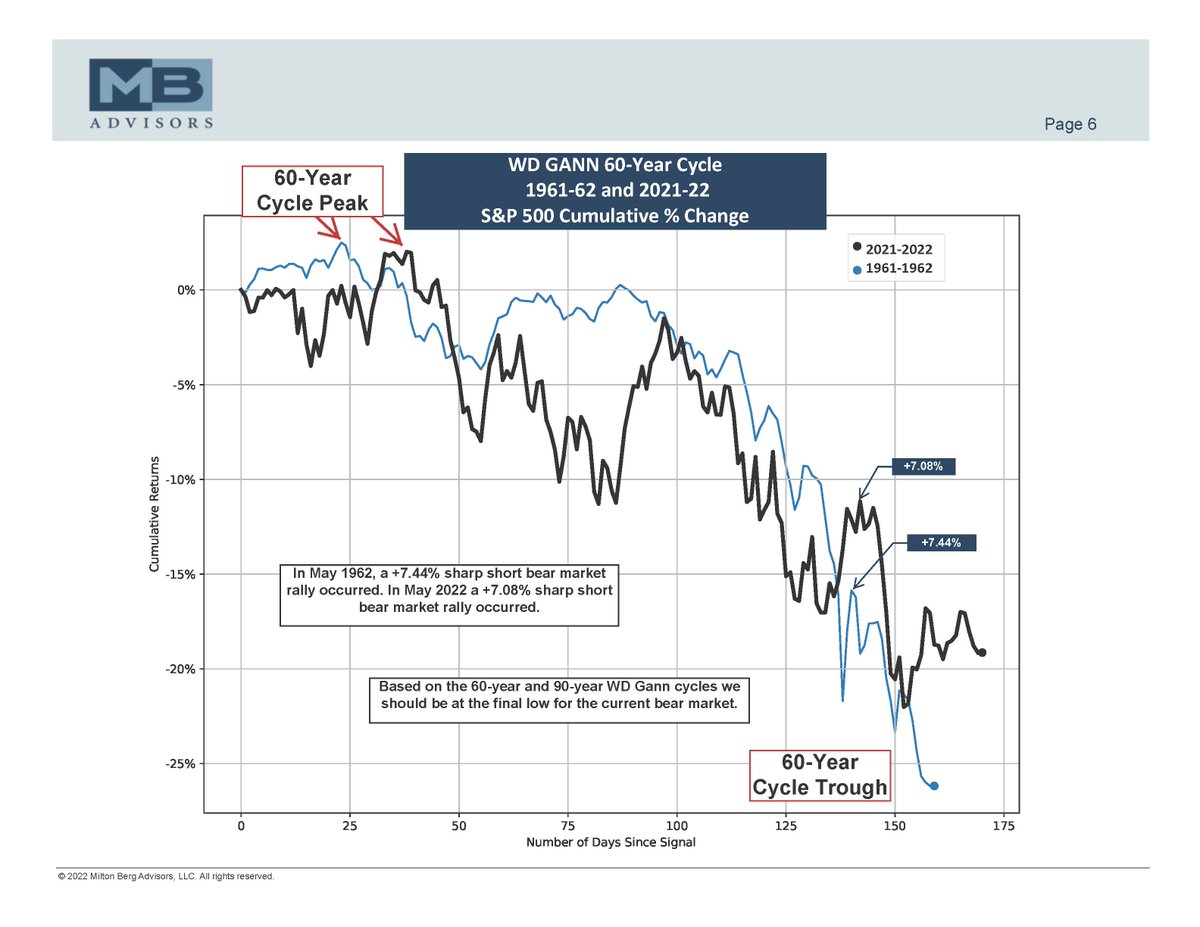

MB Advisors Institutional Research

info@miltonberg.com

https://t.co/DLmwNx0gBU

"Milton Berg's

Guide to Technical Analysis and the Stock Market"

Target 2025

11 subscribers

How to get URL link on X (Twitter) App