The SME IPO Market in 2025?

114 Listings, 58 Loses & 6 Crashes

Let’s unpack 2025’s SME market so far…

🧵A Thread 1/10

114 Listings, 58 Loses & 6 Crashes

Let’s unpack 2025’s SME market so far…

🧵A Thread 1/10

Around 114 SME IPOs hit the market in 2025!

🟢 82 opened green

🔴 32 in red

2/10

🟢 82 opened green

🔴 32 in red

2/10

Today? Only 56 are in the GREEN.

58 have sunk into the RED.

That’s 51% bleeding red 💸.

3/10

58 have sunk into the RED.

That’s 51% bleeding red 💸.

3/10

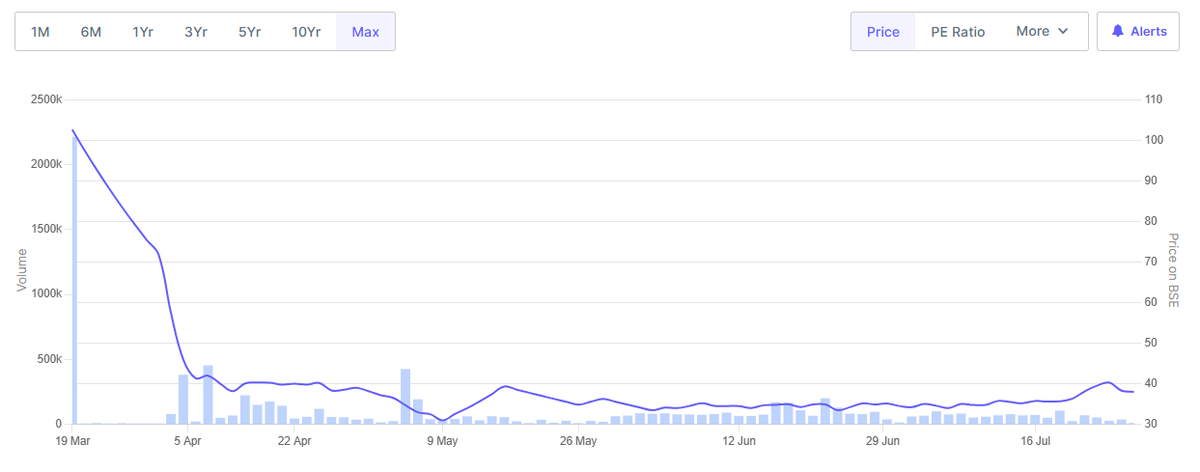

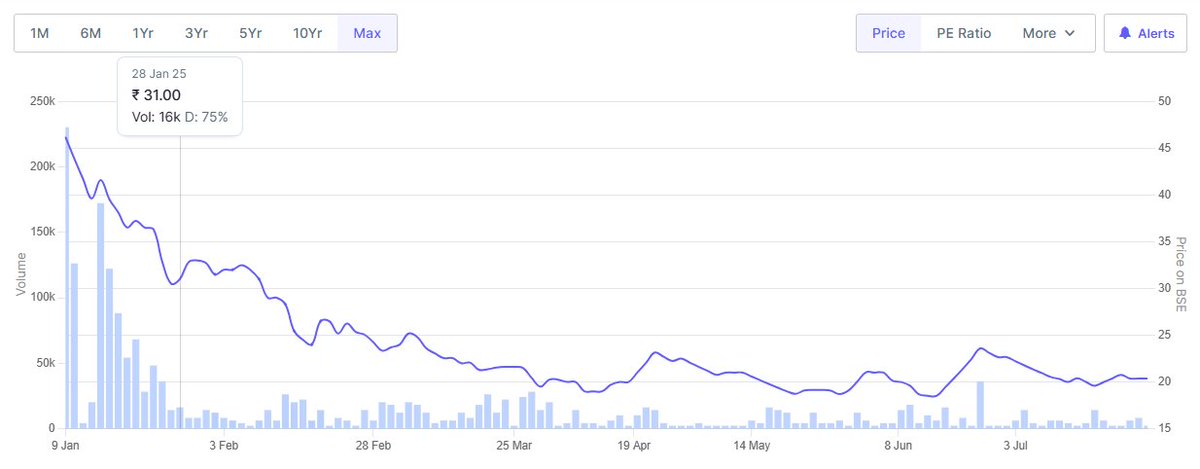

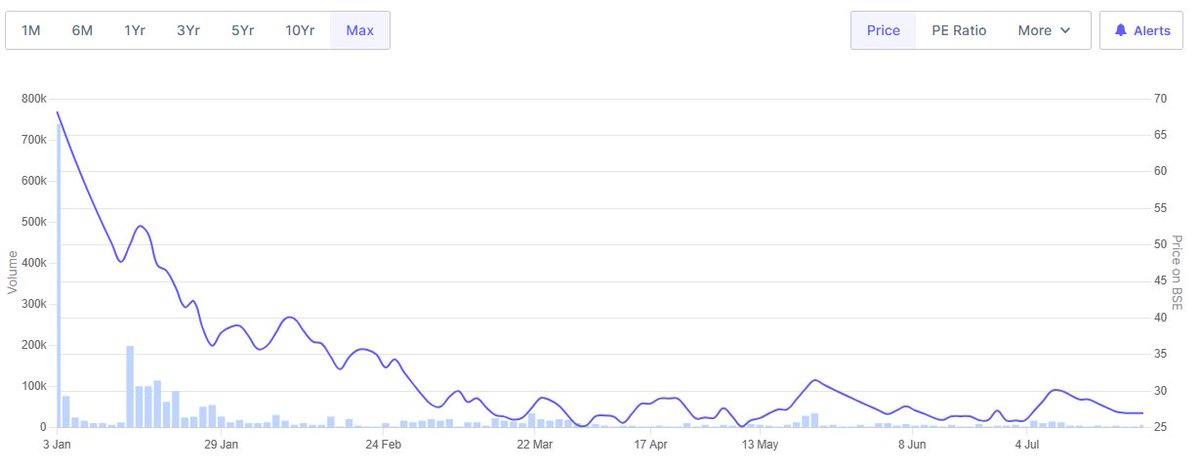

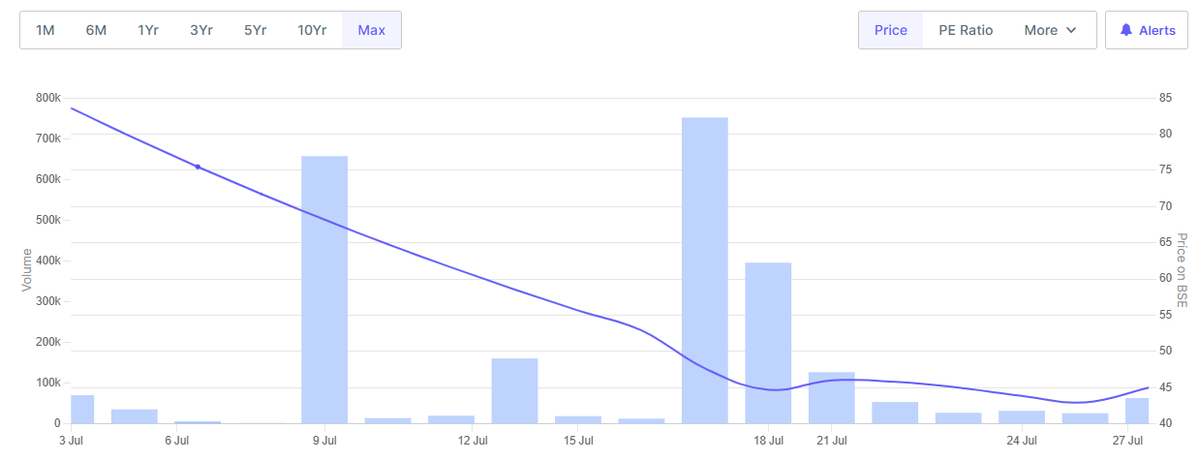

6 IPOs CRASHED >60%.

Not a dip—a nosedive. 🪂

Meet the biggest falls:

4/10

Not a dip—a nosedive. 🪂

Meet the biggest falls:

4/10

Many SME IPOs were priced like growth rockets… but were glorified small businesses.

- No pricing power

- Debt traps post-listening

- "TAM" fantasies ≠ real demand

- No pricing power

- Debt traps post-listening

- "TAM" fantasies ≠ real demand

Retail investors chase "low-price" IPOs, while insiders exit.

The lesson?

Dig deeper than the prospectus.

Profitability > Hype. Always.

The lesson?

Dig deeper than the prospectus.

Profitability > Hype. Always.

Data Source: @ETMarkets & @screener_in

Disclaimer: This is not a BUY/SELL/HOLD recommendation. Do your own due diligence.

Disclaimer: This is not a BUY/SELL/HOLD recommendation. Do your own due diligence.

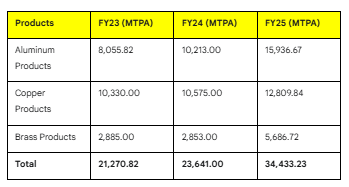

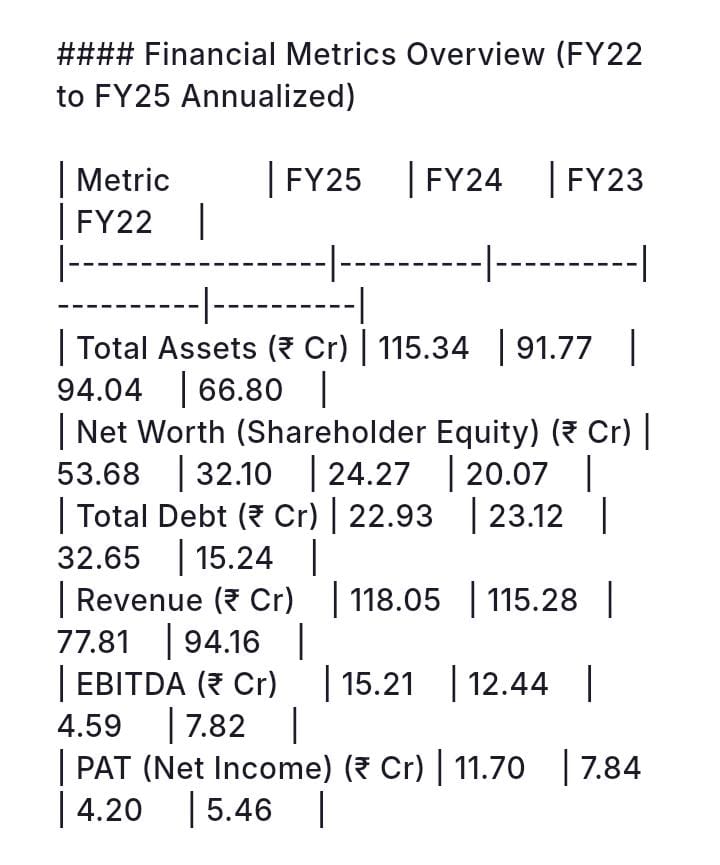

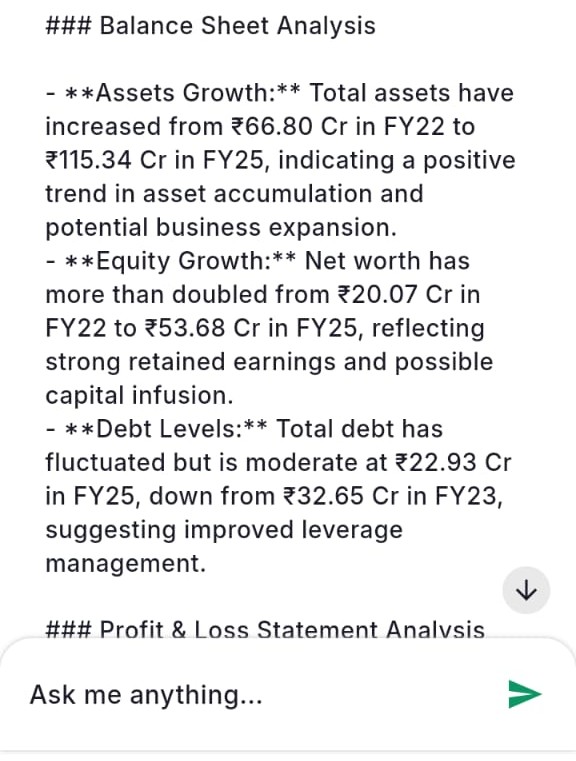

We have covered Super Iron Foundry in the past. Please check my conversation with the management:

What’s the worst IPO you’ve seen? Let’s discuss. 👇

Join our Stock Knocks Ecosystem, and share your views:

chat.whatsapp.com/Idmj9VUsw2y6cp…

Join our Stock Knocks Ecosystem, and share your views:

chat.whatsapp.com/Idmj9VUsw2y6cp…

• • •

Missing some Tweet in this thread? You can try to

force a refresh