Educational insights to help maximize your money • I help people navigate inheritances & sudden wealth • Owner @ Rogue Advisors • Tweets ≠ advice

How to get URL link on X (Twitter) App

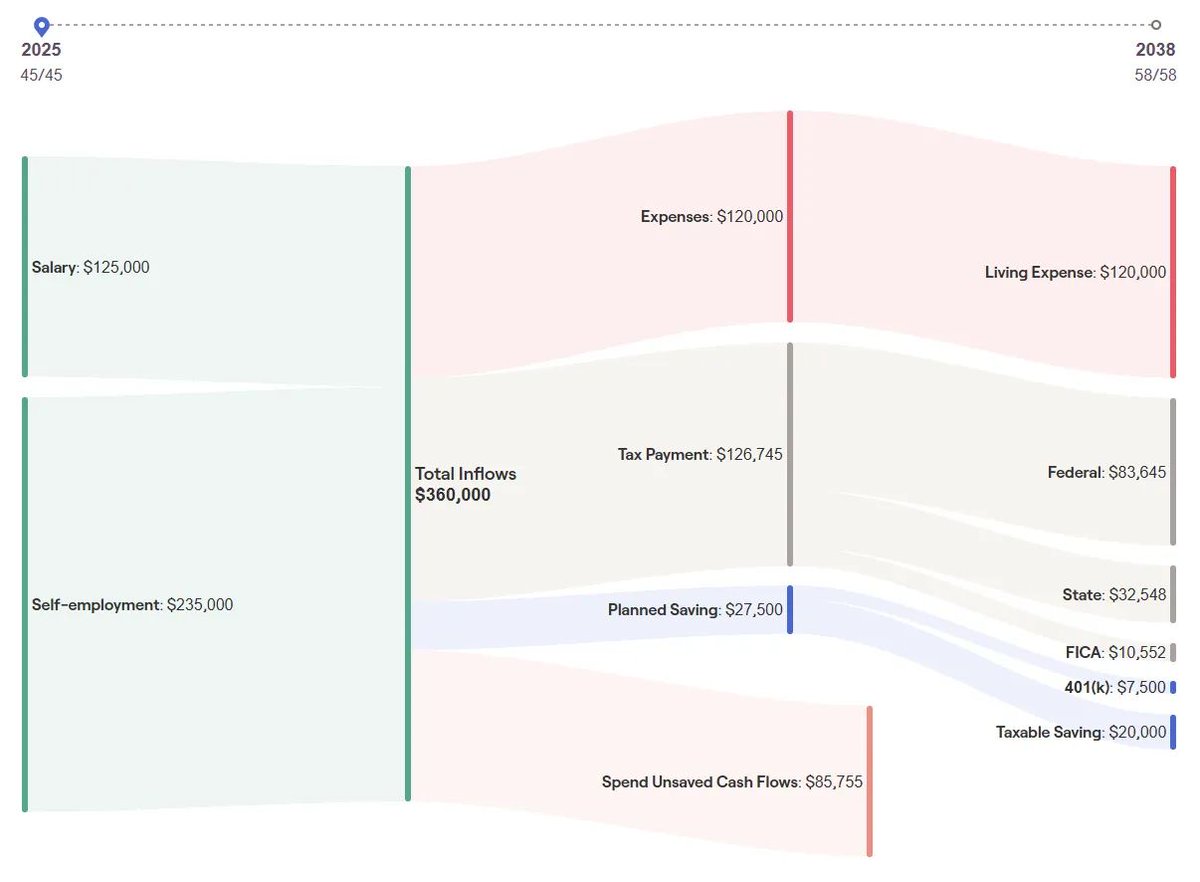

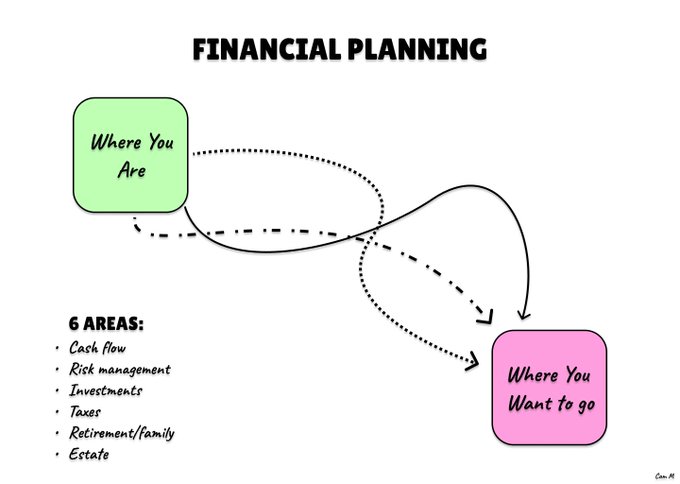

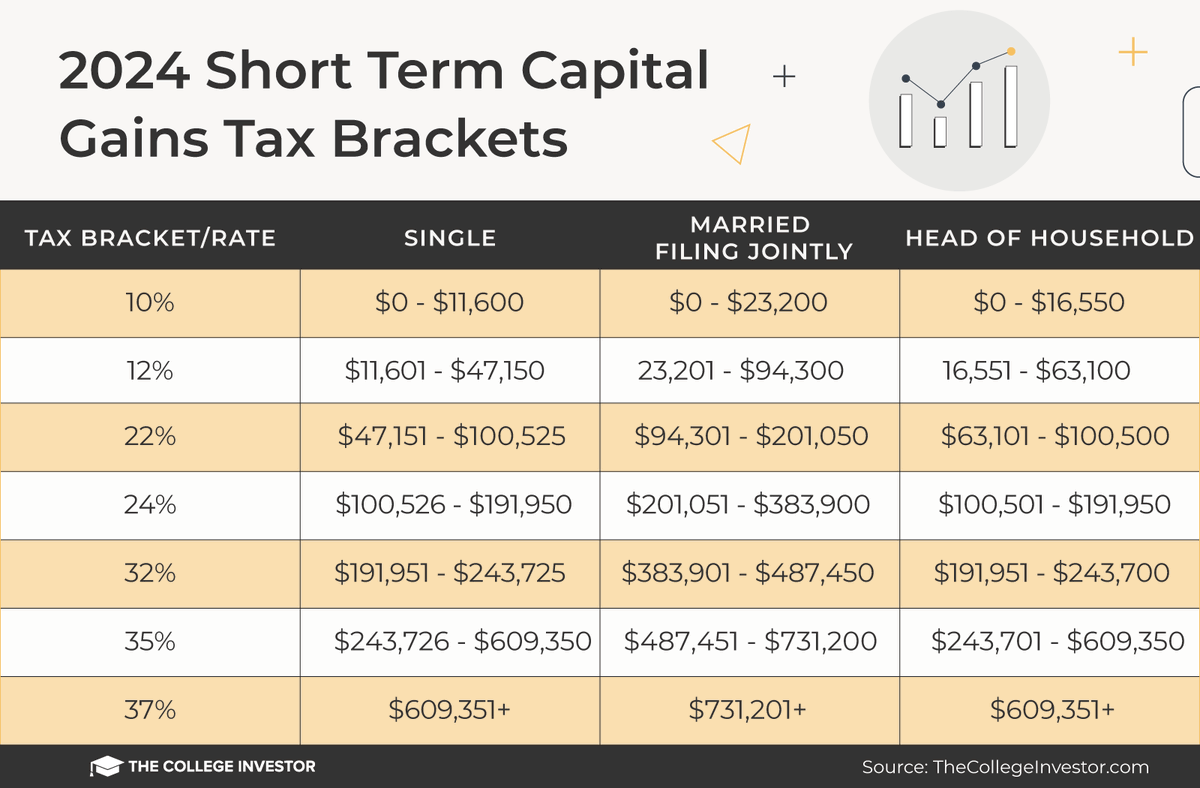

A financial plan outlines various ways to get from where you are to where you want to go.

A financial plan outlines various ways to get from where you are to where you want to go.

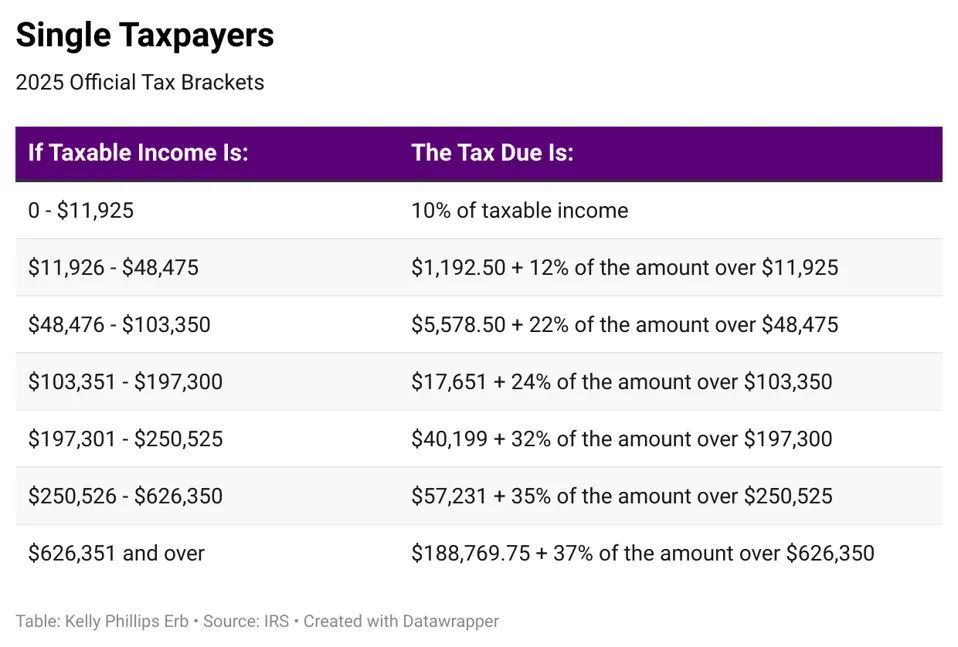

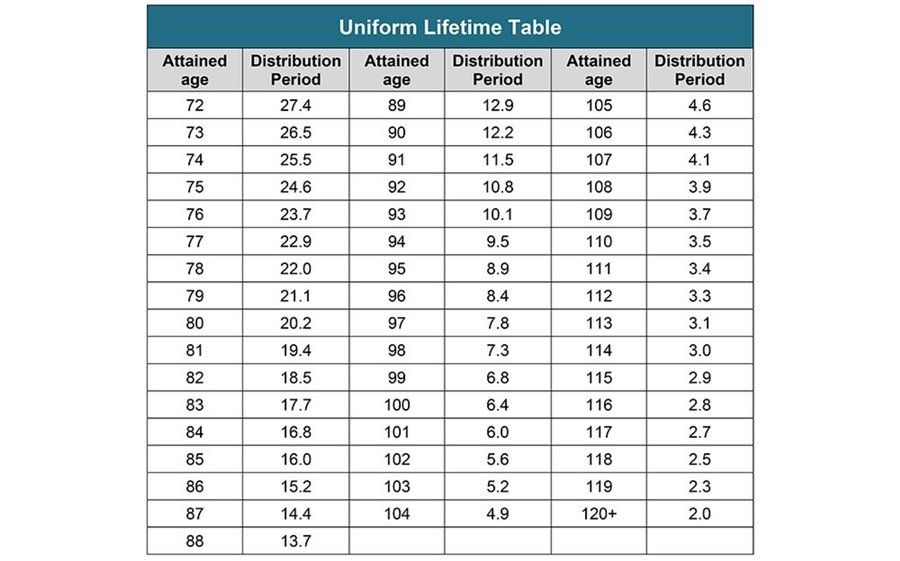

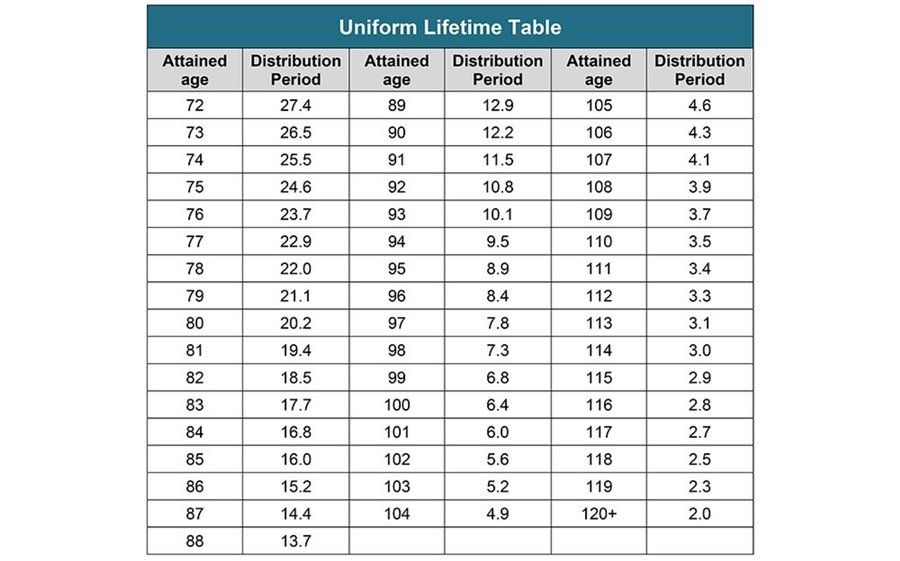

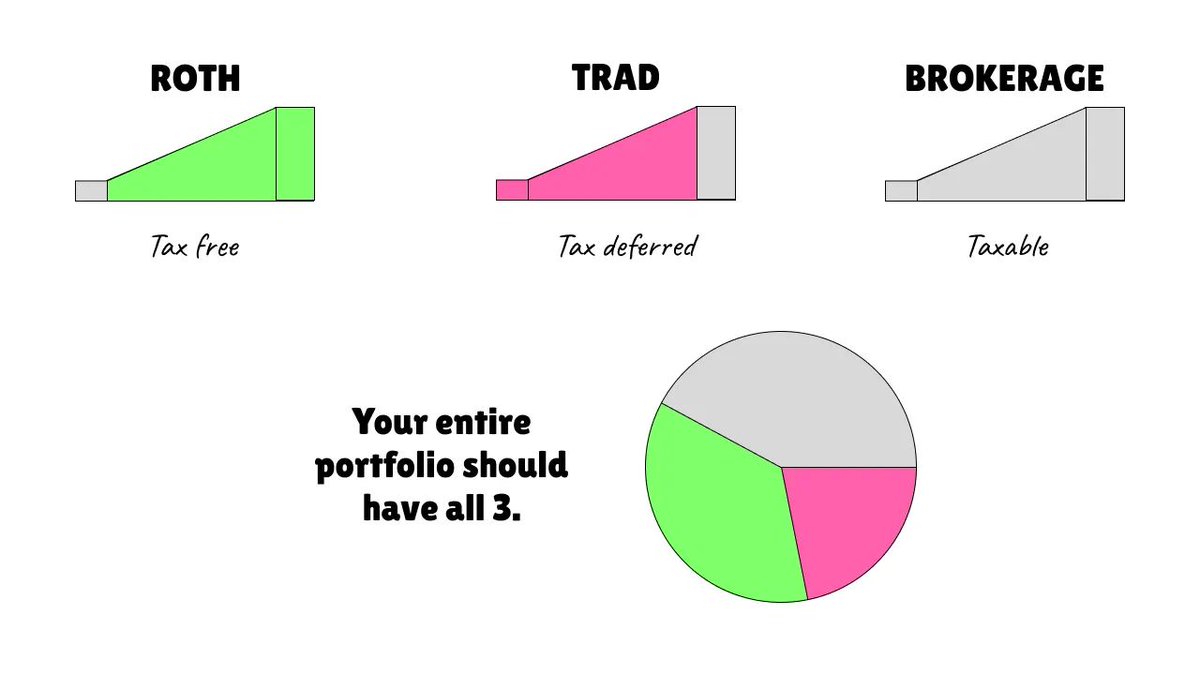

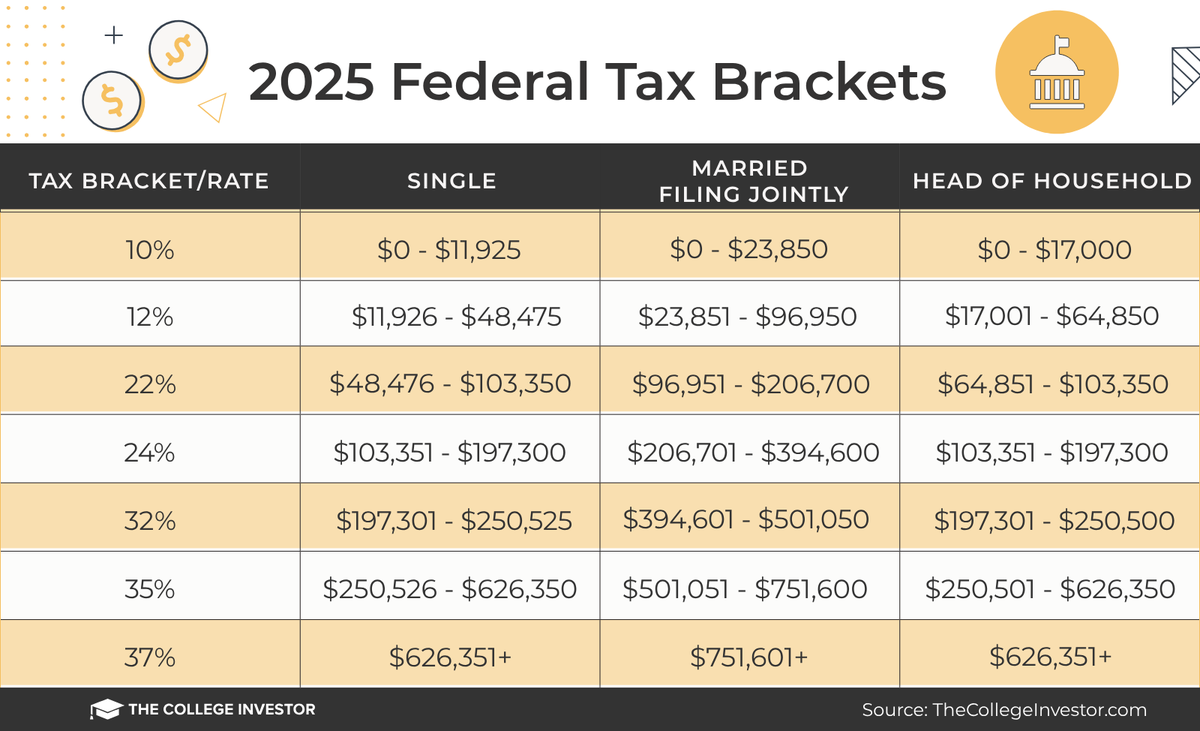

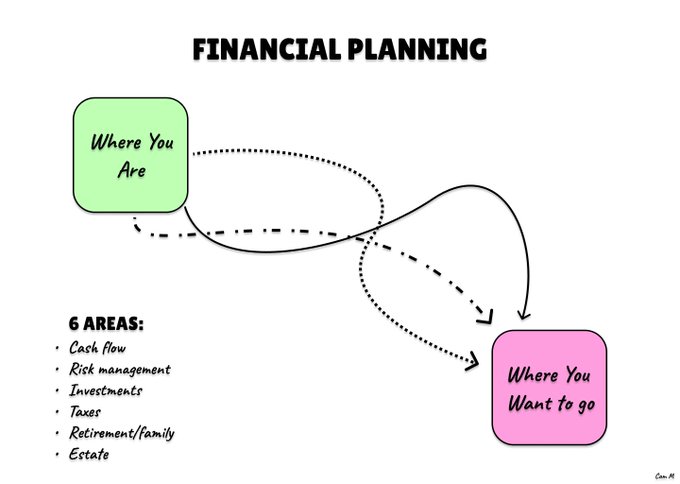

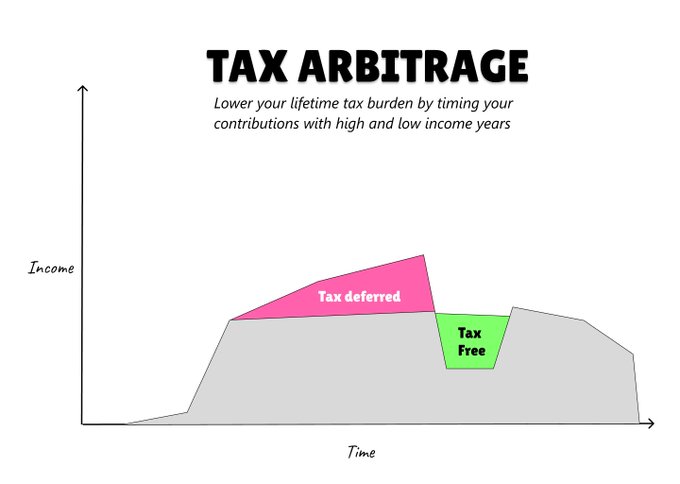

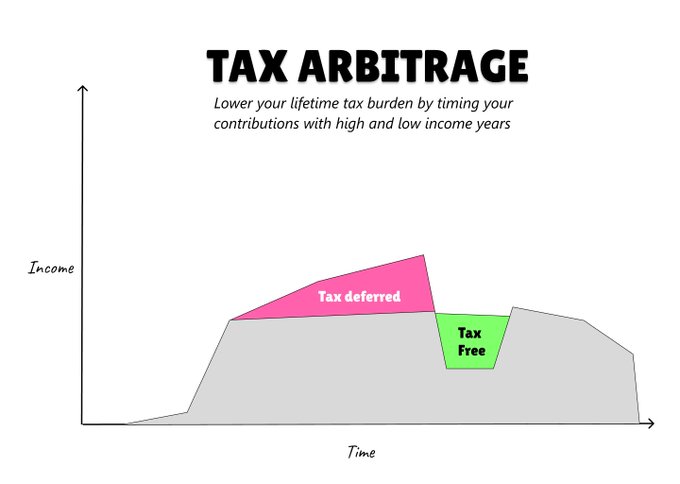

A Roth conversion is simply rolling money from a traditional (pre-tax) account to a Roth (tax free) account.

A Roth conversion is simply rolling money from a traditional (pre-tax) account to a Roth (tax free) account.