Discussing great businesses with wonderful people! Tweets are NOT financial advice. DYODD. 🇨🇦 🇫🇷 🇬🇧

How to get URL link on X (Twitter) App

1985 letter - Prem’s first annual letter.

1985 letter - Prem’s first annual letter.

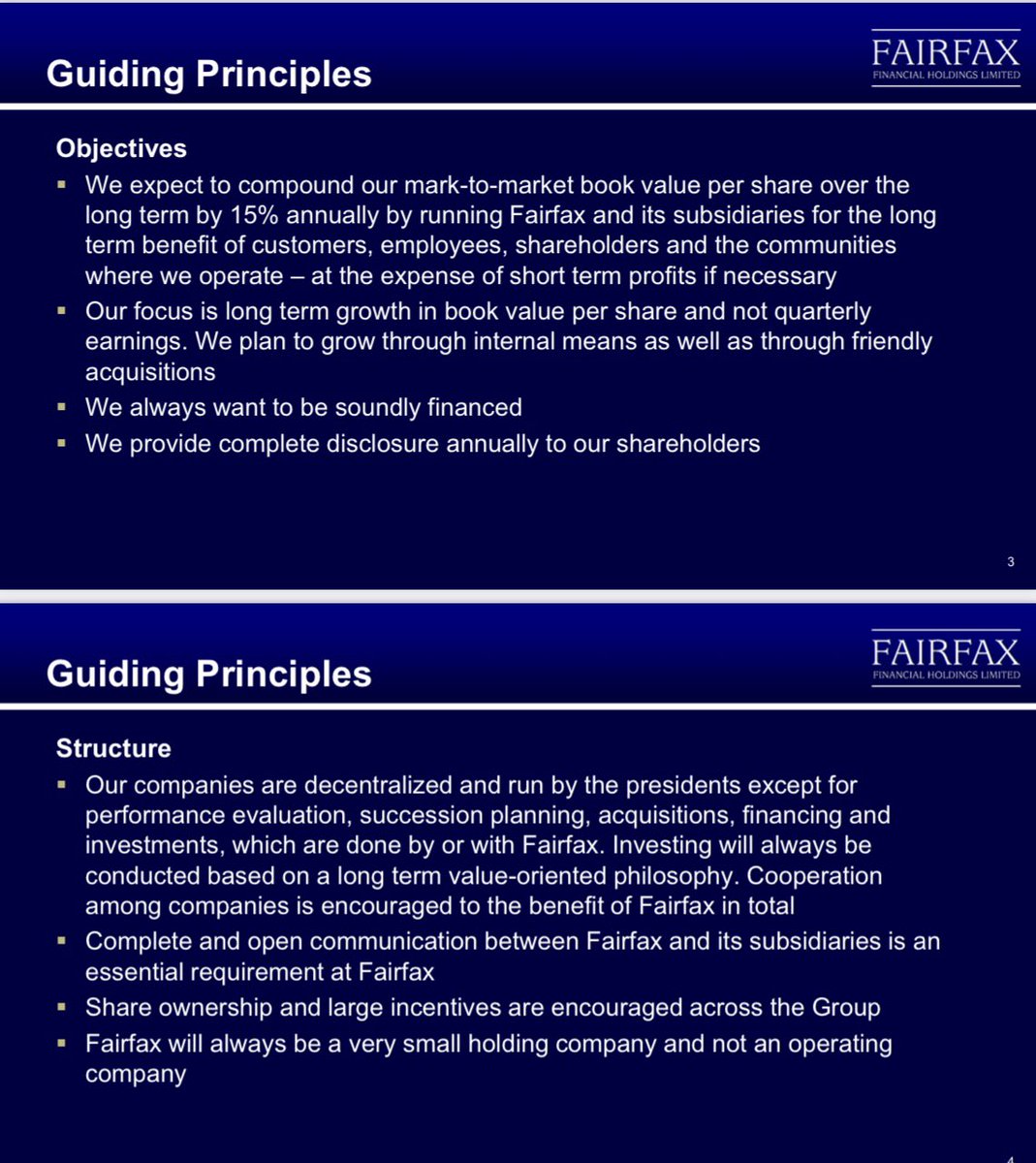

Fairfax’ Guiding Principles.

Fairfax’ Guiding Principles.

This was the clip:

This was the clip:

WHAT IS KITS?

WHAT IS KITS?

Before analyzing earnings, we need to understand what IS Brookfield exactly?

Before analyzing earnings, we need to understand what IS Brookfield exactly?https://twitter.com/newcomerinvest/status/1850612764869538177

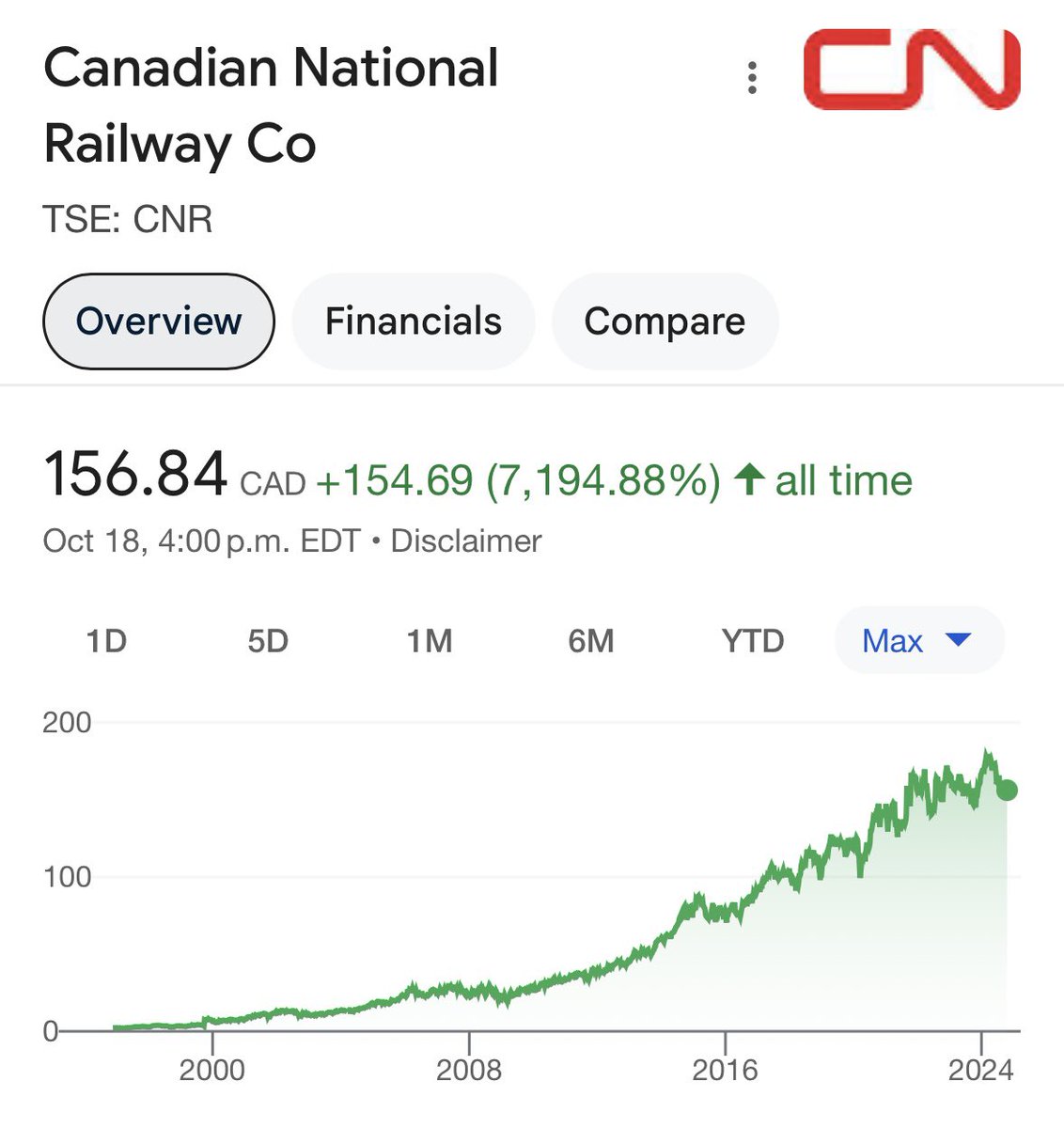

HISTORY

HISTORY

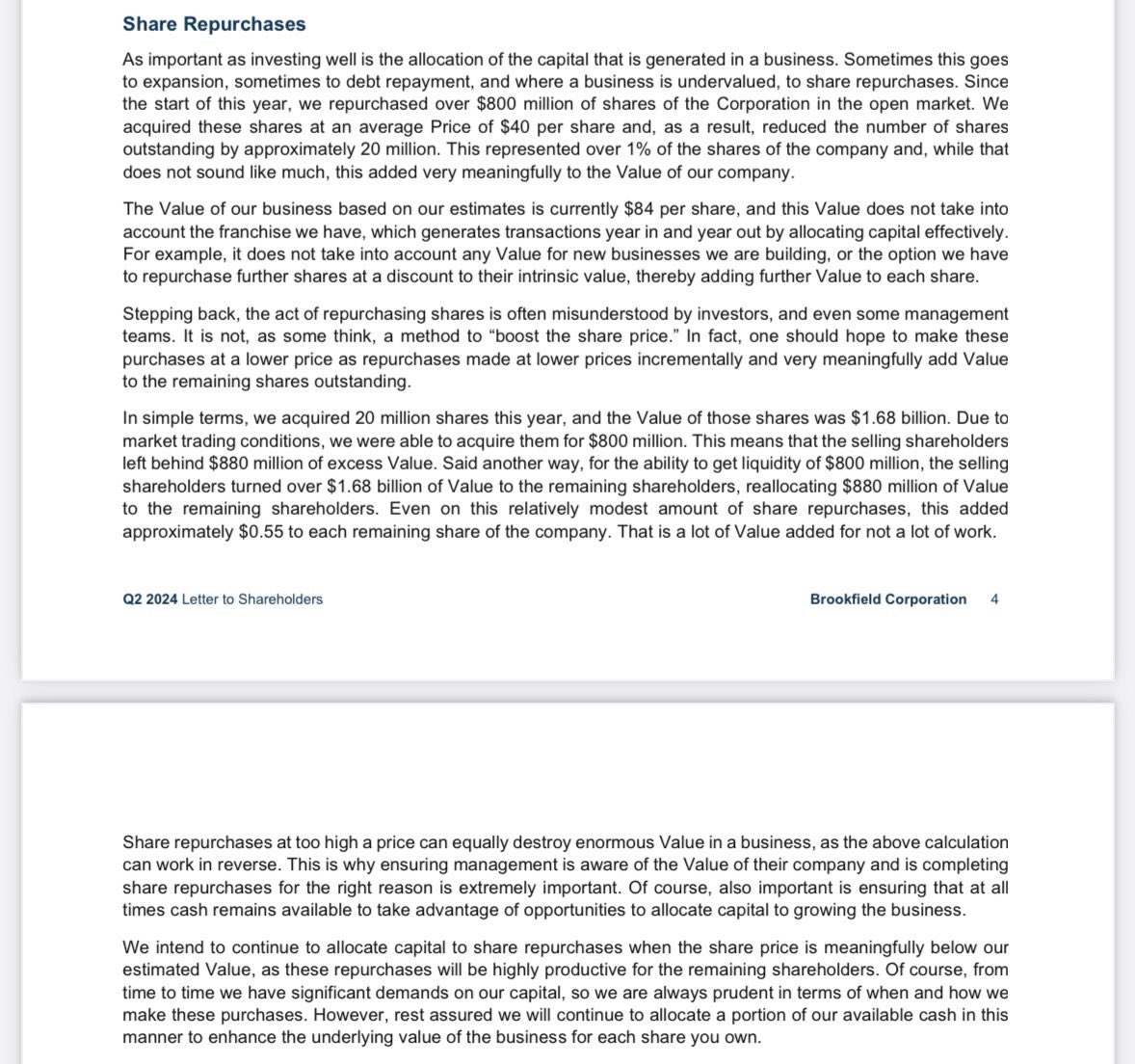

On share buybacks. Q2 2024.

On share buybacks. Q2 2024.

𝐓𝐇𝐄 𝐁𝐀𝐒𝐈𝐂𝐒:

𝐓𝐇𝐄 𝐁𝐀𝐒𝐈𝐂𝐒: