How to get URL link on X (Twitter) App

If there's one thing guaranteed in crypto, it's volatility.

If there's one thing guaranteed in crypto, it's volatility.

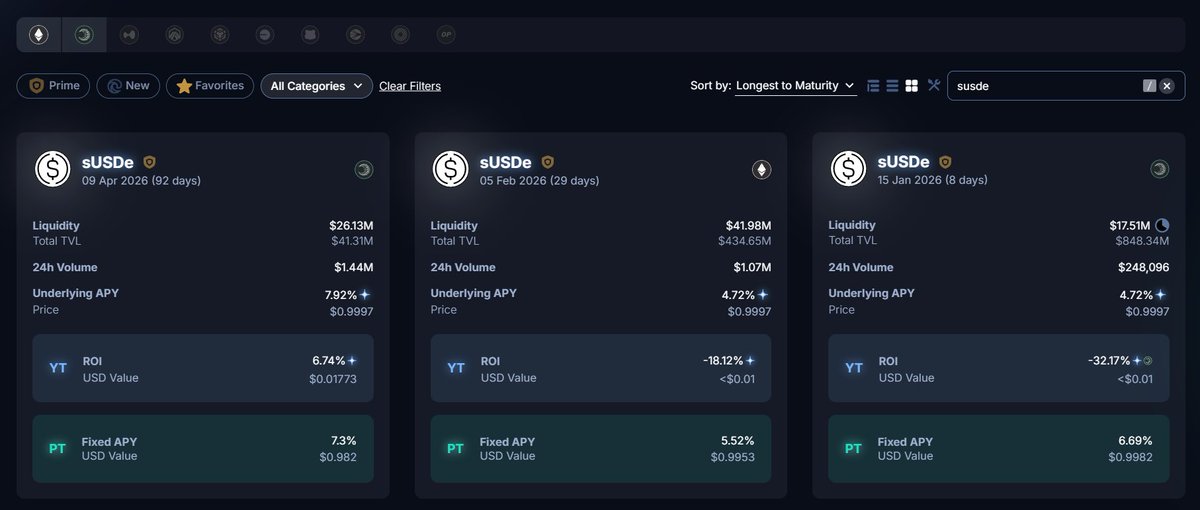

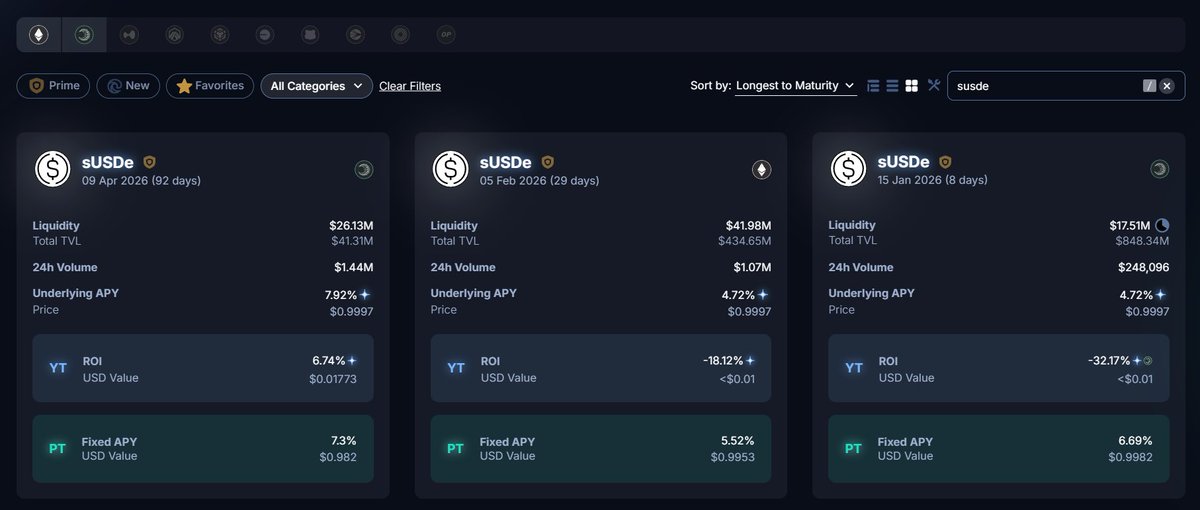

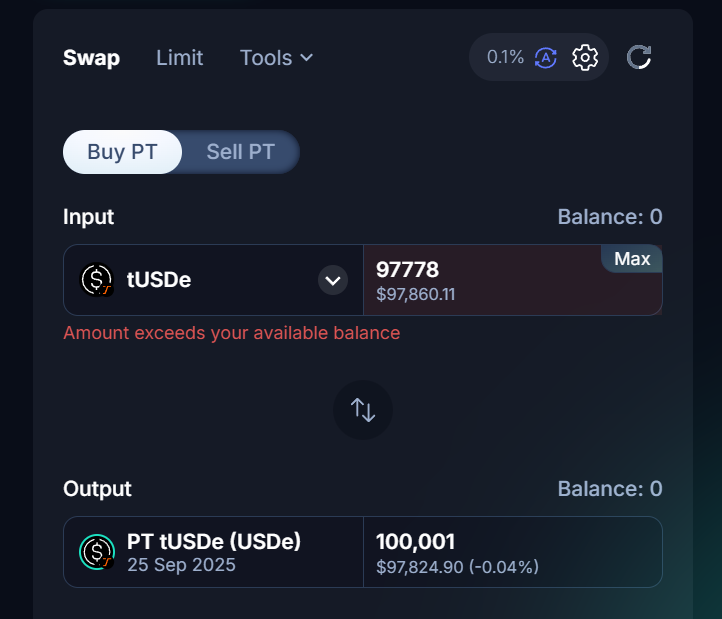

PT-sUSDe's price is inversely related to its IY.

PT-sUSDe's price is inversely related to its IY.

@pendle_fi First, let's have a look at what kinda yields you're reaping from Plasma YTs.

@pendle_fi First, let's have a look at what kinda yields you're reaping from Plasma YTs.

💡 Fixed Yield BABY

💡 Fixed Yield BABY

🔢 The Numbers

🔢 The Numbers

📈 $USDC (Euler Yield)

📈 $USDC (Euler Yield)

📊 The Numbers

📊 The Numbers

🗒️ Quick recap on what's $stS

🗒️ Quick recap on what's $stS

What is $scUSD and $scETH?

What is $scUSD and $scETH?

💡 The Scene

💡 The Scene

@pendle_fi 💡 Points

@pendle_fi 💡 Pointshttps://twitter.com/pendle_fi/status/1877534251144589611

@ether_fi @veda_labs 💡 The Points

@ether_fi @veda_labs 💡 The Points

💡 YT-liquidberaETH

💡 YT-liquidberaETH

The Basics 🎓

The Basics 🎓

🧐 SolvBTC

🧐 SolvBTC

1⃣ PT-rsETH with @SiloFinance

1⃣ PT-rsETH with @SiloFinance

💡 PT-sUSDe/DAI Morpho Vault

💡 PT-sUSDe/DAI Morpho Vault

2/ Never reuse passwords

2/ Never reuse passwords

@Bedrock_DeFi 🧑🌾 YT-uniETH: Yield

@Bedrock_DeFi 🧑🌾 YT-uniETH: Yield