Daly Asset Management is a Maryland based C-Corp that manages funds on Quantbase.

Free weekly newsletter: https://t.co/Vy69P107qv

How to get URL link on X (Twitter) App

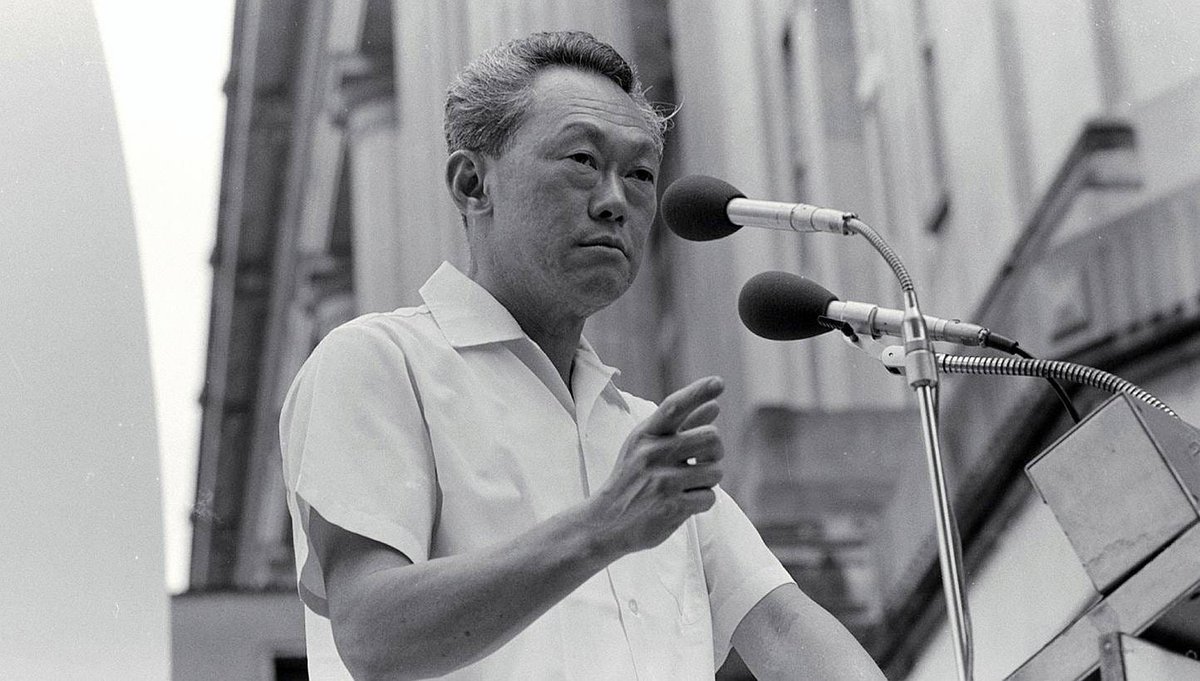

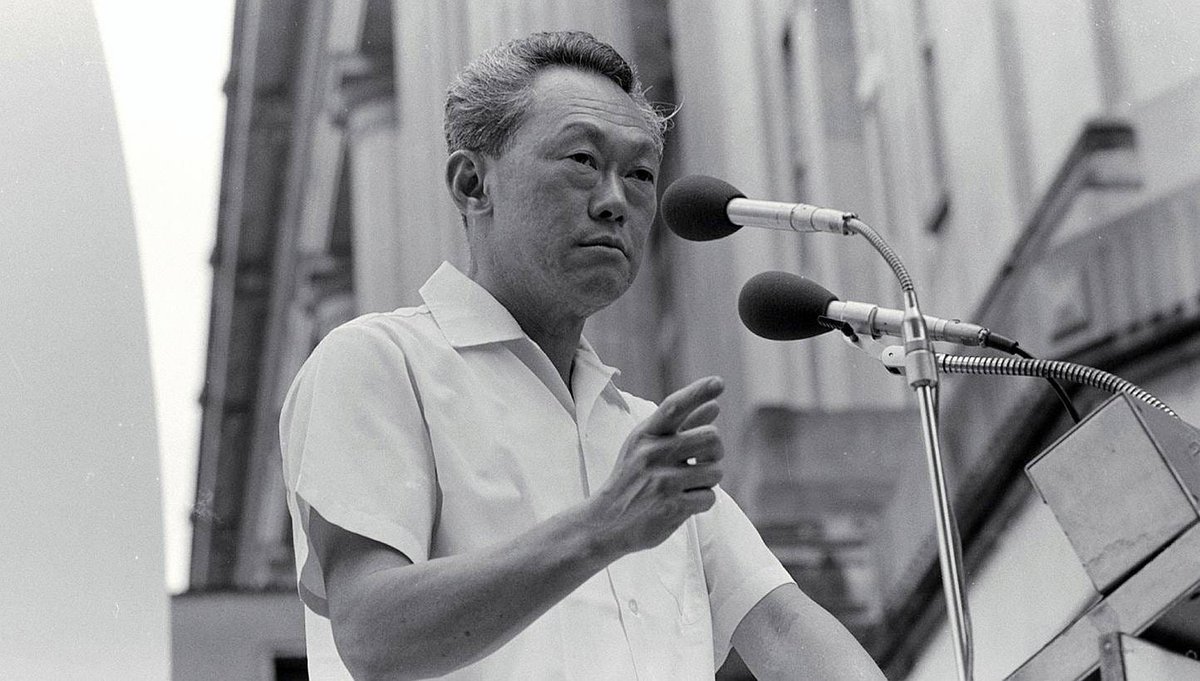

Think about this: Singapore's GDP per capita in 1965 was $500.

Think about this: Singapore's GDP per capita in 1965 was $500.

Japan's government debt hit 1,324 trillion yen in March 2025.

Japan's government debt hit 1,324 trillion yen in March 2025.

It began when employees noticed something suspicious:

It began when employees noticed something suspicious:

Think about this: The government is borrowing $21 billion every single day.

Think about this: The government is borrowing $21 billion every single day.

Think about what this means.

Think about what this means.

Think of shadow banks as China's version of private lending.

Think of shadow banks as China's version of private lending.

The economic data tells a story of systematic middle-class erosion disguised as "resilient growth."

The economic data tells a story of systematic middle-class erosion disguised as "resilient growth."

It all started with a promise.

It all started with a promise.

The numbers are brutal:

The numbers are brutal:

Most investors think these legends succeed by picking great stocks.

Most investors think these legends succeed by picking great stocks.

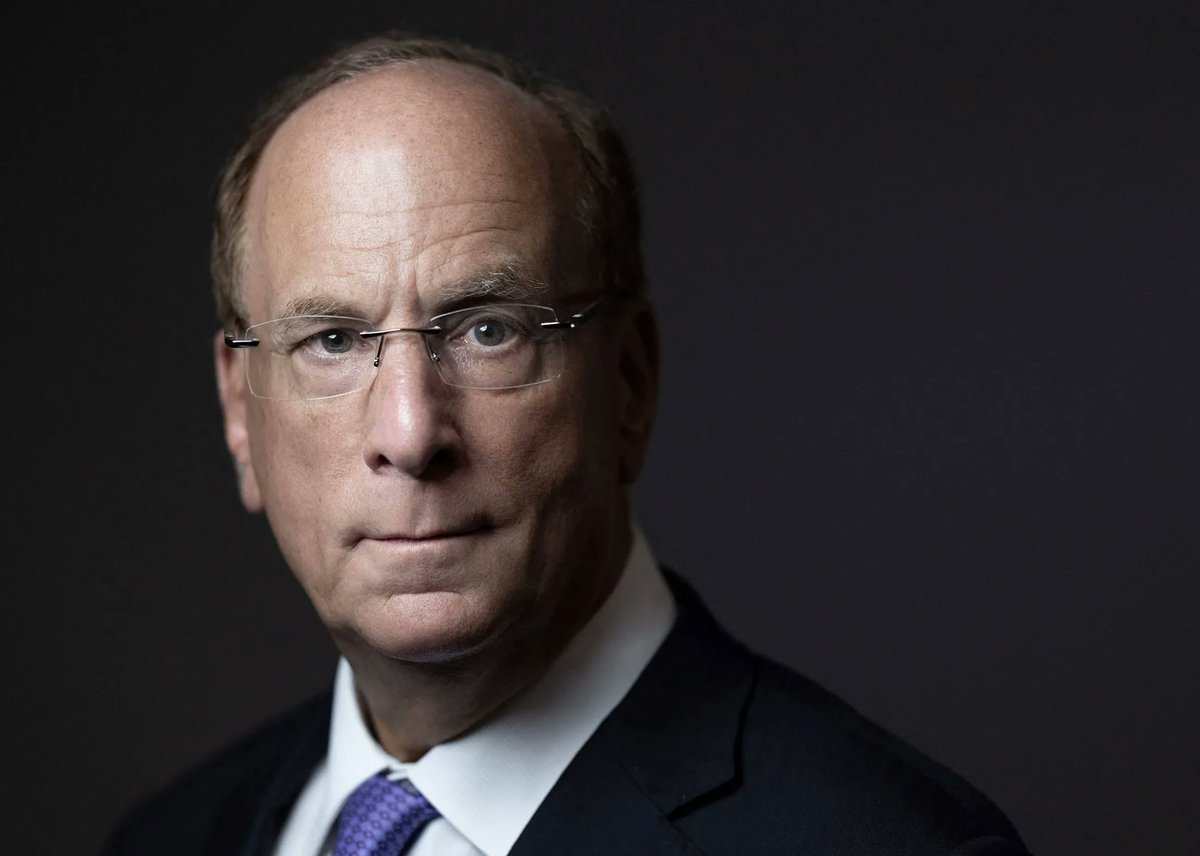

Think your S&P 500 fund gives you a voice in corporate America?

Think your S&P 500 fund gives you a voice in corporate America?

Most people think currency intervention is about national pride.

Most people think currency intervention is about national pride.

Ray Dalio just issued his most terrifying prediction yet.

Ray Dalio just issued his most terrifying prediction yet.

Most investors think the Fed's hawkish stance is about inflation control.

Most investors think the Fed's hawkish stance is about inflation control.

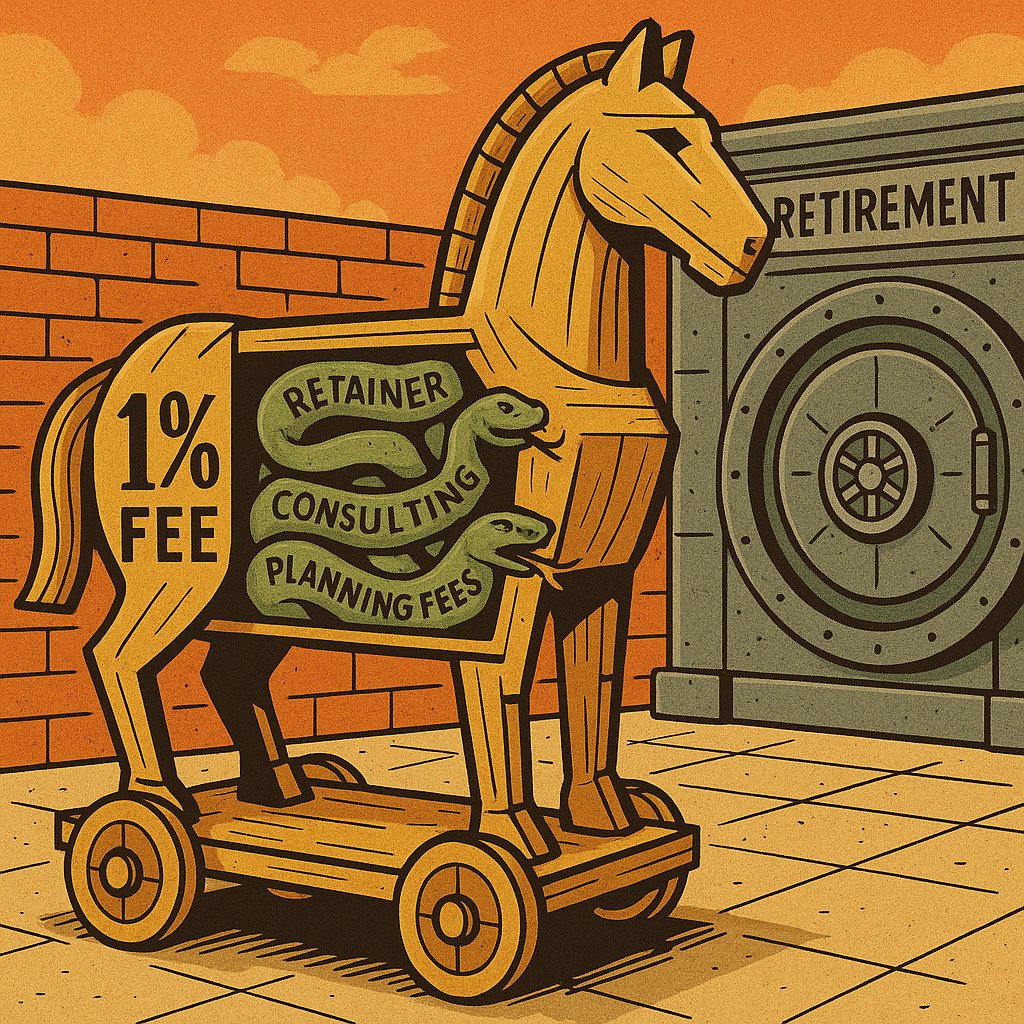

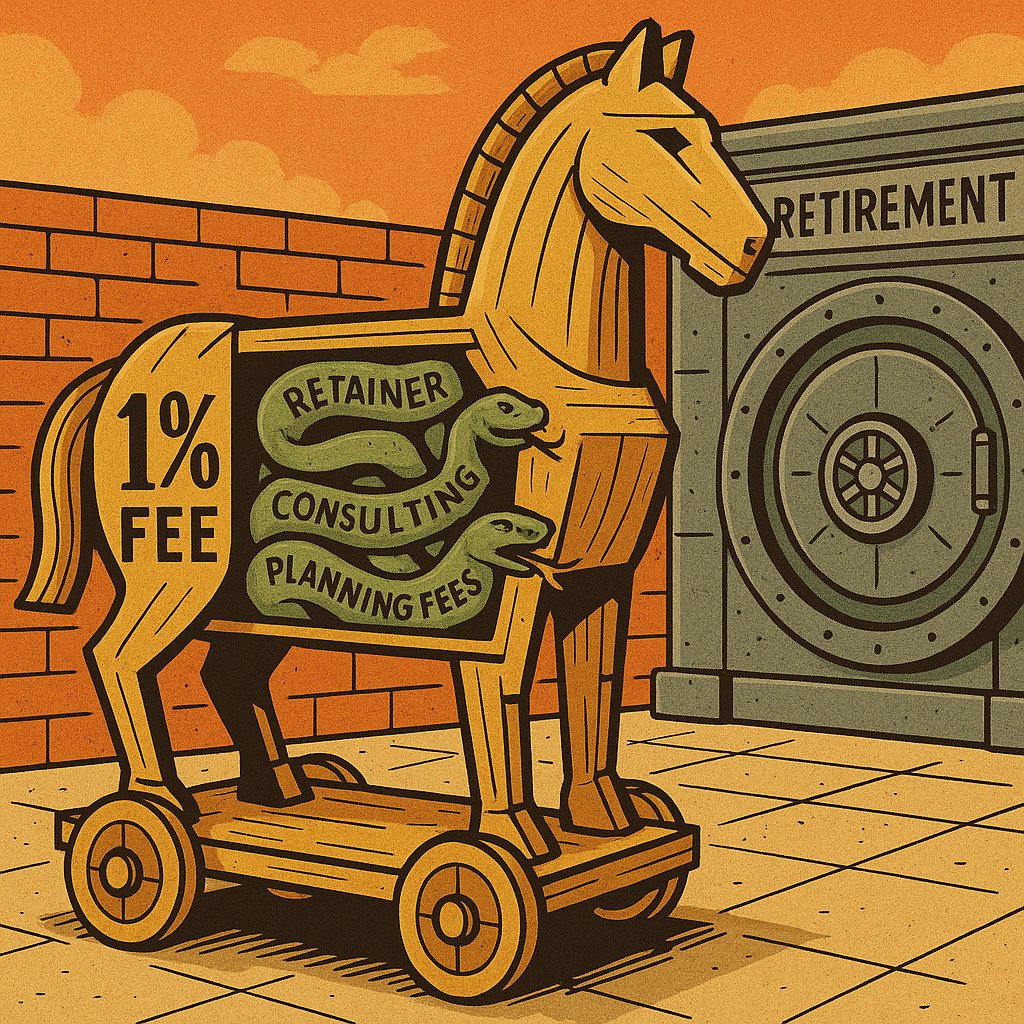

Most financial advisors sell you complexity:

Most financial advisors sell you complexity:

Think about this: You thought you were paying 1% advisor fees.

Think about this: You thought you were paying 1% advisor fees.