My newest clients make $350k/yr but are still winging it with their finances

They want to save $$ on taxes and retire in the next 15 years

Here’s 5 simple steps we took to save them $30k this year and get them on track for their goals

(With visual examples)

They want to save $$ on taxes and retire in the next 15 years

Here’s 5 simple steps we took to save them $30k this year and get them on track for their goals

(With visual examples)

First, a disclaimer: none of this is tax or investment advice.

Here’s the setup:

My clients are both 45 years old - he is a business owner and she works a corporate job and they make $360k combined

They came to me with the following cash flow situation

Here’s the setup:

My clients are both 45 years old - he is a business owner and she works a corporate job and they make $360k combined

They came to me with the following cash flow situation

- Occasionally throwing $5-10k in a joint investment account - amounting to $20k last year

- 6% 401(k) contribution for her

- Tons of cash on the sidelines because they’re unsure how to invest it

- Spending way more than they want to on random expenses

- 6% 401(k) contribution for her

- Tons of cash on the sidelines because they’re unsure how to invest it

- Spending way more than they want to on random expenses

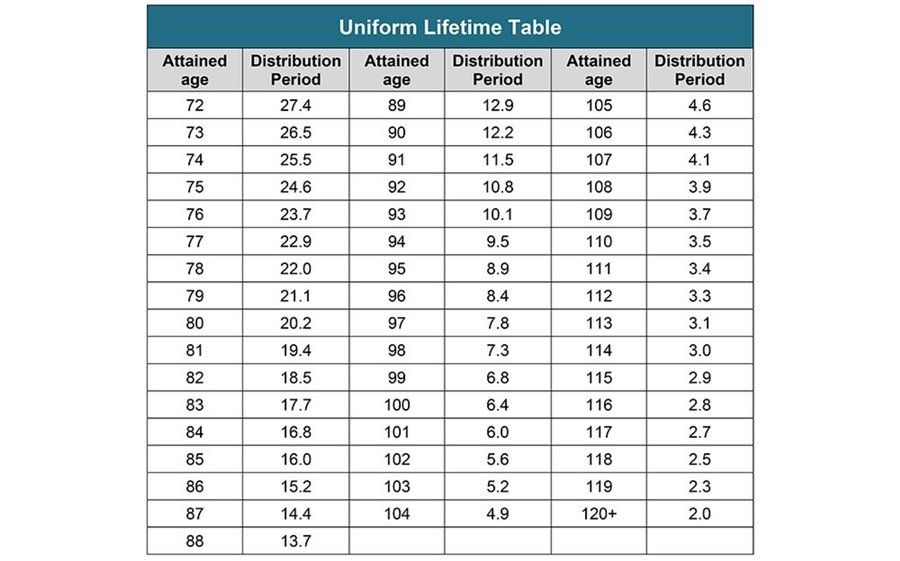

Here’s their current cash flow breakdown:

- $27,500 annual investments (Joint + 401k)

- $126,000 in total taxes

- $27,500 annual investments (Joint + 401k)

- $126,000 in total taxes

Here's what we did to set them up for success:

1- Solo K + 401(K)

A Solo 401k is a business retirement account for solo business owners

In 2025 you can contribute up to $23.5k as the employee

And 25% of total comp up to $70k as the employer

1- Solo K + 401(K)

A Solo 401k is a business retirement account for solo business owners

In 2025 you can contribute up to $23.5k as the employee

And 25% of total comp up to $70k as the employer

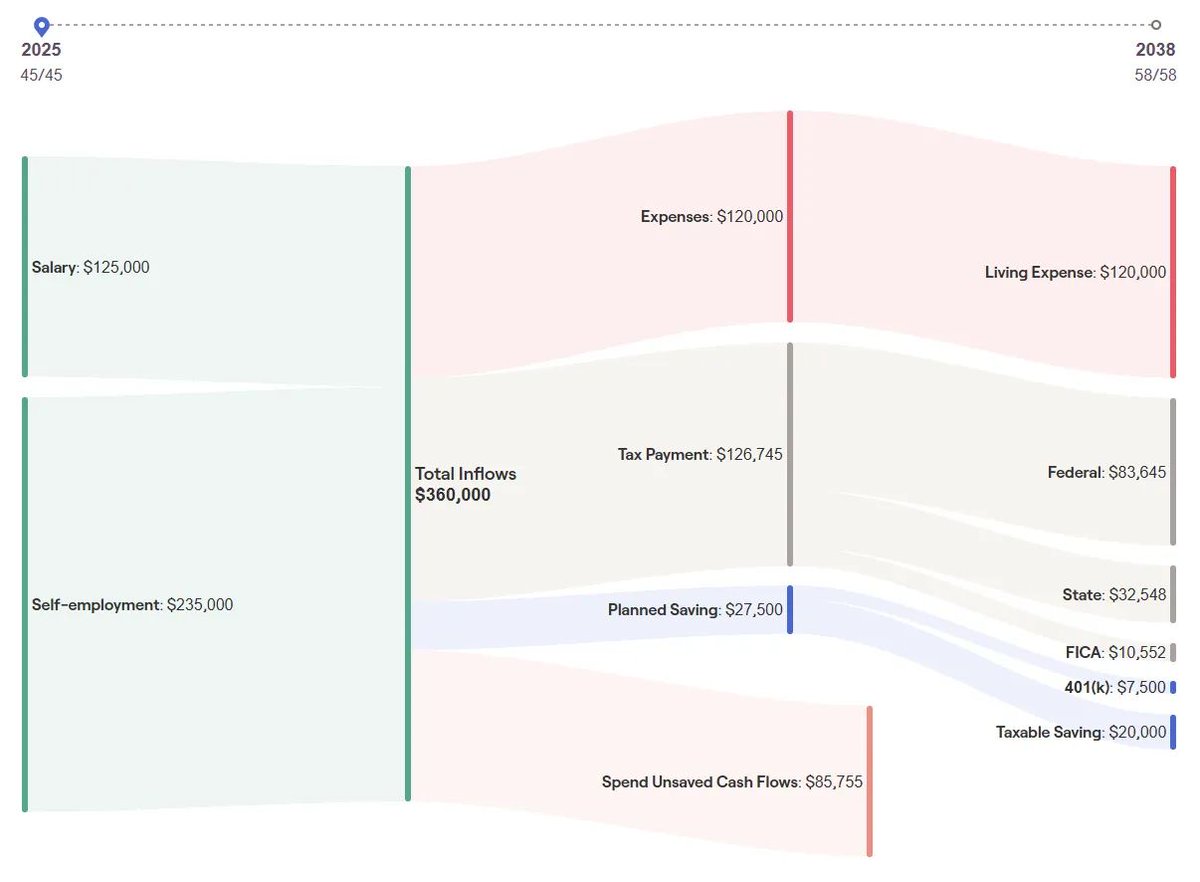

We determined he is eligible to nearly max out his Solo K

This alone saved them $19,000 in taxes

Total tax from $126k → $107k

This alone saved them $19,000 in taxes

Total tax from $126k → $107k

They also wanted additional tax savings so we decided to increase her 401(k) contribution to the max

We didn’t opt for any Roth contributions because they are in their highest earning years and planning to retire early which will allow an oppurtunity for roth conversions

More tax savings!

Total tax from $107k → $101k

We didn’t opt for any Roth contributions because they are in their highest earning years and planning to retire early which will allow an oppurtunity for roth conversions

More tax savings!

Total tax from $107k → $101k

2- HSA

After doing some digging we determined they are eligible for an HSA through her work, but they weren’t taking advantage of it

Now they are going to contribute the max every year ($8,550 in 2025) and get a deduction for it

We will help them invest the money and grow it for the next 15-20 years without paying taxes

Down the road they can withdraw tax free for qualified health expenses at ANY time as long as they keep the receipts digitally

After doing some digging we determined they are eligible for an HSA through her work, but they weren’t taking advantage of it

Now they are going to contribute the max every year ($8,550 in 2025) and get a deduction for it

We will help them invest the money and grow it for the next 15-20 years without paying taxes

Down the road they can withdraw tax free for qualified health expenses at ANY time as long as they keep the receipts digitally

That’s triple tax savings on healthcare expenses we know will come up

If they for some reason don’t have healthcare expenses, the account can still be withdrawn from in a tax defered way like a 401k

Total tax savings for tax savings for the year is now almost $30k! ($126k → $98k)

If they for some reason don’t have healthcare expenses, the account can still be withdrawn from in a tax defered way like a 401k

Total tax savings for tax savings for the year is now almost $30k! ($126k → $98k)

3- Backdoor Roth

Roth IRAs are very powerful tax free investment accounts

But if you’re married and make more than $246k (MAGI) you can’t contribute to one directly

But, there is a loophole

Roth IRAs are very powerful tax free investment accounts

But if you’re married and make more than $246k (MAGI) you can’t contribute to one directly

But, there is a loophole

The backdoor Roth is simply making a non deductible contribution to a Trad. IRA then converting the money to a Roth IRA.

Here’s how:

1. Open Trad. IRA

2. Contribute money

3. Direct rollover to Roth IRA

4. Invest it

This will let them each contribute $7,000 to a Roth IRA and start growing that bucket of tax free money before retirement

Here’s how:

1. Open Trad. IRA

2. Contribute money

3. Direct rollover to Roth IRA

4. Invest it

This will let them each contribute $7,000 to a Roth IRA and start growing that bucket of tax free money before retirement

3- Joint taxable automation

The taxable account is extremely important for folks who are retiring early and have other mid term goals

Instead of haphazardly investing $5k or $10k whenever they remember to do so, we are setting up automated monthly contribution based on their cash flow

The taxable account is extremely important for folks who are retiring early and have other mid term goals

Instead of haphazardly investing $5k or $10k whenever they remember to do so, we are setting up automated monthly contribution based on their cash flow

We will start by aiming to invest around $20k/yr and adjust if needed

That way we DCA into the market and don’t have to remember to invest when life gets busy

That way we DCA into the market and don’t have to remember to invest when life gets busy

3- Allocation

One of their biggest concerns was how to allocate their investments

First, we are setting appropriate allocation for their age and time horizon which includes diversified stocks, fixed income, alts and cash reserves

One of their biggest concerns was how to allocate their investments

First, we are setting appropriate allocation for their age and time horizon which includes diversified stocks, fixed income, alts and cash reserves

The overall allocation is around 80/20 and will continue to get more conservative over time

More importantly we are determining which accounts those assets should be in..

More importantly we are determining which accounts those assets should be in..

By putting high growth assets (like stocks and crypto) in tax free and taxable accounts

And income producing assets like fixed income in tax deferred accounts

They can save an additional $100k over the next 13 years before they retire

And income producing assets like fixed income in tax deferred accounts

They can save an additional $100k over the next 13 years before they retire

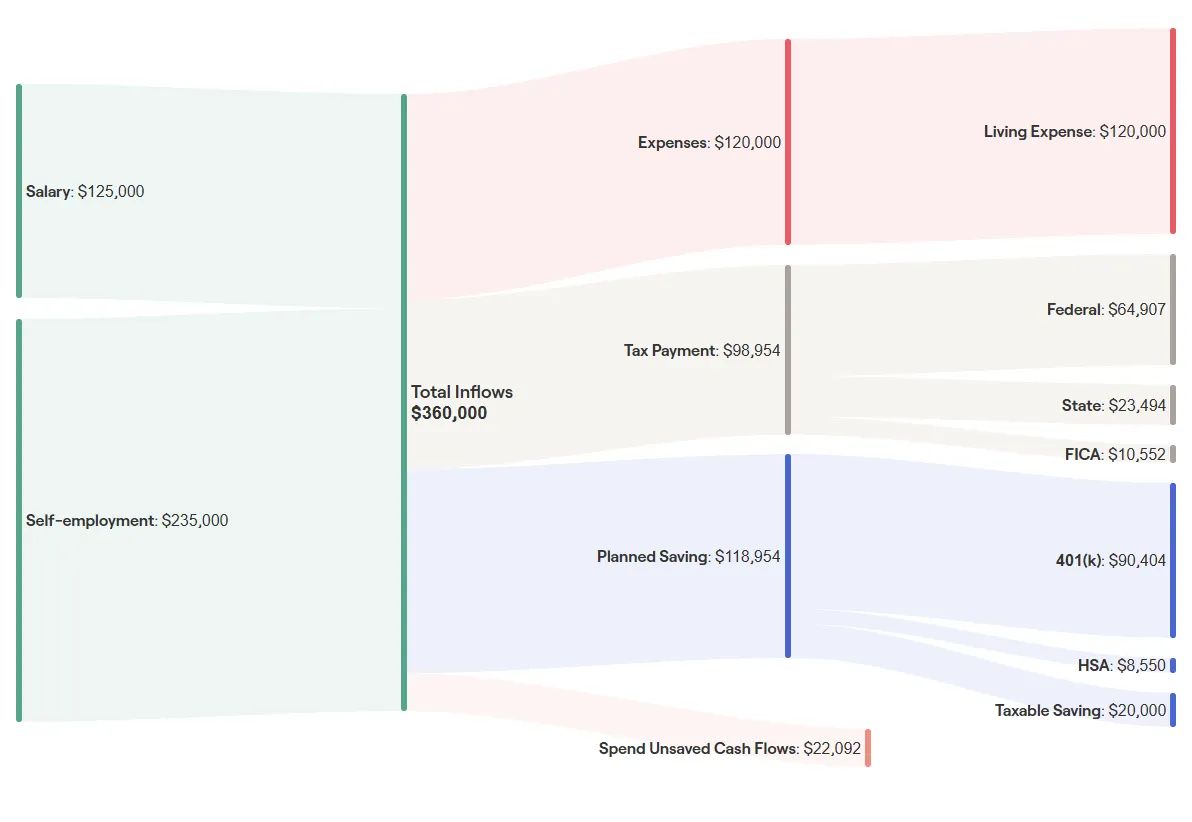

6- After all of these changes their expected tax burden over the next 13 years is down over $500k - an average of $40k/yr

AND their assets going into retirement are up by nearly $2.2m in today’s dollars over the same period of time

This is exactly what makes tax savings + investment growth a powerful combination when planning for financial freedom!

This is exactly what makes tax savings + investment growth a powerful combination when planning for financial freedom!

If you want to learn more about strategies like these, make sure to sign up for my newsletter for no nonsense financial education:

fiplaybook.carrd.co

fiplaybook.carrd.co

That's a wrap, thanks for reading!

If you enjoyed this thread, make sure to:

1- Follow me @Invested_in_You for more content like this

2- Share the first post in this thread with someone who needs to see it!

If you enjoyed this thread, make sure to:

1- Follow me @Invested_in_You for more content like this

2- Share the first post in this thread with someone who needs to see it!

https://twitter.com/invested_in_you/status/1950178254431650090

• • •

Missing some Tweet in this thread? You can try to

force a refresh