$ABVX may be up a lot since last week, but the upside from $66 remains significant. IMO, $ABVX is probably the single most obvious M&A candidate I have ever seen, and the price it's trading at remains quite attractive relative to M&A comps.

You could argue that UC has been the single biggest indication for biotech M&A over the last ~5 years. So far, essentially everything else that has made it past P2 successfully has been bought out (with lofty valuations to boot). $ABVX is in rare territory now, since nothing else like this has even made it this far (past P3) without getting bought out!

Let's go over $ABVX's data and compare it to M&A cases. I'll explain why $ABVX's final destination is, in my biased opinion, well north of $150/share.

You could argue that UC has been the single biggest indication for biotech M&A over the last ~5 years. So far, essentially everything else that has made it past P2 successfully has been bought out (with lofty valuations to boot). $ABVX is in rare territory now, since nothing else like this has even made it this far (past P3) without getting bought out!

Let's go over $ABVX's data and compare it to M&A cases. I'll explain why $ABVX's final destination is, in my biased opinion, well north of $150/share.

1) What $ABVX Just Showed

The results of their P3 studies were incredible. $ABVX has shown:

➡️The 3rd highest clinical remission delta ever seen in a P3 program (16.4%). The only two drugs to have higher deltas are Rinvoq and Veslipity, both with dangerous safety warnings on label.

➡️Squeaky clean safety. Adverse event rates were essentially the same on drug as with placebo...transient headaches were the only tolerability signal (already known from P2 data), and they only lasted an average of 2 days before going away on their own...

➡️Excellent Secondary Endpoint Efficacy. Specifically, a 27% endoscopic improvement delta (the most objective endpoint in UC) is the 2nd highest ever recorded in P3, exceeded only by Rinvoq (which has multiple potentially fatal side effects with black box warning).

$ABVX posted these incredible results despite the facts that:

➡️Their trial enrolled the highest percentage of JAKi refractory patients in any UC trial EVER. Much like their P2b, their P3 showed incredible results despite treating more severe patients than any comparator drug.

➡️Their induction timepoint was only 8 weeks. Most other new studies are using 12-14 week induction timepoints, because the remission delta increases with longer treatment. $ABVX cut no corners, and is still beating the comps that sandbag their data by running longer induction periods.

Top tier efficacy and water-like safety despite treating the most severe patient population ever, all in a convenient once-daily pill that requires no pre-initiation bloodwork/lab testing...this P3 readout for $ABVX was a GRAND SLAM.

The results of their P3 studies were incredible. $ABVX has shown:

➡️The 3rd highest clinical remission delta ever seen in a P3 program (16.4%). The only two drugs to have higher deltas are Rinvoq and Veslipity, both with dangerous safety warnings on label.

➡️Squeaky clean safety. Adverse event rates were essentially the same on drug as with placebo...transient headaches were the only tolerability signal (already known from P2 data), and they only lasted an average of 2 days before going away on their own...

➡️Excellent Secondary Endpoint Efficacy. Specifically, a 27% endoscopic improvement delta (the most objective endpoint in UC) is the 2nd highest ever recorded in P3, exceeded only by Rinvoq (which has multiple potentially fatal side effects with black box warning).

$ABVX posted these incredible results despite the facts that:

➡️Their trial enrolled the highest percentage of JAKi refractory patients in any UC trial EVER. Much like their P2b, their P3 showed incredible results despite treating more severe patients than any comparator drug.

➡️Their induction timepoint was only 8 weeks. Most other new studies are using 12-14 week induction timepoints, because the remission delta increases with longer treatment. $ABVX cut no corners, and is still beating the comps that sandbag their data by running longer induction periods.

Top tier efficacy and water-like safety despite treating the most severe patient population ever, all in a convenient once-daily pill that requires no pre-initiation bloodwork/lab testing...this P3 readout for $ABVX was a GRAND SLAM.

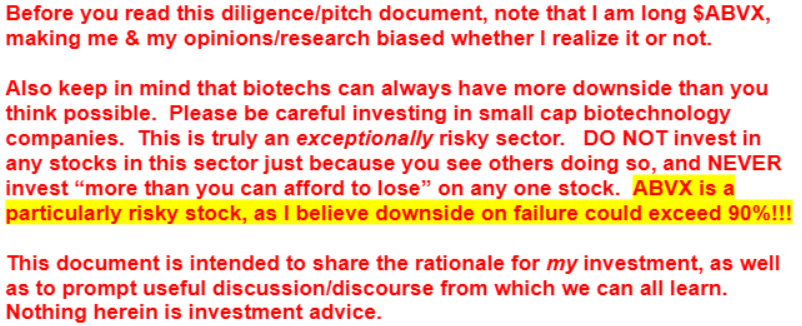

2) General M&A Comps for $ABVX

🗒️Important Note: There are no post-phase 3 data M&A comps we can make for $ABVX because...EVERYTHING ELSE HAS BEEN BOUGHT OUT *BEFORE* PHASE 3 DATA ARRIVED!

The table attached summarizes the main M&A case studies in this space, with $ABVX's upside to those prices ranging from 37%-120%.

In the slides that follow, I will break down these comps and explain why I think that $ABVX should be valued even higher than the high end of that M&A range (yes, I think remaining upside should be >120%).

🗒️Important Note: There are no post-phase 3 data M&A comps we can make for $ABVX because...EVERYTHING ELSE HAS BEEN BOUGHT OUT *BEFORE* PHASE 3 DATA ARRIVED!

The table attached summarizes the main M&A case studies in this space, with $ABVX's upside to those prices ranging from 37%-120%.

In the slides that follow, I will break down these comps and explain why I think that $ABVX should be valued even higher than the high end of that M&A range (yes, I think remaining upside should be >120%).

3) $ABVX Vs S1P1 M&A Comps

Zeposia and Velsipity are S1P1 drugs that were acquired for $7.2B and $6.7B respectively (37-47% upside from $ABVX's current valuation). Here are the reasons that $ABVX's drug should be valued much higher than these S1P1 comps were:

1⃣ SAFETY! ABVX is headed for a squeaky clean safety label. This is not only comforting for doctors/patients, but it also opens the door to combination therapy with other drugs that might be immunosuppressive without worrying about increasing infection risk.

2⃣Ease of Use! Both are once-daily oral drugs, but the S1P1 class has highly burdensome initiation requirements. Once your GI doctor decides to put you on one and goes through the infection risks with you, you then have to go through many other hoops BEFORE you can start the drug:

↪️Bloodwork must be performed and result normal (CBC, LFTs, Hep B/C, VZV IgG, HIB, TB test)

↪️Ophthalmologic (eye) exam must be done (due to risk of macular edema from the drug)

↪️Electrocardiogram (heart monitoring) due to the risk of heart block

👉$ABVX's obefazimod should have none of these burdensome initiation requirements. Your GI doc prescribes it that day, and you are both DONE. GI docs will vastly prefer this low-friction prescription, and given that it has high efficacy with no safety concerns...why wouldn't they?!

3⃣Uniqueness of MoA! There were multiple S1P1 drugs in the pipeline for UC at the time of these acquisitions (Velsipity and Zeposia approved in the US, and VTX-002 was among a list of others). The fact that there would be intra-class competition in the S1P1 market was known at the time of these acquisitions, however...

↪️$ABVX's miR-124 MoA is the only drug known to be in development ANYWHERE with that MoA right now! There is no competition anywhere in site for this drug. This will be a huge advantage for its uptake.

➡️In an era where any promising drug target gets flooded with dozens of "me too" drugs with the same MoA, it is incredibly rare to see a drug with a unique MoA like this be so efficacious in such a large indication with ZERO competition. This is a truly rare asset for big pharma.

4⃣Timeline advantage. $ABVX is already through the bulk of its P3 studies, whereas the S1P1s were bought out months to years BEFORE P3 induction readouts. Not only is ABVX closer to making money, but they also have less risk than the S1P1s did, and ABVX will require far less funding to finish up their P3 program than the S1P1s did!

Noting the 4 points above, it is obvious to me that $ABVX's Obefazimod is worth significantly more than the $6.7-$7.2B price tags that these S1P1 drugs fetched. The current $4.9B valuation cannot, in my opinion, last long.

Zeposia and Velsipity are S1P1 drugs that were acquired for $7.2B and $6.7B respectively (37-47% upside from $ABVX's current valuation). Here are the reasons that $ABVX's drug should be valued much higher than these S1P1 comps were:

1⃣ SAFETY! ABVX is headed for a squeaky clean safety label. This is not only comforting for doctors/patients, but it also opens the door to combination therapy with other drugs that might be immunosuppressive without worrying about increasing infection risk.

2⃣Ease of Use! Both are once-daily oral drugs, but the S1P1 class has highly burdensome initiation requirements. Once your GI doctor decides to put you on one and goes through the infection risks with you, you then have to go through many other hoops BEFORE you can start the drug:

↪️Bloodwork must be performed and result normal (CBC, LFTs, Hep B/C, VZV IgG, HIB, TB test)

↪️Ophthalmologic (eye) exam must be done (due to risk of macular edema from the drug)

↪️Electrocardiogram (heart monitoring) due to the risk of heart block

👉$ABVX's obefazimod should have none of these burdensome initiation requirements. Your GI doc prescribes it that day, and you are both DONE. GI docs will vastly prefer this low-friction prescription, and given that it has high efficacy with no safety concerns...why wouldn't they?!

3⃣Uniqueness of MoA! There were multiple S1P1 drugs in the pipeline for UC at the time of these acquisitions (Velsipity and Zeposia approved in the US, and VTX-002 was among a list of others). The fact that there would be intra-class competition in the S1P1 market was known at the time of these acquisitions, however...

↪️$ABVX's miR-124 MoA is the only drug known to be in development ANYWHERE with that MoA right now! There is no competition anywhere in site for this drug. This will be a huge advantage for its uptake.

➡️In an era where any promising drug target gets flooded with dozens of "me too" drugs with the same MoA, it is incredibly rare to see a drug with a unique MoA like this be so efficacious in such a large indication with ZERO competition. This is a truly rare asset for big pharma.

4⃣Timeline advantage. $ABVX is already through the bulk of its P3 studies, whereas the S1P1s were bought out months to years BEFORE P3 induction readouts. Not only is ABVX closer to making money, but they also have less risk than the S1P1s did, and ABVX will require far less funding to finish up their P3 program than the S1P1s did!

Noting the 4 points above, it is obvious to me that $ABVX's Obefazimod is worth significantly more than the $6.7-$7.2B price tags that these S1P1 drugs fetched. The current $4.9B valuation cannot, in my opinion, last long.

4) $ABVX Vs TL1A M&A Comps

The two main comps for TL1A valuations are RVT-3101 from $ROIV And Tulisokibart from $RXDX. Let's focus on why I think $ABVX should be worth MORE than the $10.8B price tag that Tulisokibart fetched.

1⃣Uniqueness of MoA. TL1A has interesting P2 data so far, but it is another victim of the "me too" phenomenon in biotech. There are at least 4 TL1A drugs with P2 level data ALREADY (tulisokibart, RVT-3101, Afimkibart, Duvakitug).

↪️$ABVX's obefazimod is the ONLY drug with its MoA with data of any kind, and it is already through phase 3 data! The uniquness of obefazimods' will be a HUGELY valuable asset in its launch, but the "me-four+" status of the TL1As hasn't stopped pharma from paying >$10B for these drugs...how much more could $ABVX be worth as potentially the only unique asset in the IBD space?

2⃣Development Timeline. $ABVX is years ahead of all TL1A drugs. It will make its mark and take market share for years before a single TL1A arrives on the market to compete.

3⃣SAFE and ORAL treatment. $ABVX's obefazimod is on track for a perfectly clean safety label. TL1As have not yet shown major safety risks, but their data is all very early (versus 4-6 year OLE and P3 level data for $ABVX). TL1A is in the TNFa pathway, which already has a black box warning...there is a strong chance that the TL1A drugs all end up with some safety warning and/or lab testing requirements that Obefazimod will not have.

↪️And of course, $ABVX's drug is a once-daily oral, versus all TL1A drugs being infusion and/or SubQ injections!

4⃣Efficacy Comparisons. The TL1a class has so far boasted P2 induction remission deltas in the 20s, which would hurdle $ABVX's 3rd-highest-ever phase 3 rate of 16.4% IF the TL1As can reproduce those numbers in larger trials. However, there are huge caveats to consider here, and I feel strongly that $ABVX's drug is actually MORE efficacious than the TL1A class is!

↪️$ABVX's remission delta was measured at only 8 weeks...the TL1a drugs are all using 12-14 week timepoints for induction, so they are artificially increasing their efficacy numbers by simply running longer induction studies!

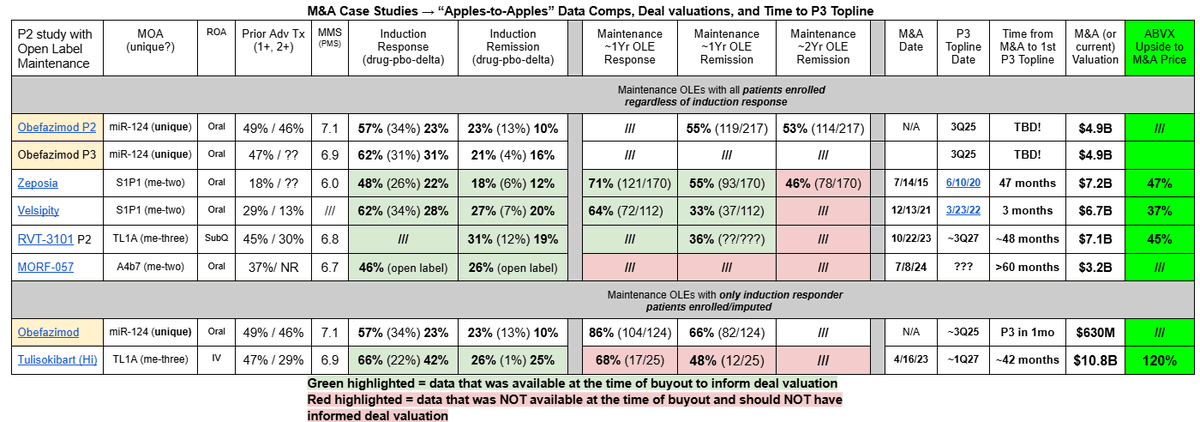

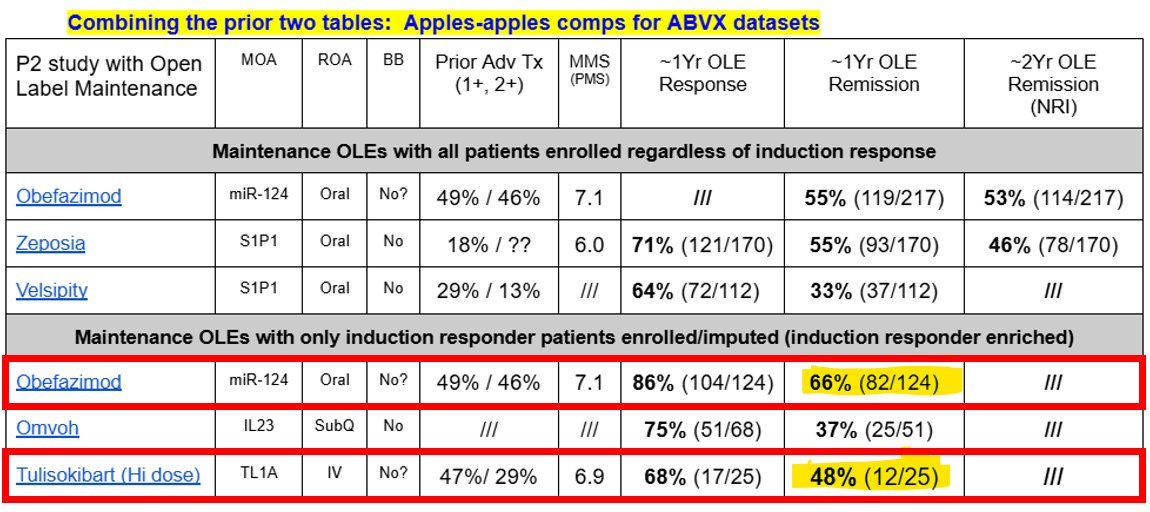

↪️The point above is potentially proven by comparing the phase 2 maintenance data of obefazimod versus tulisokibart. See the figure attached. When you compare the maintenance data $ABVX generated in P2 versus Tulisokibart's, $ABVX absolutely crushes the TL1A class's efficacy on this apples-to-apples maintenance data comparison.

So, I think that the case is strong to support the idea that $ABVX's Obefazimod is better than the TL1A class in every way. More efficacious, safer, unique MoA, and further along in development. IMO, $ABVX should fetch a buyout valuation HIGHER than the $10.8B price tag that Tulisokibart did.

That would set the M&A valuation floor at ~$146/share with $ABVX's current OS.

The two main comps for TL1A valuations are RVT-3101 from $ROIV And Tulisokibart from $RXDX. Let's focus on why I think $ABVX should be worth MORE than the $10.8B price tag that Tulisokibart fetched.

1⃣Uniqueness of MoA. TL1A has interesting P2 data so far, but it is another victim of the "me too" phenomenon in biotech. There are at least 4 TL1A drugs with P2 level data ALREADY (tulisokibart, RVT-3101, Afimkibart, Duvakitug).

↪️$ABVX's obefazimod is the ONLY drug with its MoA with data of any kind, and it is already through phase 3 data! The uniquness of obefazimods' will be a HUGELY valuable asset in its launch, but the "me-four+" status of the TL1As hasn't stopped pharma from paying >$10B for these drugs...how much more could $ABVX be worth as potentially the only unique asset in the IBD space?

2⃣Development Timeline. $ABVX is years ahead of all TL1A drugs. It will make its mark and take market share for years before a single TL1A arrives on the market to compete.

3⃣SAFE and ORAL treatment. $ABVX's obefazimod is on track for a perfectly clean safety label. TL1As have not yet shown major safety risks, but their data is all very early (versus 4-6 year OLE and P3 level data for $ABVX). TL1A is in the TNFa pathway, which already has a black box warning...there is a strong chance that the TL1A drugs all end up with some safety warning and/or lab testing requirements that Obefazimod will not have.

↪️And of course, $ABVX's drug is a once-daily oral, versus all TL1A drugs being infusion and/or SubQ injections!

4⃣Efficacy Comparisons. The TL1a class has so far boasted P2 induction remission deltas in the 20s, which would hurdle $ABVX's 3rd-highest-ever phase 3 rate of 16.4% IF the TL1As can reproduce those numbers in larger trials. However, there are huge caveats to consider here, and I feel strongly that $ABVX's drug is actually MORE efficacious than the TL1A class is!

↪️$ABVX's remission delta was measured at only 8 weeks...the TL1a drugs are all using 12-14 week timepoints for induction, so they are artificially increasing their efficacy numbers by simply running longer induction studies!

↪️The point above is potentially proven by comparing the phase 2 maintenance data of obefazimod versus tulisokibart. See the figure attached. When you compare the maintenance data $ABVX generated in P2 versus Tulisokibart's, $ABVX absolutely crushes the TL1A class's efficacy on this apples-to-apples maintenance data comparison.

So, I think that the case is strong to support the idea that $ABVX's Obefazimod is better than the TL1A class in every way. More efficacious, safer, unique MoA, and further along in development. IMO, $ABVX should fetch a buyout valuation HIGHER than the $10.8B price tag that Tulisokibart did.

That would set the M&A valuation floor at ~$146/share with $ABVX's current OS.

5) $PTGX and $MORF $ABVX Valuation Comps

$MORF should be minimally discussed, as it was bought out SUPER early without even having any randomized data. Still, its $3.2B valuation goes to show how even tiny/unvalidated datasets in UC can be very valuable for safe, oral drugs. This shows how $4.9B post-P3 induction data for $ABVX is an absurdly low valuation.

The more interesting value comparator is likely $PTGX, who owns only 6-10% of their oral IL-23 drug (Icotrokinra). This small royalty ownership makes it hard to precisely value their UC asset, but on the day they disclosed their P2 UC data, their valuation rose $1.25B. If you use the high end of their royalty ownership (10%) and multiply their stock move by 10, the "value" of that P2 dataset that day was $12.5B.

↪️This would translate to a price per share of $169 for $ABVX

➡️Note that $PTGX's P2 remission delta was 19% (higher than $ABVX's 16.4% in P3), but I fully expect that $PTGX's phase 3 efficacy will be LOWER than ABVX's.

❓Why❓

👉$PTGX's numbers were small n, and UC is a noisy indication. Note that in ABTECT1 (one of $ABVX's 2 phase 3 studies) both the 25mg and 50mg arms had HIGHER remission deltas than $PTGX had in P2 at 21.4% and 19.3%.

↪️So, in Phase 3, I expect $PTGX's efficacy to come down and be lower than $ABVX's 16.4% week 8 number.

👉I am confident in this prediction because there are already 4 (!!!) IL23 inhibitors approved for ulcerative colitis, and NONE of them has EVER shown a clinical remission delta as high as $ABVX just showed. We already know what the IL23 MoA is capable of in UC, and $ABVX hurdled that bar. $PTGX will match the historic IL-23 bar at best, which is lower than what $ABVX has shown.

So, again, we have the $PTGX comp that would get $ABVX's valuation close to $170/share, DESPITE the fact that $PTGX has a me-five MoA that is multiple YEARS behind $ABVX's obefazimod...the stock price in the $60s continues to look like ridiculous value any way we cut the data.

$MORF should be minimally discussed, as it was bought out SUPER early without even having any randomized data. Still, its $3.2B valuation goes to show how even tiny/unvalidated datasets in UC can be very valuable for safe, oral drugs. This shows how $4.9B post-P3 induction data for $ABVX is an absurdly low valuation.

The more interesting value comparator is likely $PTGX, who owns only 6-10% of their oral IL-23 drug (Icotrokinra). This small royalty ownership makes it hard to precisely value their UC asset, but on the day they disclosed their P2 UC data, their valuation rose $1.25B. If you use the high end of their royalty ownership (10%) and multiply their stock move by 10, the "value" of that P2 dataset that day was $12.5B.

↪️This would translate to a price per share of $169 for $ABVX

➡️Note that $PTGX's P2 remission delta was 19% (higher than $ABVX's 16.4% in P3), but I fully expect that $PTGX's phase 3 efficacy will be LOWER than ABVX's.

❓Why❓

👉$PTGX's numbers were small n, and UC is a noisy indication. Note that in ABTECT1 (one of $ABVX's 2 phase 3 studies) both the 25mg and 50mg arms had HIGHER remission deltas than $PTGX had in P2 at 21.4% and 19.3%.

↪️So, in Phase 3, I expect $PTGX's efficacy to come down and be lower than $ABVX's 16.4% week 8 number.

👉I am confident in this prediction because there are already 4 (!!!) IL23 inhibitors approved for ulcerative colitis, and NONE of them has EVER shown a clinical remission delta as high as $ABVX just showed. We already know what the IL23 MoA is capable of in UC, and $ABVX hurdled that bar. $PTGX will match the historic IL-23 bar at best, which is lower than what $ABVX has shown.

So, again, we have the $PTGX comp that would get $ABVX's valuation close to $170/share, DESPITE the fact that $PTGX has a me-five MoA that is multiple YEARS behind $ABVX's obefazimod...the stock price in the $60s continues to look like ridiculous value any way we cut the data.

$ABVX Valuation Summary & My BIASED Opinion:

The high end of IBD M&A comps of $10.8B would put $ABVX's current valuation at $146/share. The (very rough) $PTGX "value" comparison gets it close to $170/share. Despite these numbers conveying significant upside from here, I don't think that even these lofty numbers adequately capture the incredible value of $ABVX's asset.

➡️$ABVX has the ONLY drug with a unique MoA on the UC market (assuming MORF gets to market). TL1A is already at Me-four. IL-23 is at me-five. Meanwhile, $ABVX's obefazimod doesn't even have any competitor drugs in human studies....

➡️$ABVX is likely to have a squeaky clean safety label with no pre-initiation testing requirements. This is not only good for patient/physician uptake, but also means that it can be combined with any MoA on the market without worrying about safety risks!

➡️$ABVX's efficacy is top-tier, likely only clearly beat by Rinvoq, which has the worst safety label on the market. Even the TL1A class looks inferior to Obefazimod when you look at available maintenance data comparisons and adjust for longer induction timepoints! Eventual oral competitors like $MORF and $PTGX are using me-too MoAs that we already know the efficacy ceiling for from their injectable counterparts...$ABVX beat those class's induction efficacy in P3 already!

➡️$ABVX is further along in development than all of these valuation comps! They are not only closer to commercialization, but the bulk of their trial burn is behind them AND the risk of disappointing P3 induction data is eliminated already!

So how do *I* value $ABVX's potential M&A price tag? Well, as discussed above, I think the drug is clearly worth more than the $10.8-$12.5B high end of comparators for multiple reasons.

The blockbuster Entyvio is already doing >$6B annual sales in IBD, largely because it is a SAFE drug that works. $ABVX's drug is looking just as safe, but more efficacious, and ORAL as opposed to IV infusion like Entyvio...Assuming that $ABVX gets to just HALF of the peak sales of Entyvio is likely conservative IMO...so $3B peak sales for Obefazimod. Then assign a 5x valuation multiple to that, and you arrive at a very rough $15B M&A value for $ABVX, or ~$203/share.

Yes, this may seem lofty, but I actually think this is plausible. I expect a bidding war for this asset as it could fit in LITERALLY ANY big pharma's UC strategy. There is no UC drug that obefazimod *couldn't* be combined with. It is HIGHLY efficacious. It is EXTERMELY safe. It will be the only drug on the market with a unique MoA. It is YEARS ahead of other drugs that have already fetched $10B+ valuations. IMO, GI doctors will be handing this drug out like candy to IBD patients and pharma companies will engage in a bidding war to make it their own.

Although $200+/share may seem like a stretch when you see the stock currently trading around $66, if you look at the data and the comparator valuations...I personally don't think such a price tag is a stretch at all.

The high end of IBD M&A comps of $10.8B would put $ABVX's current valuation at $146/share. The (very rough) $PTGX "value" comparison gets it close to $170/share. Despite these numbers conveying significant upside from here, I don't think that even these lofty numbers adequately capture the incredible value of $ABVX's asset.

➡️$ABVX has the ONLY drug with a unique MoA on the UC market (assuming MORF gets to market). TL1A is already at Me-four. IL-23 is at me-five. Meanwhile, $ABVX's obefazimod doesn't even have any competitor drugs in human studies....

➡️$ABVX is likely to have a squeaky clean safety label with no pre-initiation testing requirements. This is not only good for patient/physician uptake, but also means that it can be combined with any MoA on the market without worrying about safety risks!

➡️$ABVX's efficacy is top-tier, likely only clearly beat by Rinvoq, which has the worst safety label on the market. Even the TL1A class looks inferior to Obefazimod when you look at available maintenance data comparisons and adjust for longer induction timepoints! Eventual oral competitors like $MORF and $PTGX are using me-too MoAs that we already know the efficacy ceiling for from their injectable counterparts...$ABVX beat those class's induction efficacy in P3 already!

➡️$ABVX is further along in development than all of these valuation comps! They are not only closer to commercialization, but the bulk of their trial burn is behind them AND the risk of disappointing P3 induction data is eliminated already!

So how do *I* value $ABVX's potential M&A price tag? Well, as discussed above, I think the drug is clearly worth more than the $10.8-$12.5B high end of comparators for multiple reasons.

The blockbuster Entyvio is already doing >$6B annual sales in IBD, largely because it is a SAFE drug that works. $ABVX's drug is looking just as safe, but more efficacious, and ORAL as opposed to IV infusion like Entyvio...Assuming that $ABVX gets to just HALF of the peak sales of Entyvio is likely conservative IMO...so $3B peak sales for Obefazimod. Then assign a 5x valuation multiple to that, and you arrive at a very rough $15B M&A value for $ABVX, or ~$203/share.

Yes, this may seem lofty, but I actually think this is plausible. I expect a bidding war for this asset as it could fit in LITERALLY ANY big pharma's UC strategy. There is no UC drug that obefazimod *couldn't* be combined with. It is HIGHLY efficacious. It is EXTERMELY safe. It will be the only drug on the market with a unique MoA. It is YEARS ahead of other drugs that have already fetched $10B+ valuations. IMO, GI doctors will be handing this drug out like candy to IBD patients and pharma companies will engage in a bidding war to make it their own.

Although $200+/share may seem like a stretch when you see the stock currently trading around $66, if you look at the data and the comparator valuations...I personally don't think such a price tag is a stretch at all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh