Largest LBO Failure in History

In 2007, KKR & TPG bet on the “safest” asset class.

In reality, it was a ticking bomb.

The biggest PE bankruptcy ever.

Thread

In 2007, KKR & TPG bet on the “safest” asset class.

In reality, it was a ticking bomb.

The biggest PE bankruptcy ever.

Thread

TXU looked like a dream LBO:

- Largest coal power operator in Texas

- 3M retail customers

- $4B EBITDA

- Stable utility cash flows

KKR & TPG thought they’d locked in a “safe” annuity.

Instead, they set a ticking bomb.

- Largest coal power operator in Texas

- 3M retail customers

- $4B EBITDA

- Stable utility cash flows

KKR & TPG thought they’d locked in a “safe” annuity.

Instead, they set a ticking bomb.

Why they did it:

Bet on rising natural gas prices

Deregulated Texas market = growth

Monopoly-like infrastructure

Classic “steady cash flow + leverage” LBO profile

$44.3B EV, 8.5x EBITDA, $36B of debt.

It was supposed to be a cash-printing machine.

Bet on rising natural gas prices

Deregulated Texas market = growth

Monopoly-like infrastructure

Classic “steady cash flow + leverage” LBO profile

$44.3B EV, 8.5x EBITDA, $36B of debt.

It was supposed to be a cash-printing machine.

Politics & PR:

TXU planned 11 new coal plants = environmental backlash.

To get the deal approved, KKR/TPG:

✅ Cut new plants to 3

✅ Promised carbon cuts

✅ Slashed residential prices 10%

✅ Put WWF Chairman on the board

It was the first “green” mega buyout.

TXU planned 11 new coal plants = environmental backlash.

To get the deal approved, KKR/TPG:

✅ Cut new plants to 3

✅ Promised carbon cuts

✅ Slashed residential prices 10%

✅ Put WWF Chairman on the board

It was the first “green” mega buyout.

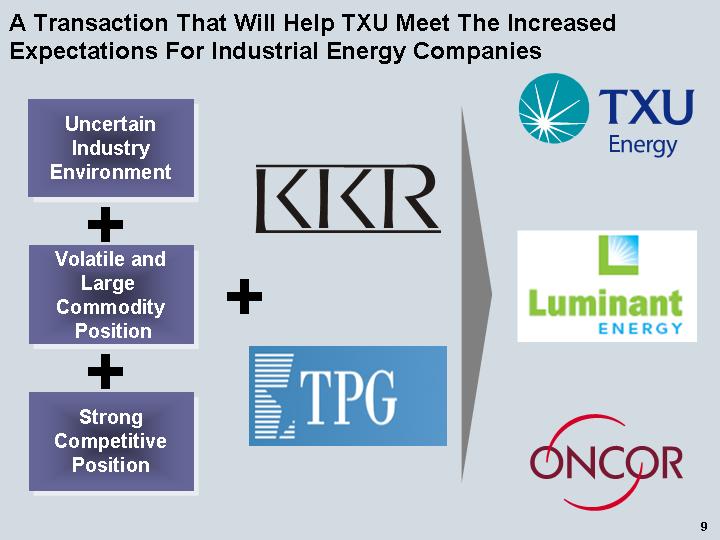

Deal Structure:

$24.5B senior secured loans

$11.25B unsecured bridge

$8B equity

Advisors: Credit Suisse & Lazard

Banks: GS, Citi, JPM, Lehman, MS

TXU renamed to Energy Future Holdings and split into Luminant, Oncor, and TXU Energy.

$24.5B senior secured loans

$11.25B unsecured bridge

$8B equity

Advisors: Credit Suisse & Lazard

Banks: GS, Citi, JPM, Lehman, MS

TXU renamed to Energy Future Holdings and split into Luminant, Oncor, and TXU Energy.

The Thesis:

Gas prices stay high → electricity prices follow → TXU’s coal & nuclear plants print money.

Leverage magnifies returns.

It was a commodity macro bet disguised as a utility LBO.

Gas prices stay high → electricity prices follow → TXU’s coal & nuclear plants print money.

Leverage magnifies returns.

It was a commodity macro bet disguised as a utility LBO.

What happened next:

2008 recession = Texas power demand -7.6%

Fracking boom → gas prices collapse

TXU’s “steady” cash flow evaporates

$3B interest payments choke the company

By 2014, $35B of debt = impossible to repay. Bankruptcy.

2008 recession = Texas power demand -7.6%

Fracking boom → gas prices collapse

TXU’s “steady” cash flow evaporates

$3B interest payments choke the company

By 2014, $35B of debt = impossible to repay. Bankruptcy.

Damage Report:

KKR writes down 50% of equity by 2009

Warren Buffett calls his $2B EFH bonds a “big mistake”

Credit rating sinks to Caa1

$3.2B negative book value

KKR writes down 50% of equity by 2009

Warren Buffett calls his $2B EFH bonds a “big mistake”

Credit rating sinks to Caa1

$3.2B negative book value

Lessons

Don’t LBO commodity bets. Cyclicality + leverage = death.

When banks are handing out unlimited debt… you’re likely at the top.

Past wins ≠ future wins. TXU wasn’t Texas Genco 2.0 – the macro flipped.

Don’t LBO commodity bets. Cyclicality + leverage = death.

When banks are handing out unlimited debt… you’re likely at the top.

Past wins ≠ future wins. TXU wasn’t Texas Genco 2.0 – the macro flipped.

• • •

Missing some Tweet in this thread? You can try to

force a refresh