It's been a long time since we've seen an @ethena_labs PT breaking 15% APY.

We now have PT-tUSDe at 15% APY AND a decent amount of time til maturity.

That means HIGHER YIELD for LONGER...

...AND a suite of lending market integrations to boot.

👇

We now have PT-tUSDe at 15% APY AND a decent amount of time til maturity.

That means HIGHER YIELD for LONGER...

...AND a suite of lending market integrations to boot.

👇

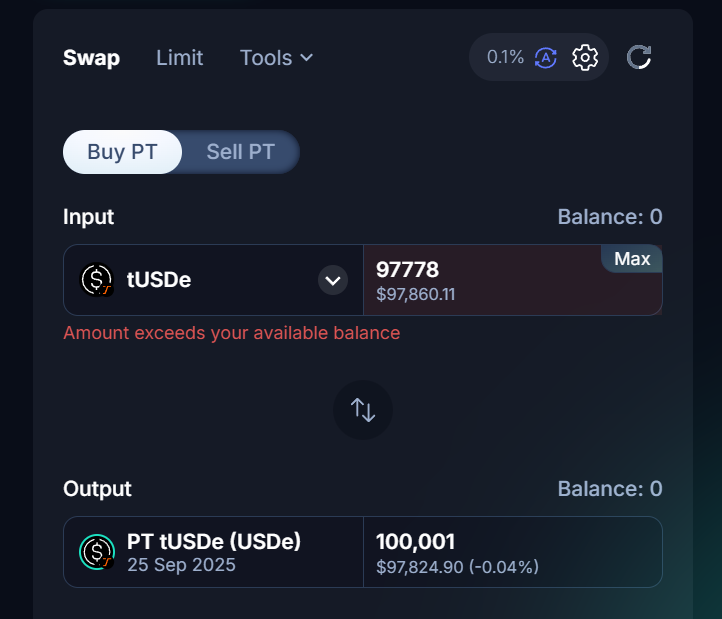

💡 Fixed Yield BABY

Fixed yield to me means getting $1 in exchange for <$1.

In the case of PT-tUSDe, I can pay $97,778 and get back $100,001.

That's:

📌 $2,223 pure profit

📌 2.27% RoI in 58 days

📌 ~15.2% APY

Fixed yield to me means getting $1 in exchange for <$1.

In the case of PT-tUSDe, I can pay $97,778 and get back $100,001.

That's:

📌 $2,223 pure profit

📌 2.27% RoI in 58 days

📌 ~15.2% APY

⚒️ Leveraged Fixed Yield Baby

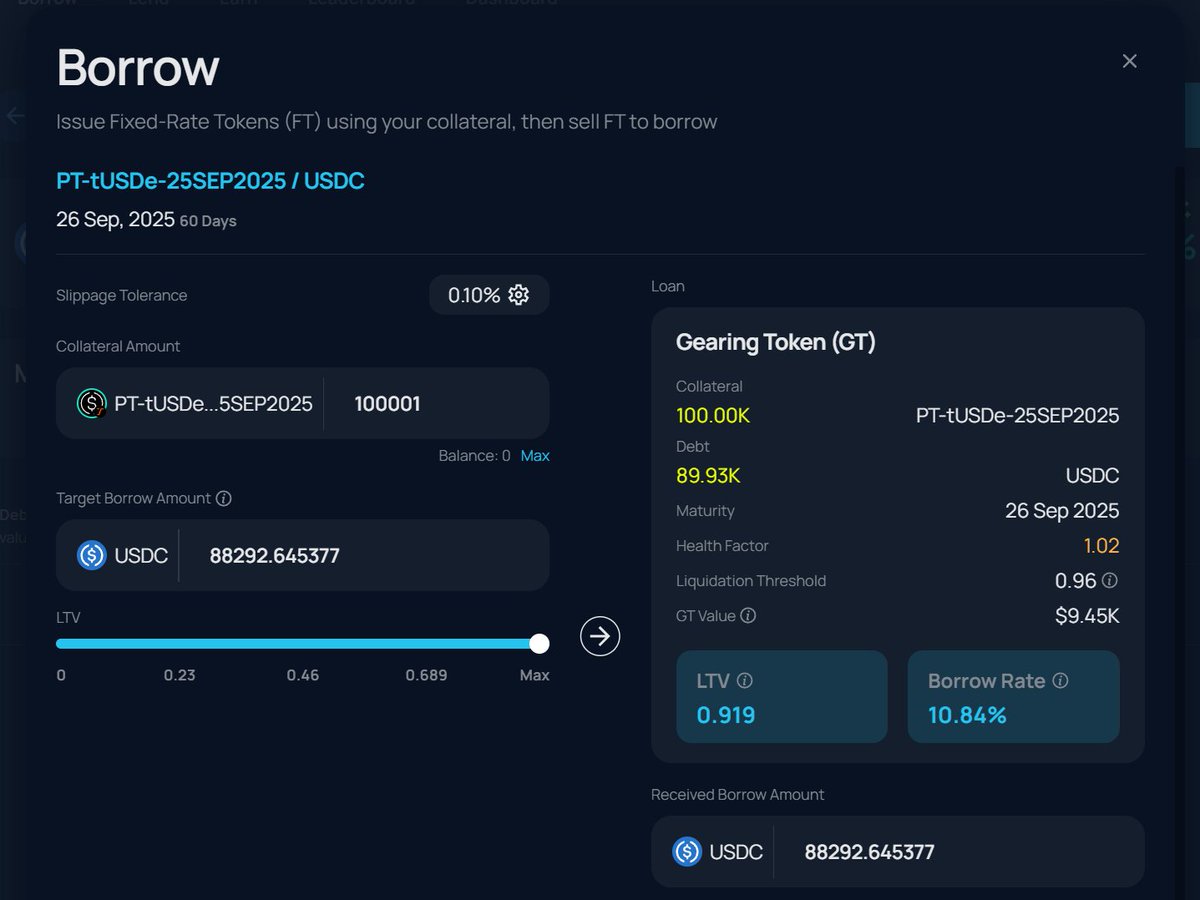

@TermMaxFi lets me do something silly:

1. Deposit 100,001 PT-tUSDe

2. Borrow 88,292 USDC

M interest cost is known upfront.

That's:

📌 $1,638 interest paid

📌11.7% borrow APR

Fixing both collateral yield AND borrow cost should be illegal lmao 🫧

@TermMaxFi lets me do something silly:

1. Deposit 100,001 PT-tUSDe

2. Borrow 88,292 USDC

M interest cost is known upfront.

That's:

📌 $1,638 interest paid

📌11.7% borrow APR

Fixing both collateral yield AND borrow cost should be illegal lmao 🫧

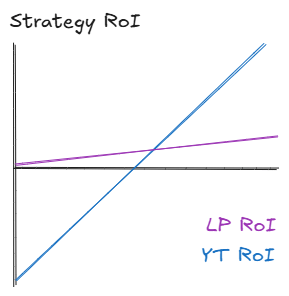

♻️ Leveraged Variable Fixed Yield Baby

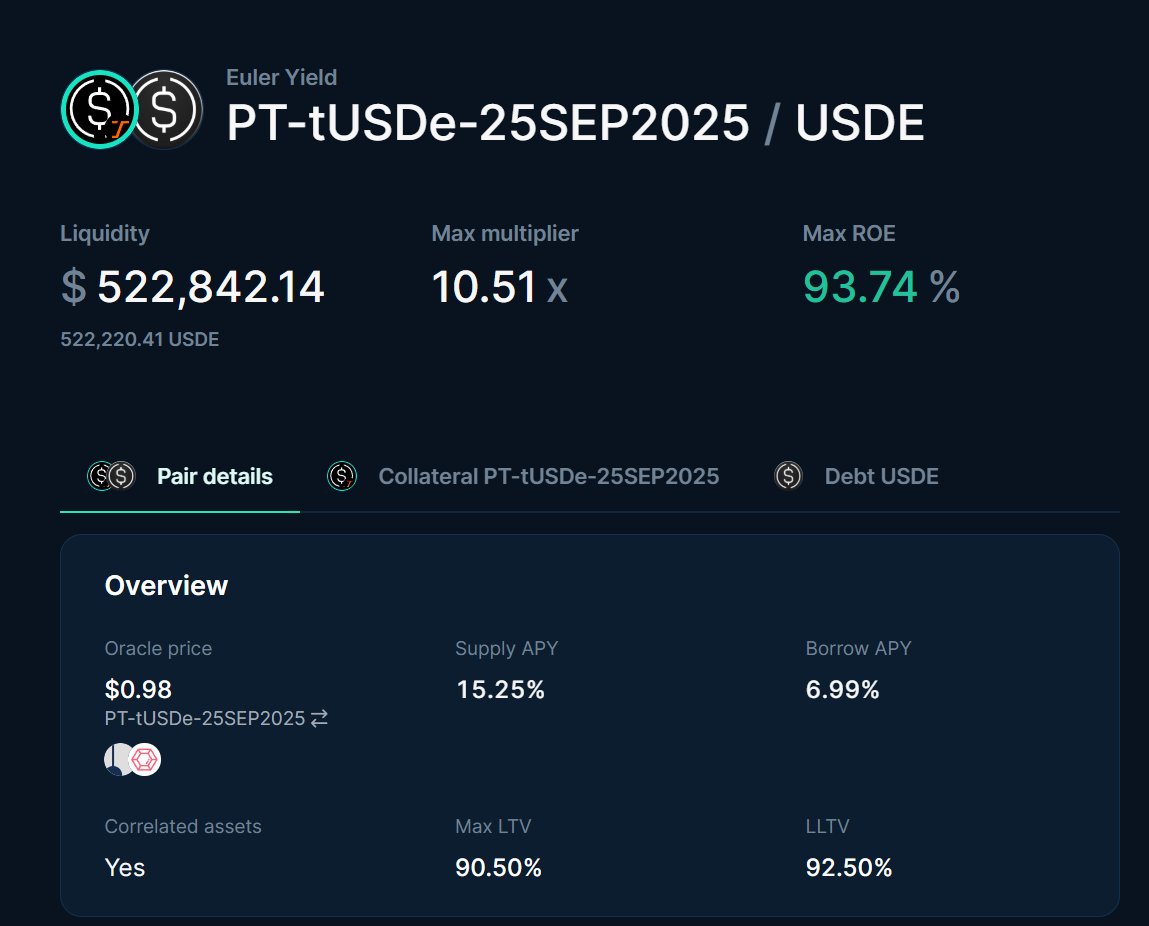

For the variable rate enjoyers, make sure to check out @eulerfinance:

1. Deposit PT-tUSDe (earn fixed)

2. Borrow USDe (pay variable; currently 7% APY)

8.3% spread on every loop?

That's literally FREE MONEY on the table for you boys.

For the variable rate enjoyers, make sure to check out @eulerfinance:

1. Deposit PT-tUSDe (earn fixed)

2. Borrow USDe (pay variable; currently 7% APY)

8.3% spread on every loop?

That's literally FREE MONEY on the table for you boys.

They say a rising tide lifts all boats.

The tide is PT-tUSDe Implied APY.

The boat(s) is stablecoin rates on every lending market.

You're welcome.

Pendle

The tide is PT-tUSDe Implied APY.

The boat(s) is stablecoin rates on every lending market.

You're welcome.

Pendle

• • •

Missing some Tweet in this thread? You can try to

force a refresh