In the outcome that $NVDA:

A: Stays dominant in AI hardware, it's going to beat $TSM a fair bit.

B: Stops being dominant in AI hardware, it's going to drop a lot. Plus, $TSM will benefit from even larger volumes of hardware spend.

$TSM seems the much better risk:reward.

A: Stays dominant in AI hardware, it's going to beat $TSM a fair bit.

B: Stops being dominant in AI hardware, it's going to drop a lot. Plus, $TSM will benefit from even larger volumes of hardware spend.

$TSM seems the much better risk:reward.

The tail risk with $TSM is China invades Taiwan. But after studying modern submarine tech, I'm convinced that's very unlikely. And over time, $TSM is going to bring more of its capacity to the USA reducing that risk.

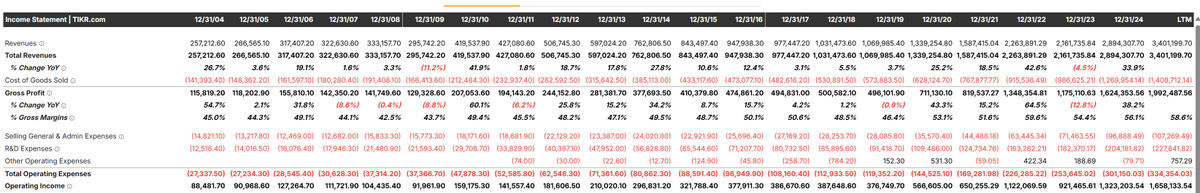

How can people see $TSM and think we're in an AI bubble?

It's 20x earnings, 30% return on capital, return on capital is trending up and the growth runway is obvious.

People always say how cyclical semiconductors are - even when they haven't been cyclical for many years.

It's 20x earnings, 30% return on capital, return on capital is trending up and the growth runway is obvious.

People always say how cyclical semiconductors are - even when they haven't been cyclical for many years.

This is not a cyclical business. Just because people say 2+2=5 many times, doesn't mean they're right.

$TSM can easily triple in the next 5 years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh