The Fed isn't fighting inflation anymore.

They're orchestrating the biggest corporate wealth transfer since 2008.

$4.2 trillion in debt matures by 2026, and overleveraged companies are sitting ducks.

Here's the controlled demolition Wall Street won't tell you about:🧵

They're orchestrating the biggest corporate wealth transfer since 2008.

$4.2 trillion in debt matures by 2026, and overleveraged companies are sitting ducks.

Here's the controlled demolition Wall Street won't tell you about:🧵

Most investors think the Fed's hawkish stance is about inflation control.

The reality? They're setting up the biggest corporate debt crisis since 2008.

Around 70% of investment-grade bonds issued during the zero-rate era are about to hit refinancing cliffs.

The math?

The reality? They're setting up the biggest corporate debt crisis since 2008.

Around 70% of investment-grade bonds issued during the zero-rate era are about to hit refinancing cliffs.

The math?

Here's the math that Wall Street doesn't want you to see:

Companies borrowed heavily at average rates below 3% from 2020-2022.

Those same companies will refinance at 6%+ in the current environment.

That's more than double their interest expense on existing debt.

Companies borrowed heavily at average rates below 3% from 2020-2022.

Those same companies will refinance at 6%+ in the current environment.

That's more than double their interest expense on existing debt.

The targeting is systematic across sectors:

Real estate companies hold over $900 billion in maturing debt by 2025.

Energy and tech firms face hundreds of billions in refinancing needs.

Every sector that binged on cheap money is about to pay the price.

Real estate companies hold over $900 billion in maturing debt by 2025.

Energy and tech firms face hundreds of billions in refinancing needs.

Every sector that binged on cheap money is about to pay the price.

While it shows rates potentially declining to mid-3% by 2026, current refinancing costs remain elevated at 6%+.

Corporate treasurers modeled refinancing at much lower rates when they issued this debt.

The result? Tens of billions annually in additional interest payments.

Corporate treasurers modeled refinancing at much lower rates when they issued this debt.

The result? Tens of billions annually in additional interest payments.

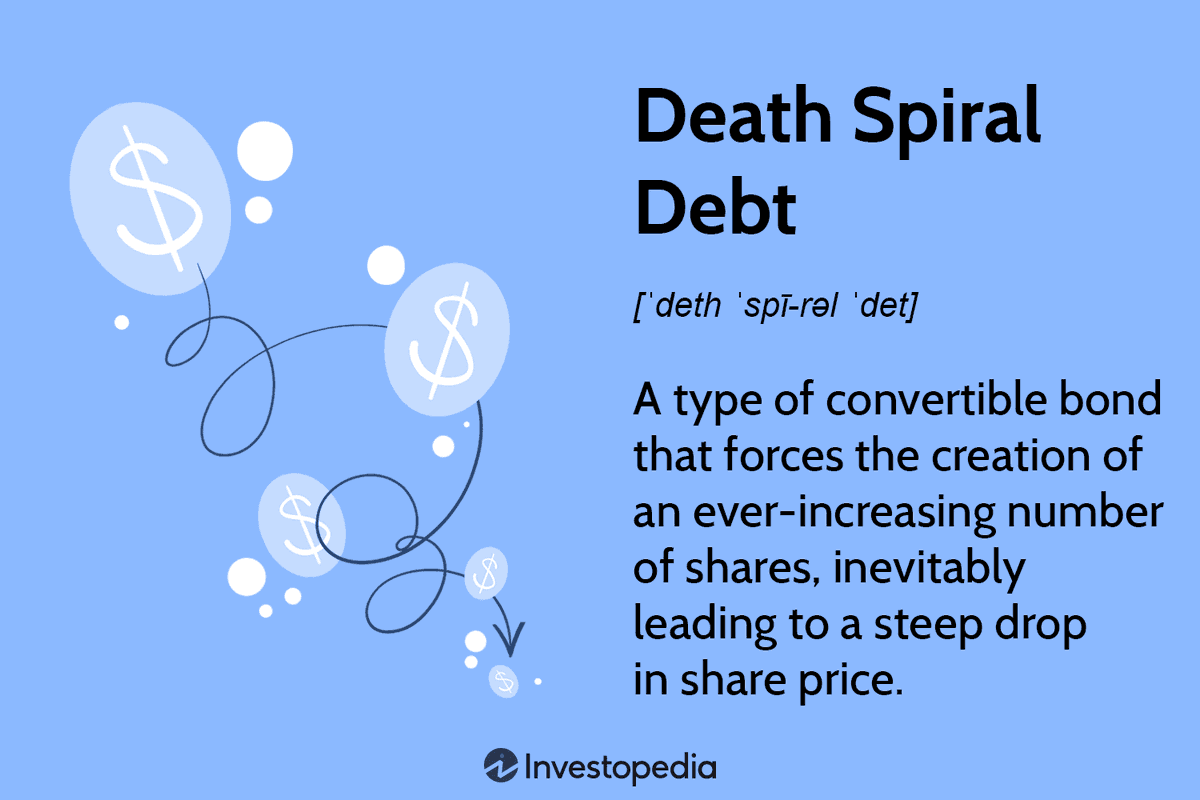

Let's examine the cascade effect:

1. Higher interest costs force companies to cut capital expenditure.

2. Reduced capex leads to slower revenue growth.

3. Slower growth triggers credit rating downgrades.

4. Downgrades increase borrowing costs even further.

A death spiral.

1. Higher interest costs force companies to cut capital expenditure.

2. Reduced capex leads to slower revenue growth.

3. Slower growth triggers credit rating downgrades.

4. Downgrades increase borrowing costs even further.

A death spiral.

The zombies are already emerging:

11% of Russell 2000 companies now qualify as "zombie firms", businesses that can't cover interest payments from operating income.

That's up significantly from pre-pandemic levels.

Credit markets are pricing in the inevitable:

11% of Russell 2000 companies now qualify as "zombie firms", businesses that can't cover interest payments from operating income.

That's up significantly from pre-pandemic levels.

Credit markets are pricing in the inevitable:

High-yield spreads widened 60-89 basis points in Q1 2025.

Investment-grade spreads also increased substantially.

Covenant-lite loans now represent over 80% of new issuance.

Lenders are demanding protection because they see what's coming.

Investment-grade spreads also increased substantially.

Covenant-lite loans now represent over 80% of new issuance.

Lenders are demanding protection because they see what's coming.

The Fed's communication strategy reveals their true position:

They're not fighting inflation anymore.

They're managing a controlled deleveraging of overleveraged companies.

The rate environment is forcing a reckoning with the debt binge.

They're not fighting inflation anymore.

They're managing a controlled deleveraging of overleveraged companies.

The rate environment is forcing a reckoning with the debt binge.

Here's the timeline that matters:

2025: $2.4 trillion in corporate debt matures

2026: Additional trillions come due

Companies have limited time to find financing in a 6%+ rate environment.

2025: $2.4 trillion in corporate debt matures

2026: Additional trillions come due

Companies have limited time to find financing in a 6%+ rate environment.

The sectors facing the biggest squeeze:

Commercial real estate: Nearly 47% of loans mature by end of 2026

Other heavily leveraged sectors face similar maturity walls

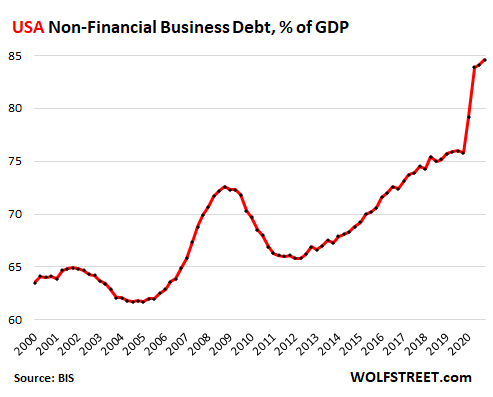

Let's compare this to 2008:

Commercial real estate: Nearly 47% of loans mature by end of 2026

Other heavily leveraged sectors face similar maturity walls

Let's compare this to 2008:

In 2008, corporate debt-to-GDP was 45%.

Today, it's around 51%, a record high.

The Fed funds rate in 2008 dropped to 0.25% within months.

This time, they're maintaining higher rates longer.

Small and mid-cap companies face severe challenges:

Today, it's around 51%, a record high.

The Fed funds rate in 2008 dropped to 0.25% within months.

This time, they're maintaining higher rates longer.

Small and mid-cap companies face severe challenges:

They can't access capital markets like large corporations.

Regional banks are restricting lending to preserve capital.

Private credit costs 11%+ for companies without investment-grade ratings.

The funding desert is expanding rapidly, while the big banks are preparing..

Regional banks are restricting lending to preserve capital.

Private credit costs 11%+ for companies without investment-grade ratings.

The funding desert is expanding rapidly, while the big banks are preparing..

Major financial institutions are positioning for credit stress.

Banks are increasing loan loss provisions.

Commercial lending exposure is being reduced.

They know what the data shows.

Banks are increasing loan loss provisions.

Commercial lending exposure is being reduced.

They know what the data shows.

The current rate environment isn't just economic forecasting, it's economic rebalancing.

Years of ultra-low rates created systematic over-leveraging.

The correction will transfer assets from overleveraged companies to those with stronger balance sheets.

Years of ultra-low rates created systematic over-leveraging.

The correction will transfer assets from overleveraged companies to those with stronger balance sheets.

Smart investors aren't waiting for the refinancing crisis to unfold.

They're positioning for the systematic transfer of assets from overleveraged companies to cash-rich buyers:

They're positioning for the systematic transfer of assets from overleveraged companies to cash-rich buyers:

Tired of high-fee advisors who underdeliver?

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

Our FREE weekly newsletter teaches:

- How to spot hidden portfolio fees

- Macro trends Wall Street hides

- Independent investing strategies

Subscribe here for FREE: dalyam.beehiiv.com

If you found this helpful consider:

- RTing the tweet below

- Following me @LiamDalyAsset

Thanks for reading.

- RTing the tweet below

- Following me @LiamDalyAsset

Thanks for reading.

https://twitter.com/1897772264696799232/status/1950194708082544744

• • •

Missing some Tweet in this thread? You can try to

force a refresh