Where fundamentals & technicals meet 🤝 Bull & Bear Cases, Fair Value Targets, Moat Analysis, & Technical Indicators powered by Analytics & Agentic AI

How to get URL link on X (Twitter) App

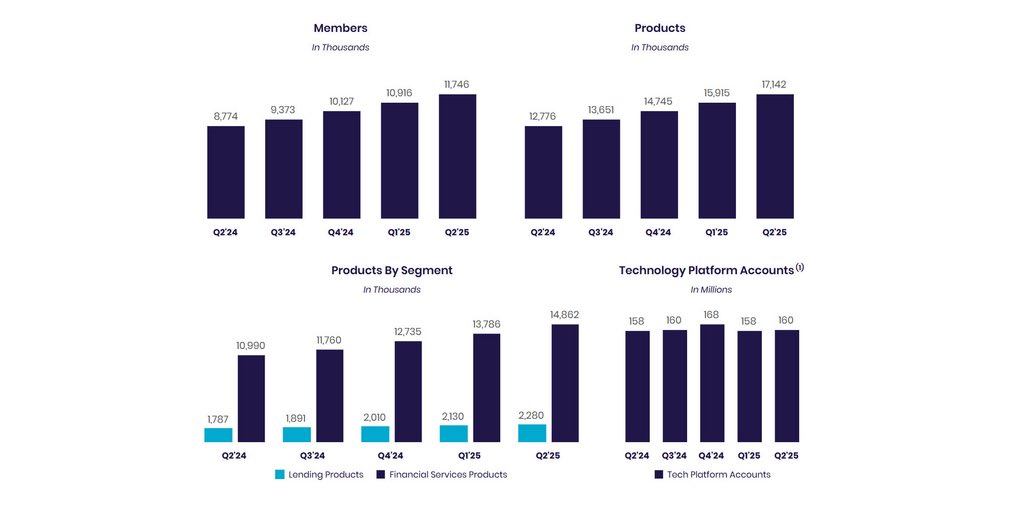

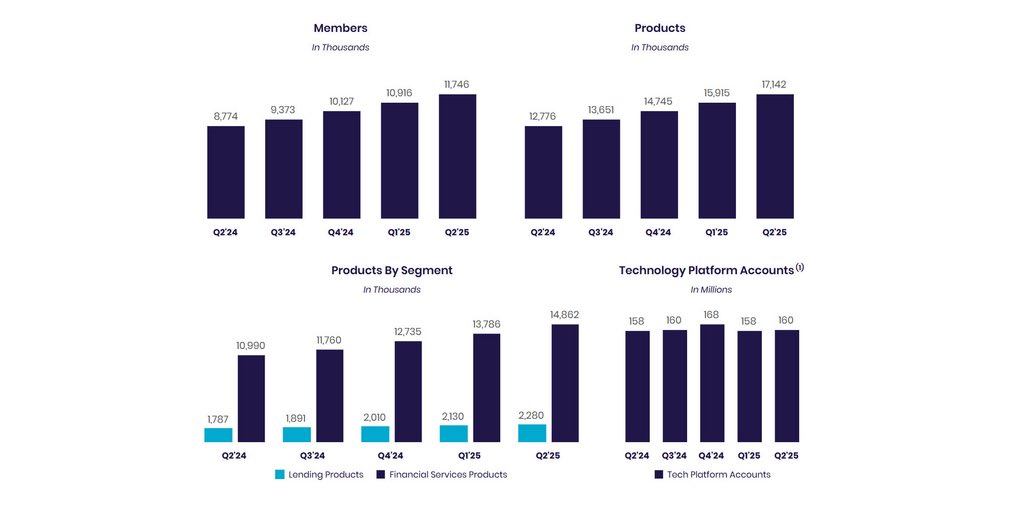

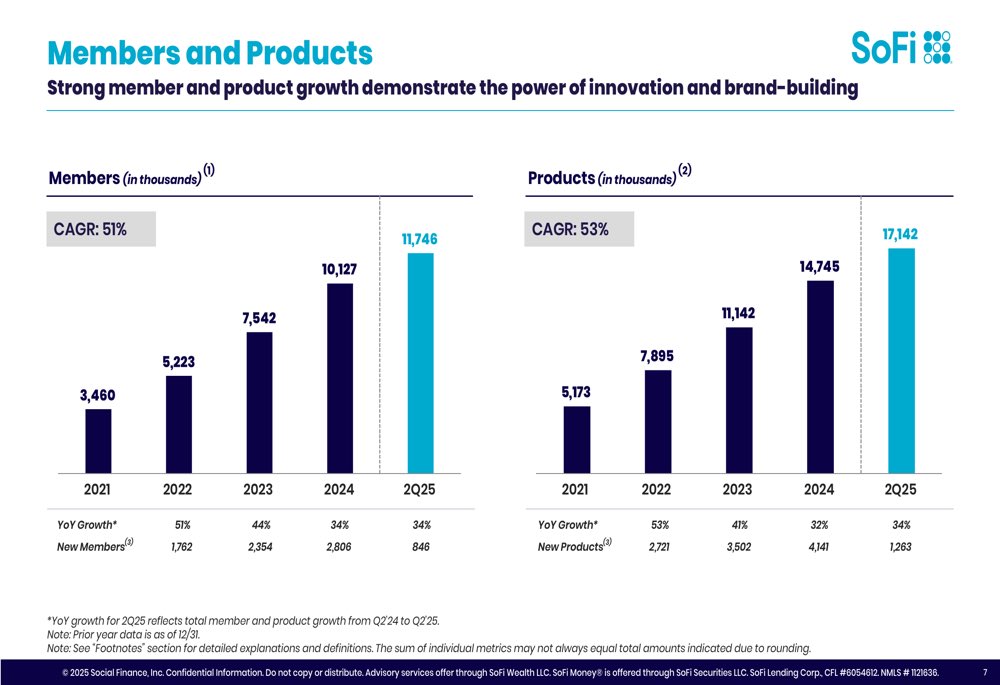

🐂 BULL CASE $SOFI

🐂 BULL CASE $SOFI

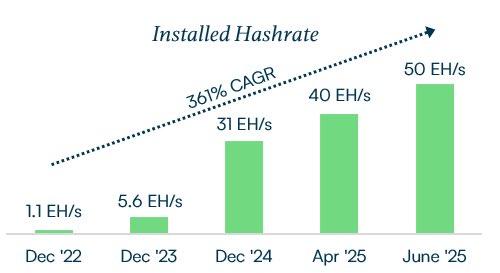

🐂 BULL CASE $IREN $BTC

🐂 BULL CASE $IREN $BTC