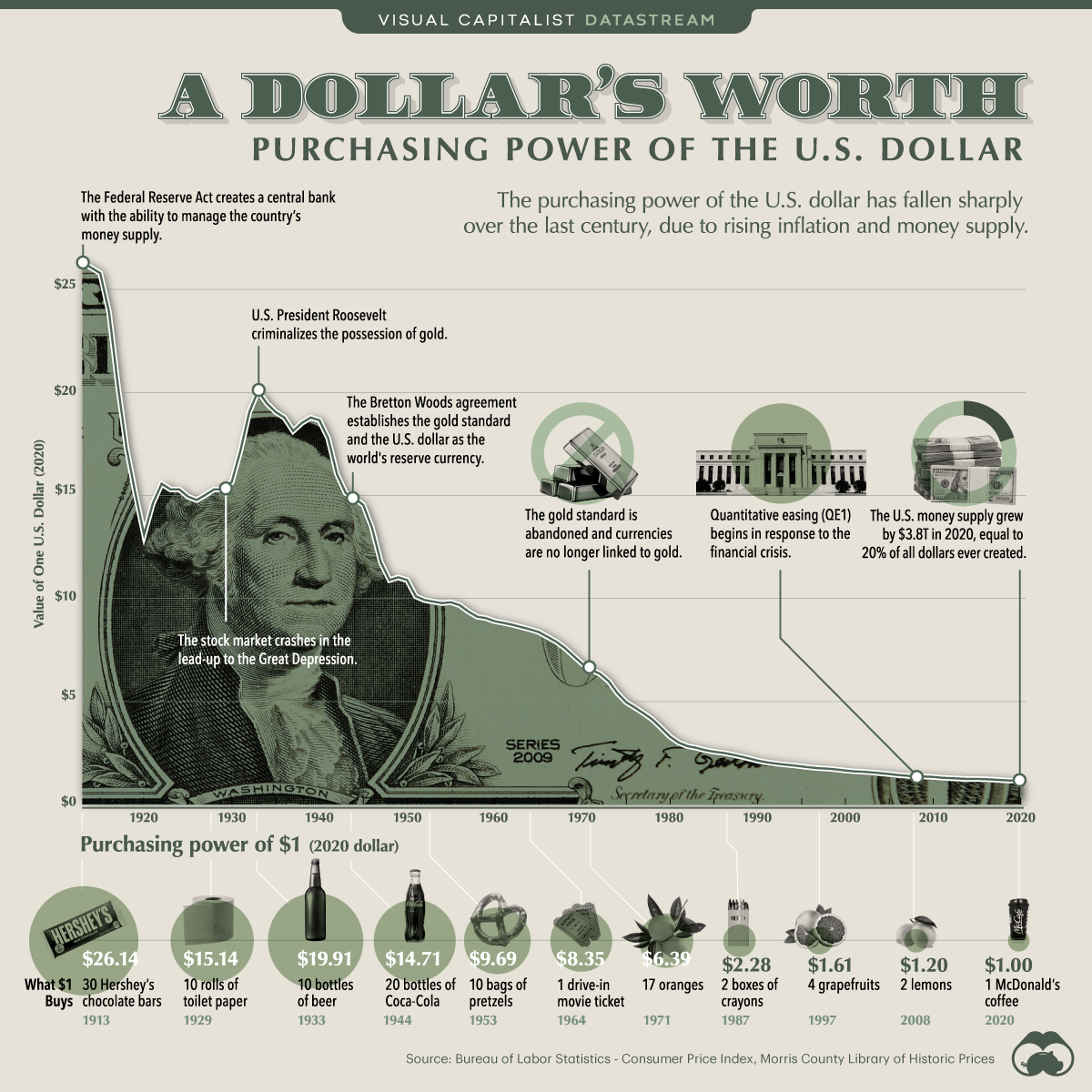

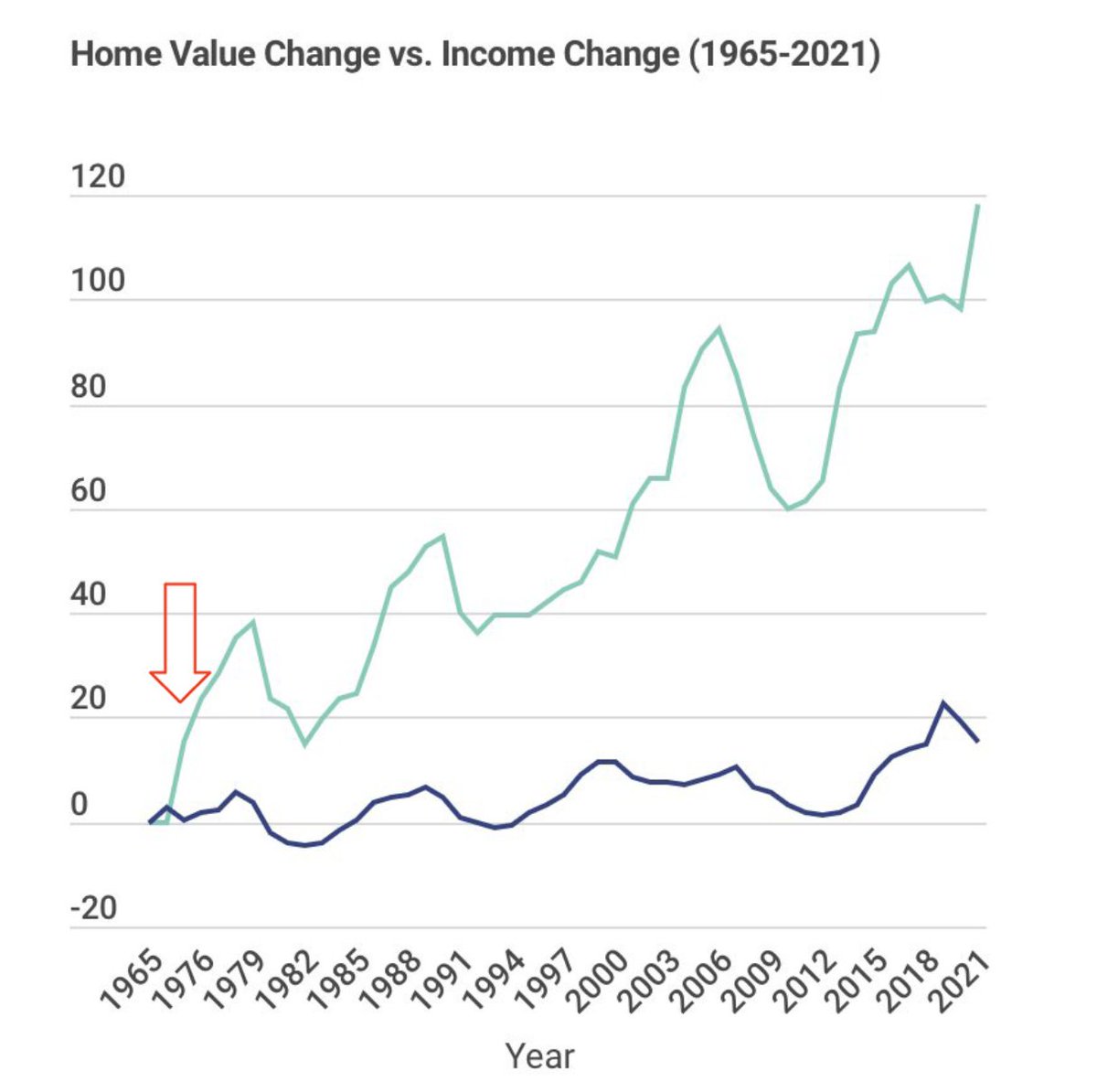

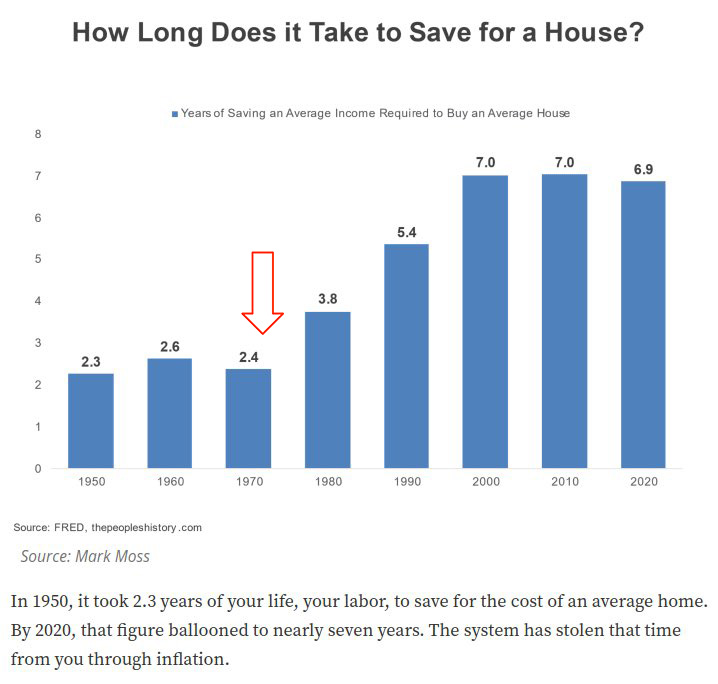

In 1970, the median home cost 2.5x the average annual income.

Today, it’s 6.6x.

That’s not lifestyle inflation.

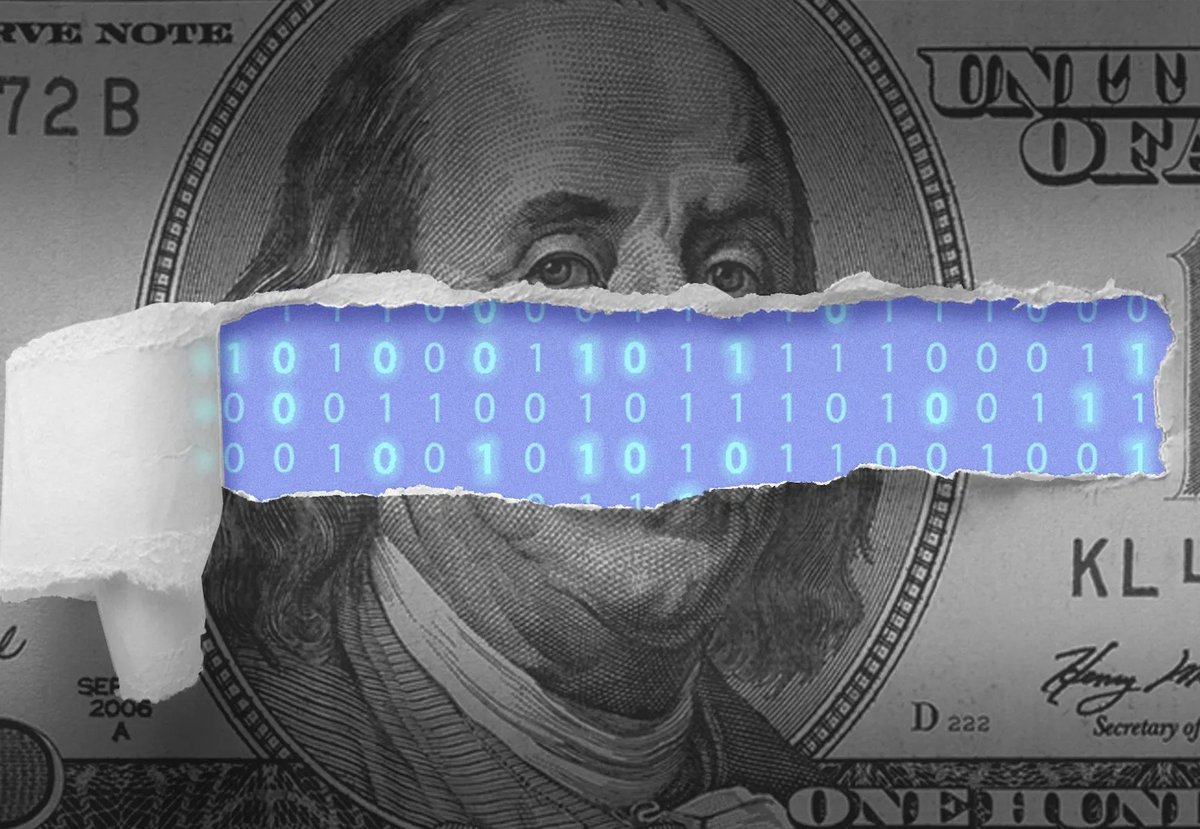

That’s fiat theft. 🧵👇

Today, it’s 6.6x.

That’s not lifestyle inflation.

That’s fiat theft. 🧵👇

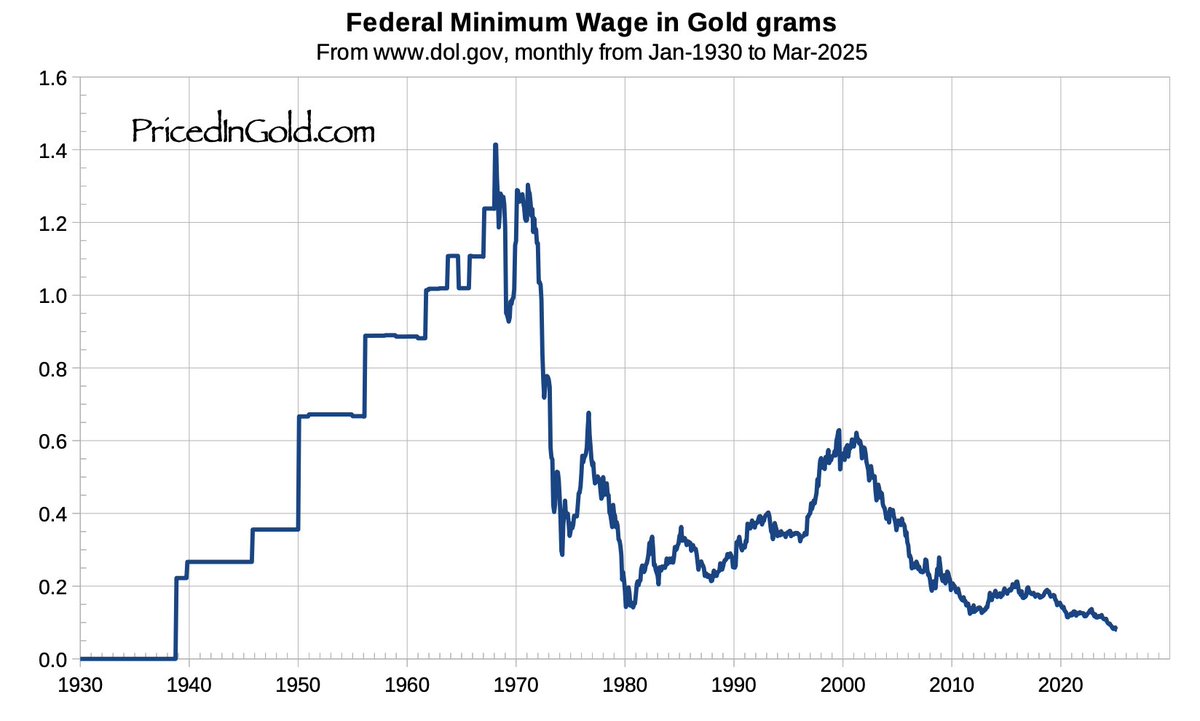

Minimum wage in 1971 was $1.60/hr.

Gold was $35/oz.

Work 40 hours = 1.83 ounces of gold.

Today, you earn 0.08 ounces for the same job.

The money didn’t lose value—the system took it from you.

Gold was $35/oz.

Work 40 hours = 1.83 ounces of gold.

Today, you earn 0.08 ounces for the same job.

The money didn’t lose value—the system took it from you.

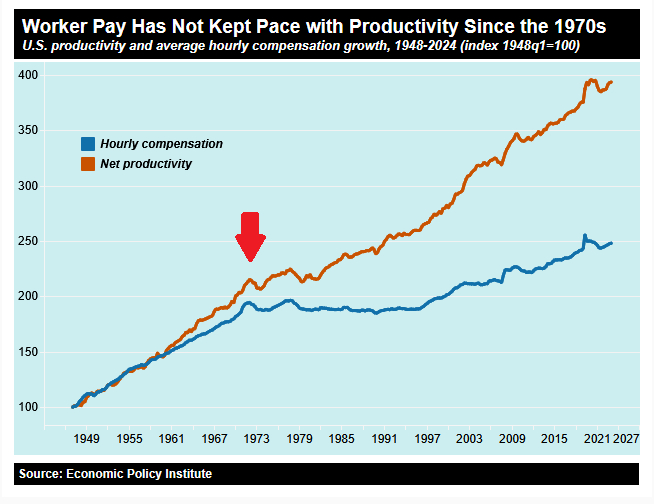

This isn’t just about homes.

It’s everything:

• Wages flat since ’71

• Education and healthcare costs through the roof

• Housing pushed up by monetary premiums

Boomers locked in the gains. Gen Z inherited the bill.

It’s everything:

• Wages flat since ’71

• Education and healthcare costs through the roof

• Housing pushed up by monetary premiums

Boomers locked in the gains. Gen Z inherited the bill.

Fiat rewards asset holders.

Not savers.

Not workers.

Not young people trying to build a life.

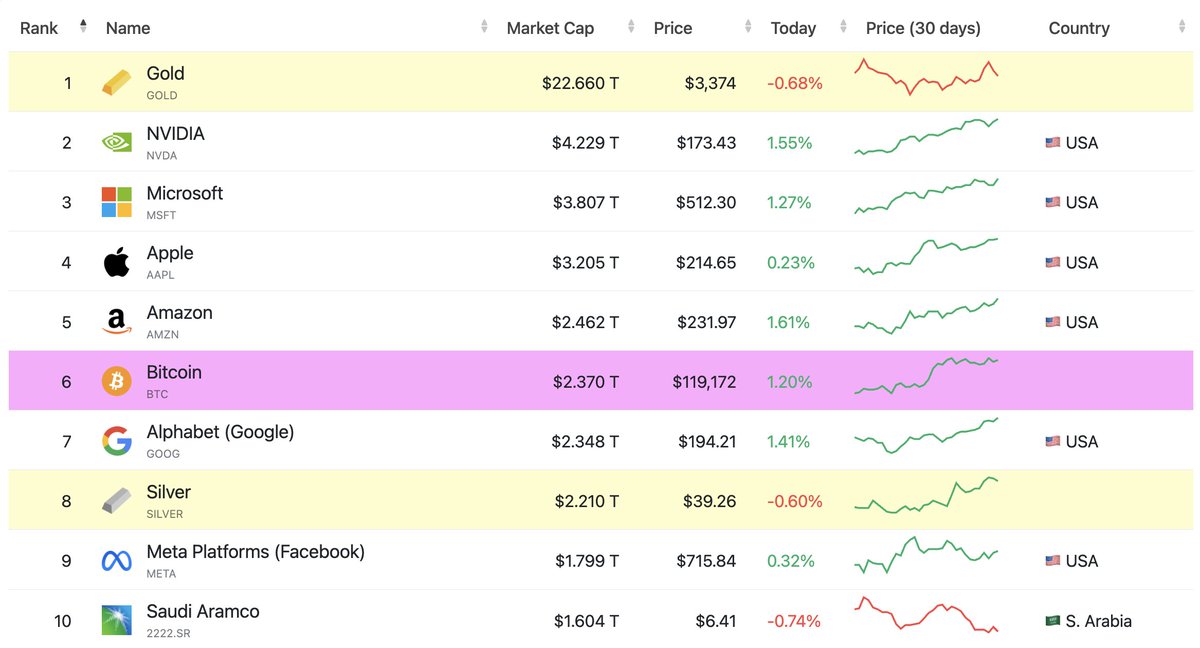

Bitcoin reverses that. It flips the incentives.

Not savers.

Not workers.

Not young people trying to build a life.

Bitcoin reverses that. It flips the incentives.

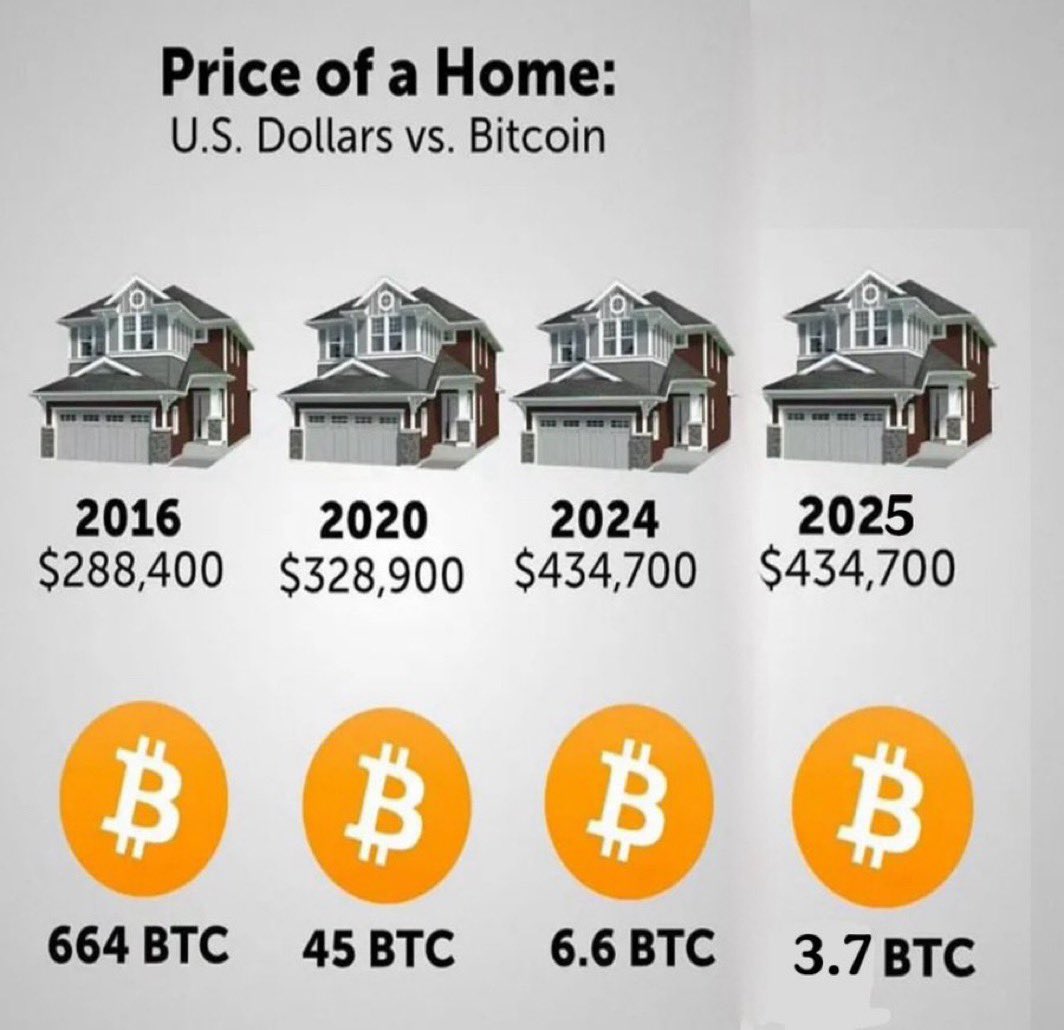

Under a Bitcoin standard:

• Saving matters

• Debt becomes expensive

• Housing prices track utility, not monetary distortion

• Your labor can store value

• Saving matters

• Debt becomes expensive

• Housing prices track utility, not monetary distortion

• Your labor can store value

This is why young people are checking out.

• Meme stocks

• Casino coins

• YOLO option trades

They’re not lazy—they’re desperate for a way out of a broken game.

• Meme stocks

• Casino coins

• YOLO option trades

They’re not lazy—they’re desperate for a way out of a broken game.

You can’t fix this with a policy tweak.

Or a different president.

Or a bigger stimulus check.

You need a different foundation for money.

Or a different president.

Or a bigger stimulus check.

You need a different foundation for money.

Fiat took the ladder up behind the previous generation.

Bitcoin builds a new one.

The American Dream isn’t dead—it’s just priced in Bitcoin now.

Bitcoin builds a new one.

The American Dream isn’t dead—it’s just priced in Bitcoin now.

It’s not enough to see the problem.

Who’s actually doing something about it?

Come meet the leaders bringing Bitcoin to the heart of U.S. policy at BTC in DC.

🎟 | Code: SWAN for 10% off tickets btcindc.com

Who’s actually doing something about it?

Come meet the leaders bringing Bitcoin to the heart of U.S. policy at BTC in DC.

🎟 | Code: SWAN for 10% off tickets btcindc.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh