Prem Watsa is often referred to as “Canada’s Warren Buffett”.

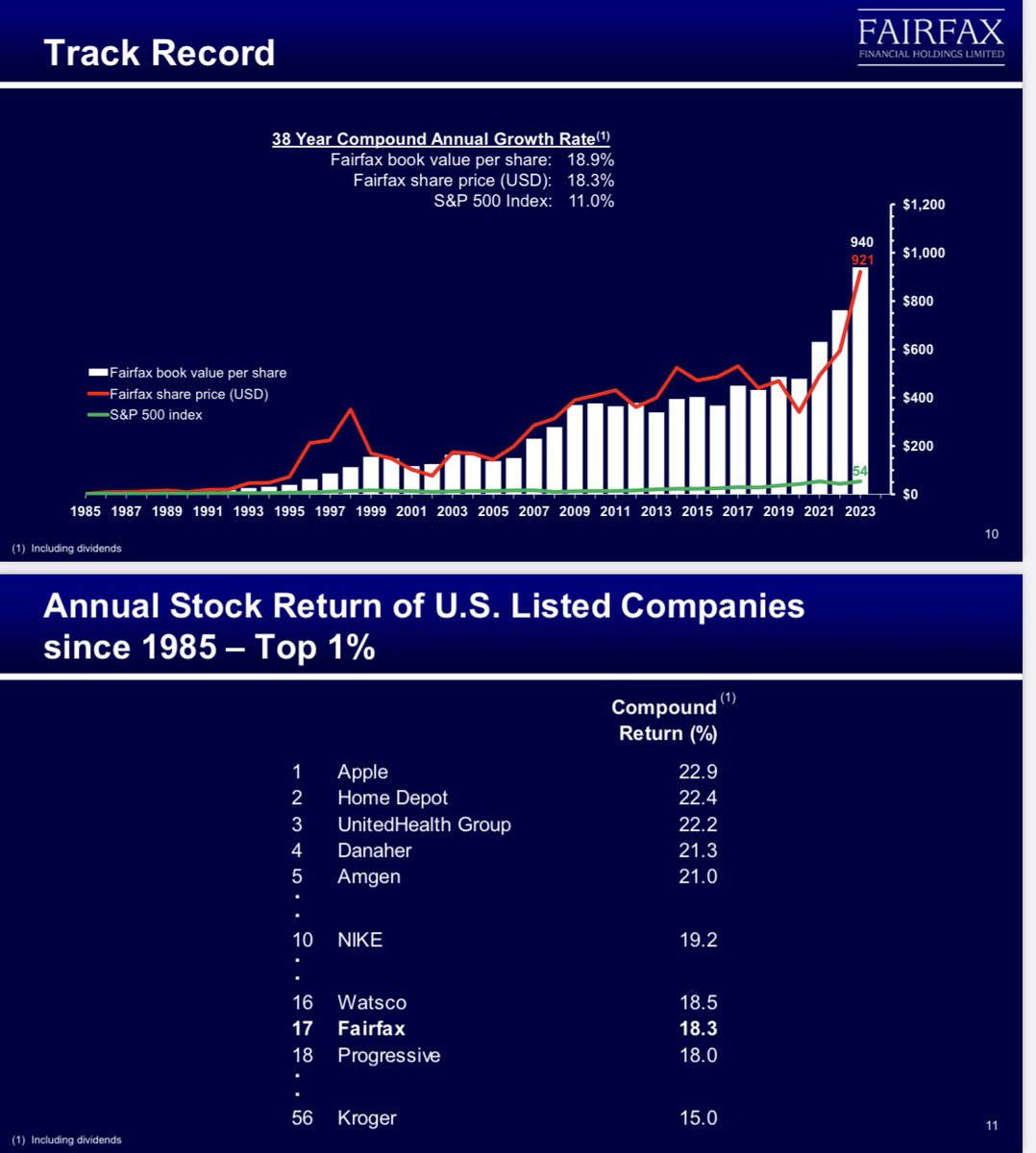

Fairfax $FFH $FRFHF has an incredible track record since their inception in 1985.

I love Prem’s annual letters & compiled some good moments.

Save this thread and read below ⬇️

Fairfax $FFH $FRFHF has an incredible track record since their inception in 1985.

I love Prem’s annual letters & compiled some good moments.

Save this thread and read below ⬇️

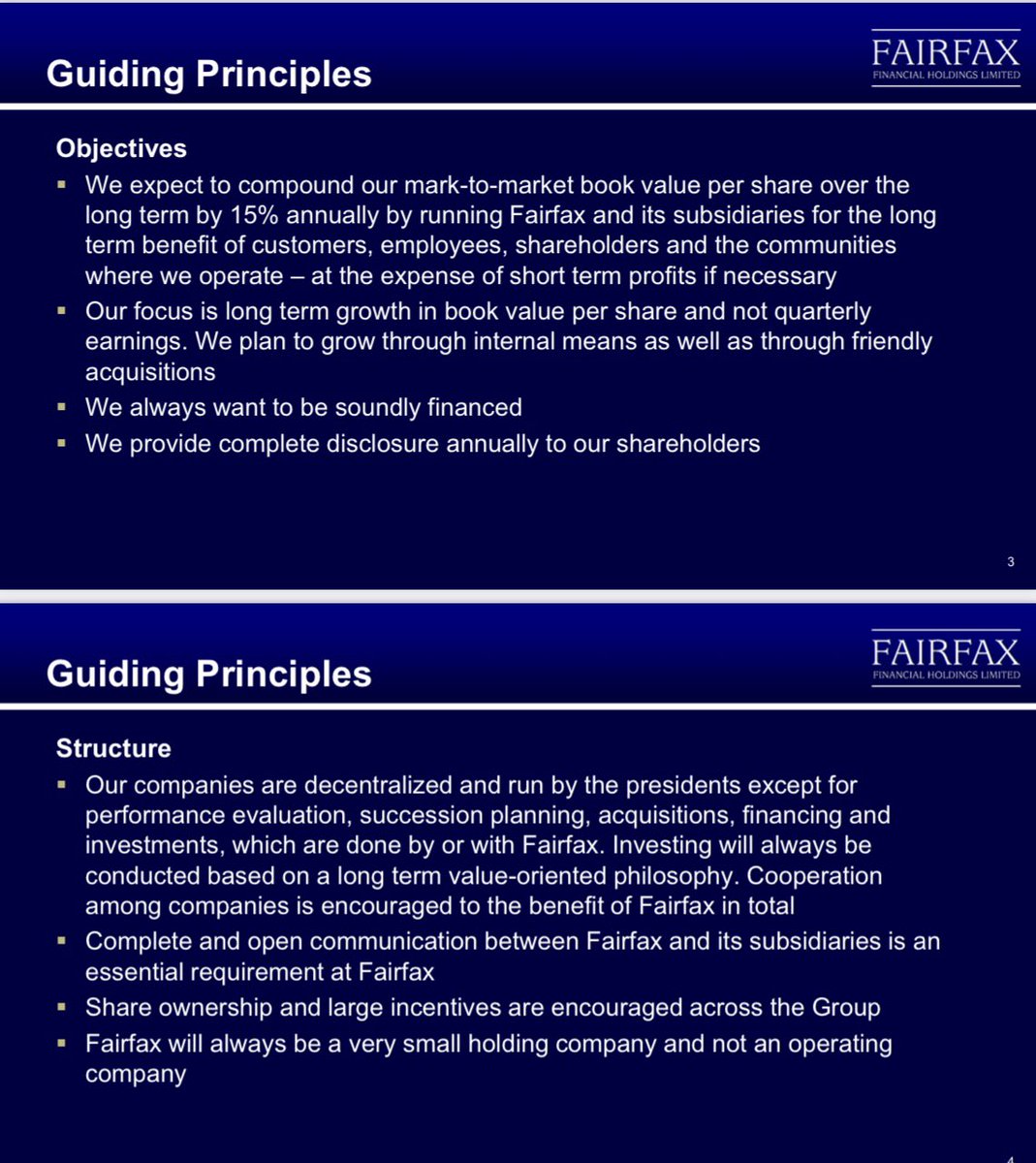

1985 letter - Prem’s first annual letter.

Sets the tone for the many following decades.

“Our investment philosophy is based on the value approach as laid out by Ben Graham and practiced by his famous disciple, Warren Buffett. “

Sets the tone for the many following decades.

“Our investment philosophy is based on the value approach as laid out by Ben Graham and practiced by his famous disciple, Warren Buffett. “

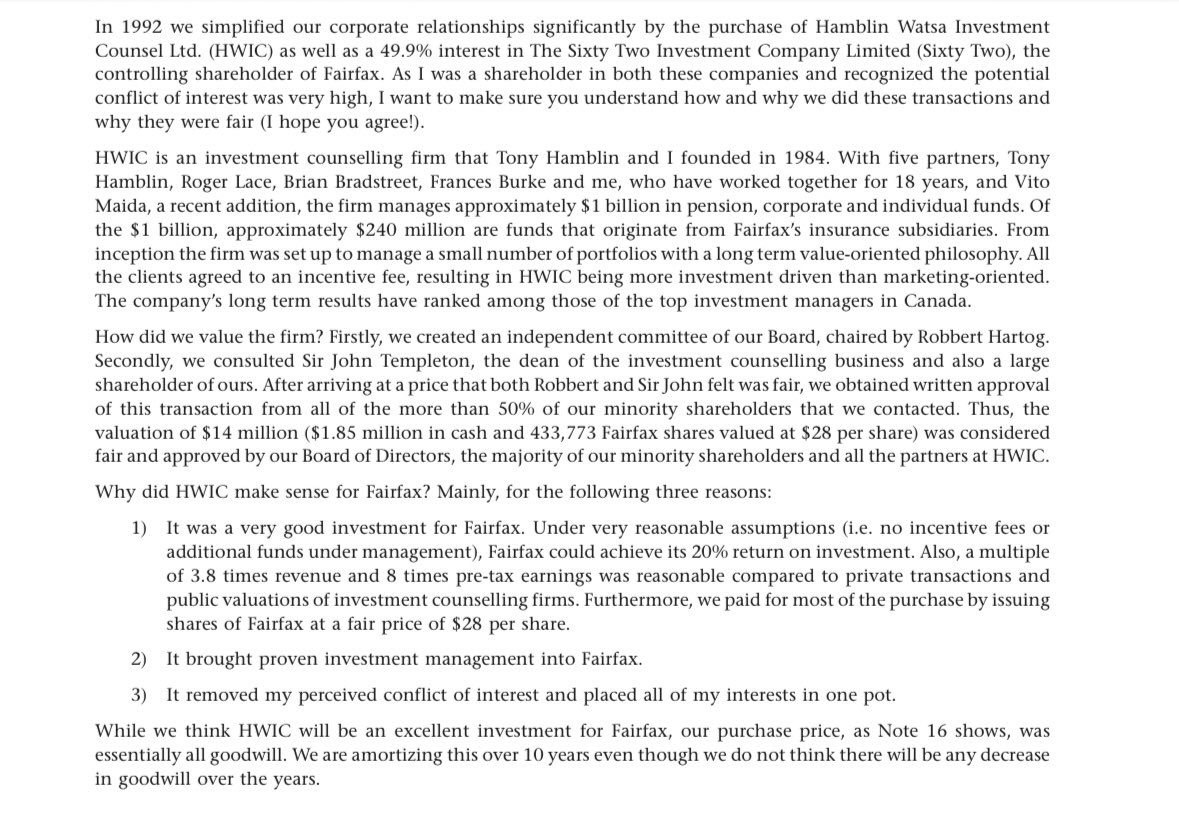

1992 letter - integrating Hamblin Watsa into Fairfax, and the reasoning for that decision.

In retrospect: a great move!

In retrospect: a great move!

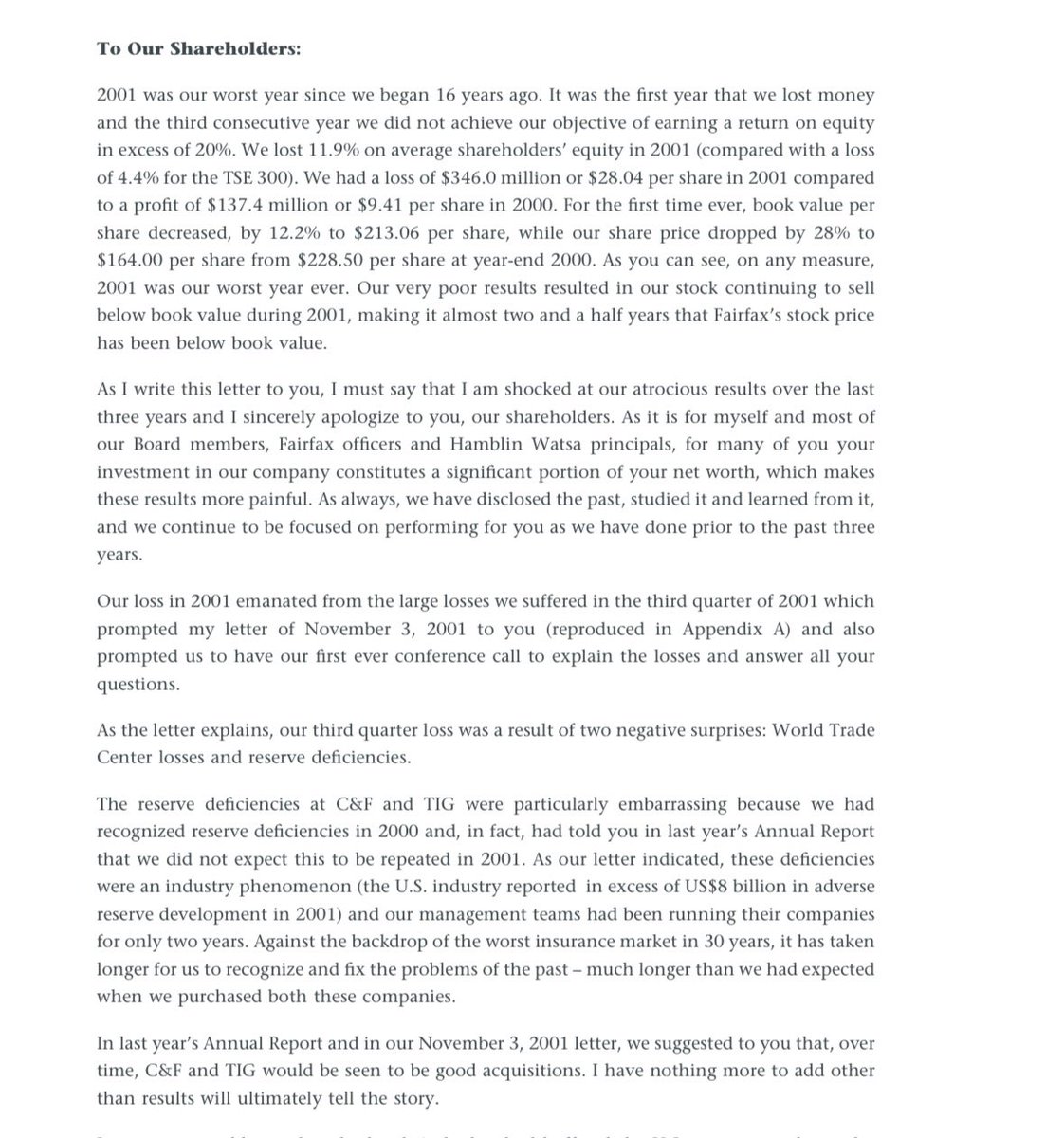

2001 letter - a challenging year with “atrocious results”

Fairfax is not immune to a bad year (or even multiple consecutive bad years.)

Fairfax is not immune to a bad year (or even multiple consecutive bad years.)

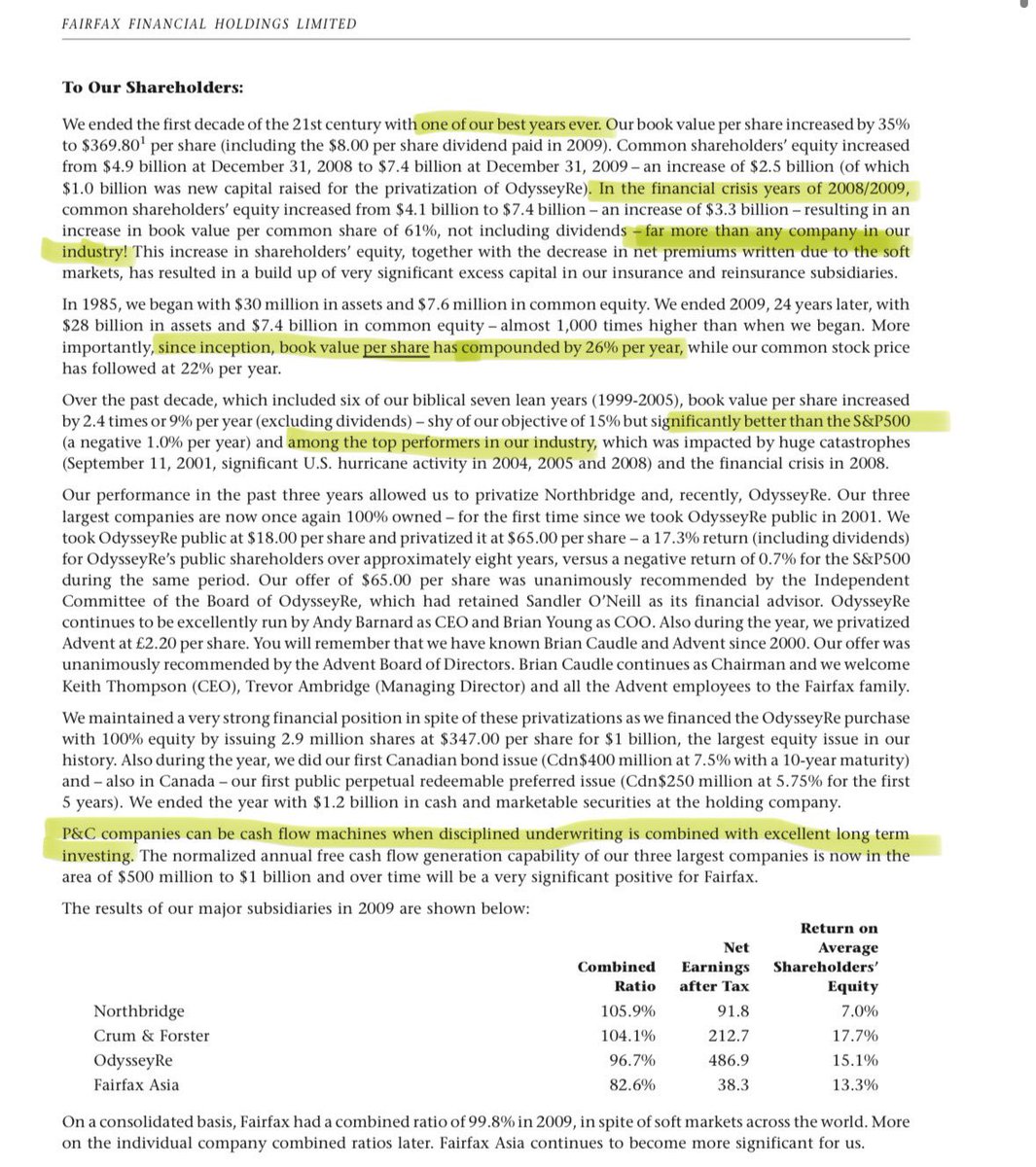

2009 letter - incredibly, in the middle of the global financial crisis: “one of our best years ever”

2009 pt. II - “our results in 2008-2009 are quite exceptional - no other company in the industry has come close to matching them”

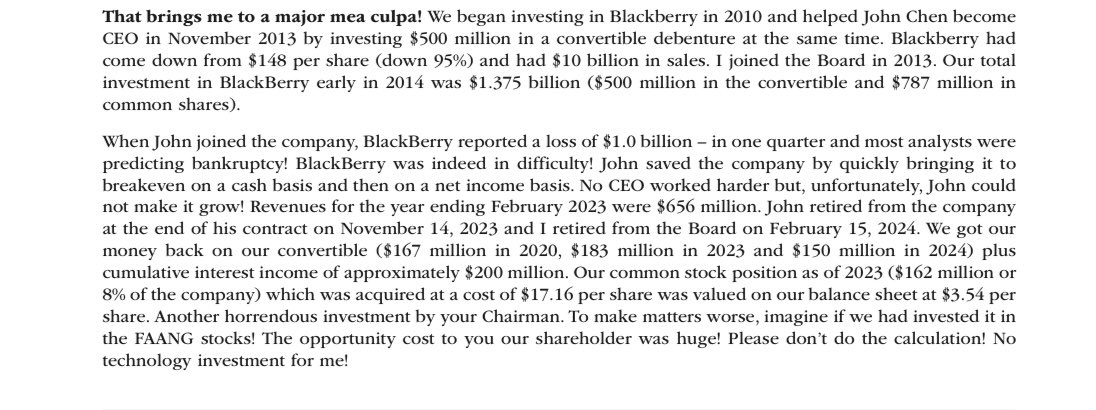

2024 letter - looking back on Blackberry, admittedly a mistake.

Crucial to understand that not every investment will always pan out. But you can still get fantastic returns if most of your good investments do very well (which they did.)

Crucial to understand that not every investment will always pan out. But you can still get fantastic returns if most of your good investments do very well (which they did.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh