Gaps, High Total Volume, High and Low TRIN readings, and short term Breadth Surges can signal at both market bottoms and tops. (See academia.edu/18668085/Bound…

miltonberg.com

miltonberg.com

In our recent reports we have listed extremely low TRIN levels as well as potential exhaustive upside gaps as signs of an impending market peak.

The S&P 500 and NASDAQ closed at new all-time highs. Yet, the S&P 600 declined -1.58% on the day. 3-day NASDAQ volume was highest in history. (We exclude option expiration days and rebalancing days from the data). 5-day NASDAQ volume was highest in history.

NASDAQ has traded above its 5-day average for 23 consecutive days. NASDAQ TRIN closed at a near historic low 0.22. This is the 3rd lowest reading in history.

High volume is an important signal of a turning point. For example in 1987 two weeks and -1.03% before the final peak, the S&P 500 and NASDAQ both generated record volume.

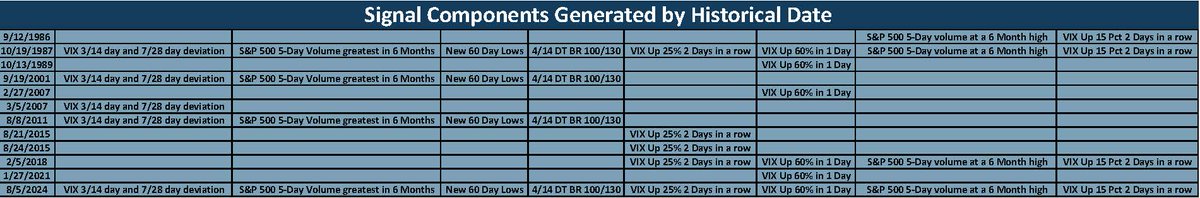

When high volume is generated in combination with standard market indicators it often generates precise and robust signals.

There has never been a day in history when NASDAQ 3-day and 5-day volume were at records and VIX deviation from its 20 day average was as low as it was yesterday.

There has never been a day in history when NASDAQ traded above its 5-day average for 23 days and TRIN traded at 0.30 or lower.

There has never been a day in history when NASDAQ traded above its 5-day average for 23 days and 3-day volume or 5-day was at a record.

There has never been a day in history when NASDAQ traded above its 5-day average for 23 days and 3-day volume or 5-day was at a record.

On January 27, 2021, NASDAQ 5-day volume was greatest in 200 days, and NASDAQ TRIN closed below 0.30. The speculative mania then in effect peaked two-weeks later on February 12 when the infamous ARKK (ARK Innovative ETF) peaked and declined -81.07%.

Renaissance IPO Equity ETF peaked as well and declined -68.76%. (The broad market continued higher.)

Again, January 7, 2025, NASDAQ 5-day volume was greatest in 200 days, NASDAQ TRIN closed below 0.30, NASDAQ had peaked on December 16 and was churning at the top. It held near the high until February 19 and then declined in its Bear market.

NASDAQ has gained 17 of 21 days. NDX is at an all-time high. Similar action, on June 13, 1990, January 14, 1994, July 31, 1997, July 15, 1998, August 28, 2018 and July 10, 2024 were followed by declines in the S&P 500 of -19.03%, -7.57%, -8.10%, -18.51%, -18.85% and -7.94%.

The combination of record volume, low TRIN, gaps into a high, divergences at the highs VIX deviation, upside streaks double tops (BKX on a long term basis S&P 500 and NASDAQ on a 5-7 month basis), which may suggest caution

Our trading model for our retail newsletter has been positioned 100% long VOO since April 8. Our institutional Clients have been offered more nuanced long, leveraged long and sector exposure.

• • •

Missing some Tweet in this thread? You can try to

force a refresh