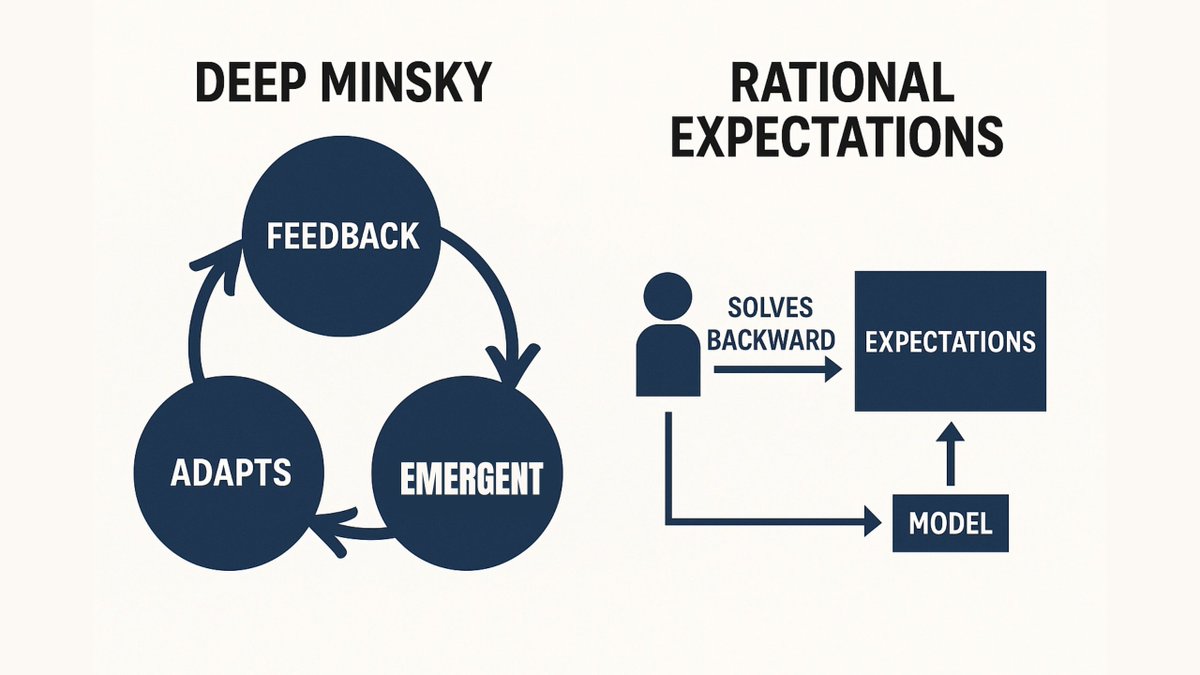

Mainstream macro relies on rational expectations: agents are assumed to know the model and forecast the future accordingly.

But real economies aren't solved backwards.

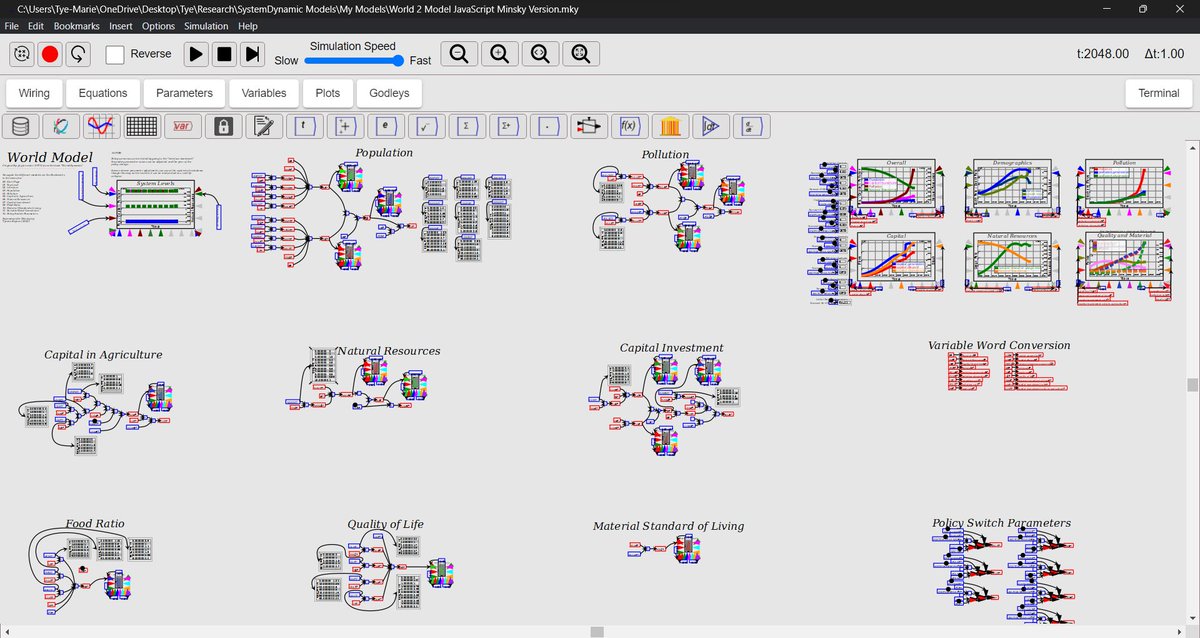

The Deep Minsky model throws this out, and models how expectations actually evolve.

🧵1/7

But real economies aren't solved backwards.

The Deep Minsky model throws this out, and models how expectations actually evolve.

🧵1/7

Instead of perfect foresight, Deep Minsky agents adapt using feedback:

-Flows inform future behavior

-Perceived trends shift confidence

-Expectations are path-dependent

This lets the model evolve historically, not jump from equilibrium to equilibrium.

🧵2/7

-Flows inform future behavior

-Perceived trends shift confidence

-Expectations are path-dependent

This lets the model evolve historically, not jump from equilibrium to equilibrium.

🧵2/7

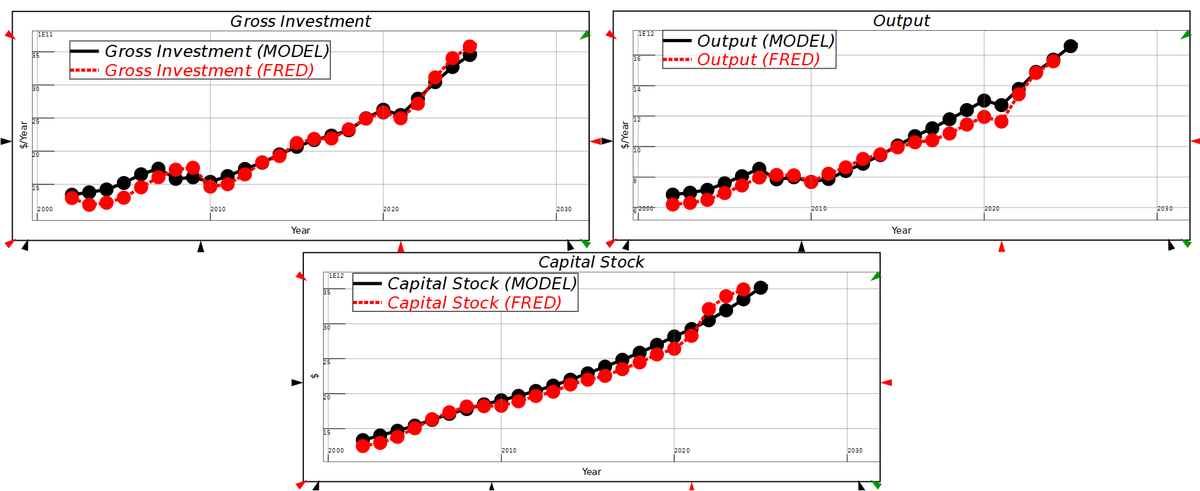

In Deep Minsky, investment, consumption, and pricing decisions respond to changing financial conditions, not "optimal" plans.

Expectations are formed endogenously, through firm behavior, bank leverage, and wage–price dynamics.

🧵3/7

Expectations are formed endogenously, through firm behavior, bank leverage, and wage–price dynamics.

🧵3/7

This adaptation isn't noise — it's structure.

Expectations shift because balance sheets shift.

Because profits change.

Because interest payments rise.

The system learns over time — but it doesn’t “know” its future.

🧵4/7

Expectations shift because balance sheets shift.

Because profits change.

Because interest payments rise.

The system learns over time — but it doesn’t “know” its future.

🧵4/7

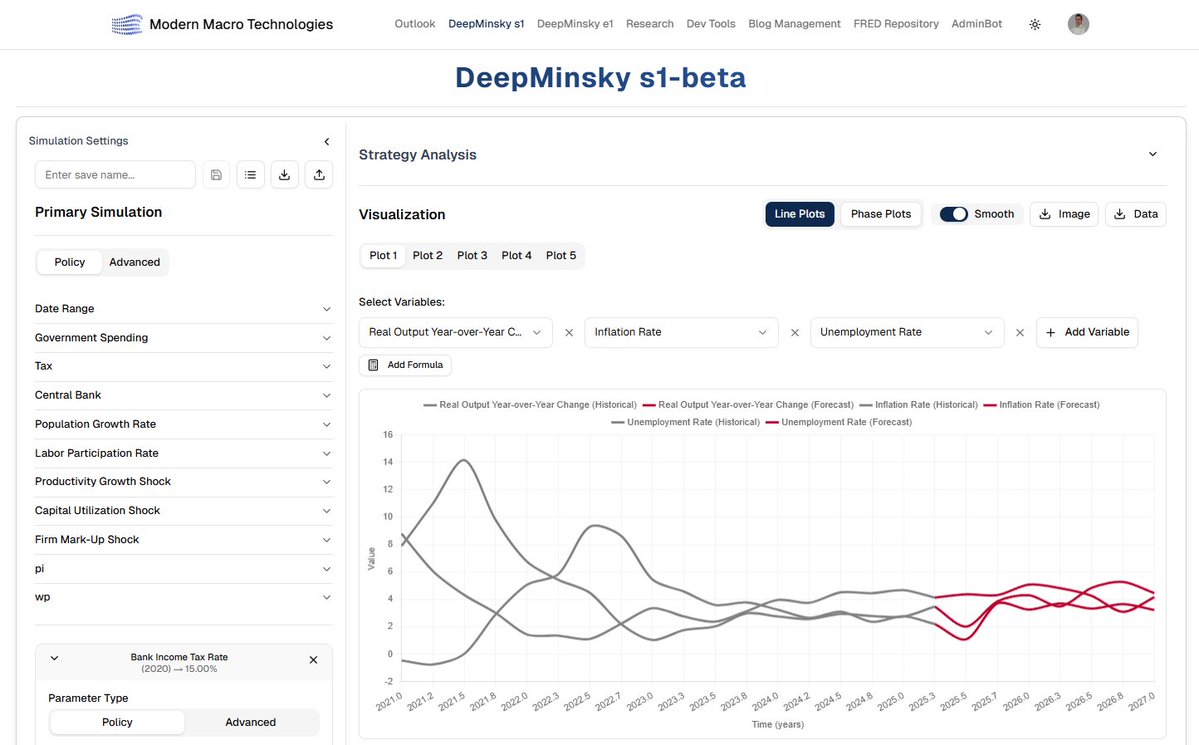

Rational expectations collapse uncertainty into probabilities.

Deep Minsky keeps uncertainty radical:

-There's no stable distribution

-The future is not priced in

-Mistakes accumulate

This gives us crisis, not optimization.

🧵5/7

Deep Minsky keeps uncertainty radical:

-There's no stable distribution

-The future is not priced in

-Mistakes accumulate

This gives us crisis, not optimization.

🧵5/7

By rejecting rational expectations, Deep Minsky allows for:

-Self-reinforcing feedback

-Emergent dynamics

-Financial instability

-Endogenous turning points

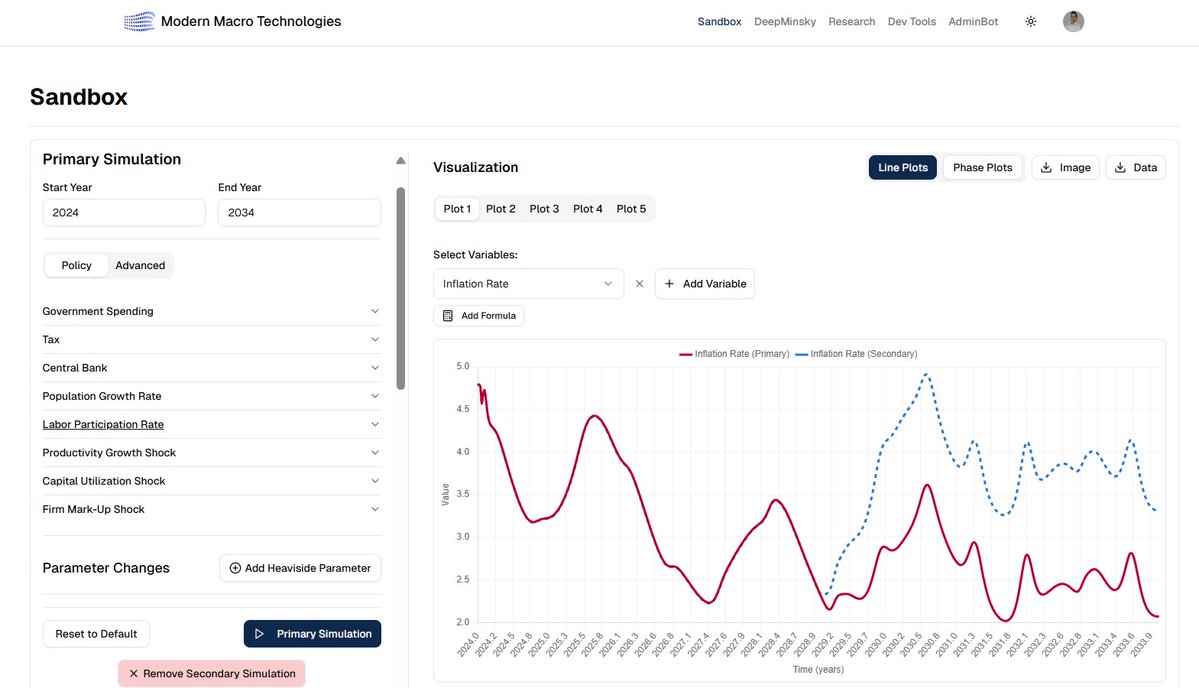

The model can forecast the uncertainty — but its really designed to simulates how things might unfold.

🧵6/7

-Self-reinforcing feedback

-Emergent dynamics

-Financial instability

-Endogenous turning points

The model can forecast the uncertainty — but its really designed to simulates how things might unfold.

🧵6/7

You don’t need agents who solve the system.

You need a system that evolves with agents inside it.

Deep Minsky is built to model that kind of world — one where expectations are uncertain, history matters, and stability is temporary.

🧵7/7modernmacro.tech

You need a system that evolves with agents inside it.

Deep Minsky is built to model that kind of world — one where expectations are uncertain, history matters, and stability is temporary.

🧵7/7modernmacro.tech

• • •

Missing some Tweet in this thread? You can try to

force a refresh