A system dynamicist specializing it's application for Macroeconomic Forecasting.

How to get URL link on X (Twitter) App

If depressions are mainly caused by government excess, that timeline doesn't work. The U.S. wasn't running huge deficits before the crash. It was tightening fiscally, and a depression followed.

If depressions are mainly caused by government excess, that timeline doesn't work. The U.S. wasn't running huge deficits before the crash. It was tightening fiscally, and a depression followed.

https://twitter.com/JesusFerna7026/status/1994464610922238065

They say: Equilibrium isn't stable, it can explode.

They say: Equilibrium isn't stable, it can explode.

DSGE models boil the entire economy down to 3 equations:

DSGE models boil the entire economy down to 3 equations:

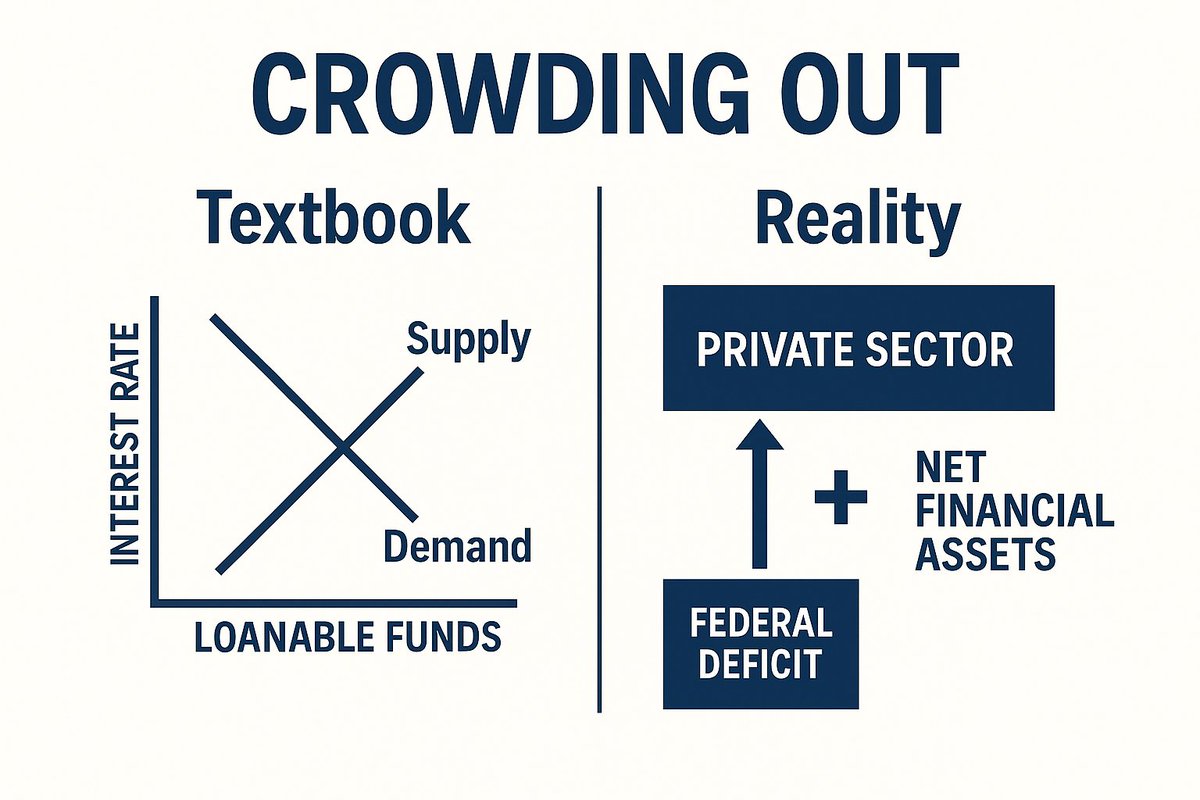

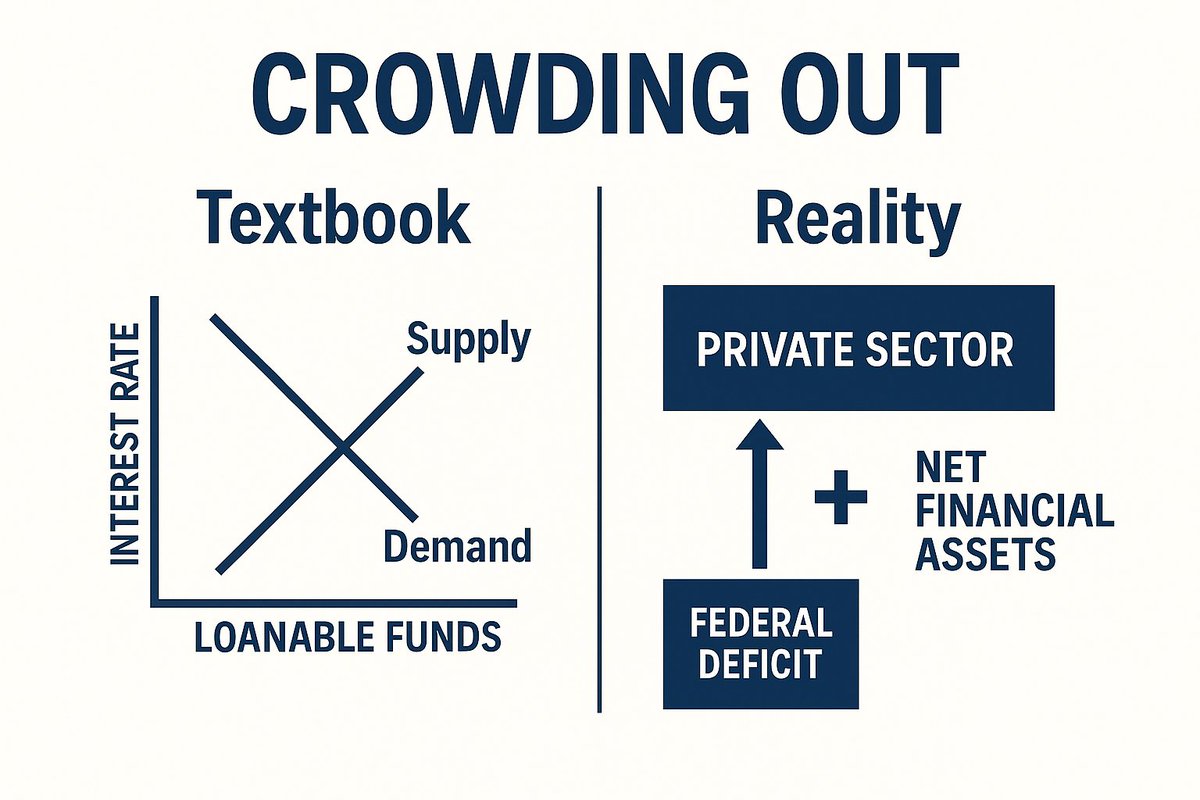

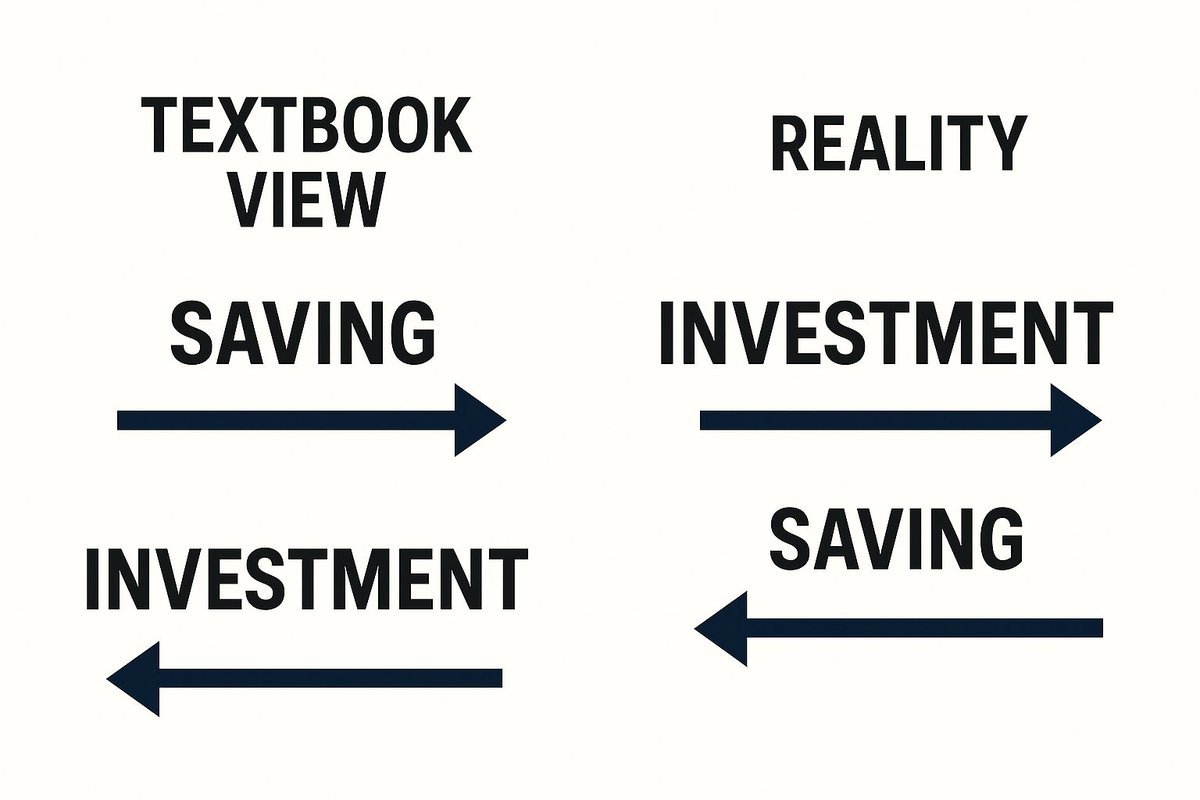

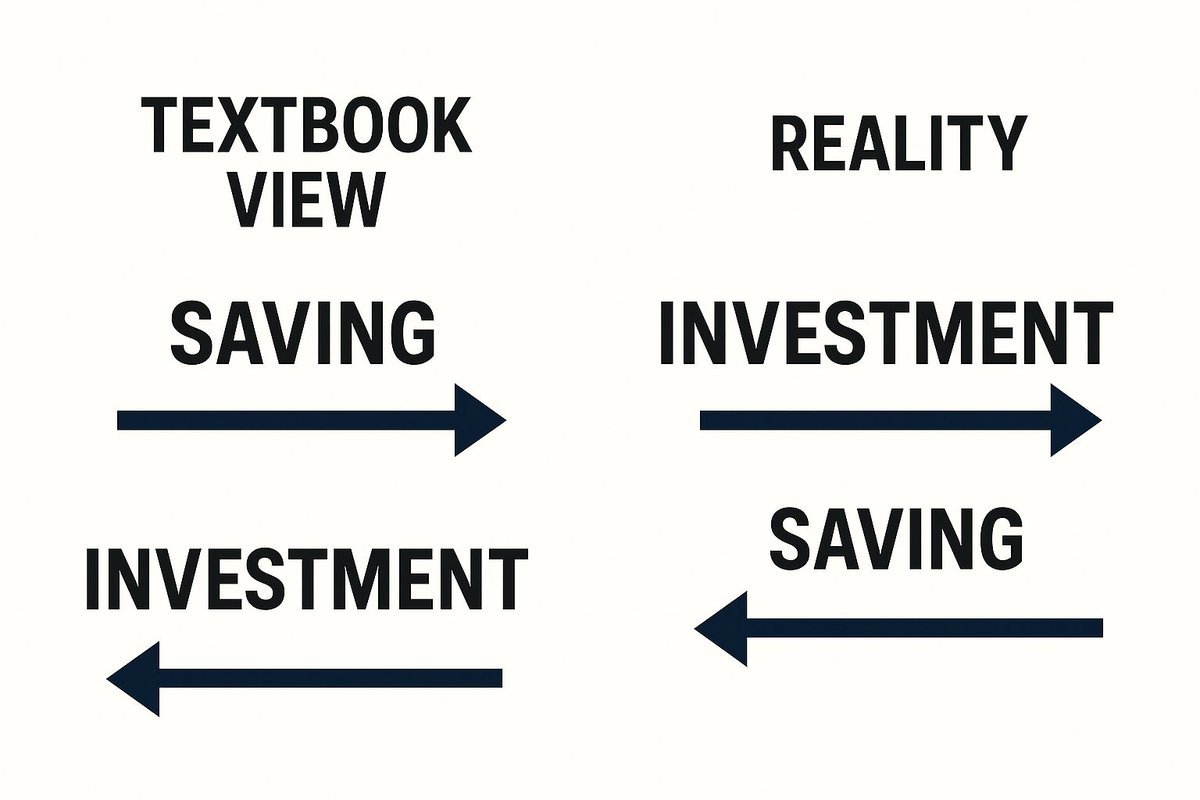

The textbook story starts with loanable funds: households save, banks lend those savings, and interest rates tidy everything up.

The textbook story starts with loanable funds: households save, banks lend those savings, and interest rates tidy everything up.

Start with old-school neoclassical DSGE.

Start with old-school neoclassical DSGE.

The fallacious story goes like this: banks take deposits, keep 10% as reserves, and lend out the rest. That fraction supposedly limits how much credit they can create.

The fallacious story goes like this: banks take deposits, keep 10% as reserves, and lend out the rest. That fraction supposedly limits how much credit they can create.

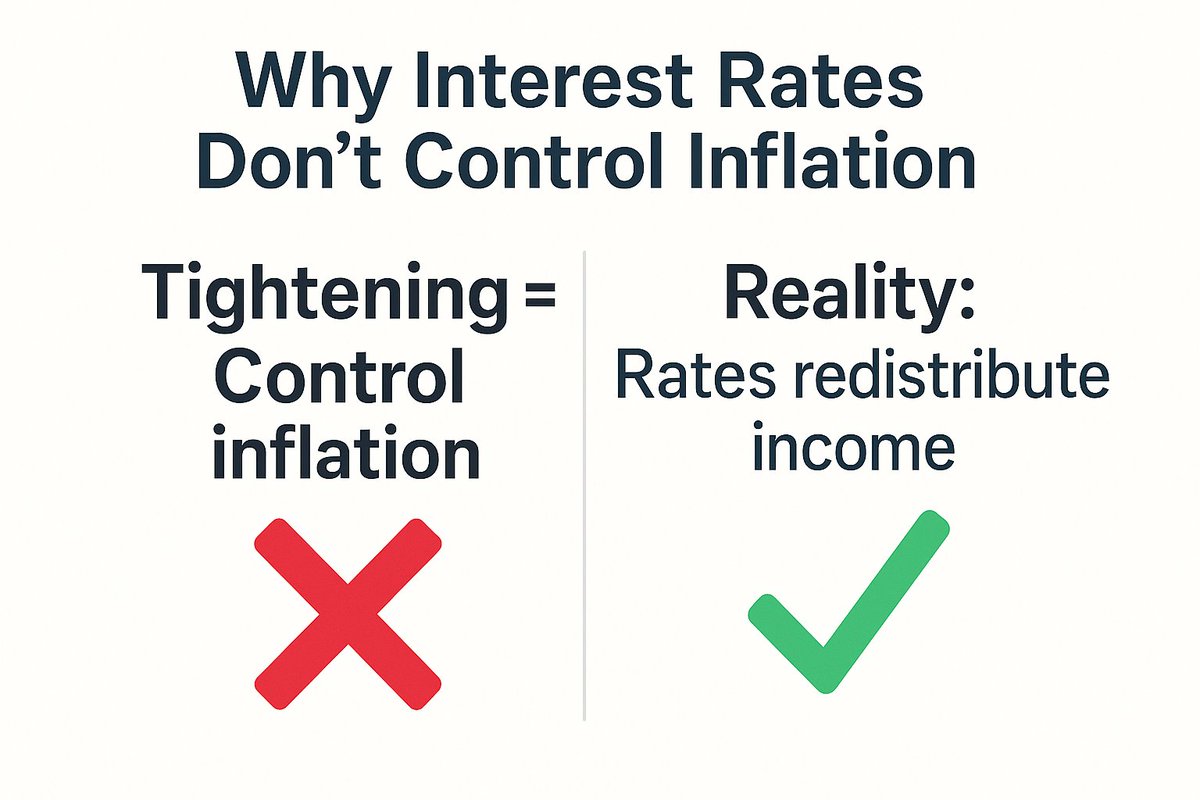

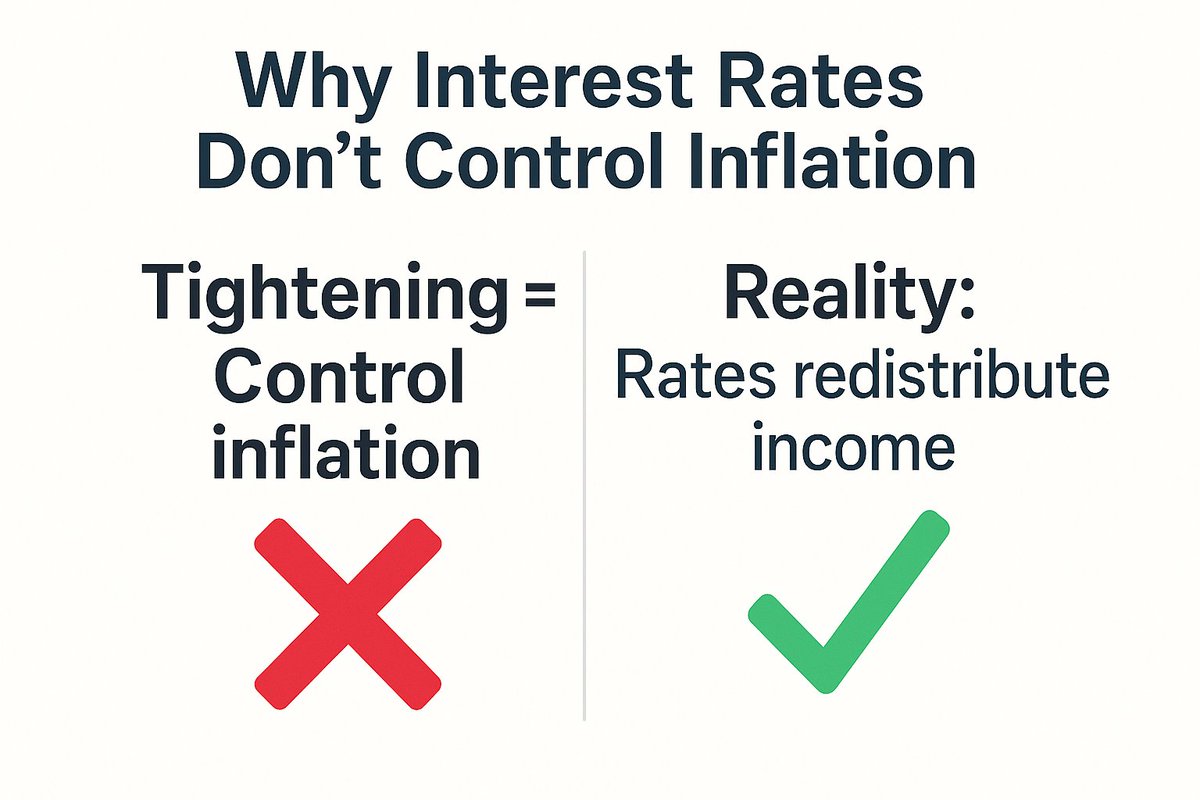

The textbook story: higher rates → less borrowing → lower demand → lower inflation.

The textbook story: higher rates → less borrowing → lower demand → lower inflation.

Story: gov't spends → prints money → inflation.

Story: gov't spends → prints money → inflation.

The idea is simple: governments should not spend more than they tax.

The idea is simple: governments should not spend more than they tax.

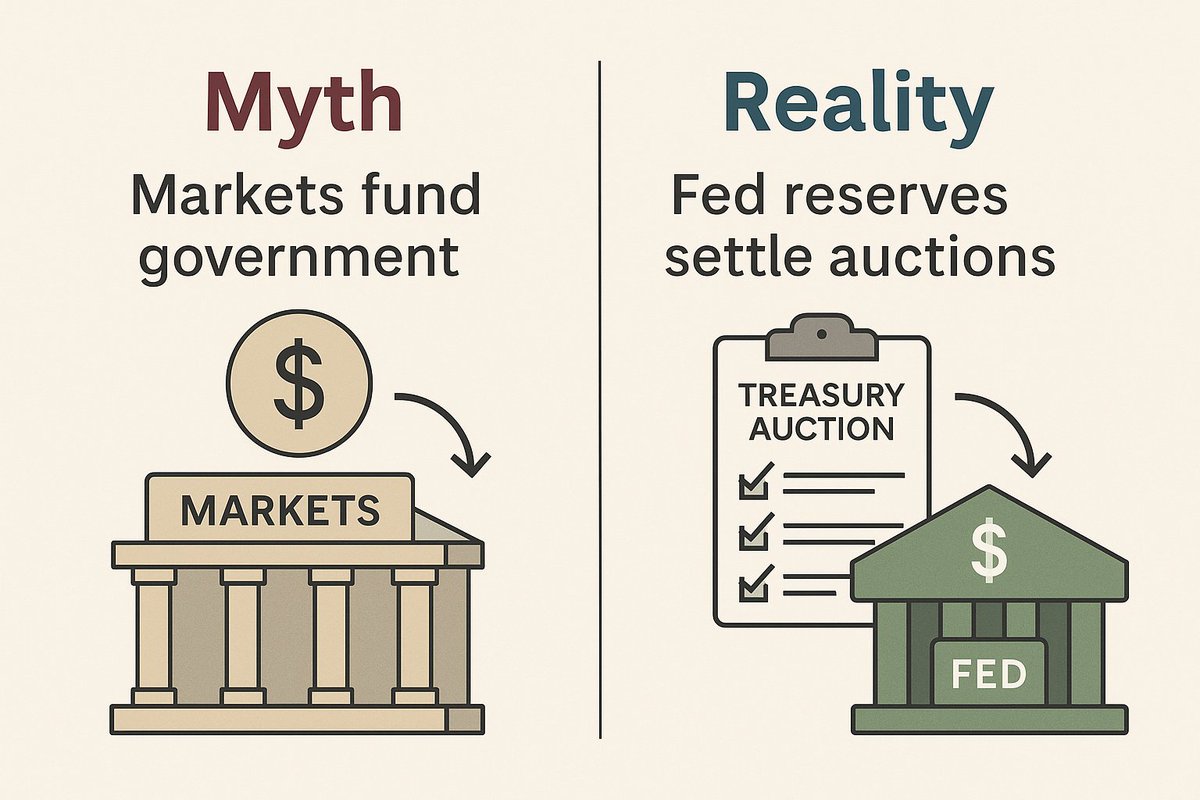

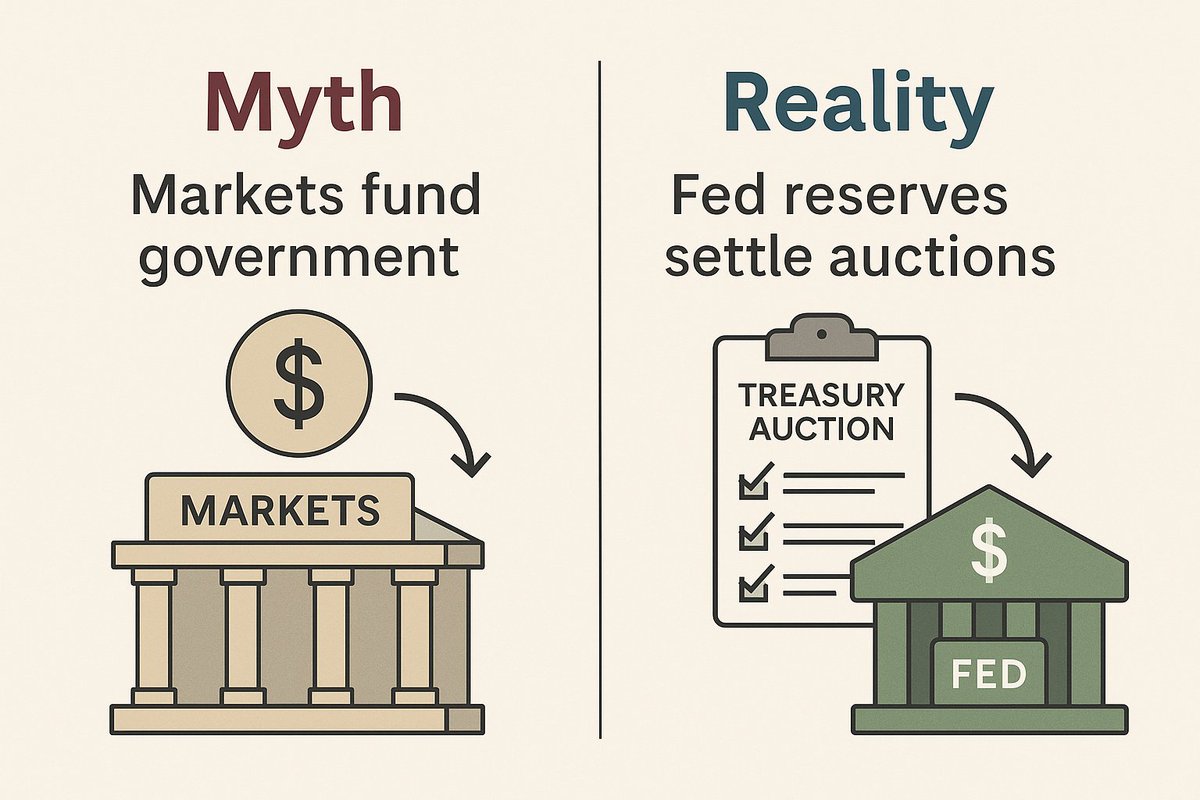

Every week, the Treasury issues new securities at auction.

Every week, the Treasury issues new securities at auction.

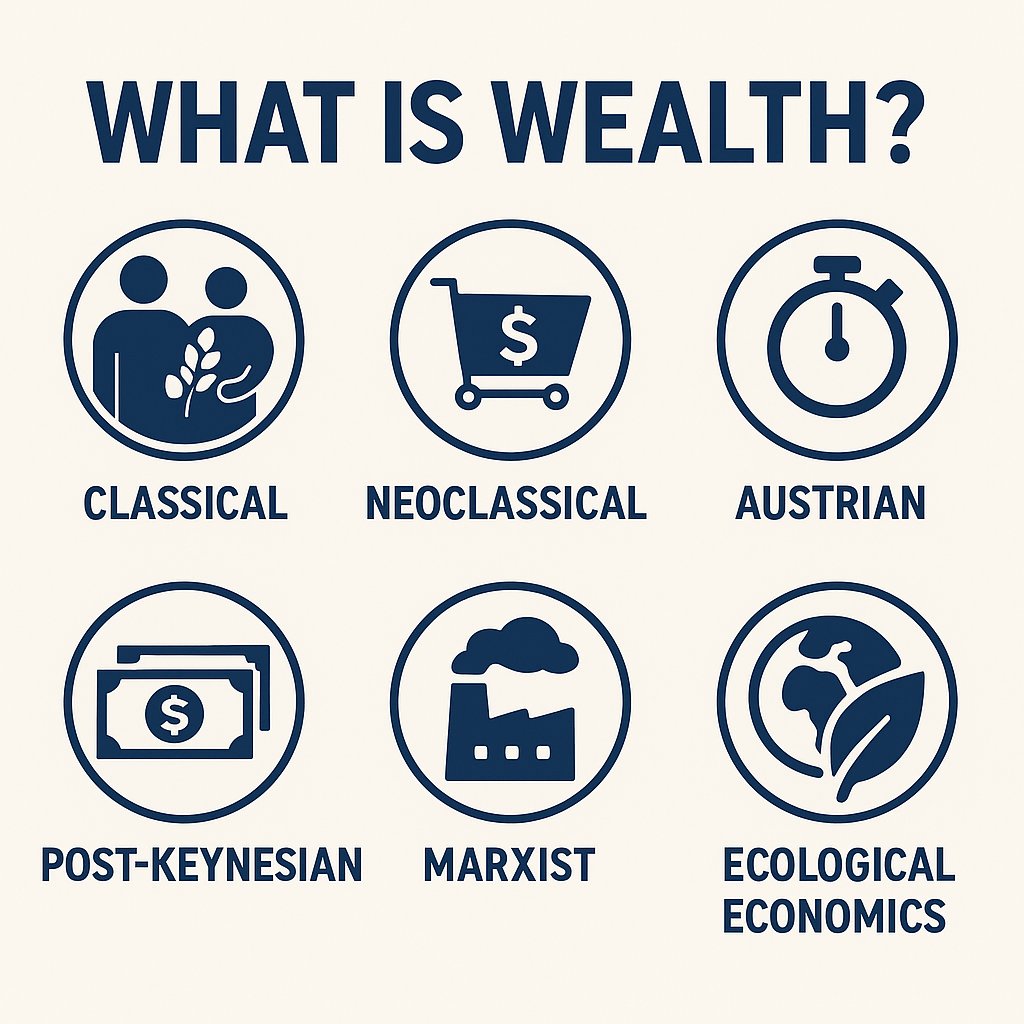

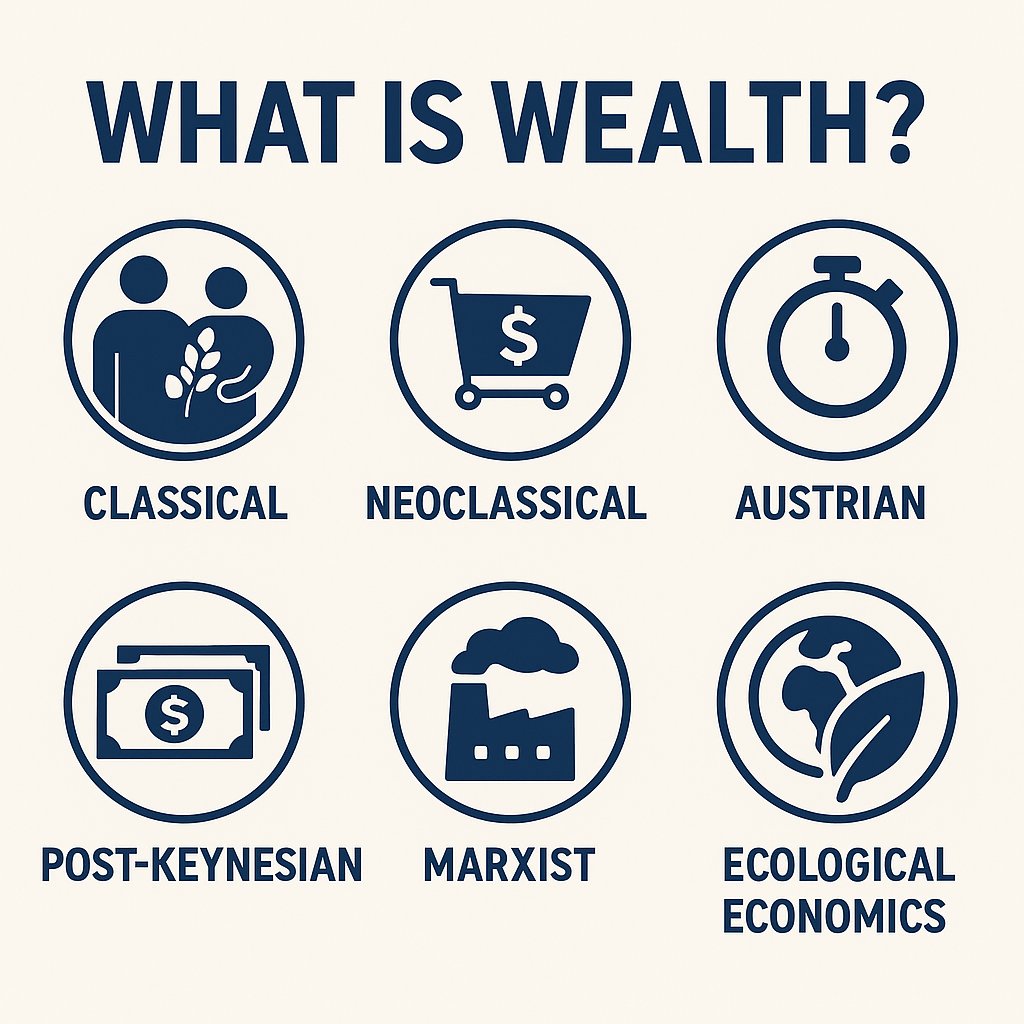

Classical economics (Smith, Ricardo):

Classical economics (Smith, Ricardo):

The textbook story:

The textbook story:

https://twitter.com/elonmusk/status/1962680097816879208

Musk’s story: if population falls, economies collapse.

Musk’s story: if population falls, economies collapse.

Since 1978:

Since 1978:

No real-world industry looks like this.

No real-world industry looks like this.

Buybacks spark endless debate: are they corporate greed, or rational capital use?

Buybacks spark endless debate: are they corporate greed, or rational capital use?

Wicksell’s idea: there exists some "natural" interest rate where saving = investment and inflation is stable.

Wicksell’s idea: there exists some "natural" interest rate where saving = investment and inflation is stable.

Because reserves don’t flow into the real economy.

Because reserves don’t flow into the real economy.

The Goodwin growth cycle shows it:

The Goodwin growth cycle shows it:

1929, Japan’s 1990s bust, the 2008 GFC, all preceded by surging private debt-to-GDP.

1929, Japan’s 1990s bust, the 2008 GFC, all preceded by surging private debt-to-GDP.

Traditionally, it meant banks held a fixed % of deposits in reserve (say 10%) and lent out the rest.

Traditionally, it meant banks held a fixed % of deposits in reserve (say 10%) and lent out the rest.