🔥 $SOFI Delivers a Powerhouse Q2 —

Stock Jumps ~9% in Pre‑Market 🌟

SoFi Technologies crushed expectations, reporting record‑breaking metrics in Q2: net revenue surged ~44% to $855M, net income skyrocketed to $97M, and adjusted EPS clocked in at $0.08. The stock is already lighting up pre-market, trading up nearly 9% as investors reward strong execution and upward guidance.

We’ve been long-term bulls — and this morning only confirms our conviction. TLDR at the bottom 👇

📊 INVESTMENT TAKEAWAY

SoFi Technologies presents a compelling growth story with its integrated financial services platform and demonstrated ability to achieve profitability while maintaining strong revenue growth. The company’s Q2 2025 results show accelerating momentum, with record revenue of $854.9 million (43% YoY growth) and $97 million in net income.

However, the elevated valuation (forward P/E of 72.48) suggests high growth expectations are already priced in, leaving limited margin for execution missteps.

While SoFi’s banking charter and technology investments provide competitive advantages, investors should carefully weigh these strengths against intensifying competition and potential credit quality concerns.

🤔 ANALYTICAL REASONING

From an investment perspective, SoFi represents the evolution of financial services in the digital age. The company’s transformation from a student loan refinancing platform to a comprehensive financial services provider demonstrates management’s strategic vision and execution capabilities.

The banking charter obtained in 2022 has proven to be a significant competitive advantage, allowing SoFi to reduce funding costs, offer competitive deposit rates, and expand its product ecosystem.

Today’s Q2 2025 earnings release confirms the company’s growth trajectory remains intact, with accelerating revenue growth of 43% year-over-year and meaningful profitability at $97 million in net income. This performance validates management’s “financial services super-app” strategy and suggests continued market share gains in the competitive fintech landscape.

However, the investment thesis must be tempered by valuation considerations. Trading at a forward P/E of 72.48, SoFi commands a significant premium to traditional financial institutions and even many technology companies. This valuation implies flawless execution and sustained high growth rates, leaving little room for operational missteps or macroeconomic headwinds.

The competitive landscape also presents challenges, as both traditional banks and fintech startups continue to invest heavily in digital capabilities. While SoFi’s integrated platform and banking charter provide advantages, the company must continue innovating to maintain its competitive edge and justify its premium valuation.

Credit quality remains another key consideration. As SoFi’s loan portfolio expands, particularly in potentially higher-risk segments like personal loans, investors should monitor credit performance metrics closely, especially if economic conditions deteriorate.

In conclusion, SoFi represents a high-growth, high-potential investment in the financial services sector, with demonstrated execution capabilities and a compelling product ecosystem. However, the elevated valuation suggests much of this potential is already reflected in the stock price, warranting a balanced approach to position sizing and entry points for investors considering exposure to this innovative fintech leader.

Stock Jumps ~9% in Pre‑Market 🌟

SoFi Technologies crushed expectations, reporting record‑breaking metrics in Q2: net revenue surged ~44% to $855M, net income skyrocketed to $97M, and adjusted EPS clocked in at $0.08. The stock is already lighting up pre-market, trading up nearly 9% as investors reward strong execution and upward guidance.

We’ve been long-term bulls — and this morning only confirms our conviction. TLDR at the bottom 👇

📊 INVESTMENT TAKEAWAY

SoFi Technologies presents a compelling growth story with its integrated financial services platform and demonstrated ability to achieve profitability while maintaining strong revenue growth. The company’s Q2 2025 results show accelerating momentum, with record revenue of $854.9 million (43% YoY growth) and $97 million in net income.

However, the elevated valuation (forward P/E of 72.48) suggests high growth expectations are already priced in, leaving limited margin for execution missteps.

While SoFi’s banking charter and technology investments provide competitive advantages, investors should carefully weigh these strengths against intensifying competition and potential credit quality concerns.

🤔 ANALYTICAL REASONING

From an investment perspective, SoFi represents the evolution of financial services in the digital age. The company’s transformation from a student loan refinancing platform to a comprehensive financial services provider demonstrates management’s strategic vision and execution capabilities.

The banking charter obtained in 2022 has proven to be a significant competitive advantage, allowing SoFi to reduce funding costs, offer competitive deposit rates, and expand its product ecosystem.

Today’s Q2 2025 earnings release confirms the company’s growth trajectory remains intact, with accelerating revenue growth of 43% year-over-year and meaningful profitability at $97 million in net income. This performance validates management’s “financial services super-app” strategy and suggests continued market share gains in the competitive fintech landscape.

However, the investment thesis must be tempered by valuation considerations. Trading at a forward P/E of 72.48, SoFi commands a significant premium to traditional financial institutions and even many technology companies. This valuation implies flawless execution and sustained high growth rates, leaving little room for operational missteps or macroeconomic headwinds.

The competitive landscape also presents challenges, as both traditional banks and fintech startups continue to invest heavily in digital capabilities. While SoFi’s integrated platform and banking charter provide advantages, the company must continue innovating to maintain its competitive edge and justify its premium valuation.

Credit quality remains another key consideration. As SoFi’s loan portfolio expands, particularly in potentially higher-risk segments like personal loans, investors should monitor credit performance metrics closely, especially if economic conditions deteriorate.

In conclusion, SoFi represents a high-growth, high-potential investment in the financial services sector, with demonstrated execution capabilities and a compelling product ecosystem. However, the elevated valuation suggests much of this potential is already reflected in the stock price, warranting a balanced approach to position sizing and entry points for investors considering exposure to this innovative fintech leader.

🐂 BULL CASE $SOFI

1.Accelerating Revenue Growth and Profitability:

Today’s Q2 2025 earnings release shows SoFi’s revenue growth accelerating to 43% year-over-year, reaching a record $854.9 million with $97 million in net income. According to the earnings release, “SoFi Technologies, Inc. reported financial results today for its second quarter ended June 30, 2025” with these impressive figures, demonstrating the company’s ability to scale efficiently while maintaining profitability.

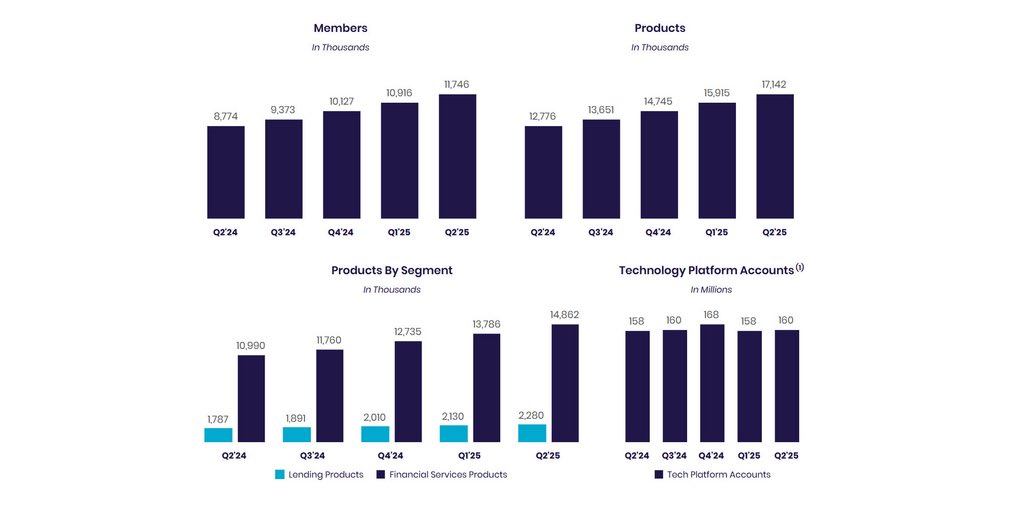

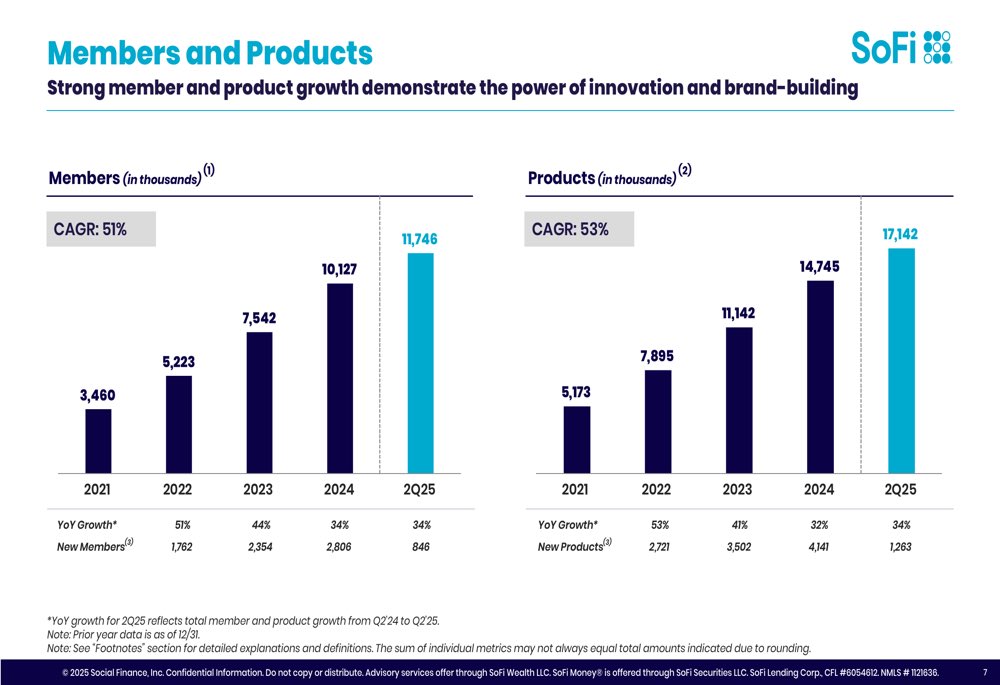

2.Strong Member and Product Growth:

SoFi continues to demonstrate robust user acquisition and cross-selling capabilities. As noted in the Q2 2025 investor presentation, “record revenue growth accelerates to 44% as profits surge,” indicating the company’s successful execution of its growth strategy and ability to monetize its expanding user base.

3.Successful Banking Strategy Implementation:

Since obtaining its banking charter, SoFi has effectively leveraged this advantage to lower funding costs and offer competitive deposit rates. The company’s integrated digital financial services platform has been “bolstered by significant product expansion and robust technological investments,” according to Monexa’s analysis of SoFi’s 2025 growth strategy, positioning it well against traditional financial institutions.

4.Technology and AI-Driven Innovation:

SoFi’s Galileo platform continues to be a significant growth driver. According to INO’s analysis, “Technology and AI-driven innovation are key components of SoFi’s growth strategy. The company has continued to expand its Galileo platform, a banking-as-a-service solution that powers fintech operations for various enterprises.” This B2B offering provides a diversified revenue stream beyond consumer-facing products.

5.Upward Guidance Revisions:

Management has demonstrated confidence in their growth trajectory by raising 2025 guidance. As reported by Investors.com, “SoFi Technologies earnings and revenue growth beat views and accelerated. The fintech raised its 2025 revenue guidance.” This positive outlook suggests continued momentum in the company’s core business segments.

1.Accelerating Revenue Growth and Profitability:

Today’s Q2 2025 earnings release shows SoFi’s revenue growth accelerating to 43% year-over-year, reaching a record $854.9 million with $97 million in net income. According to the earnings release, “SoFi Technologies, Inc. reported financial results today for its second quarter ended June 30, 2025” with these impressive figures, demonstrating the company’s ability to scale efficiently while maintaining profitability.

2.Strong Member and Product Growth:

SoFi continues to demonstrate robust user acquisition and cross-selling capabilities. As noted in the Q2 2025 investor presentation, “record revenue growth accelerates to 44% as profits surge,” indicating the company’s successful execution of its growth strategy and ability to monetize its expanding user base.

3.Successful Banking Strategy Implementation:

Since obtaining its banking charter, SoFi has effectively leveraged this advantage to lower funding costs and offer competitive deposit rates. The company’s integrated digital financial services platform has been “bolstered by significant product expansion and robust technological investments,” according to Monexa’s analysis of SoFi’s 2025 growth strategy, positioning it well against traditional financial institutions.

4.Technology and AI-Driven Innovation:

SoFi’s Galileo platform continues to be a significant growth driver. According to INO’s analysis, “Technology and AI-driven innovation are key components of SoFi’s growth strategy. The company has continued to expand its Galileo platform, a banking-as-a-service solution that powers fintech operations for various enterprises.” This B2B offering provides a diversified revenue stream beyond consumer-facing products.

5.Upward Guidance Revisions:

Management has demonstrated confidence in their growth trajectory by raising 2025 guidance. As reported by Investors.com, “SoFi Technologies earnings and revenue growth beat views and accelerated. The fintech raised its 2025 revenue guidance.” This positive outlook suggests continued momentum in the company’s core business segments.

🐻 BEAR CASE

1.Elevated Valuation Metrics:

With a forward P/E ratio of 72.48 and a price-to-book ratio of 3.47, SoFi trades at a significant premium to traditional financial institutions. As noted by Seeking Alpha, “SoFi Technologies’ valuation is excessively high, with aggressive growth assumptions that are not supported by the company’s fundamentals and competitive landscape,” suggesting potential downside risk if growth slows.

2.Intensifying Competition:

The fintech space continues to see new entrants and aggressive moves from established players. According to Investing.com’s SWOT analysis, “Increased competition in the fintech space could also pressure SoFi’s market share and force the company to increase marketing spend or reduce fees, impacting profitability.” This competitive pressure may erode margins over time.

3.Regulatory Uncertainties:

As a bank holding company, SoFi faces increased regulatory scrutiny and compliance costs. While specific 2025 regulatory challenges weren’t detailed in search results, this remains an inherent risk for fintech companies operating in the heavily regulated financial services industry.

4.Credit Quality Concerns:

In a potentially slowing economic environment, SoFi’s lending portfolio could face deteriorating credit metrics. As highlighted by Yahoo Finance, risks include “credit challenges, funding and liquidity” issues that could impact the company’s financial performance, particularly if economic conditions worsen.

5.Execution Risks in New Verticals:

As SoFi continues to expand beyond its core lending business, there are execution risks in scaling newer product offerings. Markets Gone Wild notes that “while the company’s disruption of traditional financial services has been impressive, it faces significant challenges from economic uncertainty, regulatory scrutiny, and competition,” which could impact growth in emerging business segments.

$SOFI

1.Elevated Valuation Metrics:

With a forward P/E ratio of 72.48 and a price-to-book ratio of 3.47, SoFi trades at a significant premium to traditional financial institutions. As noted by Seeking Alpha, “SoFi Technologies’ valuation is excessively high, with aggressive growth assumptions that are not supported by the company’s fundamentals and competitive landscape,” suggesting potential downside risk if growth slows.

2.Intensifying Competition:

The fintech space continues to see new entrants and aggressive moves from established players. According to Investing.com’s SWOT analysis, “Increased competition in the fintech space could also pressure SoFi’s market share and force the company to increase marketing spend or reduce fees, impacting profitability.” This competitive pressure may erode margins over time.

3.Regulatory Uncertainties:

As a bank holding company, SoFi faces increased regulatory scrutiny and compliance costs. While specific 2025 regulatory challenges weren’t detailed in search results, this remains an inherent risk for fintech companies operating in the heavily regulated financial services industry.

4.Credit Quality Concerns:

In a potentially slowing economic environment, SoFi’s lending portfolio could face deteriorating credit metrics. As highlighted by Yahoo Finance, risks include “credit challenges, funding and liquidity” issues that could impact the company’s financial performance, particularly if economic conditions worsen.

5.Execution Risks in New Verticals:

As SoFi continues to expand beyond its core lending business, there are execution risks in scaling newer product offerings. Markets Gone Wild notes that “while the company’s disruption of traditional financial services has been impressive, it faces significant challenges from economic uncertainty, regulatory scrutiny, and competition,” which could impact growth in emerging business segments.

$SOFI

🏰 COMPETITIVE MOAT ANALYSIS – $SOFI

SoFi Technologies has established itself as a leading fintech company with a rapidly expanding “financial services super-app” strategy that has driven record revenue growth of 44% as of Q2 2025, reaching $855 million with net income of $97 million.

The company’s competitive position is strengthened by its unique one-stop-shop digital financial services model that integrates lending, banking, investing, and financial planning services on a single platform, creating significant cross-selling opportunities and customer stickiness.

While SoFi faces intense competition from both traditional banks and specialized fintech players like Robinhood, Chime, Affirm, LendingClub, and Upstart, its banking charter (obtained in 2022) provides a significant regulatory advantage over many fintech competitors.

SoFi’s market dynamics are characterized by rapid member acquisition and product adoption, with the company leveraging its tech stack and data analytics capabilities to create a widening moat in the digital banking space, though its premium valuation (P/E ratio of 48.88) suggests investors are pricing in continued strong execution against established and emerging competitors.

📌 DEFENSIVE MOATS:

•Banking Charter

•Integrated Financial Ecosystem

•Brand Recognition

•Technology Infrastructure

📌 OFFENSIVE MOATS:

•Cross-Selling Efficiency

•Data Advantage

•Vertical Integration

•Scalability

📌 MOAT DURABILITY RISKS:

•Competitive Pressure

•Regulatory Environment

•Technology Obsolescence Risk

•Economic Sensitivity

📊 MARKET POSITIONING

SoFi has positioned itself as a leading digital-first financial services provider targeting primarily millennials and Gen Z consumers with higher income potential.

It competes across multiple sectors:

•Digital banking (vs. Chime, Varo)

•Investment platforms (vs. Robinhood, Wealthfront)

•Lending (vs. LendingClub, Upstart, Affirm)

Unlike single-product fintechs, SoFi offers a comprehensive suite of services, while maintaining a more agile and tech-forward approach than traditional banks.

📌 Core Strategic Differentiators:

•Full-Service Platform

•Banking Charter

•Tech Infrastructure (Galileo, Technisys)

•Member-Centric Benefits

📌 Competitive Threats:

Robinhood, Chime, Affirm, LendingClub, Upstart, and traditional banks like JPMorgan & Bank of America

SoFi Technologies has established itself as a leading fintech company with a rapidly expanding “financial services super-app” strategy that has driven record revenue growth of 44% as of Q2 2025, reaching $855 million with net income of $97 million.

The company’s competitive position is strengthened by its unique one-stop-shop digital financial services model that integrates lending, banking, investing, and financial planning services on a single platform, creating significant cross-selling opportunities and customer stickiness.

While SoFi faces intense competition from both traditional banks and specialized fintech players like Robinhood, Chime, Affirm, LendingClub, and Upstart, its banking charter (obtained in 2022) provides a significant regulatory advantage over many fintech competitors.

SoFi’s market dynamics are characterized by rapid member acquisition and product adoption, with the company leveraging its tech stack and data analytics capabilities to create a widening moat in the digital banking space, though its premium valuation (P/E ratio of 48.88) suggests investors are pricing in continued strong execution against established and emerging competitors.

📌 DEFENSIVE MOATS:

•Banking Charter

•Integrated Financial Ecosystem

•Brand Recognition

•Technology Infrastructure

📌 OFFENSIVE MOATS:

•Cross-Selling Efficiency

•Data Advantage

•Vertical Integration

•Scalability

📌 MOAT DURABILITY RISKS:

•Competitive Pressure

•Regulatory Environment

•Technology Obsolescence Risk

•Economic Sensitivity

📊 MARKET POSITIONING

SoFi has positioned itself as a leading digital-first financial services provider targeting primarily millennials and Gen Z consumers with higher income potential.

It competes across multiple sectors:

•Digital banking (vs. Chime, Varo)

•Investment platforms (vs. Robinhood, Wealthfront)

•Lending (vs. LendingClub, Upstart, Affirm)

Unlike single-product fintechs, SoFi offers a comprehensive suite of services, while maintaining a more agile and tech-forward approach than traditional banks.

📌 Core Strategic Differentiators:

•Full-Service Platform

•Banking Charter

•Tech Infrastructure (Galileo, Technisys)

•Member-Centric Benefits

📌 Competitive Threats:

Robinhood, Chime, Affirm, LendingClub, Upstart, and traditional banks like JPMorgan & Bank of America

🧠 CONCLUSION

SoFi has established a differentiated position in the competitive fintech landscape with its comprehensive financial services platform, banking charter, and technology infrastructure.

While it faces significant competition from both specialized fintechs and traditional banks, its integrated approach and focus on member experience provide a foundation for sustainable competitive advantage.

The company’s continued success will depend on its ability to maintain technological leadership, efficiently acquire and cross-sell to customers, and navigate an increasingly competitive landscape where the boundaries between different types of financial service providers are blurring.

TLDR:

💥 $SOFI just delivered a blowout quarter — record revenue, strong profitability, and raised guidance

🔒 Its moat continues to widen thanks to its charter, tech stack, and cross-sell execution

⚠️ Valuation remains high, but bulls have reason to believe

🏦 Anthony Noto is building the next-gen bank — and Q2 proves it’s working

SoFi has established a differentiated position in the competitive fintech landscape with its comprehensive financial services platform, banking charter, and technology infrastructure.

While it faces significant competition from both specialized fintechs and traditional banks, its integrated approach and focus on member experience provide a foundation for sustainable competitive advantage.

The company’s continued success will depend on its ability to maintain technological leadership, efficiently acquire and cross-sell to customers, and navigate an increasingly competitive landscape where the boundaries between different types of financial service providers are blurring.

TLDR:

💥 $SOFI just delivered a blowout quarter — record revenue, strong profitability, and raised guidance

🔒 Its moat continues to widen thanks to its charter, tech stack, and cross-sell execution

⚠️ Valuation remains high, but bulls have reason to believe

🏦 Anthony Noto is building the next-gen bank — and Q2 proves it’s working

• • •

Missing some Tweet in this thread? You can try to

force a refresh