Can a two-decade-old stock strategy still work in crypto?

I tested Larry Connors’ famous 2-period RSI strategy on crypto.

Here’s what happened (and how I improved it):

I tested Larry Connors’ famous 2-period RSI strategy on crypto.

Here’s what happened (and how I improved it):

Larry Connors' RSI(2) strategy is one of the most cited mean reversion systems in stock trading.

But how does it hold up in crypto, a market with 24/7 trading, higher volatility and slightly different behaviour

Let's test it:

But how does it hold up in crypto, a market with 24/7 trading, higher volatility and slightly different behaviour

Let's test it:

Basic entry rules:

1. Close > Moving Average 200

2. Close < Moving Average 5

3. RSI 2 < 10

Exit rule: Close > Moving Average 5

Entry and exit occurs on daily close.

1. Close > Moving Average 200

2. Close < Moving Average 5

3. RSI 2 < 10

Exit rule: Close > Moving Average 5

Entry and exit occurs on daily close.

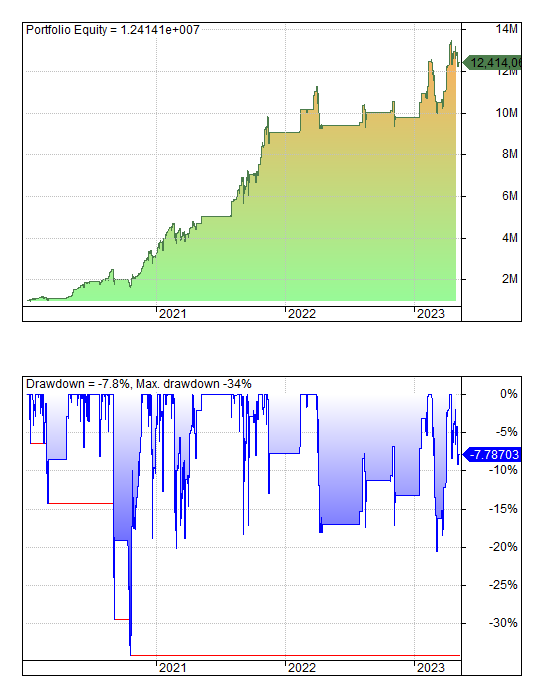

Results on Bitcoin are not very good

Only +50% from 2020 to mid-2023.

Mostly out of the market. Performance is flat and inconsistent.

Only +50% from 2020 to mid-2023.

Mostly out of the market. Performance is flat and inconsistent.

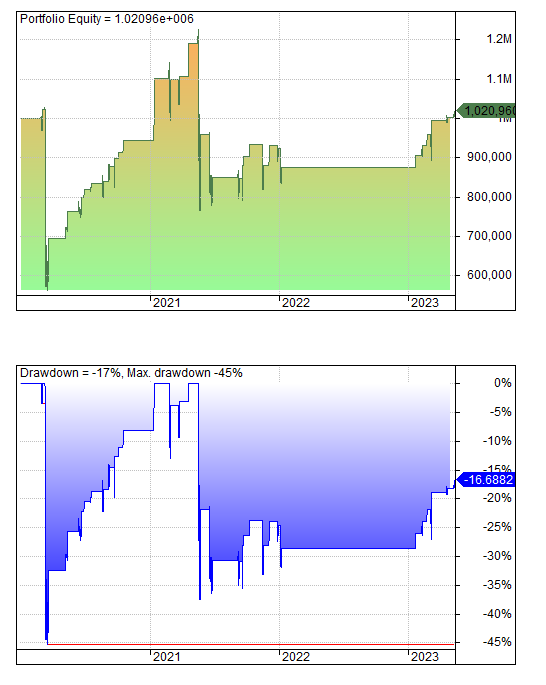

Results on Ethereum are even worse.

Flat returns equity curve and no consistent edge.

So… is the strategy useless in crypto?

Not necessarily.

Flat returns equity curve and no consistent edge.

So… is the strategy useless in crypto?

Not necessarily.

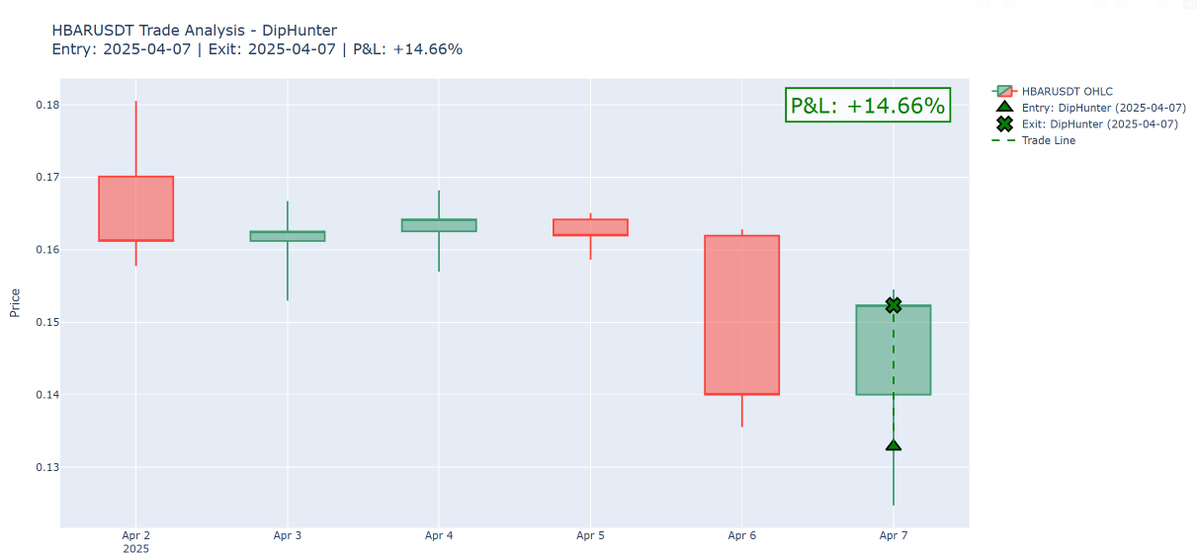

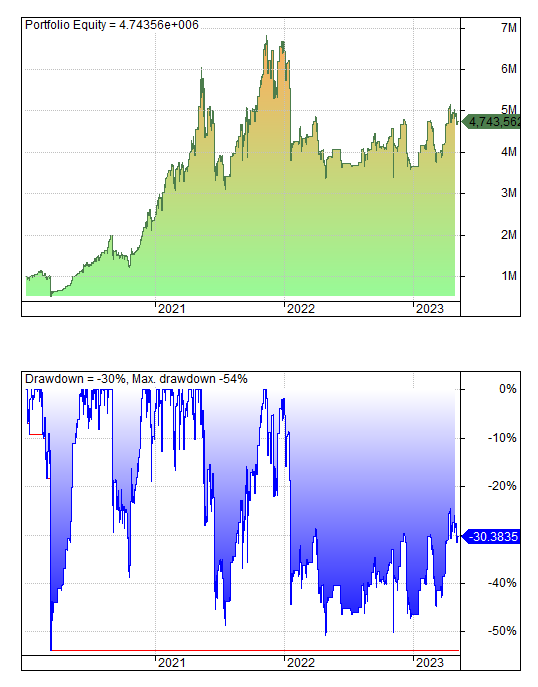

What if we take a different approach?

I applied the strategy to a portfolio of the 100 largest coins, always entering the top 3 coins with the strongest 7-day momentum.

Let's take a look at the results:

I applied the strategy to a portfolio of the 100 largest coins, always entering the top 3 coins with the strongest 7-day momentum.

Let's take a look at the results:

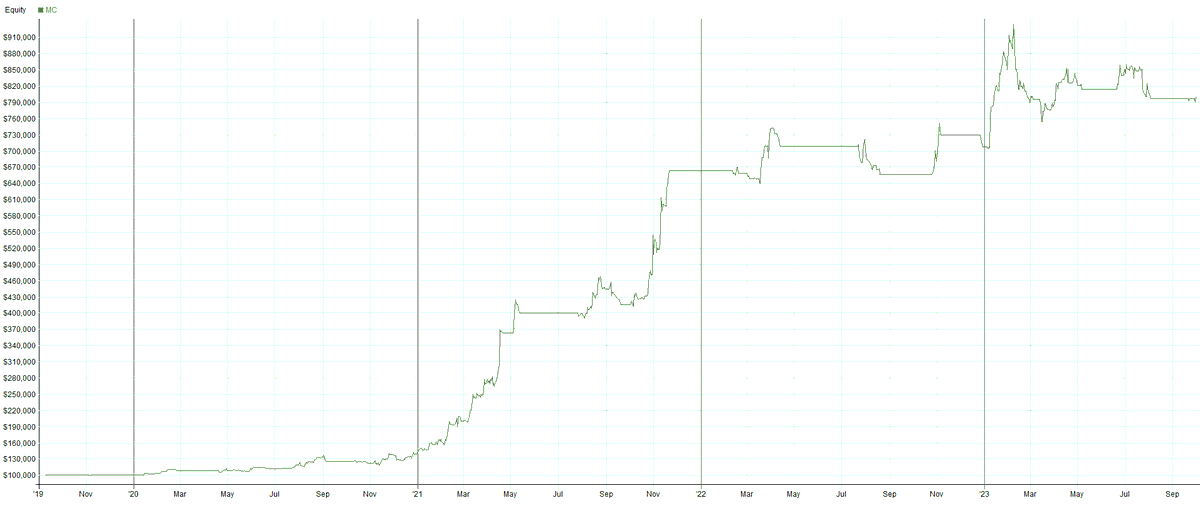

The strategy returned 370% from 2020 to mid-2023.

It was flat in 2022. Yet this is a period when it should perform relatively decently.

The drawdowns are also quite deep, up to 50%, which is not an ideal characteristic of a Mean Reversion strategy.

It was flat in 2022. Yet this is a period when it should perform relatively decently.

The drawdowns are also quite deep, up to 50%, which is not an ideal characteristic of a Mean Reversion strategy.

What's the reason for these large drawdowns?

Entries into the market when conditions are not favourable.

The strategy keeps entering an oversold market in a severe bear market.

But we can avoid this with a regime filter:

Entries into the market when conditions are not favourable.

The strategy keeps entering an oversold market in a severe bear market.

But we can avoid this with a regime filter:

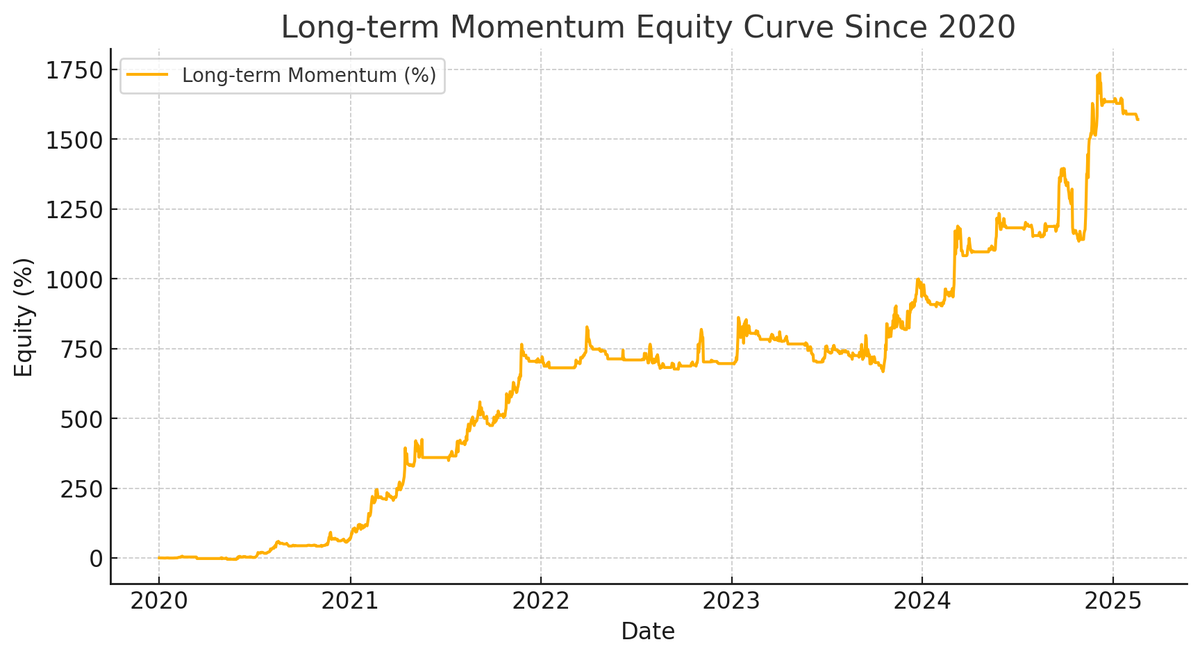

My favourite basic regime filter for crypto long trades?

BTC > Moving Average 50

With this simple change in logic, we only enter when Bitcoin is in a bullish regime.

BTC > Moving Average 50

With this simple change in logic, we only enter when Bitcoin is in a bullish regime.

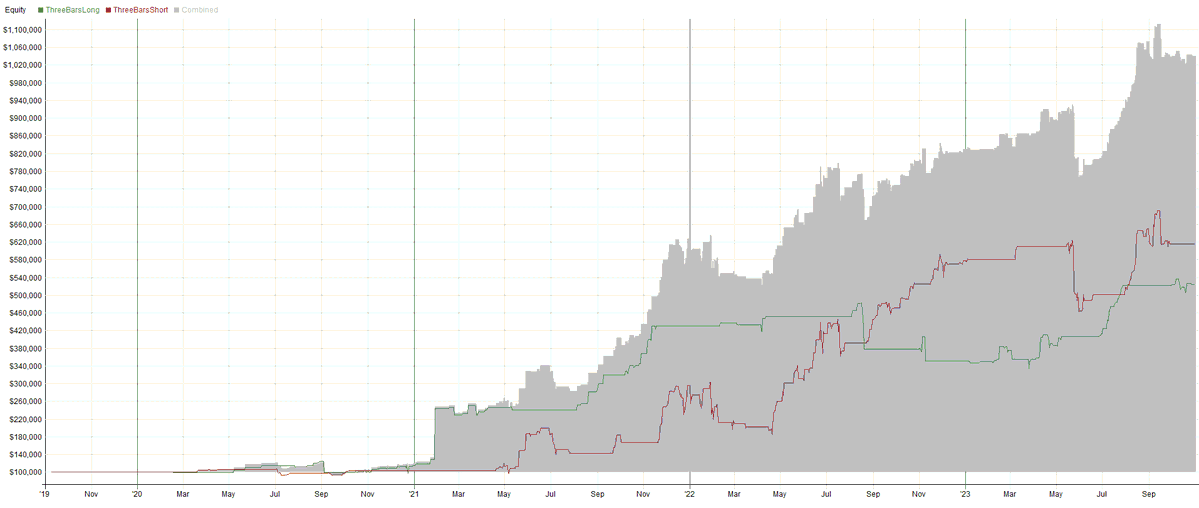

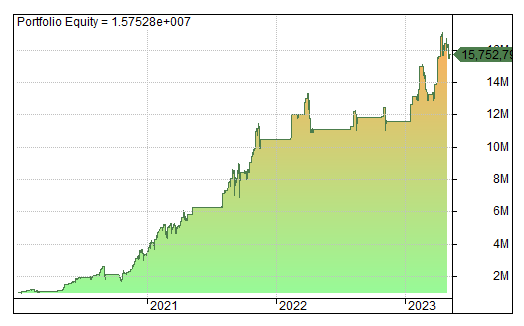

With the BTC > MA(50) filter:

• We avoided much of the 2022 drawdown

• Preserved gains from earlier phases

• Re-entered in 2023 as the market recovered

• Equity curve smoothed significantly

• We avoided much of the 2022 drawdown

• Preserved gains from earlier phases

• Re-entered in 2023 as the market recovered

• Equity curve smoothed significantly

At first glance, the RSI(2) strategy looked useless in crypto.

But with a few tweaks, this strategy could be live traded.

Old ideas still work. They just need to be adapted to the nature of the new market.

But with a few tweaks, this strategy could be live traded.

Old ideas still work. They just need to be adapted to the nature of the new market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh