Founder of Stock Knocks | London Business School alum + CS | Obsessed with India’s growth story, SMEs & geopolitics | Making SME investing simple with AI 🇮🇳

How to get URL link on X (Twitter) App

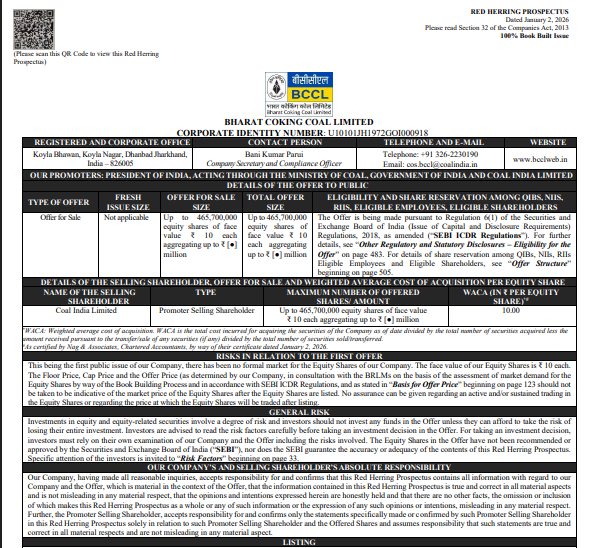

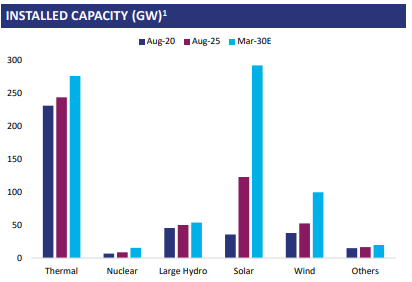

The offering comes at a fascinating time. The government is pushing divestment, but the industry backdrop is a paradox.

The offering comes at a fascinating time. The government is pushing divestment, but the industry backdrop is a paradox.

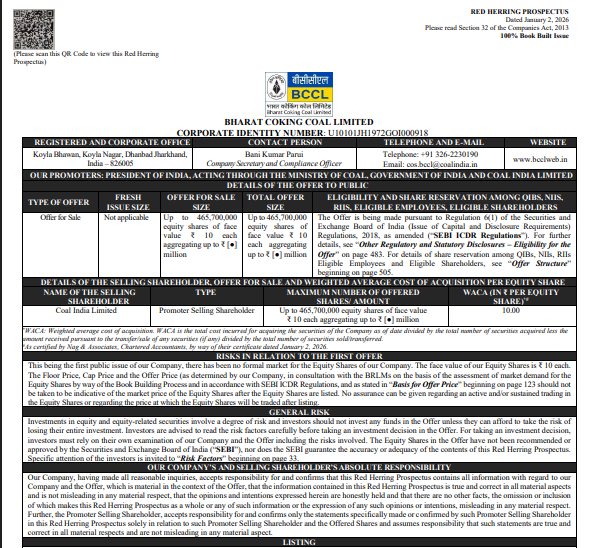

2/14 The Macro Context: Rising Import Dependence

2/14 The Macro Context: Rising Import Dependence

1/12: The Ingredient

1/12: The Ingredient

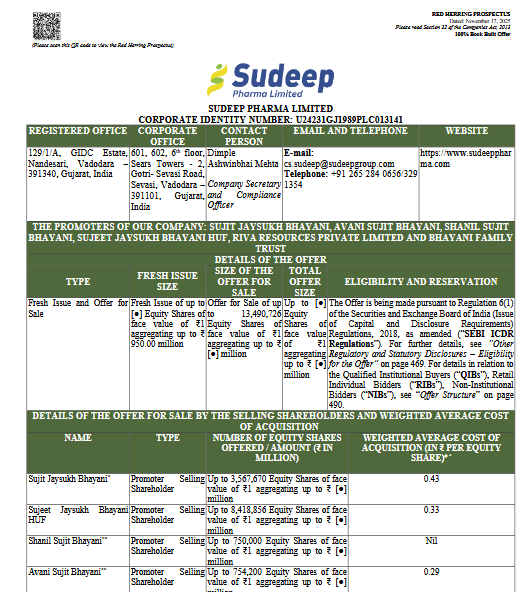

Their core business involves formulating various pesticides, including insecticides, herbicides, and fungicides.

Their core business involves formulating various pesticides, including insecticides, herbicides, and fungicides.

1/12: The Helmet King

1/12: The Helmet King

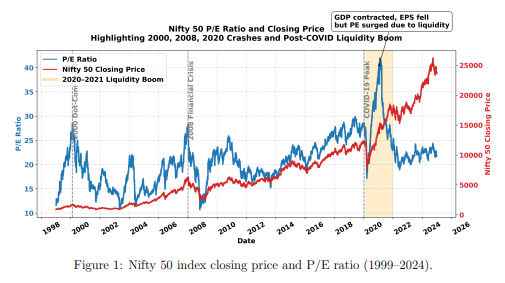

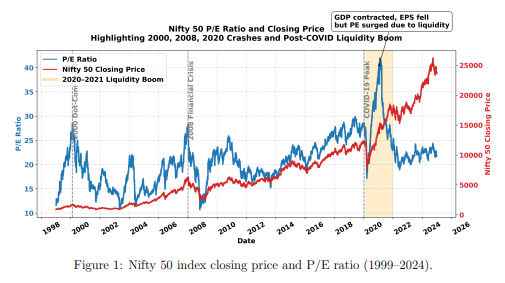

Let's start with a simple premise from a deep dive into 34 years of Nifty 50 data (1990-2024).

Let's start with a simple premise from a deep dive into 34 years of Nifty 50 data (1990-2024).

TechDefence Labs was incorporated in 2017 as a cybersecurity service company. Sunny Vaghela Ji himself has 15 years of experience in cybersecurity, starting as an ethical hacker at the age of 16.

TechDefence Labs was incorporated in 2017 as a cybersecurity service company. Sunny Vaghela Ji himself has 15 years of experience in cybersecurity, starting as an ethical hacker at the age of 16.

What does Swastika Castal do?

What does Swastika Castal do?

2/8 Business Segments & Differentiators:

2/8 Business Segments & Differentiators:

2/17 What Does Safe Enterprises Do?

2/17 What Does Safe Enterprises Do?

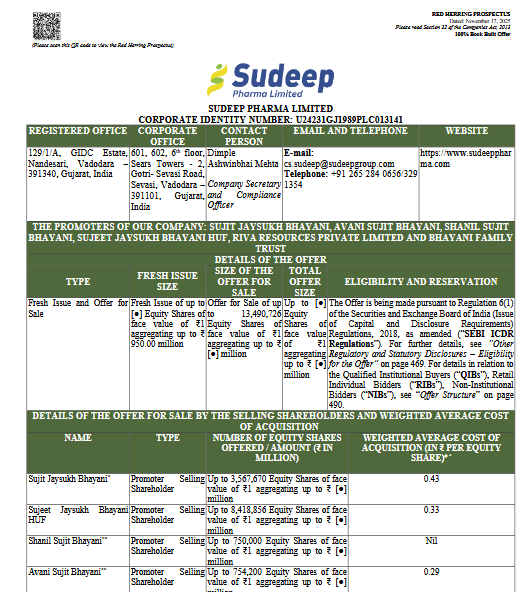

INTRODUCTION

INTRODUCTION