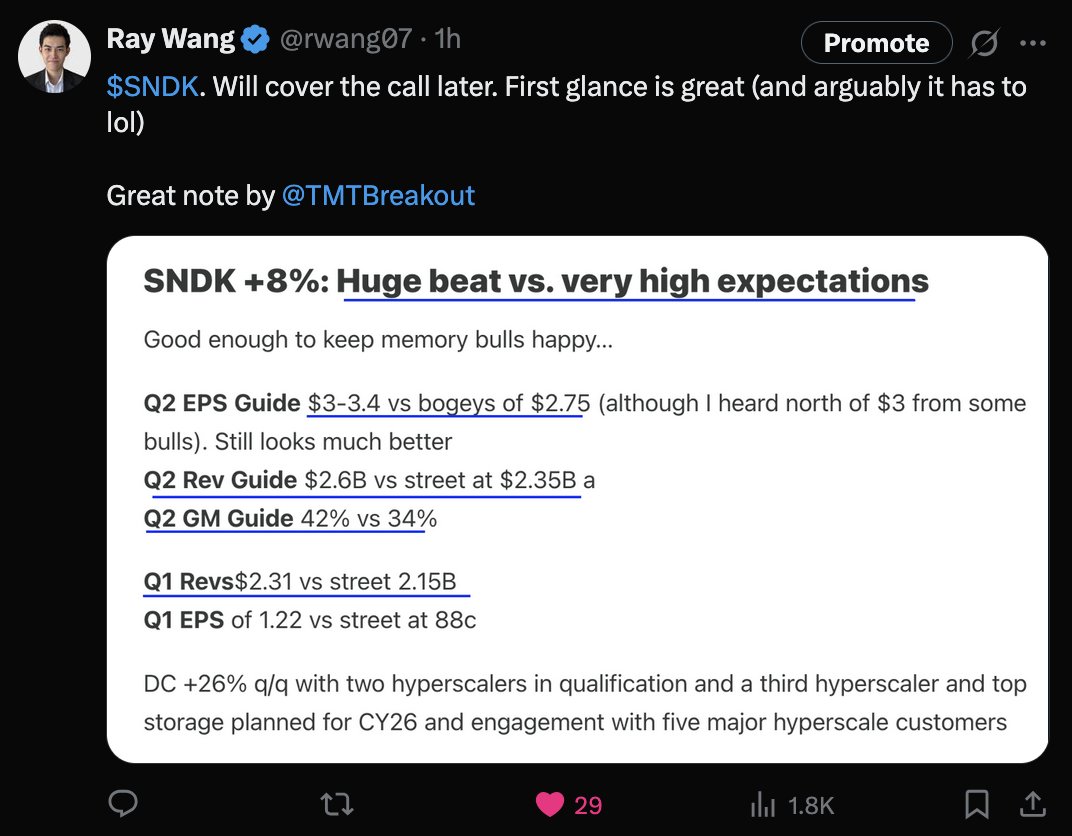

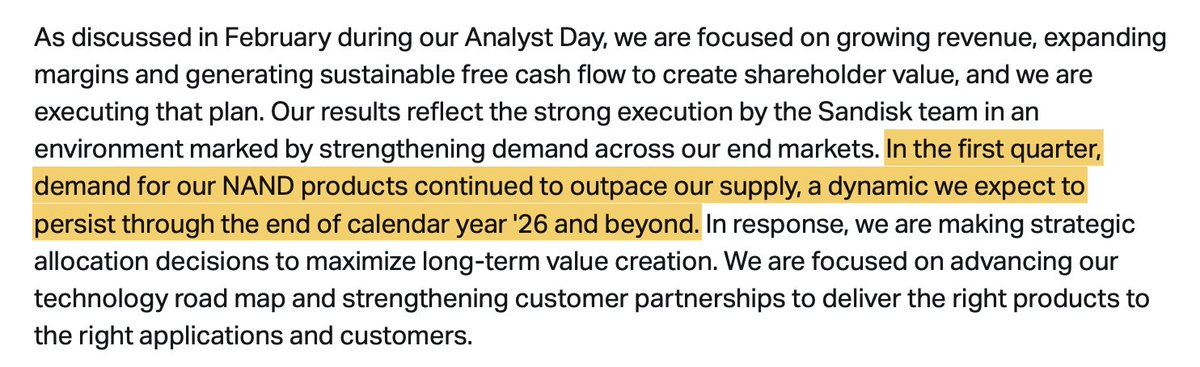

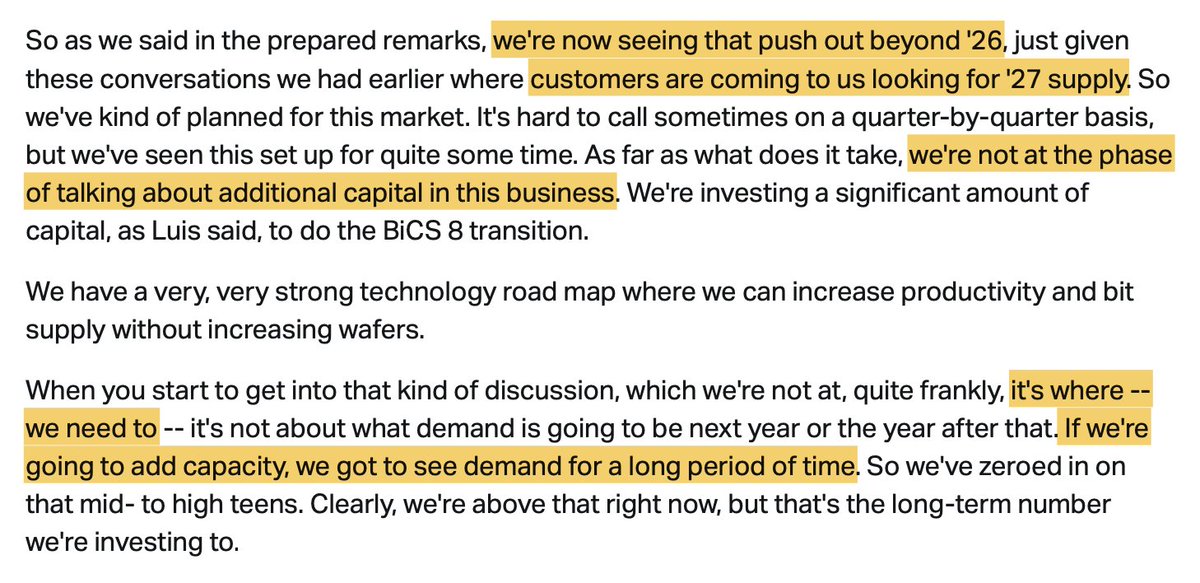

2) At a high level, it is increasingly a consensus that the NAND market is having imbalanced supply-demand dynamics. But not just this year, but also '26 (and potentially '27).

2) At a high level, it is increasingly a consensus that the NAND market is having imbalanced supply-demand dynamics. But not just this year, but also '26 (and potentially '27).

https://x.com/rwang07/status/1983334426647113740

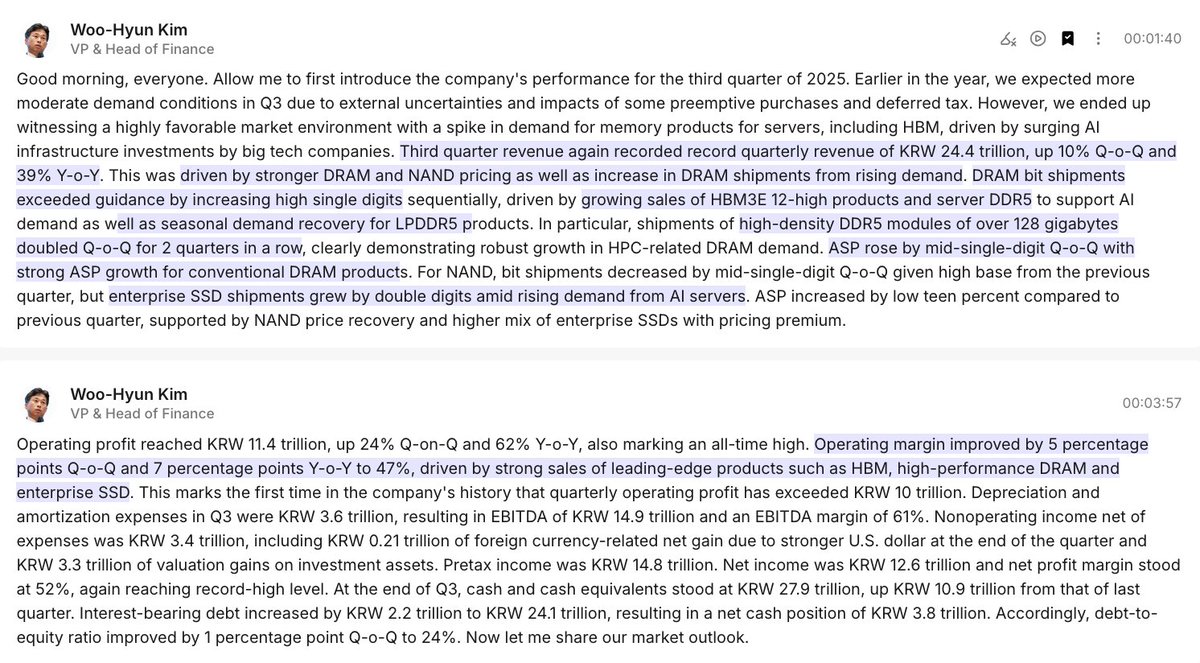

2) VP & Head of Finance Woo-Hyun Kim: "Third quarter revenue again recorded record quarterly revenue of KRW 24.4 trillion, up 10% QoQ and 39% YoY.

2) VP & Head of Finance Woo-Hyun Kim: "Third quarter revenue again recorded record quarterly revenue of KRW 24.4 trillion, up 10% QoQ and 39% YoY.

2) Yet, on the other hand, $CDNS management seem quite confident on its IP business, and in someway implying their IP business is in fact strengthened.

2) Yet, on the other hand, $CDNS management seem quite confident on its IP business, and in someway implying their IP business is in fact strengthened.

2) The token generation will be even further accelerate in Alibaba for a couple of reasons:

2) The token generation will be even further accelerate in Alibaba for a couple of reasons:

2) It is also later reported that two countries have "reach the deal" while did not disclose any details.

2) It is also later reported that two countries have "reach the deal" while did not disclose any details.

Some reference below

Some reference below

"Some of the people who have received the messages were so surprised they didn’t believe it was really Zuckerberg. One person assumed it was a hoax and didn’t respond for several days." /2

"Some of the people who have received the messages were so surprised they didn’t believe it was really Zuckerberg. One person assumed it was a hoax and didn’t respond for several days." /2

So before we dive in, let's start with a simple HBM 101 class—What is HBM?

So before we dive in, let's start with a simple HBM 101 class—What is HBM?

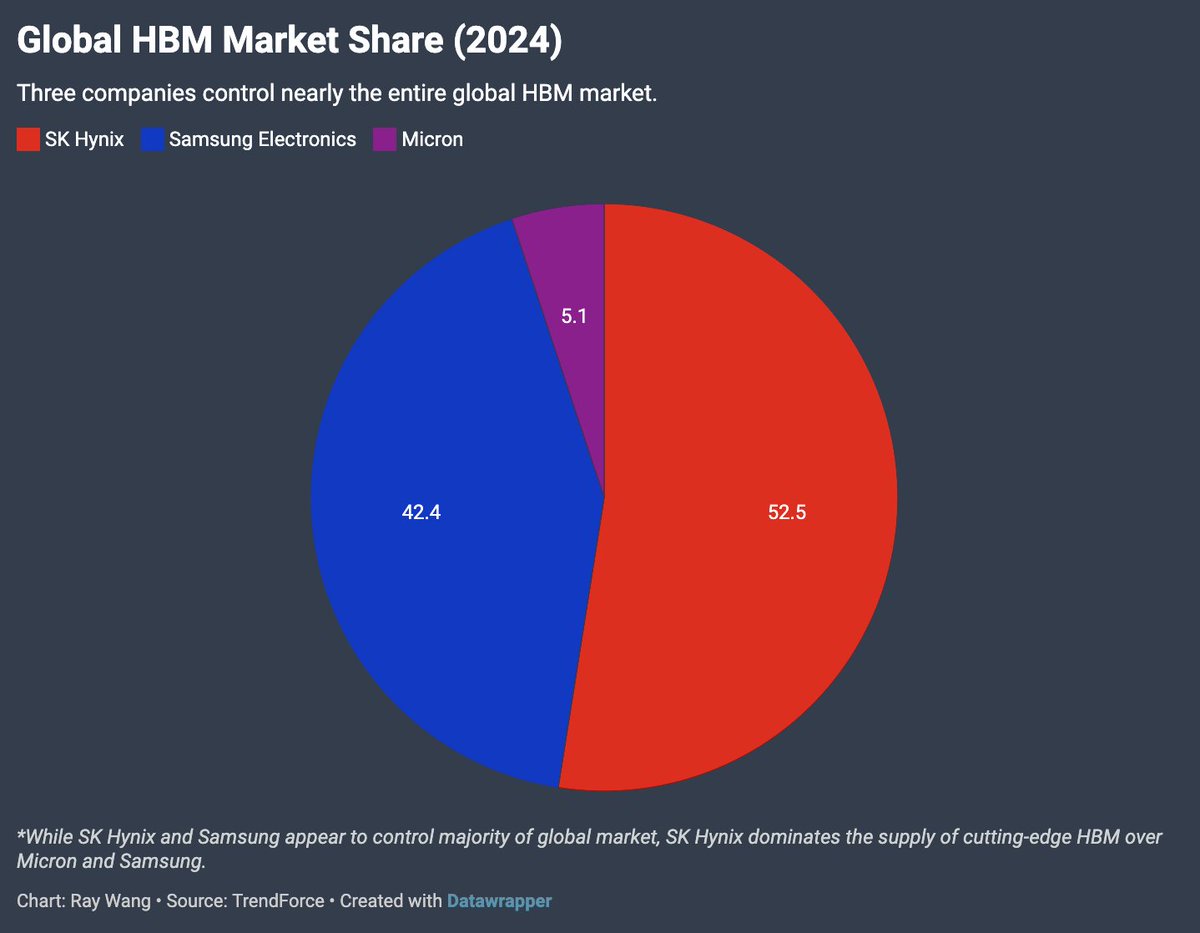

RECAP on Dec 2024 HBM rule and HBM Market:

RECAP on Dec 2024 HBM rule and HBM Market:

Morgan Stanley: "China's DeepSeek Moment" (March 2025). (2/3)

Morgan Stanley: "China's DeepSeek Moment" (March 2025). (2/3)