How to get URL link on X (Twitter) App

2/ Choose the most effective trading approach

2/ Choose the most effective trading approach

Before we dive in, I post daily insights on crypto trading.

Before we dive in, I post daily insights on crypto trading.

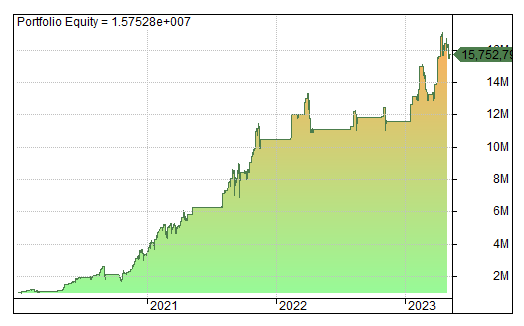

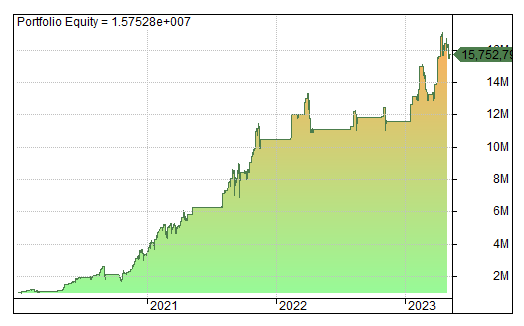

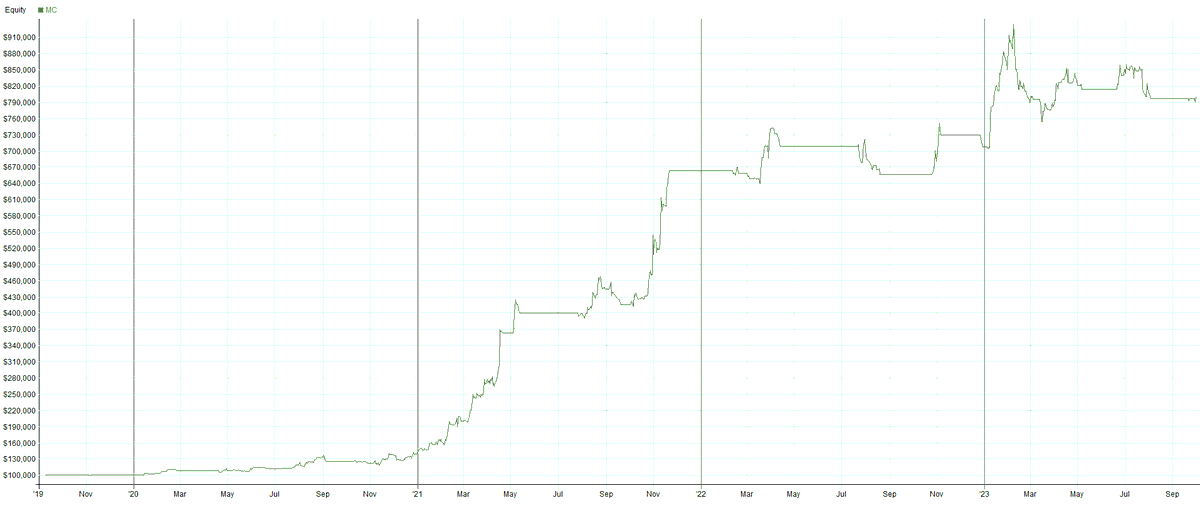

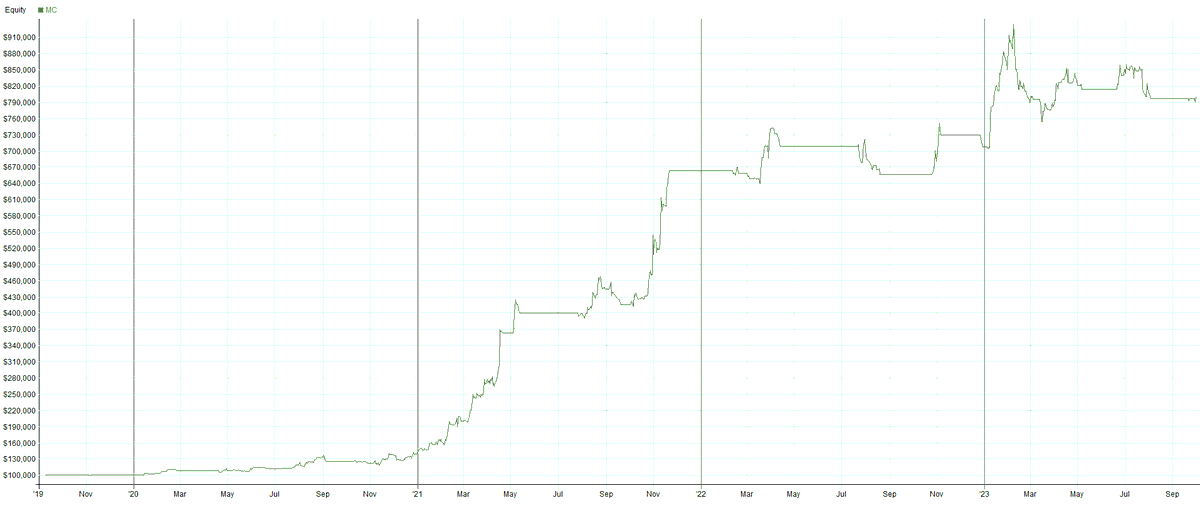

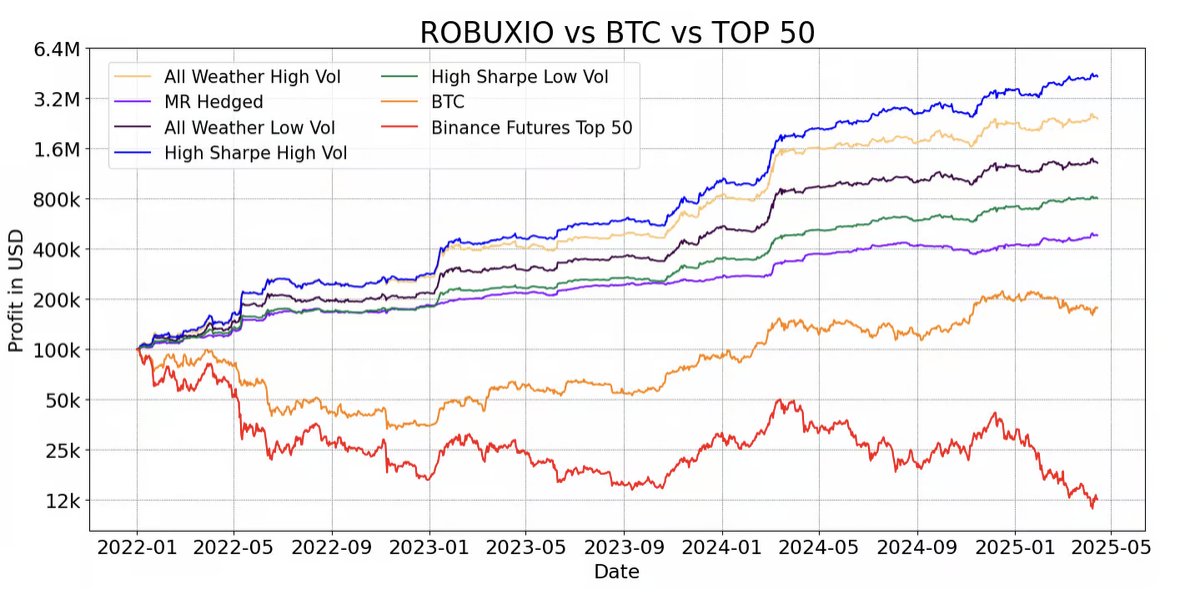

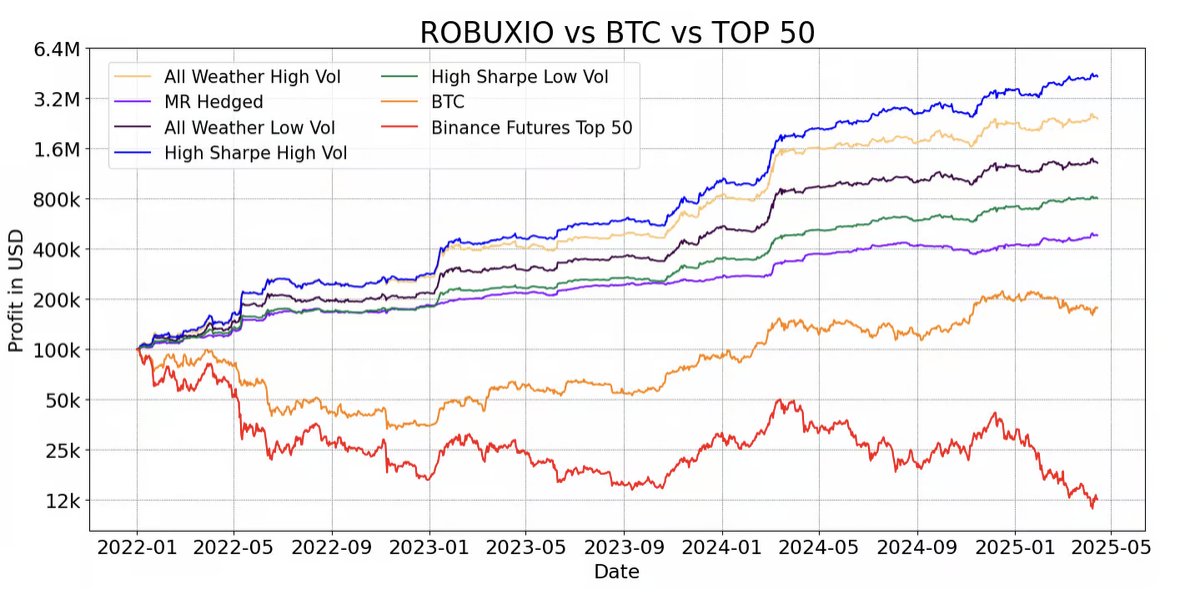

1/ Audited Returns

1/ Audited Returns

1/ Start with an idea-first approach.

1/ Start with an idea-first approach.

The most robust strategies tend to be simple.

The most robust strategies tend to be simple.

Larry Connors' RSI(2) strategy is one of the most cited mean reversion systems in stock trading.

Larry Connors' RSI(2) strategy is one of the most cited mean reversion systems in stock trading.

When you build from the idea up, you anchor your expectations in market behaviour, not just backtest stats.

When you build from the idea up, you anchor your expectations in market behaviour, not just backtest stats.

2/ What is a mean reversion strategy?

2/ What is a mean reversion strategy?

1) Start with edge. Not coins.

1) Start with edge. Not coins.

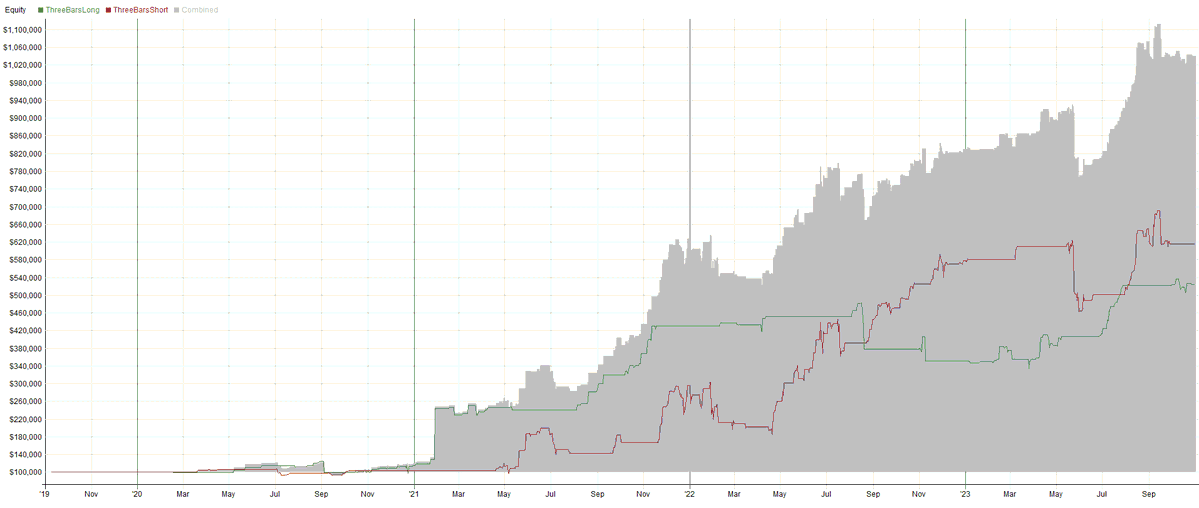

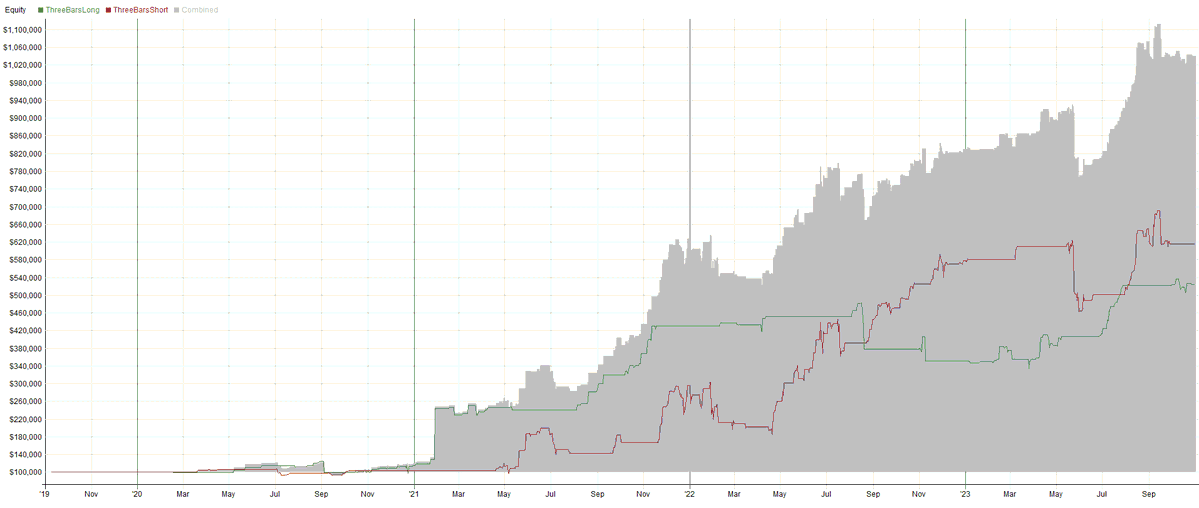

1/ Short-term momentum: Breakout Lite strategy

1/ Short-term momentum: Breakout Lite strategy

1. Audited returns

1. Audited returns

1. Audited returns

1. Audited returns

2/ Understand the Nature of the Market.

2/ Understand the Nature of the Market.

2. Portfolio consists of the following patterns:

2. Portfolio consists of the following patterns:

2. Pin Bar Definition:

2. Pin Bar Definition: