How to get URL link on X (Twitter) App

https://x.com/Rufyb/status/1983981340551770356

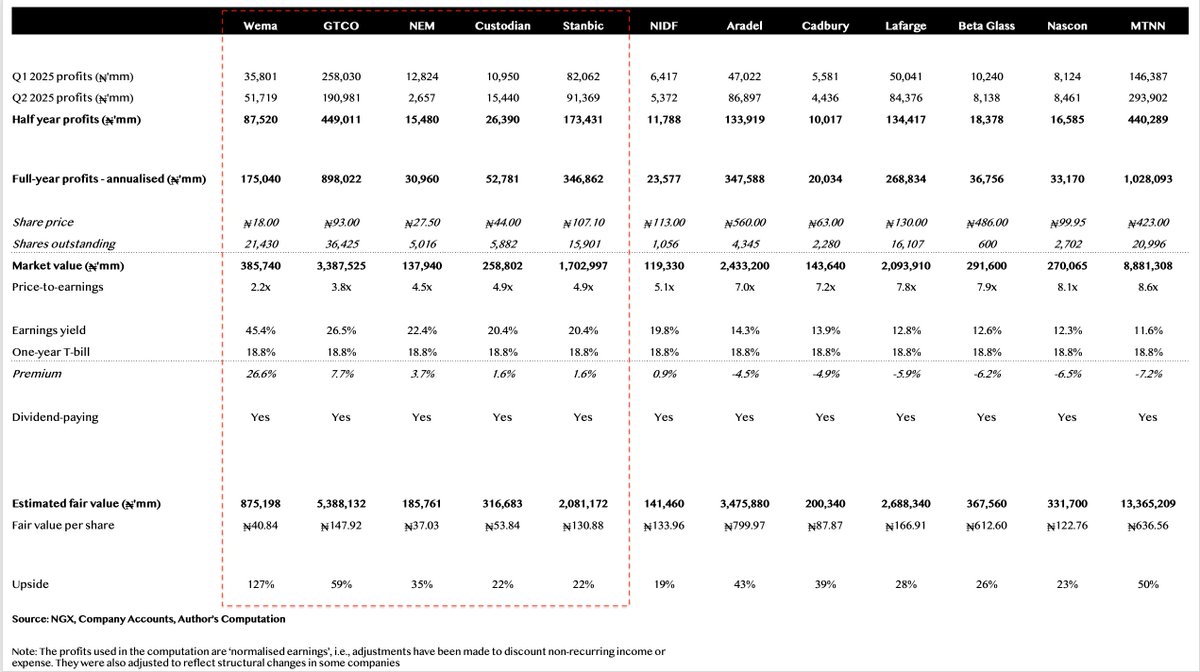

I have been following for a while now (the days when the stock price was still around ₦4 per share in 2019 thereabout. The current stock price is ₦94 per share – a 23x return).

I have been following for a while now (the days when the stock price was still around ₦4 per share in 2019 thereabout. The current stock price is ₦94 per share – a 23x return).

Toor, so this was my reasoning:

Toor, so this was my reasoning:

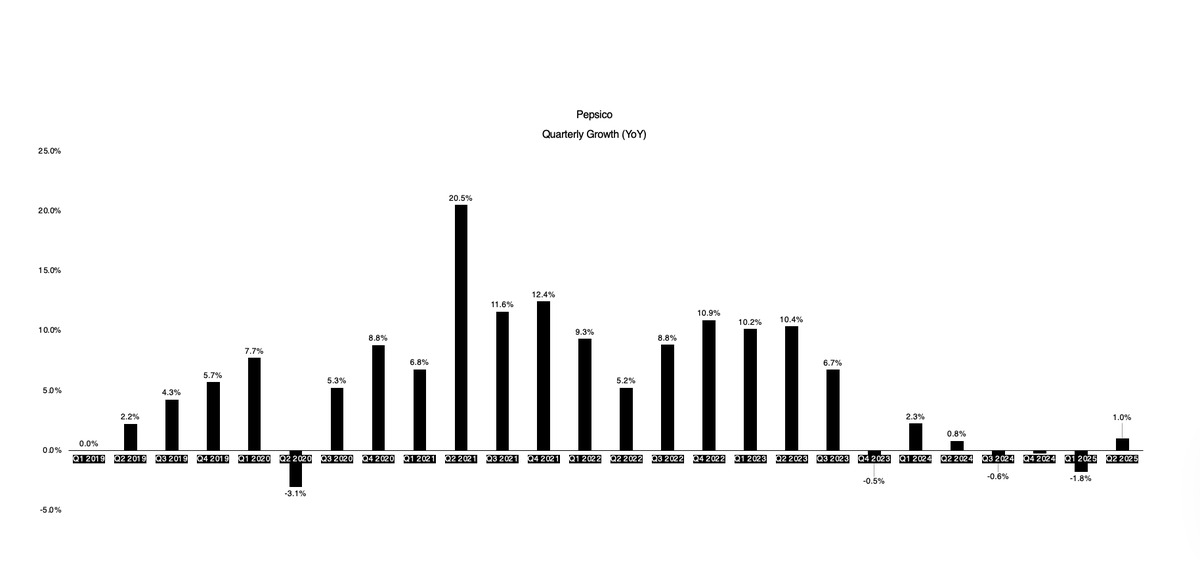

PepsiCo. had inventory issues (oversupply problems), and that affected Celsius because the oversupply needed to be corrected. By implication, Celsius' stock price tanked, declining to as low as $30. That was when I spotted it.

PepsiCo. had inventory issues (oversupply problems), and that affected Celsius because the oversupply needed to be corrected. By implication, Celsius' stock price tanked, declining to as low as $30. That was when I spotted it.

Champion Breweries has agreed to acquire the Bullet brand assets (both alcoholic and energy beverages) from Sun Mark International Limited (a British FMCG coy).

Champion Breweries has agreed to acquire the Bullet brand assets (both alcoholic and energy beverages) from Sun Mark International Limited (a British FMCG coy).

And then you ask, 'what then is the point of being a publicly-listed company?'

And then you ask, 'what then is the point of being a publicly-listed company?'

A quick detour:

A quick detour:

https://twitter.com/ngnstx/status/1942648937149575439Overview

https://twitter.com/Bond_not_james/status/1941854268694098107Balance Sheet (Assets and Liabilities)

However, that stability was bound to be temporary. The FX rate was poised to climb again simply because long-term stability is impossible when the inflation rates for the Naira (NGN) and the US Dollar (USD) are different.

However, that stability was bound to be temporary. The FX rate was poised to climb again simply because long-term stability is impossible when the inflation rates for the Naira (NGN) and the US Dollar (USD) are different.

https://twitter.com/EdiomoJose/status/1938520818667208875By prosperity, we mean that coys have to be profitable (via sustainable sources) so that they decide to expand capacity. There must also be signs of corporate profitability so that new businesses are encouraged to enter the market.

https://twitter.com/Babajiide/status/1937925630462726211Their business model allows them to maintain asset quality because they have control over the cash flows of their type of client: Civil servants.

On a YTD basis, total transactions are up by 60% from ₦2 trillion last year to ₦4 trillion this year -really strong. On a FY basis, the NGX facilitated ₦6 trillion worth of transactions (about 2% of GDP) and earned ₦8 billion in fee income.

On a YTD basis, total transactions are up by 60% from ₦2 trillion last year to ₦4 trillion this year -really strong. On a FY basis, the NGX facilitated ₦6 trillion worth of transactions (about 2% of GDP) and earned ₦8 billion in fee income.

... to young professionals about the cost dynamics associated with owning a car, and the benefits of owning a car relative to alternative means of transport.

... to young professionals about the cost dynamics associated with owning a car, and the benefits of owning a car relative to alternative means of transport.

https://twitter.com/Rufyb/status/1936082059526574364... we may need to understand a couple of things:

https://twitter.com/Oludeewon/status/1935061677252178310All the marketing done in prior years (which includes all the parallel trial and error businesses including oRide and the likes) were possible because of the significant capital they put behind it.