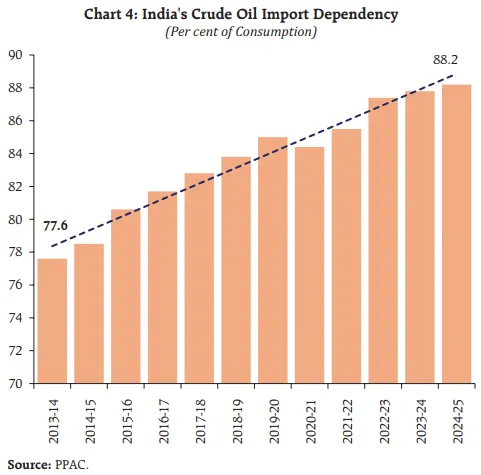

Here's something every Indian investor knows but few truly understand: we import 85% of our oil, making us incredibly vulnerable to global crude swings. But the RBI just released fascinating research on exactly how oil prices translate into inflation—and the answer might surprise you.🧵👇

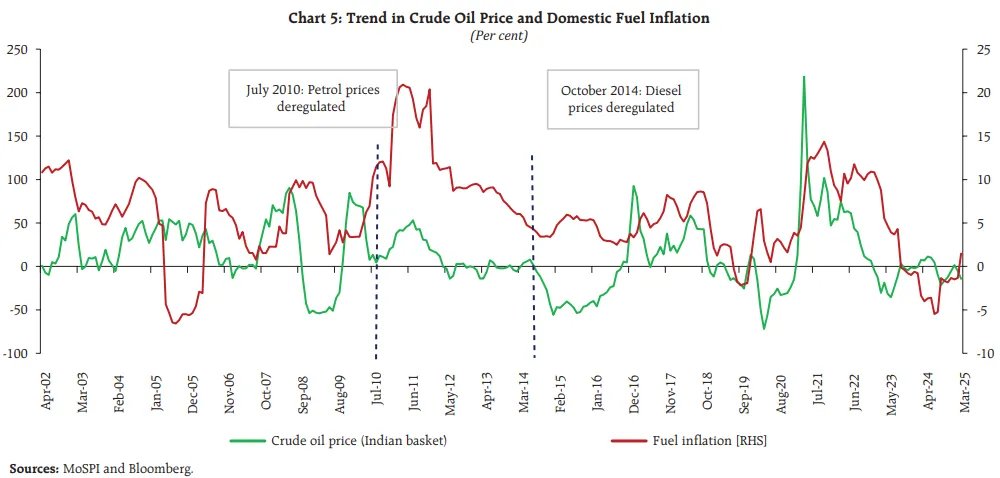

Oil price volatility has been wild recently. We've seen prices swing from $44/barrel during early pandemic days to $93/barrel in 2022-23, then back under $70 this year. For an economy like ours, this kind of churn should be devastating. But something interesting is happening.

The standard story seems simple: fuel takes up 9% of our retail inflation basket, so when crude prices rise, inflation follows. But there's a complex maze between crude oil sitting in the Gulf and the price you pay at your neighborhood petrol pump.

The "direct channel" works like this: refiners like Reliance don't just pay crude prices—they manage shipping, insurance, exchange rates, and hedging arrangements. Then they face operational costs and set "ex-refinery prices" that blend all these factors plus their profits.

Oil Marketing Companies like Bharat Petroleum then buy from refiners, add their own margins, and factor in what consumers can actually pay. They manage inventories to keep prices stable and often smooth out crude price wiggles. Your pump owner gets their cut too.

By the time you're filling your tank, you're seeing an amalgam of crude prices, hedging, logistics, technology costs, and multiple profit margins. The final number doesn't necessarily mirror crude prices—that's the "direct channel" at work.

But zoom out and there's the "indirect channel"—a complex mesh where everything in our economy runs on or is made from oil. When fuel prices rise, they pull up prices of everything else. Trucks hauling vegetables, factory generators, plastics, fertilizers—all become pricier.

Over weeks and months, businesses pass these costs to consumers. You slowly pay more for groceries, airline tickets, deliveries. While fuel costs hit first, eventually everything else follows. Oil is also traded in dollars, so higher oil prices weaken the rupee further.

As rupee weakens, importing the same barrel costs more rupees, magnifying crude spikes. Simultaneously, everything we import becomes more expensive. Businesses expecting sustained high oil prices raise prices preemptively. Workers demand higher wages.

What started as a fuel issue morphs into economy-wide inflation through this maze of second and third-order effects. The link between crude prices and inflation becomes weird—they rarely march in lockstep, with ripples playing out for months.

So what's the actual impact? The RBI's research boils it down to a simple thumb-rule: every 10% increase in oil prices lifts India's inflation by just 20 basis points—or 0.2%. That's surprisingly low compared to earlier literature suggesting 0.3-0.6%.

Part of this improvement comes from better monetary policy—the RBI doing a superior job projecting inflation, communicating intentions, and setting appropriate interest rates. But there's something else cushioning the blow.

Our oil import dependency has only worsened—from 78% a decade ago to over 88% now. The International Energy Agency projects our oil demand climbing by 1.2 million barrels daily. By 2030, we could become the world's biggest crude consumer as our economy grows.

This should make us complete "price takers" at the mercy of global oil markets that react violently to wars, sanctions, and economic fluctuations. Our economy should sway dramatically with global craziness. But it doesn't—economists call this "incomplete pass-through."

The government provides crucial insulation through taxes. When crude crashed in 2020, it raised taxes sharply—₹13/litre on petrol, ₹16 on diesel. Even with cheap oil, the government reaped benefits for emergency spending, though people weren't happy about this.

When prices surged in 2021, the government reversed course. November 2021 saw cuts of ₹5 on petrol, ₹10 on diesel. Then Russia-Ukraine war sent prices soaring, prompting May 2022 cuts of ₹8 on petrol, ₹6 on diesel—essentially rolling back COVID-era increases.

This tax policy fundamentally changed ground-level inflation perception. Even with rising crude prices, pump prices didn't rise proportionally. Our oil taxes became shock absorbers—behaving like insurance against volatility. That's why petrol didn't skyrocket last time oil did.

But the RBI warns: in an increasingly volatile world, our ability to soften these blows may be reaching limits. As oil dependency deepens and global markets get more chaotic, this insulation's cracks may show. The 0.2% thumb-rule may not hold forever.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/a-new-pillar…

All links here:thedailybrief.zerodha.com/p/a-new-pillar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh