I see that pension fund guys are loading up Okomu in a pair trade kinda form. In their heads, 'Presco is ₦1k+, Okomu should also follow suit'.

Lol, I sense an 'anchor bias' here, because Okomu is now very pricy and significantly above historical multiples...

Lol, I sense an 'anchor bias' here, because Okomu is now very pricy and significantly above historical multiples...

A quick detour:

Business model overview

Presco

Presco is an integrated palm oil coy (the 'integrated' is not mere grammar). Its operations cover:

▪︎ oil palm cultivation

▪︎ palm oil milling

▪︎ refining of palm oil

▪︎ packaging and distribution of refined products

Business model overview

Presco

Presco is an integrated palm oil coy (the 'integrated' is not mere grammar). Its operations cover:

▪︎ oil palm cultivation

▪︎ palm oil milling

▪︎ refining of palm oil

▪︎ packaging and distribution of refined products

Presco operates a fully integrated value chain and earns both local and export revenues.

Okomu primarily focuses on:

▪︎ cultivating oil palm and rubber trees

▪︎ producing crude palm oil (CPO) and natural rubber

▪︎ selling unrefined oil to local manufacturers and exporters

▪︎ cultivating oil palm and rubber trees

▪︎ producing crude palm oil (CPO) and natural rubber

▪︎ selling unrefined oil to local manufacturers and exporters

Okomu is more plantation-driven, with emphasis on growing and harvesting, and less integrated downstream compared to Presco.

Their similarities

▪︎ core product is crude palm oil

▪︎ both are affected by weather, global palm oil prices, and government trade policies

▪︎ both benefit when there is FX crisis

▪︎ both benefit from tax incentives

▪︎ core product is crude palm oil

▪︎ both are affected by weather, global palm oil prices, and government trade policies

▪︎ both benefit when there is FX crisis

▪︎ both benefit from tax incentives

Their differences

▪︎ integration

Presco does cultivation --> refining--> packaging (fully integrated). Okomu does cultivation --> milling

▪︎ downstream play

Presco has refinery and produces refined oil for retirement. Okomu does not refine

▪︎ integration

Presco does cultivation --> refining--> packaging (fully integrated). Okomu does cultivation --> milling

▪︎ downstream play

Presco has refinery and produces refined oil for retirement. Okomu does not refine

▪︎ product diversification

Presco is oil palm-focused. Okomu has a rubber business that accounts for about 15% of revenues.

▪︎ export exposure

Presco's stronger due to refined product export capacity. Okomu's export exposure is limited.

Presco is oil palm-focused. Okomu has a rubber business that accounts for about 15% of revenues.

▪︎ export exposure

Presco's stronger due to refined product export capacity. Okomu's export exposure is limited.

▪︎ revenue per hectare

Presco's higher due to value-added processing. Okomu's lower, as it is driven by volume and yield.

▪︎ capex intensity

Presco's higher due to its refinery and processing facilities. Okomu's lower because it focuses on land and yield expansion.

Presco's higher due to value-added processing. Okomu's lower, as it is driven by volume and yield.

▪︎ capex intensity

Presco's higher due to its refinery and processing facilities. Okomu's lower because it focuses on land and yield expansion.

▪︎ landbank utilisation

Presco has less unused land compared to Okomu (which means a future upside for Okomu).

Presco has less unused land compared to Okomu (which means a future upside for Okomu).

The strategic implications of the business models of the two companies are:

▪︎ Presco's margins are expected to be better because of its value-adding processing and pricing power. It also means that Presco is less susceptible to volatility in the global CPO prices.

▪︎ Presco's margins are expected to be better because of its value-adding processing and pricing power. It also means that Presco is less susceptible to volatility in the global CPO prices.

▪︎ However, Presco's business will require a lot investments in capex (which affects free cash flow).

▪︎ Okomu has more room to scale production in the future, anyway, especially with its idle landbank. However, for now, Okomu remains more exposed to raw palm oil swings.

That said, lemme state why the investors buying more of Okomu, as a form of trade pair, may be wrong...

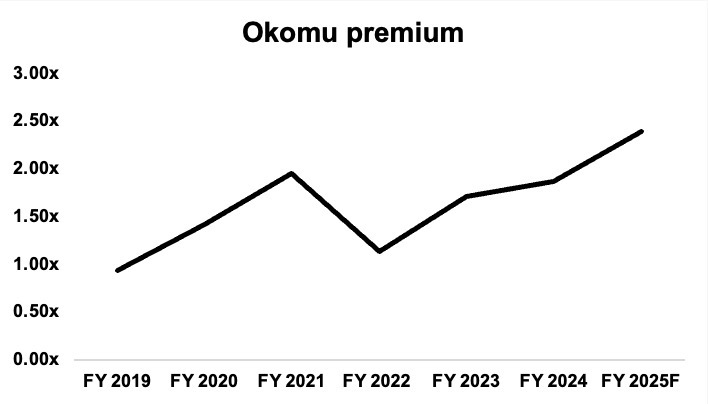

First, it is true that Okomu historically traded above Presco - but that is based on price-to-earnings multiple (not absolute share price).

First, it is true that Okomu historically traded above Presco - but that is based on price-to-earnings multiple (not absolute share price).

Howver, that premium had always remained at 2x on average. At respective current share prices, Okomu is trading at 2.5x Presco's multiple and that may not be justified.

Let's see the numbers together.

Let's see the numbers together.

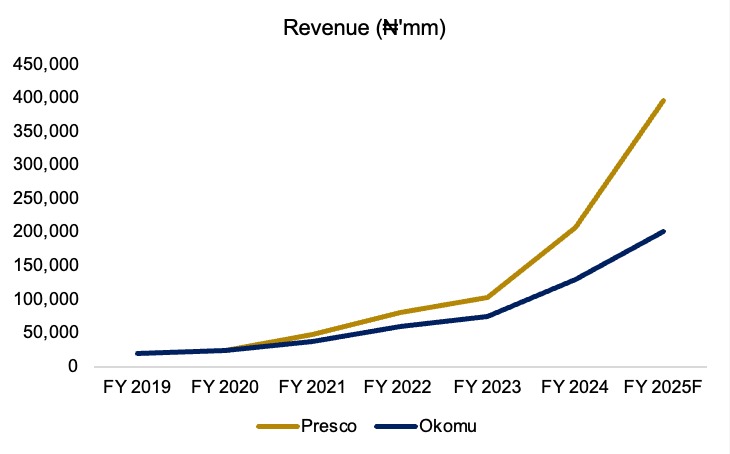

Revenue

Over the past six years, Presco's revenue CAGR is 65%, while Okomu's 48%. Presco broke away in 2021 via inorganic growth (an acquisition of Siat), and it's been moving mad since then.

Over the past six years, Presco's revenue CAGR is 65%, while Okomu's 48%. Presco broke away in 2021 via inorganic growth (an acquisition of Siat), and it's been moving mad since then.

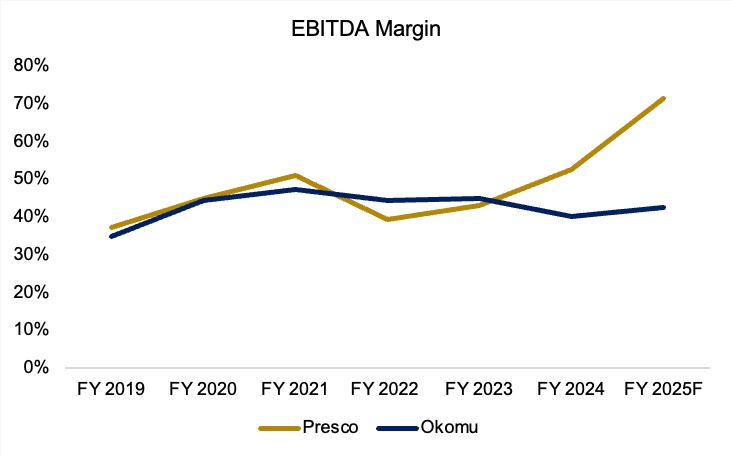

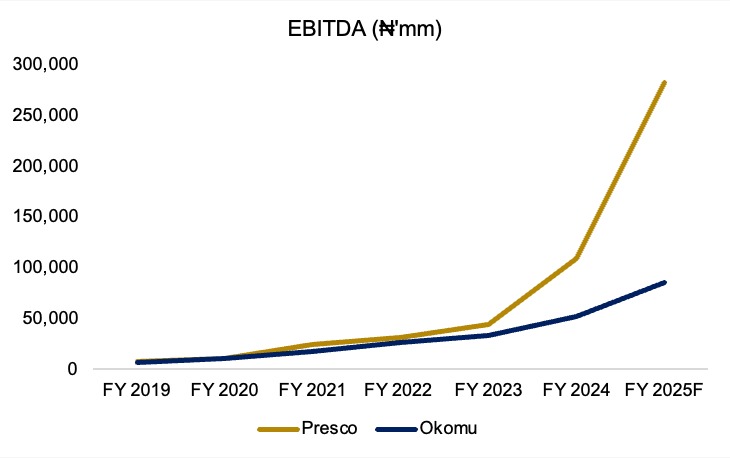

EBITDA

Presco's EBITDA and EBITDA margin are now well above Okomu's (recall the business models of the two entities).

When the FX crisis bit hard, local manufacturers of goods considered localising more of their inputs, and this was where Presco benefitted.

Presco's EBITDA and EBITDA margin are now well above Okomu's (recall the business models of the two entities).

When the FX crisis bit hard, local manufacturers of goods considered localising more of their inputs, and this was where Presco benefitted.

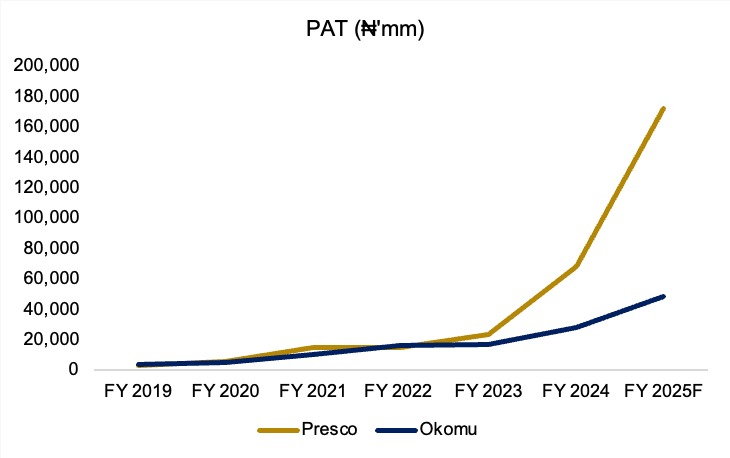

Effectively, Presco's profits have swelled in recent times. Profit CAGR is 96% (from ₦2bn levels in 2019 to ₦172bn in 2025).

Okomu's done 53% CAGR from ₦4bn to ₦50bn thereabout.

Presco now makes 2x - 3x of Okomu's profits.

Okomu's done 53% CAGR from ₦4bn to ₦50bn thereabout.

Presco now makes 2x - 3x of Okomu's profits.

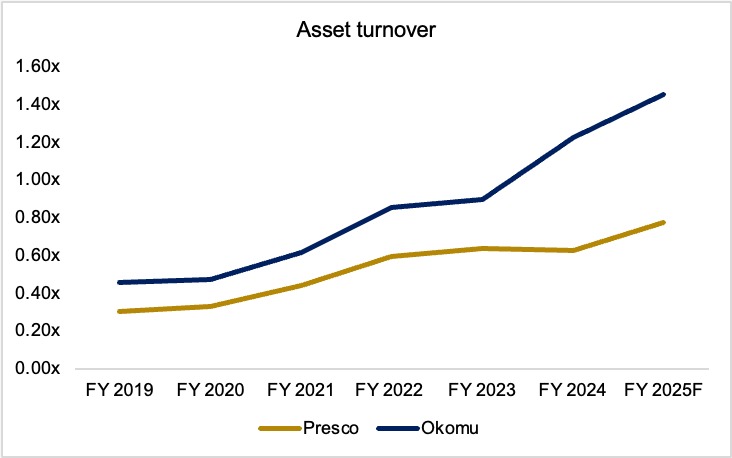

The flip of Presco's model (of vertical integration) is its relatively high capex requirements.

Although margins will be stronger, your asset turnover may not be so high. That's the tradeoff.

Okomu has always been seen as the most efficient company, but that's because....

Although margins will be stronger, your asset turnover may not be so high. That's the tradeoff.

Okomu has always been seen as the most efficient company, but that's because....

... of the business model differences.

Because of Okomu's simpler model, its cash generation has been relatively stronger, and it's been considered more efficient.

Because of Okomu's simpler model, its cash generation has been relatively stronger, and it's been considered more efficient.

Okomu has been able to make so much money in recent years because of the rising protectionism across the globe. Since COVID, the gbasgbos in the global market has favoured the oil palm guys.

Indonesia has come out multiple times to threaten global supply through its protectionist policies. And when that happens, the prices of CPO rise.

When prices rise, folks like Okomu feed fat. That development has been working for Okomu very well so far.

When prices rise, folks like Okomu feed fat. That development has been working for Okomu very well so far.

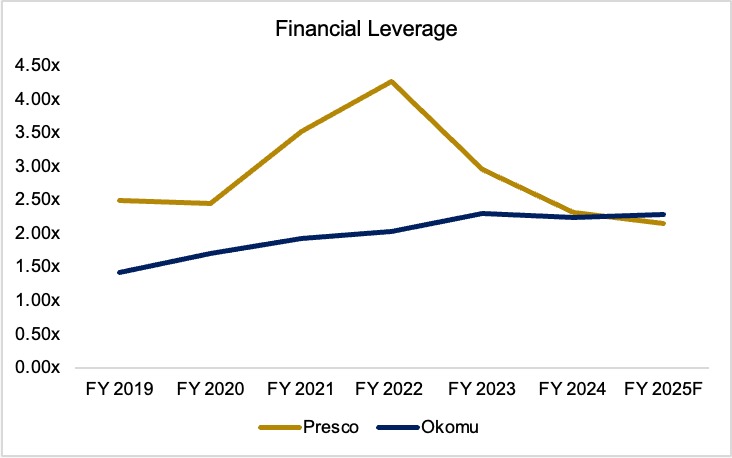

Capacity expansions, capex requirements, etc. all led to a significantly higher leverage (debt) for Presco. But in recent times, Presco has been making crazy money, and the capital structure is gradually improving... now at par with Okomu's.

As mentioned earlier, Presco is reaping a lot from its past investments. With customers now substituting their imports, Presco is their go-to guy. Meanwhile, Okomu is missing out here.

So here is what I observed about the revenue (and profits) growth drivers of the two coys:

▪︎ Okomu is benefiting from the trends in the global economy (supply uncertainty in the global market due to rising deglobalisation

▪︎ Okomu is benefiting from the trends in the global economy (supply uncertainty in the global market due to rising deglobalisation

▪︎ Presco is benefiting from customers' import substitution, as FX rates are killing. Presco is also benefiting from the global market trends.

Presco is winning on two ends, and one of them is structural (import substitution).

Presco is winning on two ends, and one of them is structural (import substitution).

Therefore, in all of these, why then should Okomu trade at this significant premium to Presco?

To start with, the historical premium should even thin out because Presco's fortunes are more structural and sustainable. Also, there is a recent superior performance by Presco.

To start with, the historical premium should even thin out because Presco's fortunes are more structural and sustainable. Also, there is a recent superior performance by Presco.

Therefore, I think Okomu's valuation is a stretch, and I hope the pension lads (and other investors) implementing this trade pair really understand the dynamics.

That said, the pension guys are institutional investors and they tend to have more information.. plus they have the resources to hire smart portfolio managers who know stuff. Hence, there is a benefit of doubt about how they are possibly thinking about these two companies.

I am team Presco, by the way.

Selah🤞🤞🤞🤞

https://x.com/Rufyb/status/1927688611660533848?t=KRkTvNjpmWzCkuS5FzRm1g&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh