The Druck Myth about terming out the US debt 101. When thinking about the government finances many smart people (including Druck) make a fatal mistake and model the government as a private sector corporation or individual. Public finance is not the same as private finance.

But let's assume for a moment that the Treasury was simply a market participant trying to time the market with its issuance. The period in focus is from April 2020 to March 2022. Where 10 year interest rates plunged during Covid and QE. Of that 2 year period Mnuchin was SoT

For 10 months and Yellen was for 14 months. So plenty of "blame" to go around if you are looking at this with an anti Yellen political bias

But ironically during that period ALL the TBILL issuance came during Mnuchin's reign. During that time Yellen "Termed out" 1TN of bills

But ironically during that period ALL the TBILL issuance came during Mnuchin's reign. During that time Yellen "Termed out" 1TN of bills

That her predecessor had issued. Because of large deficits during that whole period debt rose by 4.7TN but during the Yellen portion her contribution was a 2TN increase in debt with a 1Tn reduction in bills 3TN increase in duration.

With my private sector actor hat on I see her terming out the debt by 1TN

With my public sector actor hat on (I'll say more about this later) The whole time frame by both Sec_Treas was handled well. There was a need for spending that was financed with rapid large bills issuance

With my public sector actor hat on (I'll say more about this later) The whole time frame by both Sec_Treas was handled well. There was a need for spending that was financed with rapid large bills issuance

Then as the crisis ebbed the treasury termed out the bills. That's exactly how they should and do work.

But gosh interest rates were still so low and they had 4TN bills pre crisis why not term out more than 1TN of stuff you did in Covid and term out some of the preexisting.

But gosh interest rates were still so low and they had 4TN bills pre crisis why not term out more than 1TN of stuff you did in Covid and term out some of the preexisting.

This is where one has to divorce oneself from the myth of the government acting like a private participant. But before we do that let's set the scene.

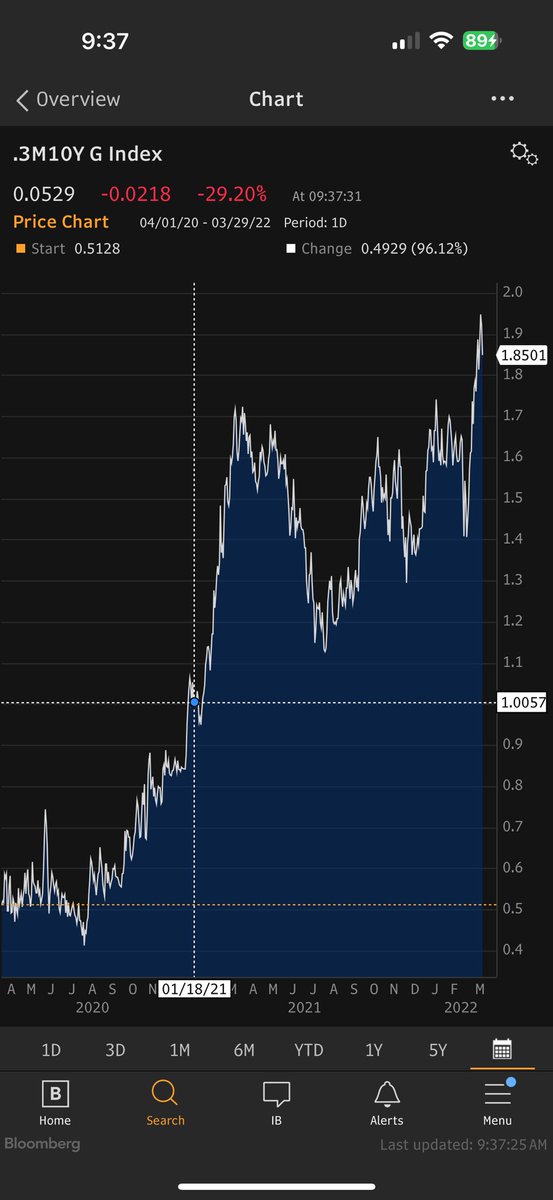

Tbill interest rates were effectively zero. For a brief time during the Mnuchin era bills yields were 50bp lower than tens

Tbill interest rates were effectively zero. For a brief time during the Mnuchin era bills yields were 50bp lower than tens

But during the whole of the Yellen period when absolute levels of 10's seemed like a great level to lock in Tbill yields were 100 to 170bp lower?

Remembering that Yellen was already terming out 1TN during that period it's unclear to me how much bigger she should have been.

Remembering that Yellen was already terming out 1TN during that period it's unclear to me how much bigger she should have been.

Perhaps she thought. Hmm I'm doing 1TN already and having a pretty big impact. If I did another 1TN maybe I'd pay 25 -50 bp higher on my 10 years. Perhaps she also though how the hell do I know what rates are going to do going forward because NO ONE KNOWs. Anyway she termed out

ALL the new stuff from Covid and didn't term out the old stuff. If she had done another 1TN without market impact she may have saved roughly 150bp at most per year over the last 4 years. Which "cost" the country or cumulatively 60BN dollars. Thats a "big" number to us but its

Fucking nothing for the government. Even if she had cut pre Covid bills in half that "savings" would have been 30BN per year or $120BN for the last 4.

So in retrospect knowing exactly how it turned out which no one knew at the time her "failure" to term out is a ridiculous

So in retrospect knowing exactly how it turned out which no one knew at the time her "failure" to term out is a ridiculous

criticism Even if you consider her a 26TN hedge fund operating as a private sector investor.

Hopefully just this section of this thread fully debunks stupid Druck comments. But if it doesn't please read on because treasury issuance policy is NOT optimizing PNL exclusively.

Hopefully just this section of this thread fully debunks stupid Druck comments. But if it doesn't please read on because treasury issuance policy is NOT optimizing PNL exclusively.

Before I do this. Let's also talk about market timing and whether people including the treasury are any good at it. At the exact time when in retrospect it was obvious to everyone that long term rates were going higher. Real investors were happy to buy treasuries at 1.5%

BofA, Republic, SVB and others loaded the boat! They loved the 170bp of carry vs fed funds! Many many investors also loved bonds including many hedge funds, insurance companies, and pension funds. These guys have one exclusive objective and that is to make PNL and they

Market timed by buying! Sure they were spectacularly wrong but MARKET TIMING is hard for the best investors on earth. The Treasury explicitly says it can't and doesn't. (They may lie). But also they buy and sell 9TN of debt every year and announce all their plans months in

advance. All their actions are front run. They have zero edge in fact they almost certainly have sizable negative alpha (thank god for me!).

Anyway let's talk about the other policy goals of the government and loop in the Fed as part of government.

During this period the

Anyway let's talk about the other policy goals of the government and loop in the Fed as part of government.

During this period the

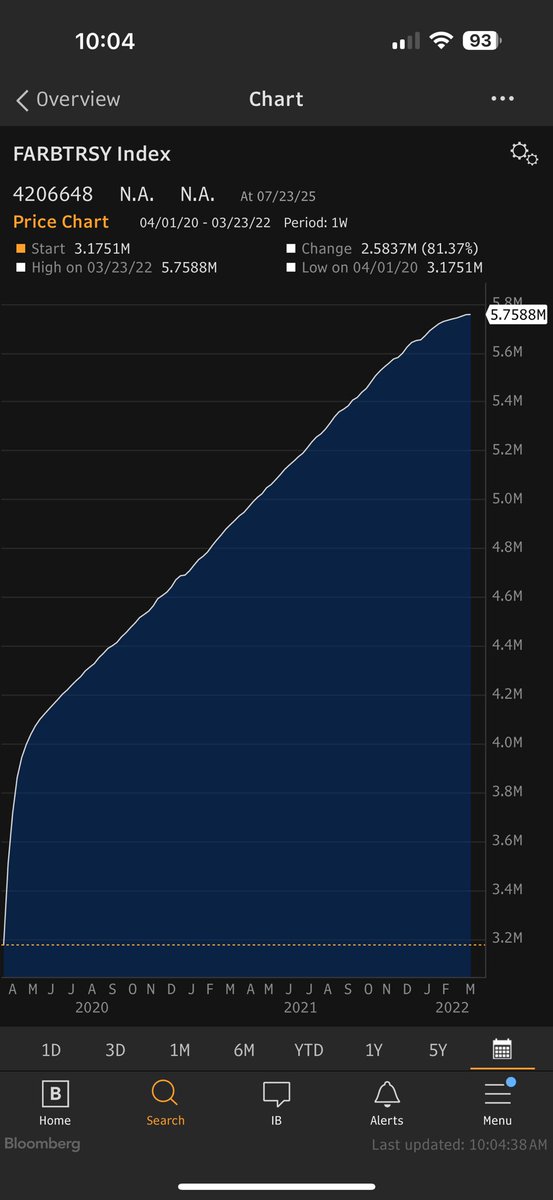

Fed BOUGHT 3.1TN of treasury duration at these incredibly low interest rates. WTF they should have been selling according to DRUCK!

Net "The consolidate Government bought 2.1TN as Janet sold 1TN and Jay bought 3.1TN (plus a crapload of MBS)

The government didn't do this for PNL reasons at all! They did it because Fed Funds rates were zero and couldn't be lowered and an economic crisis was occuring. Is QE

The government didn't do this for PNL reasons at all! They did it because Fed Funds rates were zero and couldn't be lowered and an economic crisis was occuring. Is QE

The correct lever? Was fiscal policy the right lever. Were those policies done too aggressively? In retrospect probably but at the time

It was being done for well described reasons and looking back worked out okay as of today (ignoring the highly unequal wealth impact)

It was being done for well described reasons and looking back worked out okay as of today (ignoring the highly unequal wealth impact)

The point is. If Janet had termed out more than 1TN say 2 or 3 the consolidated policy would have massively tightened conditions during a crisis. In essence Janet would have undid QE while QE was needed.

One last point. If Janet had termed out another 1TN that would

One last point. If Janet had termed out another 1TN that would

Have been bought by the private sector on leverage just like the first TN was. BofA may have had 2x the portfolio or maybe other banks would have bought or hedge funds or 401K's. The aggregate marked to market loss today would be massive. By not terming out more the

Treasury shielded the private sector and all the individuals who have deposits, mutual funds. Need mortgages or have 401K from larger losses. That is a sensible policy choice and what the Consolidated government DOES as a damper when the economy is in crisis and perhaps my

Biggest criticism of both administrations since March of 2022 is they have failed to term out the debt when the crisis is over and inflation and growth remain overheated.

• • •

Missing some Tweet in this thread? You can try to

force a refresh