🧵 Deep Dive: $ULTY's March 2025 Strategy Overhaul – How It Transforms Income Generation

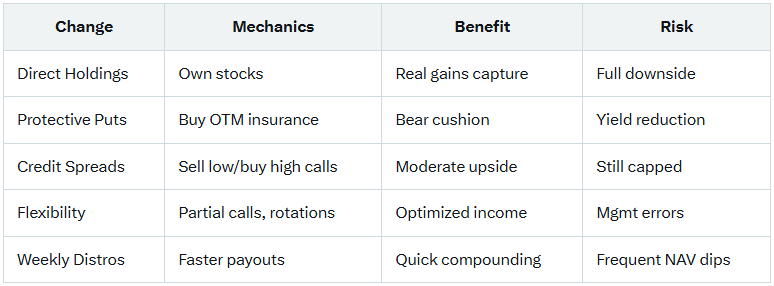

YieldMax's $ULTY ETF revamped its approach in March 2025, shifting from pure covered calls to a tactical, resilient model. This addresses past NAV erosion while boosting income potential. Let's unpack each change, mechanics, benefits, & risks 👇

YieldMax's $ULTY ETF revamped its approach in March 2025, shifting from pure covered calls to a tactical, resilient model. This addresses past NAV erosion while boosting income potential. Let's unpack each change, mechanics, benefits, & risks 👇

1/9. Background: Why the Changes?

Pre-March: $ULTY used synthetic positions (swaps) for exposure to 15-30 high-vol stocks, selling calls for premiums. But volatility led to NAV decay & uneven payouts.

March 2025 tweaks: Direct holdings, protective options, spreads, flexibility, & weekly distros. Aims: Better alignment, downside buffers, upside capture. Since then, AUM ~$1.6B, YTD returns ~15.6%.

Pre-March: $ULTY used synthetic positions (swaps) for exposure to 15-30 high-vol stocks, selling calls for premiums. But volatility led to NAV decay & uneven payouts.

March 2025 tweaks: Direct holdings, protective options, spreads, flexibility, & weekly distros. Aims: Better alignment, downside buffers, upside capture. Since then, AUM ~$1.6B, YTD returns ~15.6%.

2/9. Change 1: Direct Stock Holdings (Equity Strategy)

Now: Owns actual U.S.-listed equities (e.g., NVDA, MSTR) instead of swaps.

How it works: Builds a portfolio of volatile names, providing real asset backing & direct price exposure.

Benefits: Reduces counterparty risk from swaps; captures underlying gains better in bulls. Post-change, NAV stabilized (~$6 range despite payouts).

Risks: Full downside if stocks tank, but buffered elsewhere.

Now: Owns actual U.S.-listed equities (e.g., NVDA, MSTR) instead of swaps.

How it works: Builds a portfolio of volatile names, providing real asset backing & direct price exposure.

Benefits: Reduces counterparty risk from swaps; captures underlying gains better in bulls. Post-change, NAV stabilized (~$6 range despite payouts).

Risks: Full downside if stocks tank, but buffered elsewhere.

3/9. Change 2: Adding Protective Puts (OTM)

New: Buys out-of-the-money puts on holdings for downside mitigation.

Mechanics: Puts act as insurance—gain value if stocks drop > strike, offsetting losses. Cost: Reduces net premiums (yield dip ~5-10%).

Benefits: Cushions in bears (e.g., limits 20% drop to 10-15%). Per users, enables "gains during downturns" via put profits.

Risks: In flat/bull markets, put premiums erode yields; no full protection.

New: Buys out-of-the-money puts on holdings for downside mitigation.

Mechanics: Puts act as insurance—gain value if stocks drop > strike, offsetting losses. Cost: Reduces net premiums (yield dip ~5-10%).

Benefits: Cushions in bears (e.g., limits 20% drop to 10-15%). Per users, enables "gains during downturns" via put profits.

Risks: In flat/bull markets, put premiums erode yields; no full protection.

4/9. Change 3: Credit Call Spreads Over Traditional Calls

Shift: Uses credit spreads (sell call at strike A, buy higher at B) vs. simple covered calls.

How: Collects net premium (credit) while allowing moderate upside (to strike B). Caps gains less severely.

Benefits: More participation in rallies (e.g., capture 10-20% vs. 0%); fits vol stocks. Tactical enhancements boost risk-adjusted returns.

Risks: Still limits big surges; spreads can expire worthless in flats.

Shift: Uses credit spreads (sell call at strike A, buy higher at B) vs. simple covered calls.

How: Collects net premium (credit) while allowing moderate upside (to strike B). Caps gains less severely.

Benefits: More participation in rallies (e.g., capture 10-20% vs. 0%); fits vol stocks. Tactical enhancements boost risk-adjusted returns.

Risks: Still limits big surges; spreads can expire worthless in flats.

5/9. Change 4: Flexibility in Call Writing

Now: Writes calls on a portion (not always 100%) of holdings; rotates based on vol/market.

Mechanics: Managers pick 15-30 stocks weekly, adjust strikes/expirations dynamically.

Benefits: Optimizes income—full calls in sideways, partial in bulls. Diversification + choice = steadier payouts.

Risks: Active mgmt fees (1.30%); wrong calls amplify losses.

Now: Writes calls on a portion (not always 100%) of holdings; rotates based on vol/market.

Mechanics: Managers pick 15-30 stocks weekly, adjust strikes/expirations dynamically.

Benefits: Optimizes income—full calls in sideways, partial in bulls. Diversification + choice = steadier payouts.

Risks: Active mgmt fees (1.30%); wrong calls amplify losses.

6/9. Change 5: Weekly Distributions (from Monthly)

Since March: Pays ~$0.09/share weekly vs. monthly lumps.

How: Accelerates income flow; often 100% ROC (tax-deferred premiums).

Benefits: Compounds faster if reinvested; appeals to income hunters. Avg. annualized ~78% post-change.

Risks: More frequent ex-div drops; ROC lowers basis (tax implications on sale).

Since March: Pays ~$0.09/share weekly vs. monthly lumps.

How: Accelerates income flow; often 100% ROC (tax-deferred premiums).

Benefits: Compounds faster if reinvested; appeals to income hunters. Avg. annualized ~78% post-change.

Risks: More frequent ex-div drops; ROC lowers basis (tax implications on sale).

7/9. Overall Impact: Performance & Objectives

Primary: High current income (60-80% yields).

Secondary: Capped exposure to underlying.

Since March: NAV stable/slight up in bull; total returns outperform pre-change. Thrives in vol/sideways; lags strong bulls.

But: High risk—volatility, no guarantees.

Primary: High current income (60-80% yields).

Secondary: Capped exposure to underlying.

Since March: NAV stable/slight up in bull; total returns outperform pre-change. Thrives in vol/sideways; lags strong bulls.

But: High risk—volatility, no guarantees.

9/9. Final Thought: $ULTY's 2025 revamp makes it more investor-friendly for vol markets, blending income with protection. But suit your risk tolerance.

📖 For Educational Purposes Only

🚨 Not Financial Advice

👉 Do Your Own Research

I drop educational threads daily. If value, ❤️ or 🔁 helps spread knowledge!

$ULTY strategy thoughts? Below!

📖 For Educational Purposes Only

🚨 Not Financial Advice

👉 Do Your Own Research

I drop educational threads daily. If value, ❤️ or 🔁 helps spread knowledge!

$ULTY strategy thoughts? Below!

• • •

Missing some Tweet in this thread? You can try to

force a refresh