[1/🧵] You've probably heard about new yield opportunities with XRP that promise a return of around 20% APY. 🧐

How much truth is there to this, and what happens if you actually connect to @moremarketsxyz and deposit funds? 👇

How much truth is there to this, and what happens if you actually connect to @moremarketsxyz and deposit funds? 👇

[2/14] — 1⃣ First things first —

👉 I want you to repeat after me:

"I will not deposit all my XRP into completely new DeFi protocols right after their launch, no matter the yield"

👉 I want you to repeat after me:

"I will not deposit all my XRP into completely new DeFi protocols right after their launch, no matter the yield"

[3/14] — 2⃣ First things first —

When you join any DeFi protocol, start with very small amounts (e.g., 1 XRP) to get a feel for how things work, and try to regularly withdraw everything to test whether you can realize your profits with the protocol or not. 👍

When you join any DeFi protocol, start with very small amounts (e.g., 1 XRP) to get a feel for how things work, and try to regularly withdraw everything to test whether you can realize your profits with the protocol or not. 👍

[4/14] — 1⃣ The Promise —

If you look around on X, you'll see that many people believe that MoreMarkets offers a return of around 20%. 😑

This is because noone has tried to actually connect to the platform and have misinterpreted this statement. 👇

If you look around on X, you'll see that many people believe that MoreMarkets offers a return of around 20%. 😑

This is because noone has tried to actually connect to the platform and have misinterpreted this statement. 👇

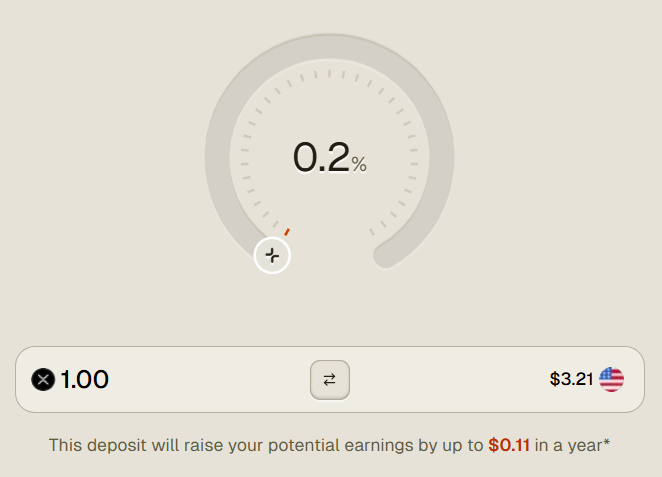

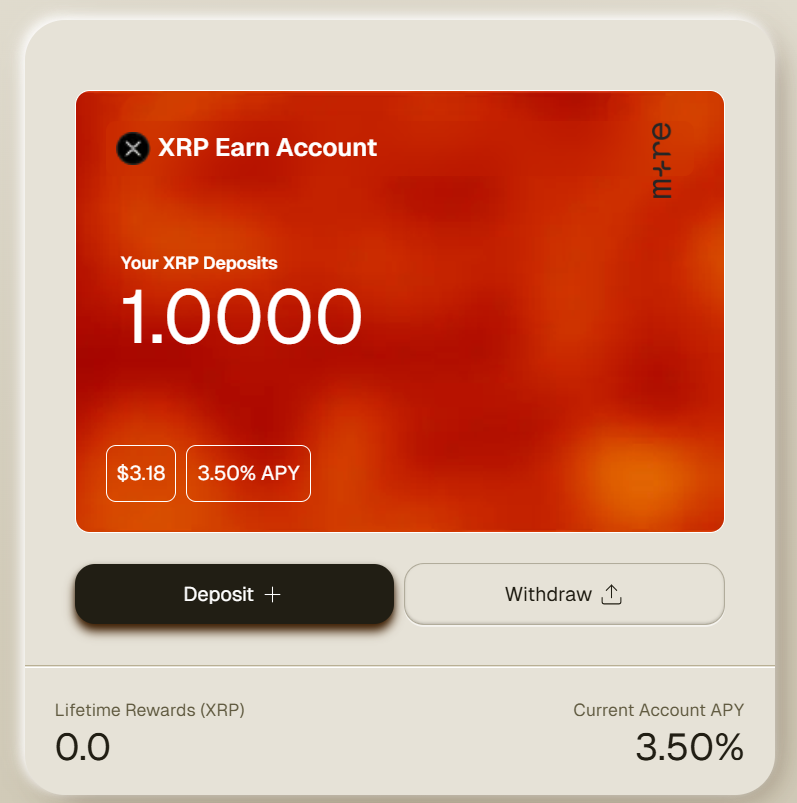

[5/14] — 2⃣ The Promise —

If you look on their homepage or care to connect to their platform to check out their service, you'll quickly see that the real yield that is currently offered is ...

🔸 3.5% APY 🧐

If you look on their homepage or care to connect to their platform to check out their service, you'll quickly see that the real yield that is currently offered is ...

🔸 3.5% APY 🧐

[6/14] — 1⃣ Under the hood —

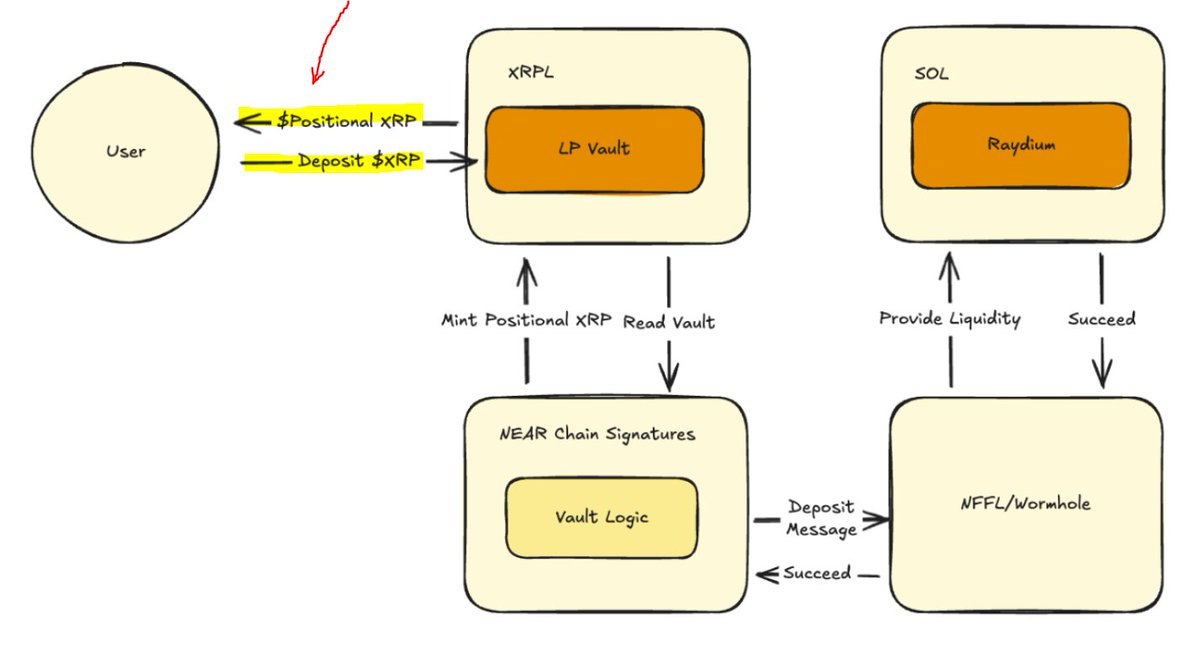

The idea is that you deposit funds into their vault account, which is then managed and deployed into various dApps on foreign blockchains to generate returns that you can claim at any time.

So far so good. 🧐

The idea is that you deposit funds into their vault account, which is then managed and deployed into various dApps on foreign blockchains to generate returns that you can claim at any time.

So far so good. 🧐

[7/14] — 2⃣ Under the hood —

The tricky part is that when you deposit your funds, you're offered a representative asset, a so-called "$Positional XRP" token.

It exists so that your accrued value on other blockchains is always taken into account when withdrawing your position.

The tricky part is that when you deposit your funds, you're offered a representative asset, a so-called "$Positional XRP" token.

It exists so that your accrued value on other blockchains is always taken into account when withdrawing your position.

[8/14] — 3⃣ Under the hood —

Yes, you guessed it: neither the locked XRPs nor your position or deployed capital across chains are insured in any way. (yet? 🥲)

So if something happens to the XRPL vault account, for example, it's a total loss. 🫤

Yes, you guessed it: neither the locked XRPs nor your position or deployed capital across chains are insured in any way. (yet? 🥲)

So if something happens to the XRPL vault account, for example, it's a total loss. 🫤

[9/14] — 4⃣ Under the hood —

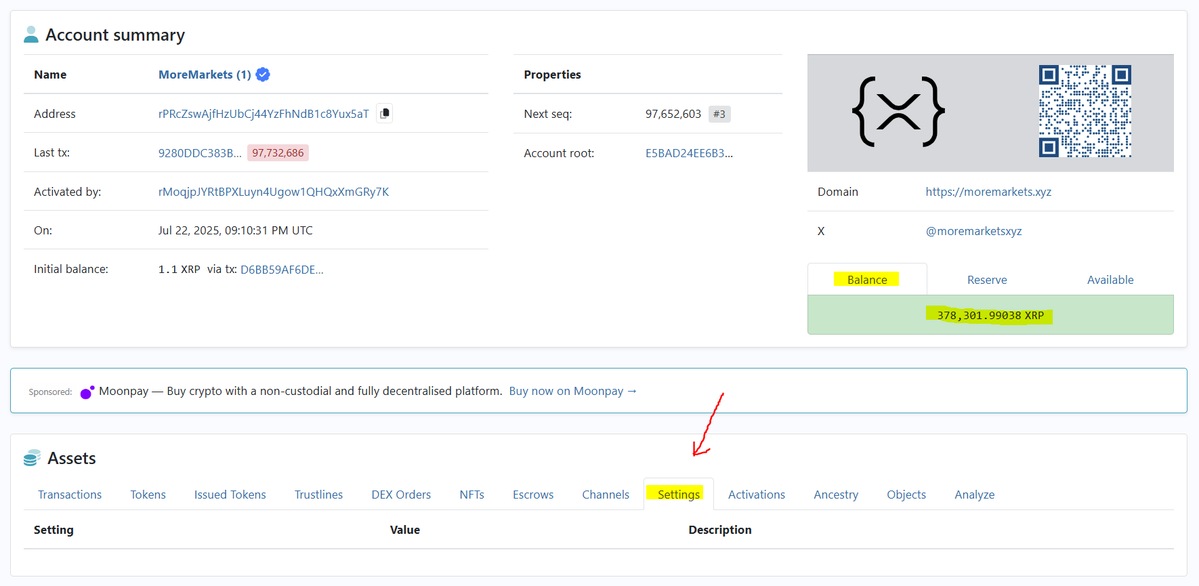

If you now ask yourself if the XRPL vault account has multi-signature configured ...

... Nope. Not yet. ☹️

👉 The docs mentions the MPC protocol, but it doesn't read like it's used for the XPRL vault as well (?) (Please correct me if I'm wrong!)

If you now ask yourself if the XRPL vault account has multi-signature configured ...

... Nope. Not yet. ☹️

👉 The docs mentions the MPC protocol, but it doesn't read like it's used for the XPRL vault as well (?) (Please correct me if I'm wrong!)

[10/14] — 5⃣ Under the hood —

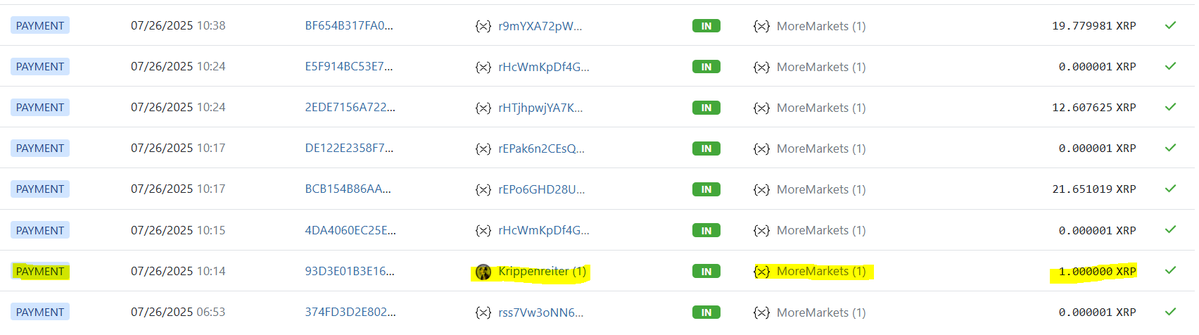

Currently, when you deposit XRPs into their vault, it's just a payment transaction to their address.

I haven't got any $Positional XRP tokens yet, which, I suppose, is because we're still in the "pre-deposits phase". (Funds are locked for 2 weeks)

Currently, when you deposit XRPs into their vault, it's just a payment transaction to their address.

I haven't got any $Positional XRP tokens yet, which, I suppose, is because we're still in the "pre-deposits phase". (Funds are locked for 2 weeks)

[11/14] — Terms of Service —

Another aspect I tried was depositing XRP while my US-based VPN was activated, i.e., using their service while connecting via a US IP address.

The platform allows it, even though it shouldn't be possible. ☹️

Another aspect I tried was depositing XRP while my US-based VPN was activated, i.e., using their service while connecting via a US IP address.

The platform allows it, even though it shouldn't be possible. ☹️

[12/14] — Summary —

🔸 The early days are rough, and there are red flags that could easily be fixed in a day.

What bothers me the most is:

🔸 The yield is once again way too low.

🔸 The capital you put in isn't even insured against a premium in the form of a fee.

🔸 The early days are rough, and there are red flags that could easily be fixed in a day.

What bothers me the most is:

🔸 The yield is once again way too low.

🔸 The capital you put in isn't even insured against a premium in the form of a fee.

[13/14] — Krippenreiter —

I write about DLT and crypto, but primarily about XRP and the XRPL-ecosystem. 🔥

If this interests you and you want to learn more, please follow me here:

@krippenreiter

Feel free to contribute by sharing here 👇

I write about DLT and crypto, but primarily about XRP and the XRPL-ecosystem. 🔥

If this interests you and you want to learn more, please follow me here:

@krippenreiter

Feel free to contribute by sharing here 👇

https://x.com/krippenreiter/status/1949095165861216698

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh