I've spent years obsessing over 100-baggers.

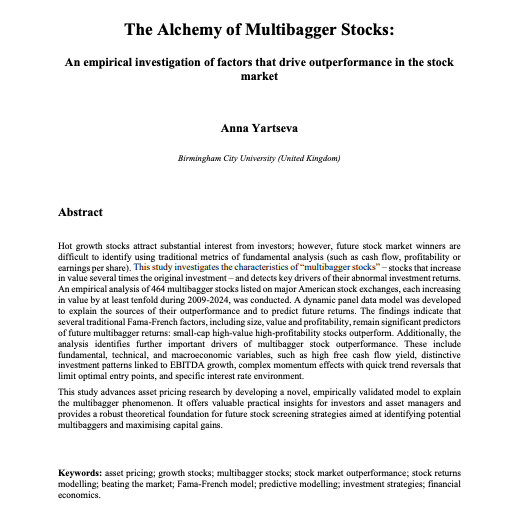

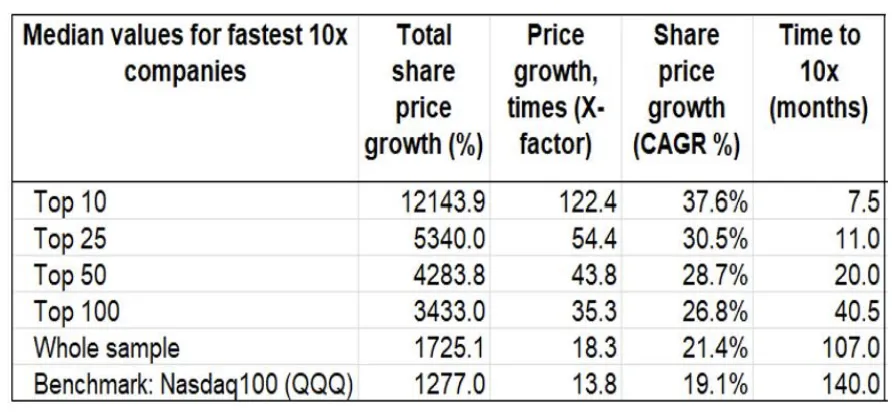

I recently found Anna Yartseva's study that analyzed 464 ten-baggers over 24 years.

It challenged everything I thought I knew. FCF yield dominated every other factor.

Here's why I'm rebuilding my approach:🧵

I recently found Anna Yartseva's study that analyzed 464 ten-baggers over 24 years.

It challenged everything I thought I knew. FCF yield dominated every other factor.

Here's why I'm rebuilding my approach:🧵

Here's the thing most investors don't realize:

Academic research on multibaggers barely exists.

Everyone knows the books by Thomas Phelps and Christopher Mayer.

Great stories, but they focus on case studies and qualitative properties.

Anna Yartseva did something different...

Academic research on multibaggers barely exists.

Everyone knows the books by Thomas Phelps and Christopher Mayer.

Great stories, but they focus on case studies and qualitative properties.

Anna Yartseva did something different...

Her study was published at Birmingham City University in February.

Completely unnoticed by most investors.

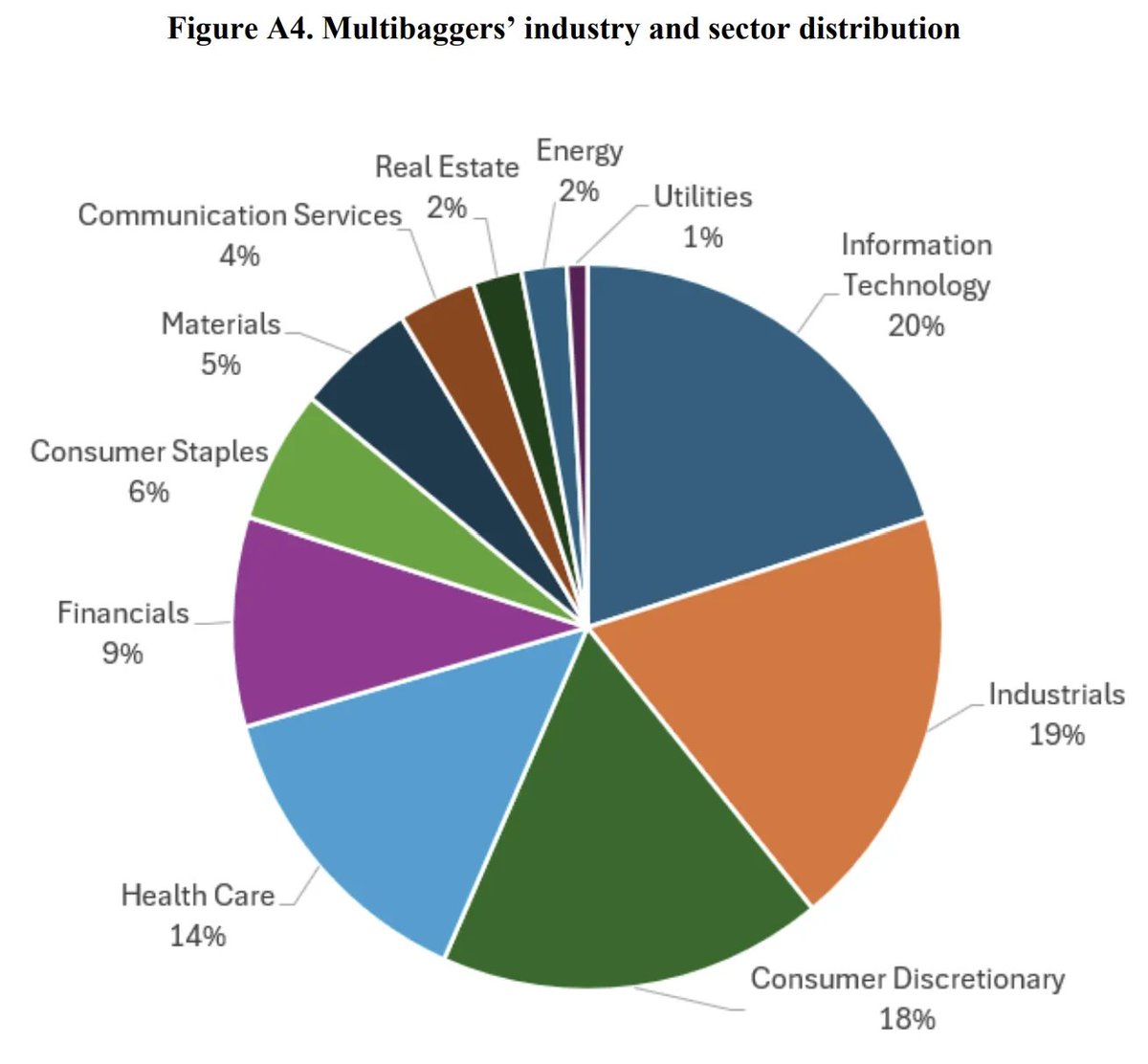

464 companies that returned 10x+ from 2009 to 2024. That's a 16.6% annual return minimum.

The goal? Find factors that actually predict outperformance.

Completely unnoticed by most investors.

464 companies that returned 10x+ from 2009 to 2024. That's a 16.6% annual return minimum.

The goal? Find factors that actually predict outperformance.

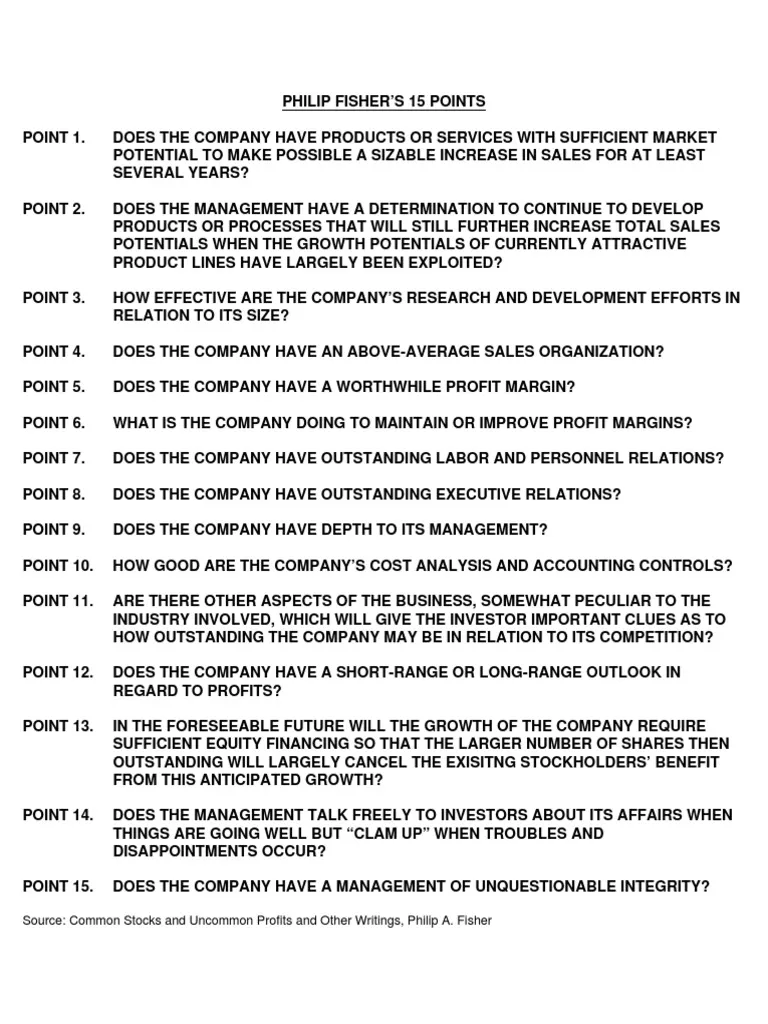

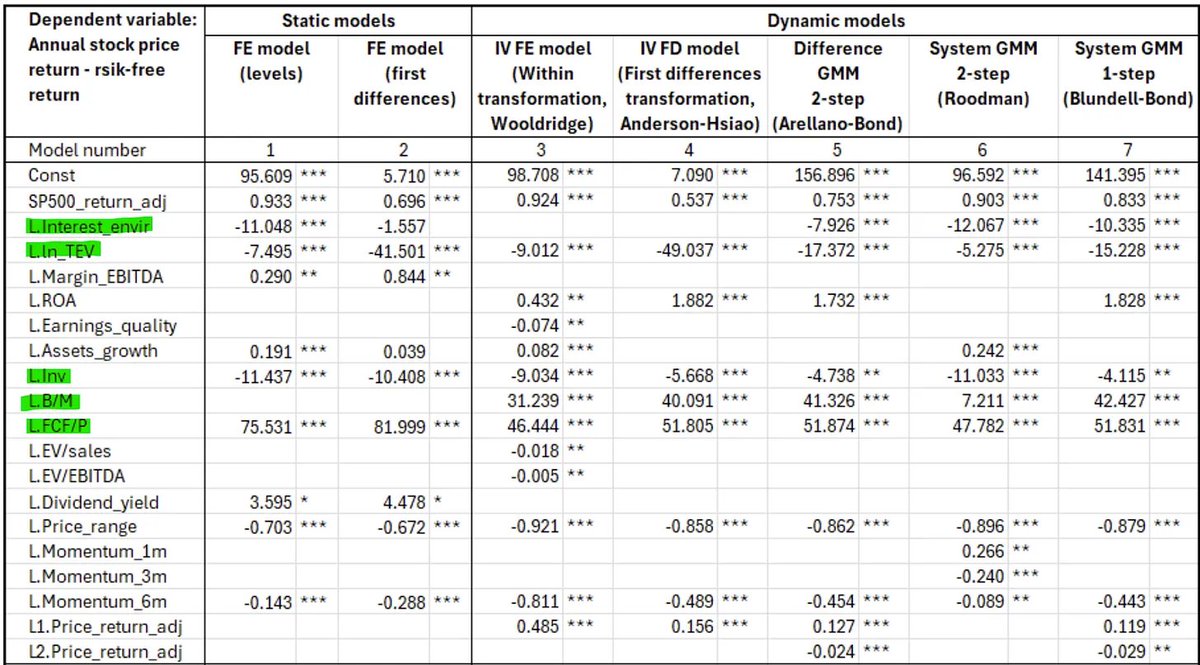

First, she tested the classic Fama-French five-factor model:

Market risk

Size factor (small vs large caps)

Value factor (book-to-market ratio)

Profitability factor

Investment factor

The results confirmed some basics but revealed hidden patterns.

Market risk

Size factor (small vs large caps)

Value factor (book-to-market ratio)

Profitability factor

Investment factor

The results confirmed some basics but revealed hidden patterns.

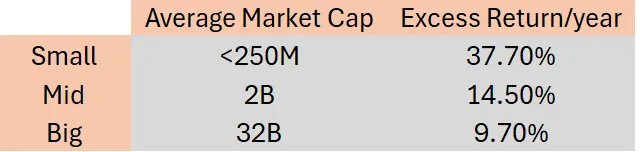

Small caps outperformed as expected.

But here's the twist: when she looked at median returns instead of averages, the size effect weakened.

Translation: Small cap alone isn't enough. You need other factors in combination.

But here's the twist: when she looked at median returns instead of averages, the size effect weakened.

Translation: Small cap alone isn't enough. You need other factors in combination.

The value factor proved stronger than size.

Companies with lower book-to-market ratios consistently outperformed.

But here's the crucial finding: small cap + high value + low profitability = negative returns.

You can't just buy cheap. You need profitable cheap.

Companies with lower book-to-market ratios consistently outperformed.

But here's the crucial finding: small cap + high value + low profitability = negative returns.

You can't just buy cheap. You need profitable cheap.

Then she pushed further.

Anna analyzed over 150 variables across 8 categories:

Capital allocation

Technical factors

Earnings growth

Financial health

Profitability

Valuation

Quality

Others

The results challenged conventional wisdom.

Anna analyzed over 150 variables across 8 categories:

Capital allocation

Technical factors

Earnings growth

Financial health

Profitability

Valuation

Quality

Others

The results challenged conventional wisdom.

Earnings growth? Statistically insignificant.

FCF growth? Also meaningless according to the model.

Financial health? Doesn't matter.

Capital allocation decisions? Irrelevant.

The data destroyed what most "experts" teach about multibagger investing.

FCF growth? Also meaningless according to the model.

Financial health? Doesn't matter.

Capital allocation decisions? Irrelevant.

The data destroyed what most "experts" teach about multibagger investing.

The strongest factor by far?

FCF/P ratio (Free Cash Flow / Price).

Pure free cash flow yield dominated every other variable in predicting 10x returns.

FCF/P ratio (Free Cash Flow / Price).

Pure free cash flow yield dominated every other variable in predicting 10x returns.

Here's what else mattered in the enhanced model:

Size factor (small caps confirmed)

Profitability factor (confirmed)

Aggressive investment (but only when profitability supports it)

Entry price timing (52-week lows outperform)

But FCF yield ruled them all.

Size factor (small caps confirmed)

Profitability factor (confirmed)

Aggressive investment (but only when profitability supports it)

Entry price timing (52-week lows outperform)

But FCF yield ruled them all.

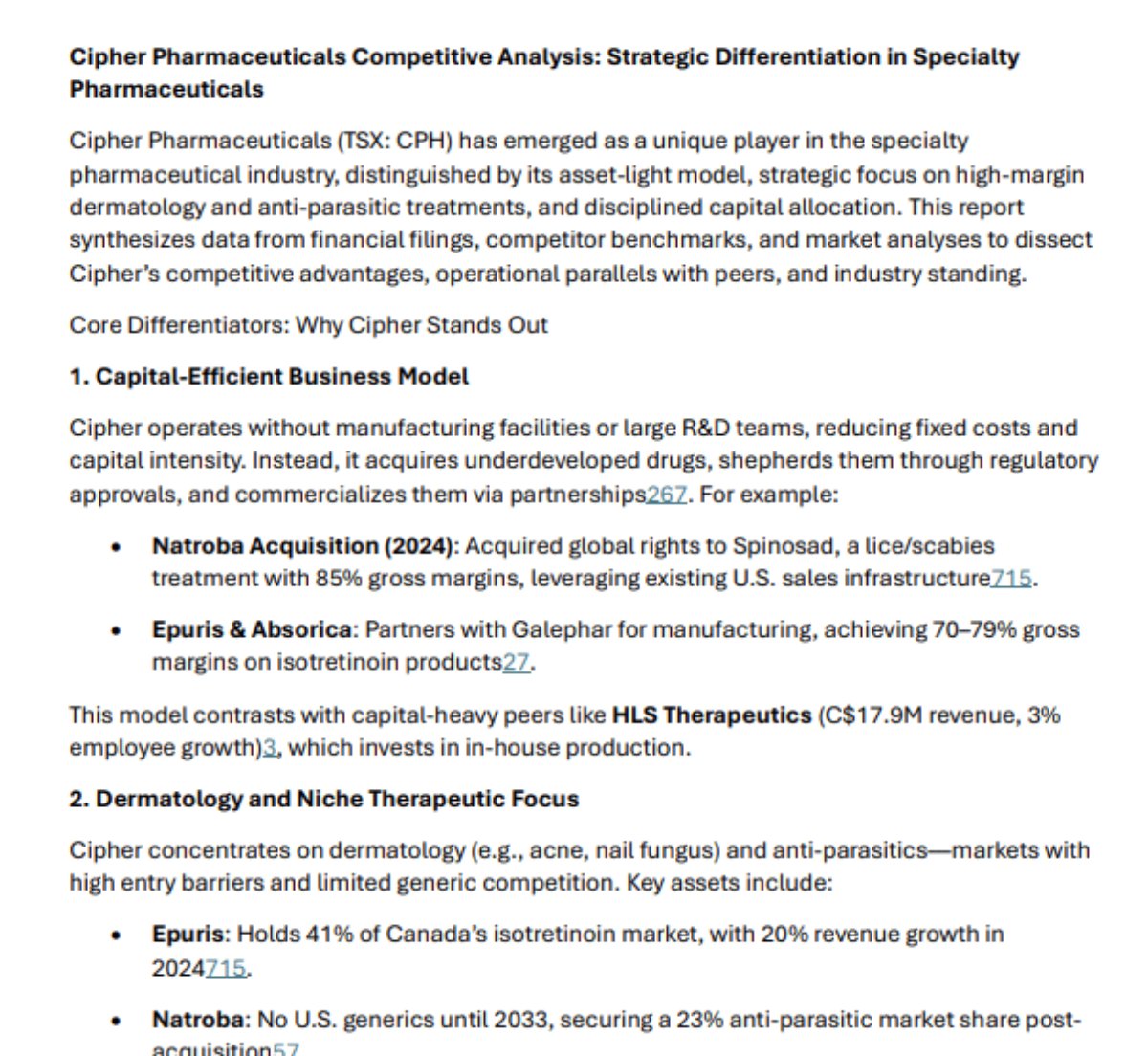

The market is fast at recognizing obvious winners.

But it's terrible at spotting turnarounds.

Companies with high FCF yields that look "horrible" to most investors? That's where real opportunities hide.

Sometimes the best investments look the worst.

But it's terrible at spotting turnarounds.

Companies with high FCF yields that look "horrible" to most investors? That's where real opportunities hide.

Sometimes the best investments look the worst.

This discovery is just the beginning for me.

Most multibagger research focuses on US stocks. I want to go global.

Do these factors work in Europe? Asia? Emerging markets?

I'm planning a worldwide study to find out.

Most multibagger research focuses on US stocks. I want to go global.

Do these factors work in Europe? Asia? Emerging markets?

I'm planning a worldwide study to find out.

My wife thinks I'm crazy for this project.

She's probably right.

I want to build a global multibagger ranking across countries and industries.

I need data scientists to help - this isn't a small project.

She's probably right.

I want to build a global multibagger ranking across countries and industries.

I need data scientists to help - this isn't a small project.

Thank you for reading.

I will be updating you guys more on this project as i work on it. If you don’t want to miss it, subscribe to my newsletter.

Join here for free:

100baggerhunting.com

I will be updating you guys more on this project as i work on it. If you don’t want to miss it, subscribe to my newsletter.

Join here for free:

100baggerhunting.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh