Mastering Bollinger Bands – From Beginner to Pro 🧵

You’ve seen the upper & lower bands on charts…

But did you know Bollinger Bands can reveal:

✅ Volatility traps

✅ Breakout zones

✅ Smart Money entries

✅ Mean reversion setups

✅ Options scalping triggers?

Let’s break it all down 👇

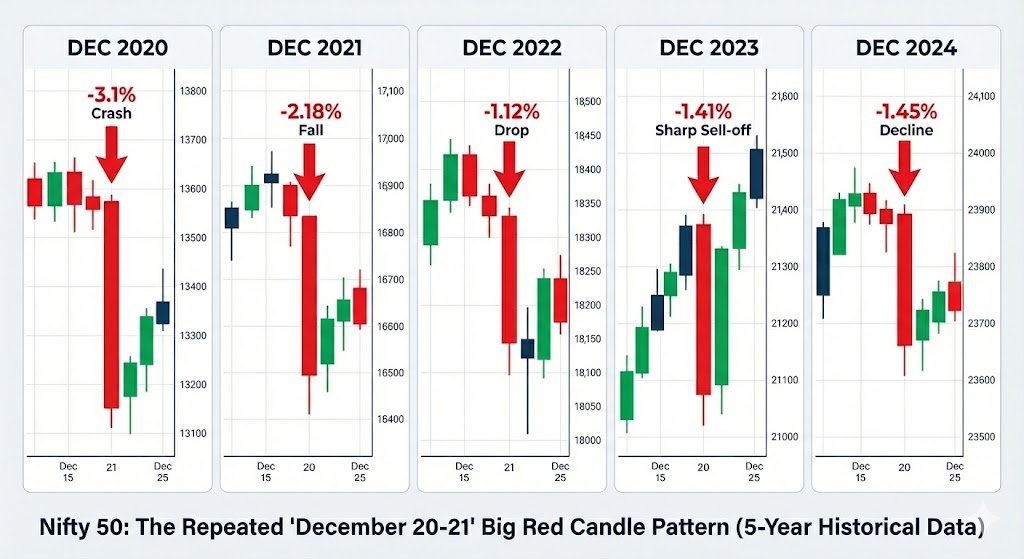

#niftycrash

You’ve seen the upper & lower bands on charts…

But did you know Bollinger Bands can reveal:

✅ Volatility traps

✅ Breakout zones

✅ Smart Money entries

✅ Mean reversion setups

✅ Options scalping triggers?

Let’s break it all down 👇

#niftycrash

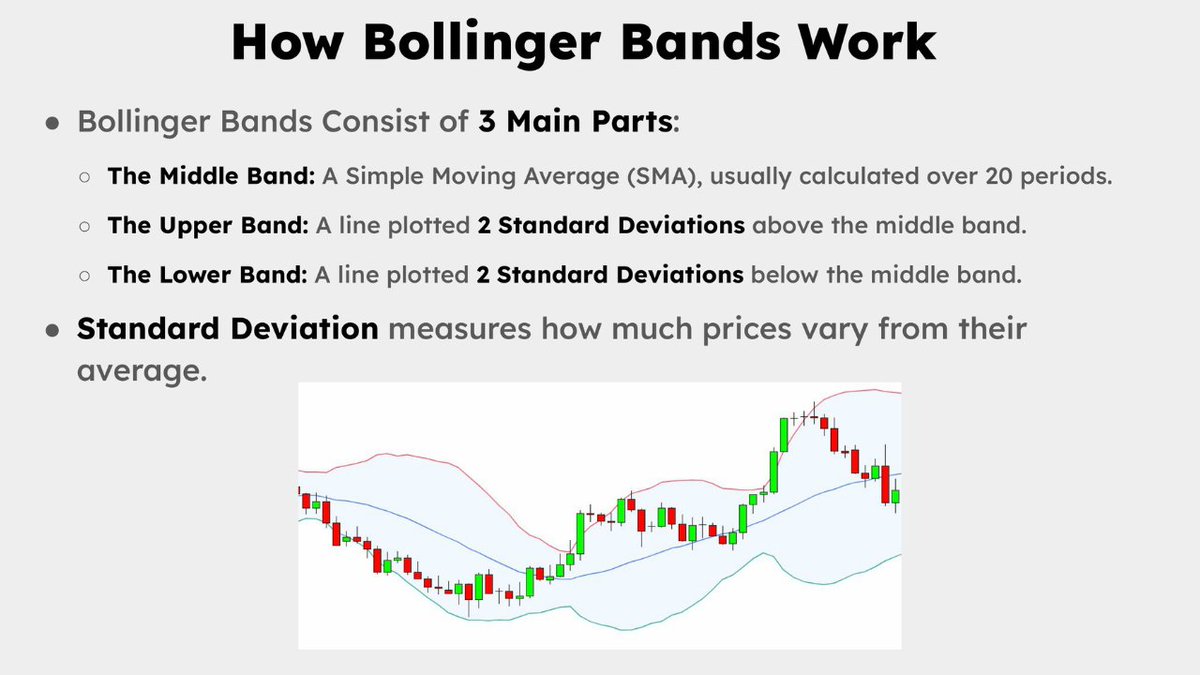

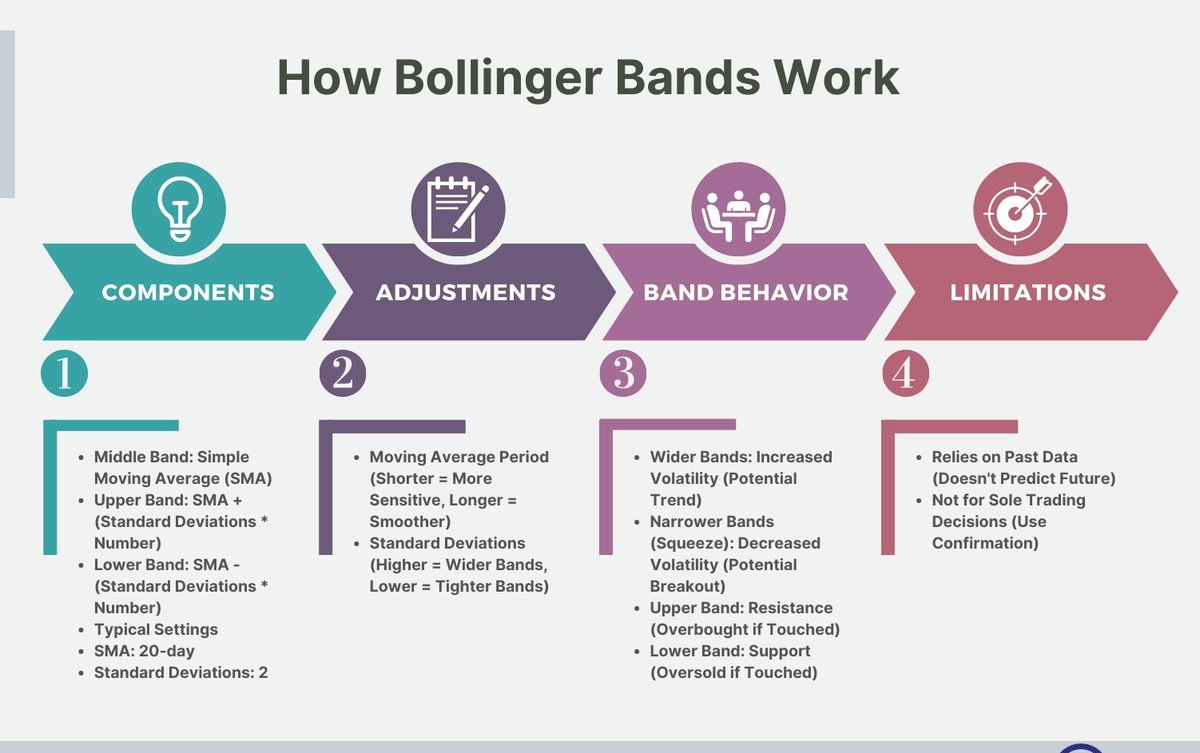

1) What Are Bollinger Bands?

Bollinger Bands consist of 3 lines:

Middle Band: 20-period Simple Moving Average (SMA)

Upper Band: SMA + 2 standard deviations

Lower Band: SMA - 2 standard deviations

📌 They show volatility & extremes in price

Think of them as volatility boundaries

Bollinger Bands consist of 3 lines:

Middle Band: 20-period Simple Moving Average (SMA)

Upper Band: SMA + 2 standard deviations

Lower Band: SMA - 2 standard deviations

📌 They show volatility & extremes in price

Think of them as volatility boundaries

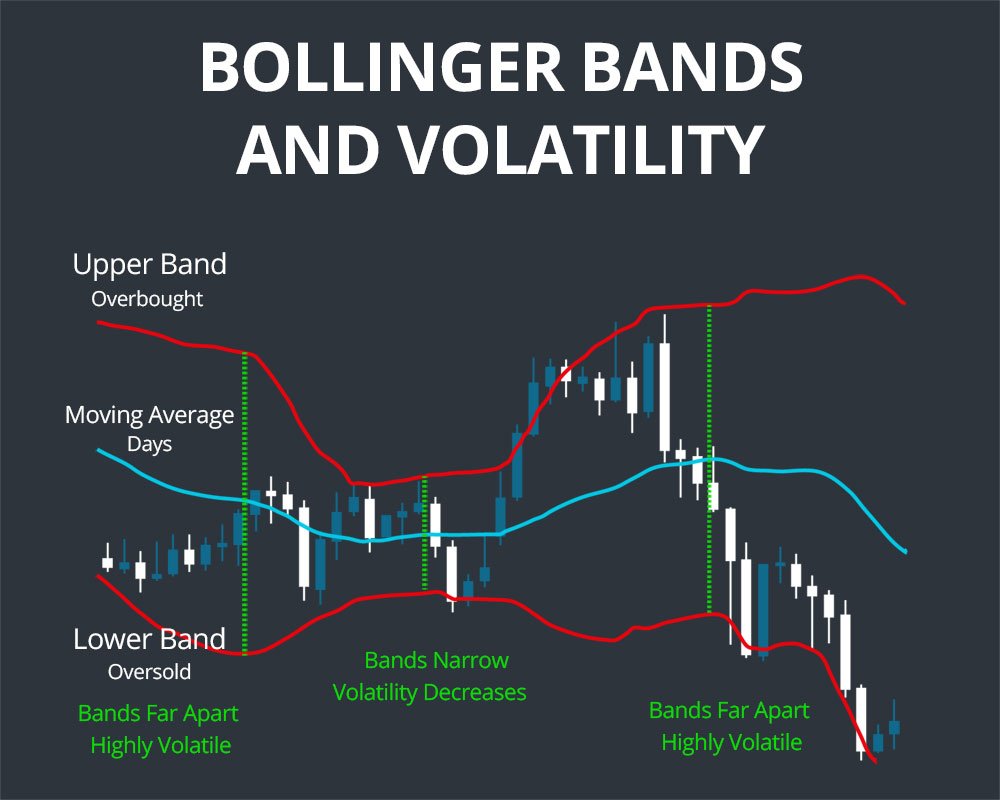

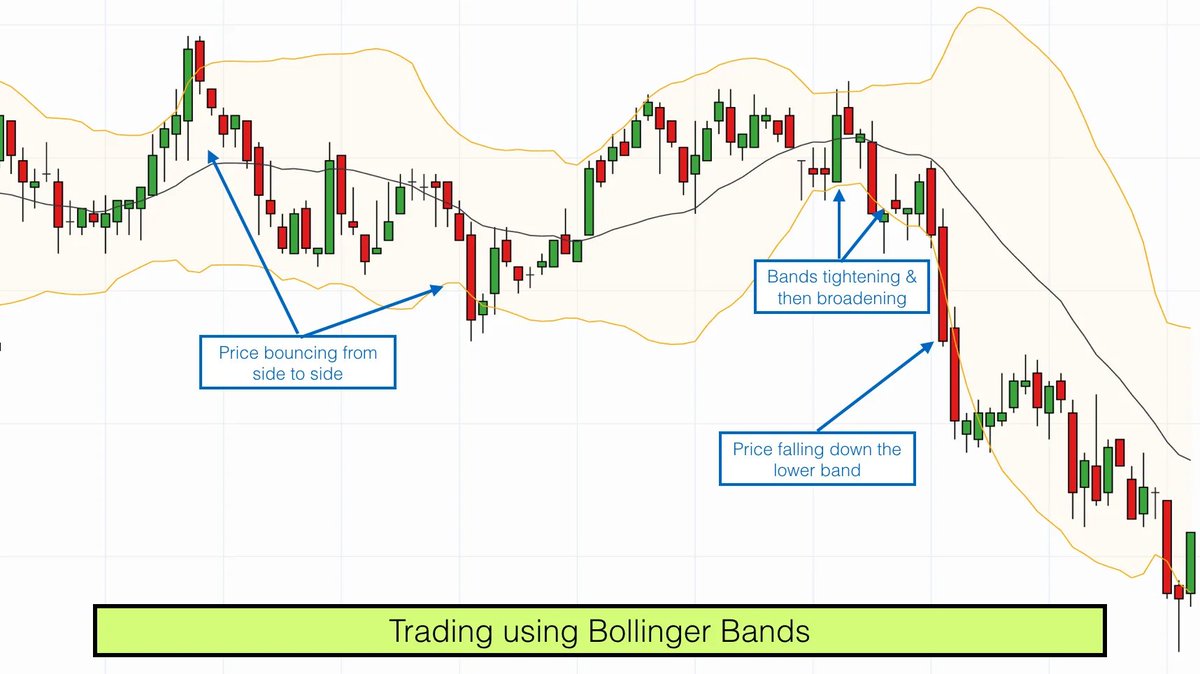

2) Core Concepts

🔹 Price expands outside bands = volatility breakout

🔹 Price compresses between bands = low volatility

🔹 Price returns to middle band = mean reversion

🔹 Bands squeeze tight = explosive move coming

🔹 Bands wide apart = reversal zone incoming

🔹 Price expands outside bands = volatility breakout

🔹 Price compresses between bands = low volatility

🔹 Price returns to middle band = mean reversion

🔹 Bands squeeze tight = explosive move coming

🔹 Bands wide apart = reversal zone incoming

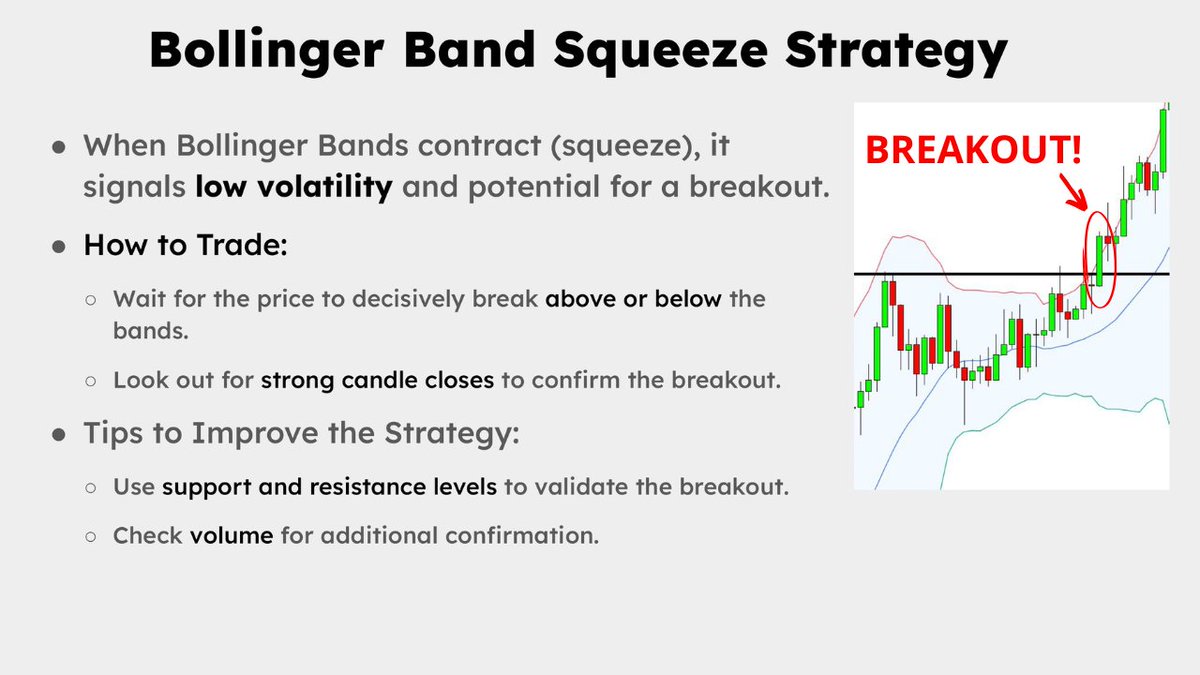

3) Strategy 1 – The Squeeze Breakout (Volatility Trap)

📌 When bands tighten → wait for breakout

✅ Look for volume spike

✅ Combine with FVG/OB zone

✅ Watch for Break of Structure (BOS)

🎯 Entry: On breakout candle

❌ SL: Opposite side of breakout candle

🎯 Target: 1.5× band width

⚡ Best on 15m / 1H timeframes

💥 Great for options scalping

📌 When bands tighten → wait for breakout

✅ Look for volume spike

✅ Combine with FVG/OB zone

✅ Watch for Break of Structure (BOS)

🎯 Entry: On breakout candle

❌ SL: Opposite side of breakout candle

🎯 Target: 1.5× band width

⚡ Best on 15m / 1H timeframes

💥 Great for options scalping

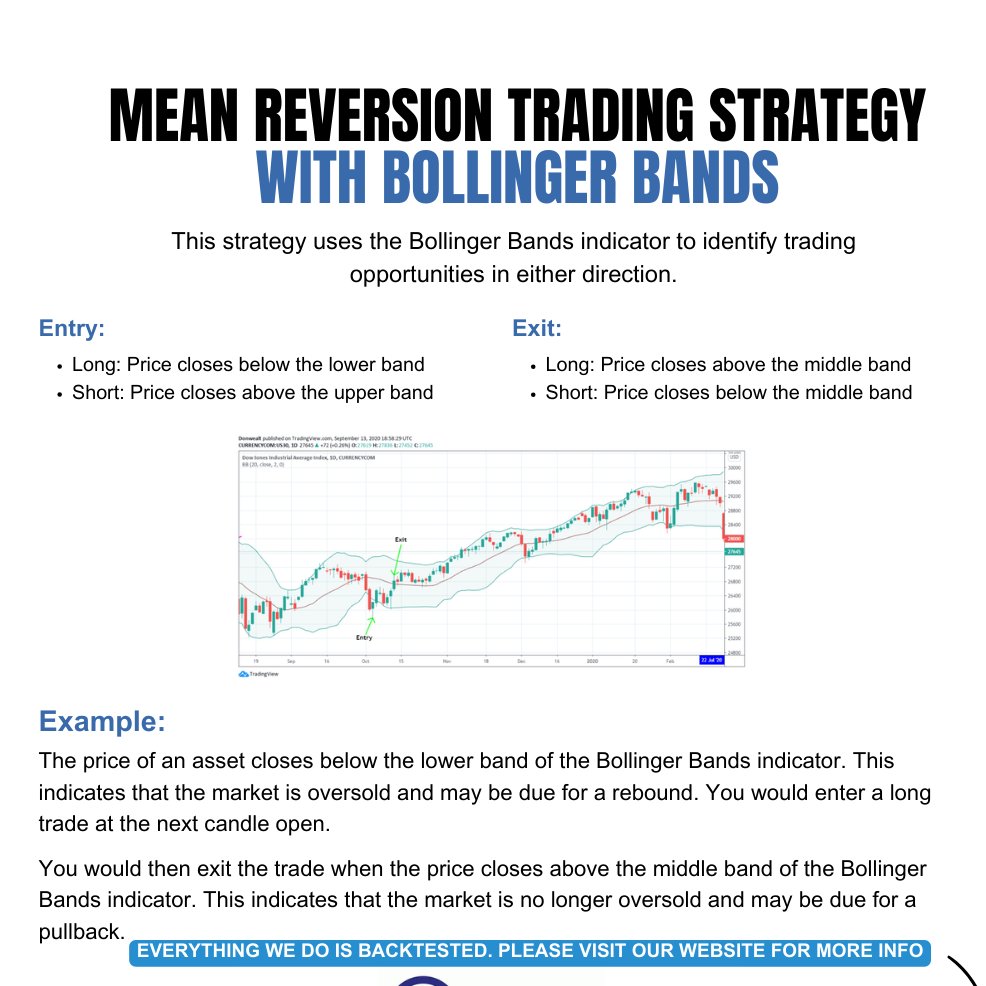

4) Strategy 2 – Reversion to Mean (Fade Extremes)

📌 When price hits upper band + RSI overbought

→ Look for bearish engulfing / rejection

→ Expect pullback to middle band

🎯 Entry: On confirmation candle

❌ SL: Above wick or band

🎯 Target: Middle band (20 SMA)

📌 Reverse setup for lower band + RSI oversold

⚠️ Avoid during trending markets

📌 When price hits upper band + RSI overbought

→ Look for bearish engulfing / rejection

→ Expect pullback to middle band

🎯 Entry: On confirmation candle

❌ SL: Above wick or band

🎯 Target: Middle band (20 SMA)

📌 Reverse setup for lower band + RSI oversold

⚠️ Avoid during trending markets

5) Strategy 3 – Riding the Band (Trend Continuation)

📌 Strong trending market

→ Price walks the upper/lower band

→ Band starts expanding

→ Pullbacks hold at middle band (20 SMA)

🎯 Entry: On pullback to middle band

❌ SL: Below recent swing

🎯 Target: Continue with trend until band flattens

✅ Combine with Supertrend or ADX

📌 Strong trending market

→ Price walks the upper/lower band

→ Band starts expanding

→ Pullbacks hold at middle band (20 SMA)

🎯 Entry: On pullback to middle band

❌ SL: Below recent swing

🎯 Target: Continue with trend until band flattens

✅ Combine with Supertrend or ADX

6) Strategy 4 – Double Tap Rejection

📌 Price hits upper band twice → forms double top

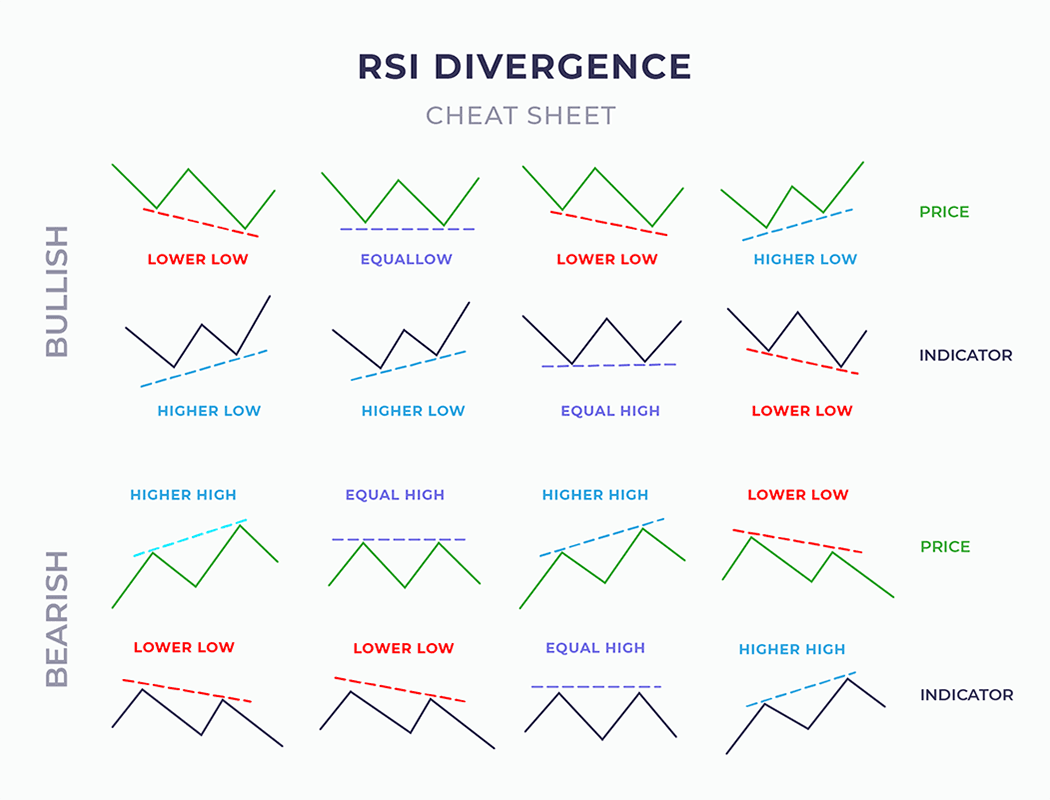

✅ Volume divergence / RSI divergence

✅ OB near second touch

🎯 Entry: On bearish engulfing

❌ SL: Above wick

🎯 Target: Middle band → lower band

💡 Combine with Smart Money concept (liquidity sweep)

📌 Price hits upper band twice → forms double top

✅ Volume divergence / RSI divergence

✅ OB near second touch

🎯 Entry: On bearish engulfing

❌ SL: Above wick

🎯 Target: Middle band → lower band

💡 Combine with Smart Money concept (liquidity sweep)

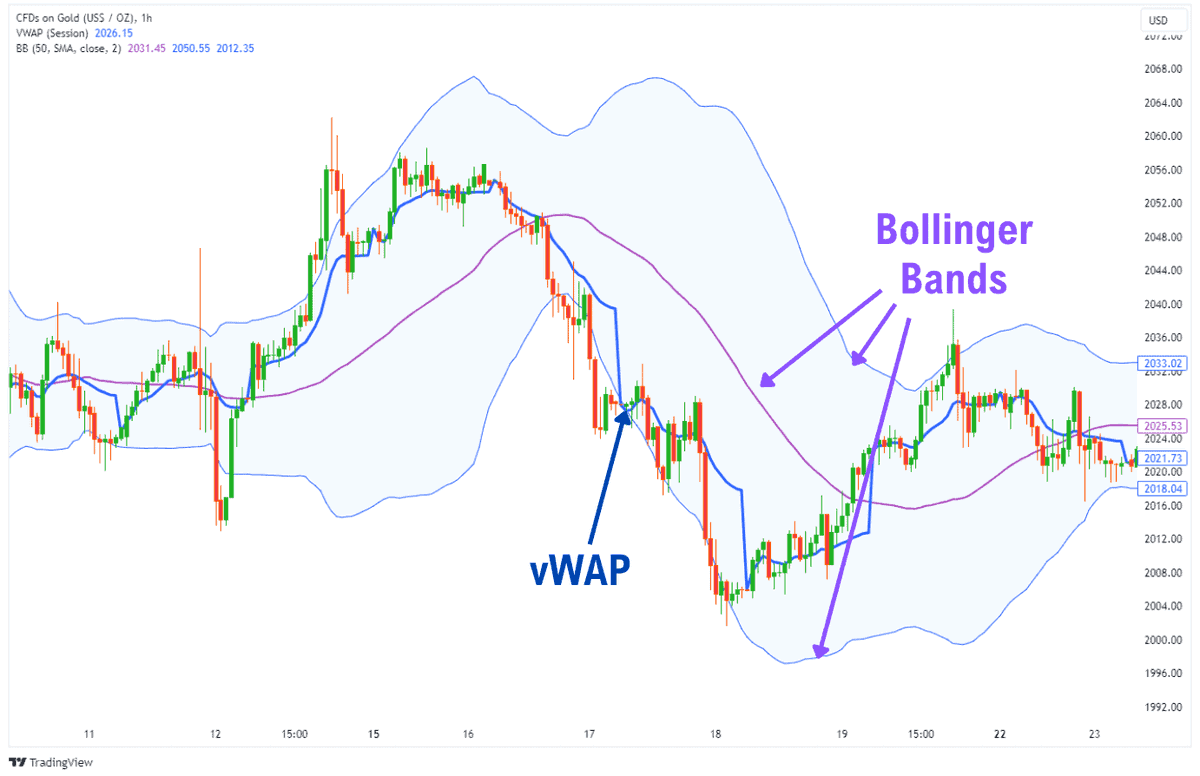

7) Bollinger Band + VWAP Combo (Intraday Edge)

✅ Price hits lower band

✅ VWAP is flat or slightly upward

✅ Strong wick rejection

✅ Volume spike

🎯 Buy CE / long future

❌ SL: Below wick

🎯 Target: VWAP → upper band

💥 Perfect for 5m scalping in Nifty / BankNifty

✅ Price hits lower band

✅ VWAP is flat or slightly upward

✅ Strong wick rejection

✅ Volume spike

🎯 Buy CE / long future

❌ SL: Below wick

🎯 Target: VWAP → upper band

💥 Perfect for 5m scalping in Nifty / BankNifty

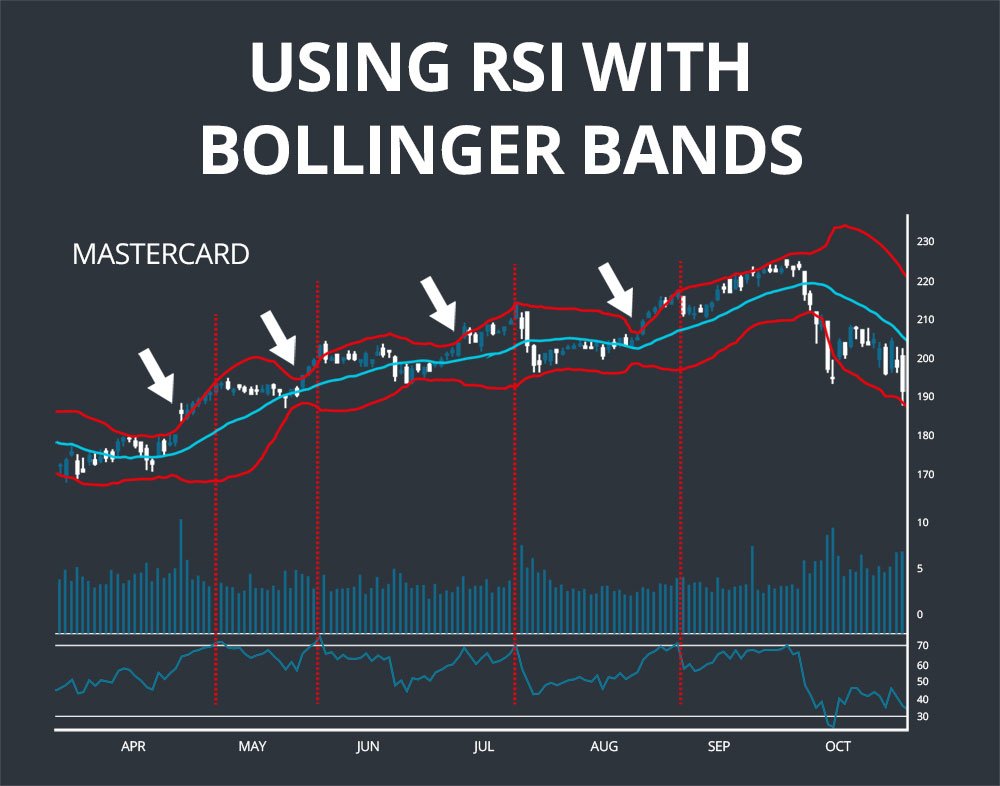

8) Bollinger Band + RSI Combo

🧠 One of the strongest confluence strategies:

📌 Price at upper band

📌 RSI divergence

📌 FVG / OB zone nearby

🎯 Entry: On candle rejection

❌ SL: Above wick

🎯 Target: 20 SMA or lower band

🟢 Use this for smart mean-reversion trades

🧠 One of the strongest confluence strategies:

📌 Price at upper band

📌 RSI divergence

📌 FVG / OB zone nearby

🎯 Entry: On candle rejection

❌ SL: Above wick

🎯 Target: 20 SMA or lower band

🟢 Use this for smart mean-reversion trades

9) When Bollinger Bands FAIL

❌ Don’t fade a breakout in a trending market

❌ Don’t use without confirmation

❌ Avoid band signals during news events

❌ Never rely only on price touching band

📌 Bands are context-driven → not magic

❌ Don’t fade a breakout in a trending market

❌ Don’t use without confirmation

❌ Avoid band signals during news events

❌ Never rely only on price touching band

📌 Bands are context-driven → not magic

• • •

Missing some Tweet in this thread? You can try to

force a refresh