In 1822, Gregor MacGregor pulled off the greatest scam in history.

He invented a fake country, sold 8 million acres of it, and convinced hundreds to move there.

Here’s the unbelievable story of the greatest con artist ever:

He invented a fake country, sold 8 million acres of it, and convinced hundreds to move there.

Here’s the unbelievable story of the greatest con artist ever:

History is full of scams, but few can match the audacity of Gregor MacGregor, a Scottish conman who sold an entire fake country to unsuspecting investors in the 1820s.

Born in Scotland in 1786, MacGregor’s early life was steeped in ambition and manipulation.

Born in Scotland in 1786, MacGregor’s early life was steeped in ambition and manipulation.

He bought his way up the ranks of the British Army, using his first wife’s wealth.

After leaving the army, MacGregor fabricated stories about his military service, claiming connections with nobility and exaggerating his achievements.

After leaving the army, MacGregor fabricated stories about his military service, claiming connections with nobility and exaggerating his achievements.

Despite his royal reputation, MacGregor found himself cut off from wealth after his wife’s death.

That’s when he set his sights on a grander scheme.

That’s when he set his sights on a grander scheme.

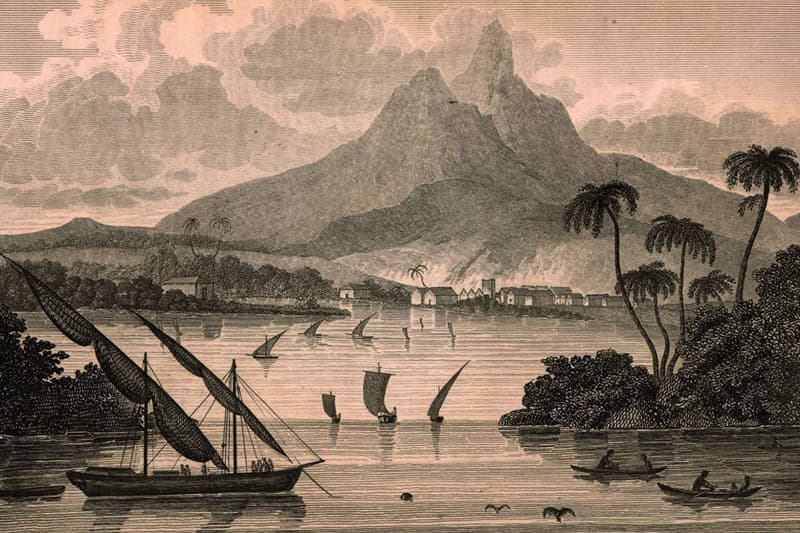

After relocating to Latin America and marrying money again, MacGregor managed to acquire a document granting him tribal land in present-day Honduras and Nicaragua.

In exchange for some rum and jewelry, he secured 8 million acres.

In exchange for some rum and jewelry, he secured 8 million acres.

But here’s the catch:

- The land was uninhabitable and barren.

- The title was symbolic and had no real legal authority.

Still, MacGregor returned to Britain claiming to be the “Prince of Poyais,” a sovereign leader of a fertile, gold-rich country on the South American coast.

- The land was uninhabitable and barren.

- The title was symbolic and had no real legal authority.

Still, MacGregor returned to Britain claiming to be the “Prince of Poyais,” a sovereign leader of a fertile, gold-rich country on the South American coast.

MacGregor knew that selling a fantasy required more than just words.

He created a fully fleshed-out “country” to sell his scam:

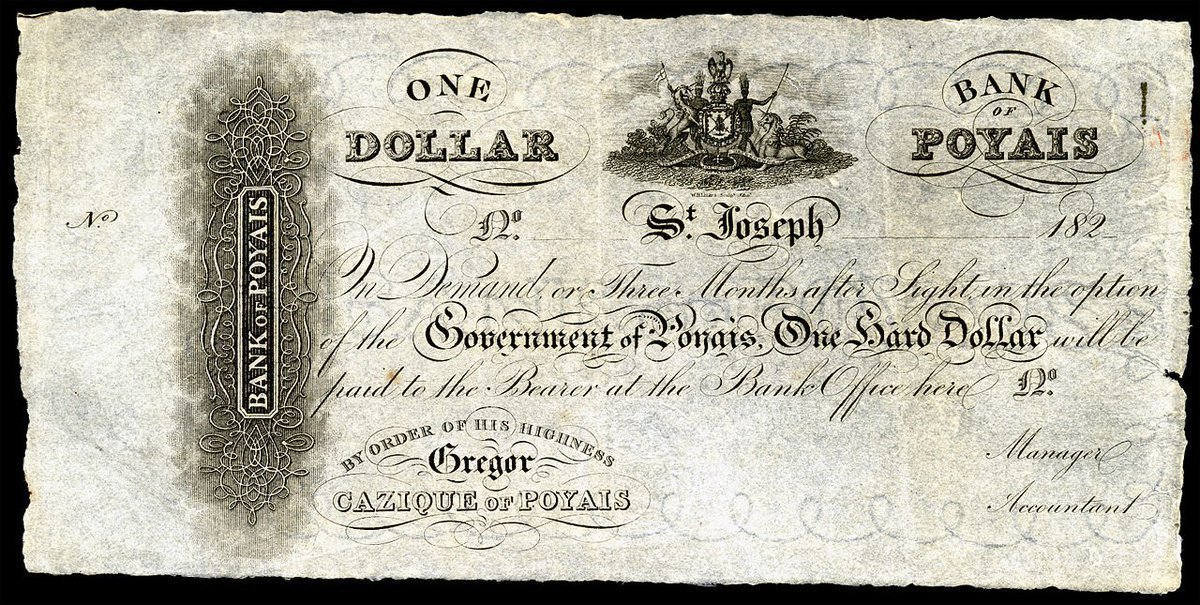

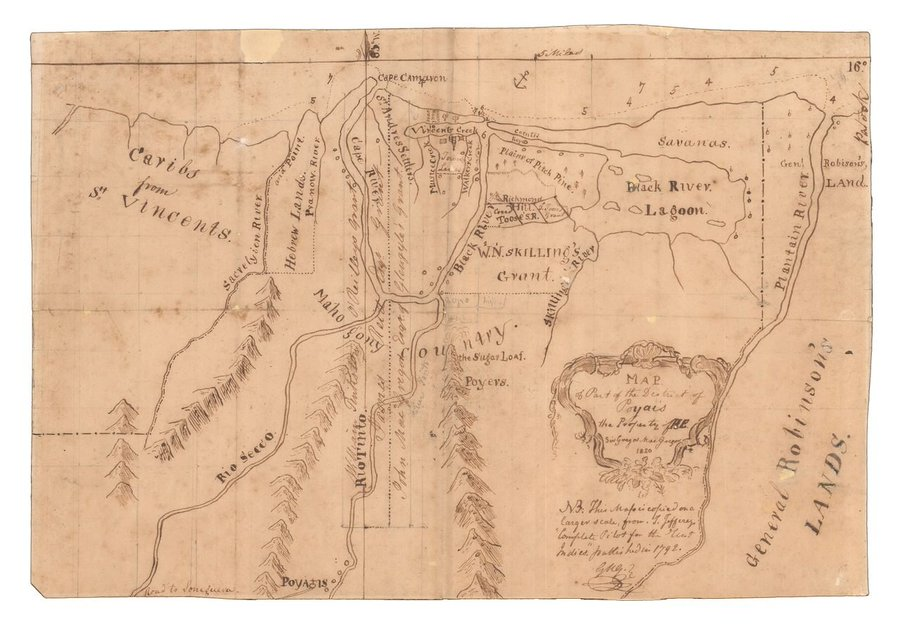

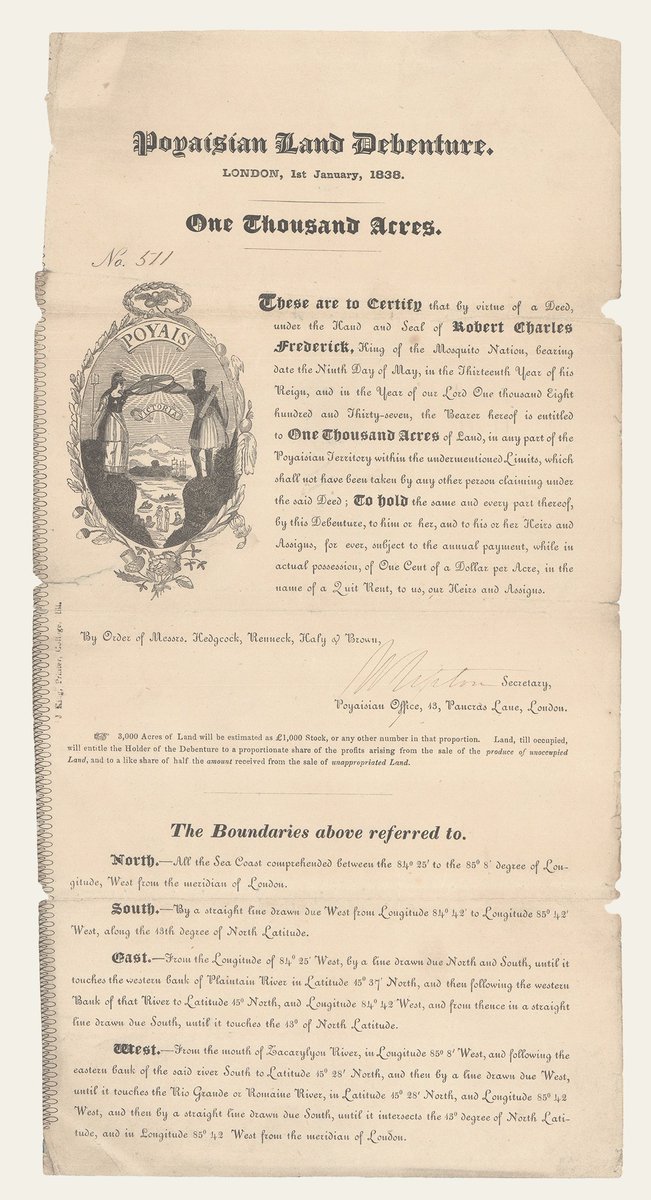

1. He crafted detailed maps, designed a flag, and even minted a fictional currency for Poyais.

He created a fully fleshed-out “country” to sell his scam:

1. He crafted detailed maps, designed a flag, and even minted a fictional currency for Poyais.

2. A book describing the paradise of Poyais was circulated widely, written under a pseudonym by MacGregor himself.

3. British newspapers published stories about Poyais’ resources and potential.

3. British newspapers published stories about Poyais’ resources and potential.

Investors and settlers lured by promises of gold, fertile land, and modern infrastructure were eager to believe in this utopia.

MacGregor didn’t stop at scamming investors; he convinced settlers to move to Poyais.

MacGregor didn’t stop at scamming investors; he convinced settlers to move to Poyais.

Hundreds sold everything they owned to join the first voyage, some even converting their savings to fake Poyais currency.

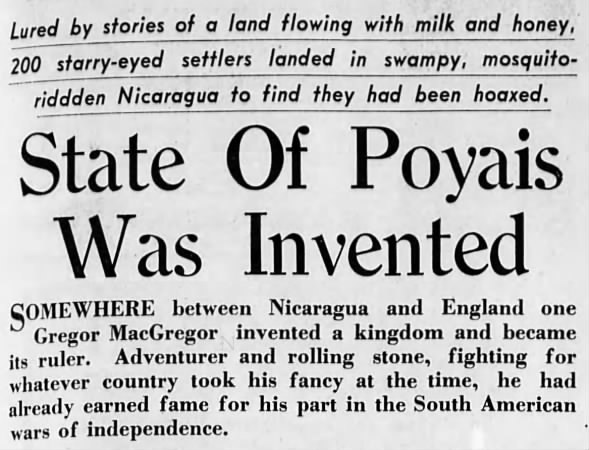

When settlers arrived, they found nothing but jungle and swamp.

Without proper shelter or supplies, many died due to starvation, disease, and exhaustion.

When settlers arrived, they found nothing but jungle and swamp.

Without proper shelter or supplies, many died due to starvation, disease, and exhaustion.

By 1823, the truth about Poyais began to unravel.

Newspapers warned the public, and British authorities intervened to stop further voyages.

MacGregor fled to France but continued the scheme there until French authorities jailed him.

Newspapers warned the public, and British authorities intervened to stop further voyages.

MacGregor fled to France but continued the scheme there until French authorities jailed him.

MacGregor’s scam was unprecedented in scale and impact:

- Investors lost millions in today’s terms.

- Settlers paid the ultimate price for trusting MacGregor’s lies.

- Investors lost millions in today’s terms.

- Settlers paid the ultimate price for trusting MacGregor’s lies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh